Last updated: Oct 29, 2021

Company: Paytm

CEO: Varun Sridhar

Founder: Vijay Shekhar Sharma

Year founded: 2010

Headquarter: Noida, Uttar Pradesh, India

Valuation (2020): $19 Billion

Annual Revenue (2020): Rs. 3,629 crore

Paytm or “Payment Through Mobile” is India’s largest payment, commerce, and e-wallet enterprise. It started in 2010 and is a brand of the parent company One97 Communications.com founded by Vijay Shekhar Sharma. In April 2020, Paytm Payment Bank reached $130 million deposited from 57 million savings accounts. [1]

It was launched as an online mobile recharge website and went on to transform its business model to a virtual and marketplace bank model. The company stands today as one of India’s largest online mobile service that includes banking services, marketplace, mobile payments, bill payments, and recharge. It has so far provided services to over 100 million users. In 2020, Paytm’s transactions grew by up to three times as users turned to digital payments to stay safe. [2]

Its diversification has garnered significant notoriety and become exemplary for many in the online payment industry. One of its more noteworthy achievements is in its collaboration with the Chinese e-commerce giant Alibaba who provided them with huge amounts of funding.

Apart from being a pioneer of the cashback business model, the company has been praised for its initiation as a startup company to a large corporation in a short span of time.

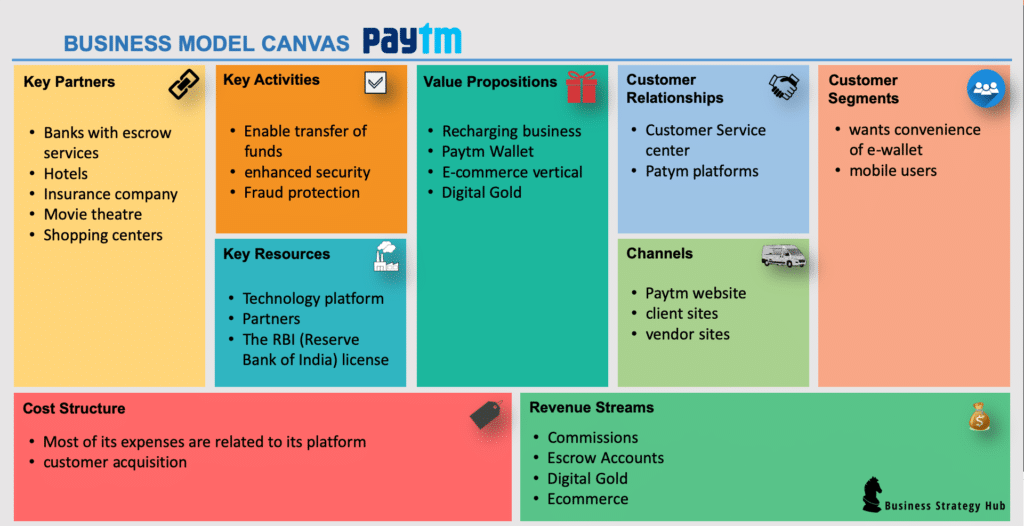

Business Model Canvas of Paytm

Paytm has remained at the forefront of innovation and providing top-notch online recharge and bill payment services to its clients. Naturally, their business model also garners significant interest.

1. Customers of Paytm

The purpose of Paytm is to serve its Indians customer base particularly the mobile phone users. Many Indian customers viewed the digital world as providing an easy opportunity for them to open a bank account. However, it didn’t turn out to be the case.

The idea of accessing easy online payments fell short, and customers ended up with nothing but poor experience. Paytm offered itself as a better alternative in this regard.

2. Value Proposition of Paytm

Some of Paytm’s more prominent propositions was its recharging business which was the company’s initial service proposition. Then it went on to diversify and advance to producing newer services from the likes of Paytm Wallet, E-commerce vertical to Digital Gold.

Paytm has also launched several services in 2020 that enhances its value proposition further. In September 2020, it launched Paytm Money’s stockbroking service that enticed over 2.2 lakh registrations, most between 18 to 30 years. [3]

The company also launched a subscription service for businesses known as ‘Paytm Subscriptions’ that enables entrepreneurs to use flexible payment methods. It also allows customers to pay their preferred payment option and supports different business models and use cases. [4]

These have garnered it the Chinese giant Alibaba’s blessings who donated huge sums of money to the organization, thereby increasing its investment potential. Paytm utilized cricket and TV advertising to reach more customers. Paytm Cricket League cashback allows users to collect playing cards, add them to their album on the Paytm app, and complete the milestones related to the player cards to be eligible to get cashback up to Rs. 1,000. [5]

3. Customer Relationships of Paytm

Paytm has 24* 7 customer care center to connect with its users. At the same time, most of the Paytm services are self serve in nature and are accessible through their platforms directly.

4. Channel of Paytm

Paytm uses many channels to attract customers. Apart from its own website which drives clicks, it has formed partnerships with many client and vendor sites that sponsor its enterprise.

Demonetization in India allowed the company to prosper significantly and reach new customers as well. Offline marketing is also a part of their customer acquisition process.

5. Key Resources of Paytm

The RBI (Reserve Bank of India) license serves as Paytm’s main resource. It needs to be specific to Paytm. The other resources are the design/software culture that makes it easier for lower-income Indians to use. In 2020, Paytm Payments Bank partnered with Mastercard to issue both virtual and physical debit cards. Virtual debit cards will help new customers to transact securely, which physical debit cards provide the option to withdraw cash from more than 1 million ATMs. [6]

6. Key Activities of Paytm

Paytm, being a technology platform, risks dangers such as security and fraud which is why it has to take effective measures in protecting its consumer’s money by enhancing its security.

It is also making new changes within its platform to attract new users and gain access to their digital wallets. Paytm recently updated its user interface to allow customers to use its Stay-at-home Essential payment feature to pay bills like electricity, car insurance, DTH recharge, water, gas, and so on without leaving their homes. [7]

7. Key Partners of Paytm

Paytm partners with the banks that provide it with payment getaways into the banking system as well as escrow services.

It collaborates with a myriad of organizations that gather bills and payments from its consumers for its services.

8. Cost Structure of Paytm

Paytm serves many customers that is the reason why it is so cost driven. Most of its expenses are related to its platform and customer acquisition. It’s a common expense shared by many businesses across the world where customer acquisition cost is substantial. The money used in this process is higher than the revenue it makes in its initial purchases.

The majority of its budget is invested in ramping up of its security and avoid the risk of fraud especially when it has to handle over 65 million customers in its platform. It includes a system that enables customers to prevent any money laundering risk.

9. Revenue Stream of Paytm

The Paytm Revenue Models come in two forms.

- Paytm makes commissions from the customer transactions through their usage of its platform.

- Escrow Accounts – escrow accounts from where it generates its revenue. Owing to the absence of its underlying capital, it offers customers no interest. As of 2019, Paytm has accumulated 3,629 crore INR in revenue. Paytm’s revenue for FY20 has increased to Rs. 3,629 crore and is focused on optimizing its expenses to become profitable by 2022. [8]

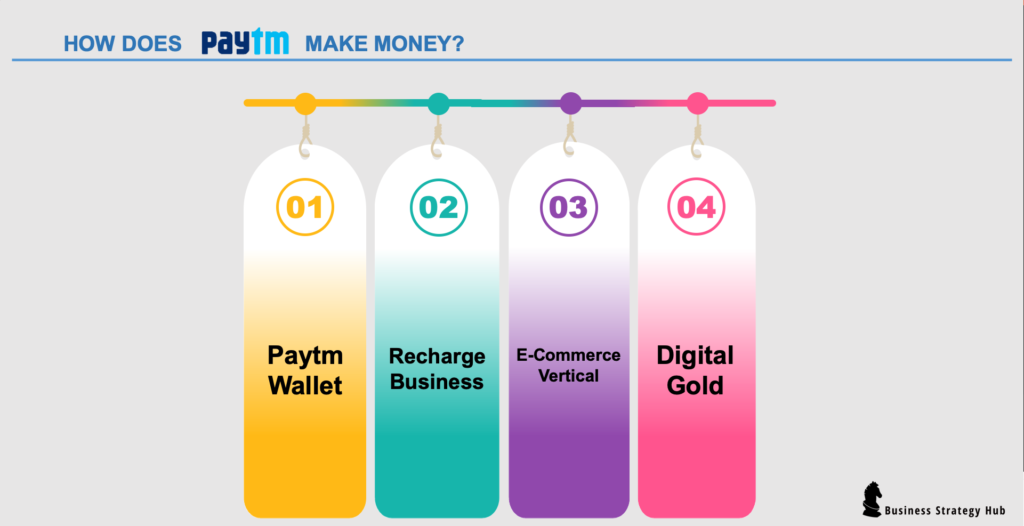

How Does Paytm Make Money?

Paytm Wallet

Paytm wallet is one of Paytm’s most effective services that form a link between the bank and the retailers. This semi-closed wallet enables you to pay your bills, pay for your tickets or pay anybody for that matter. Paytm wallet apart from its earnings, as authorized by the RBI, has the benefit of receiving interest in a consumer store, just like any other Payment Gateways.

When you store a certain amount of money in your Paytm wallet, it will then save that money in another bank from which it will earn interest at some point. It is the Paytm wallet’s main function.

For example, imagine if you make a payment of 1000 rupees to a seller and the seller makes 10 transactions to gain 10,000 rupees. If the payment of that amount is made through the Paytm wallet, the Paytm wallet will take a share of about 1% from the total amount so technically; the seller will receive about 9715 rupees.

Recharge Business

Since its inception in 2010, Paytm’s initial purpose was to provide online mobile recharging services. Its function to generate revenue was always simplistic.

Paytm ‘s service standards are as exemplary and efficient as those of other telecom service providers ranging from Vodafone to Telecom. The services are without faults and provide comfort to their customers. Currently, Paytm gains a commission of 2-3% per recharge.

It is because Paytm, owing to its encouragement to its customer to continue recharging through their platform, has stronger power in bargaining than other vendors. That’s why the commission that it acquires is that high. This commission from its recharge service serves as its revenue.

These services have aided the company significantly in expanding its base and in turn growing exponentially. Once the customer is satisfied by the service or product, he makes a return to the same enterprise thereby maintaining its customer retention and generating more traffic as a result. Paytm has utilized this strategy to its advantage and continues to make a profit.

Digital Gold

Owing to its partnership with MMTC-PAMP the well-known gold refiner, Paytm has launched “Digital Gold.” This model allows users to sell, buy or store gold in a digital platform. Now users have to pay at a minimum rate just to get their gold delivered to their households.

Paytm is well aware of how much gold is invested in India and is fully prepared to grow from this opportunity. The company has made notable plans to encourage its users to get their own Gold Bank Accounts respectively. This account apart from enabling users to buy their gold will also provide users with easy access to other Paytm services.

E-Commerce Vertical

If you go to a shop and see a board that says “Paytm Accepted here”; ask yourself what that means, it basically means that Paytm encouraging e-commerce or a transaction of online goods. Paytm has already diversified its online services with its introduction of Paytm mall.

Paytm attracts many sellers to its wide-ranging goods like shoes, clothes, etc. on its website who deliver products to you at an adequate time. Paytm Mall has been testing a group buying feature called Paytm Bang that allows buyers to pool together to buy products as a group and get larger discounts and offers. [9]

The company recently announced that it would focus on making its business software and CRM services a core revenue generator for offline merchants. It has invested in providing solutions like cloud and billing facilities to its 15 million offline merchants. [10]

Final Verdict

Paytm is a growing enterprise that has made its mark in the Indian financial and service sector. The fact that it went from a startup company to a gigantic company at a fast-pace underscores the success of India’s capitalist system and how innovation is being utilized appropriately in the country.

Many entrepreneurs can take inspiration in the Paytm model and pave the path to success by adopting a similar strategy.

References & more information

- Hamilton, A. (2020, April 22). Paytm Payments Bank partners with Mastercard for physical card rollout. Fintech Futures

- PTI. Paytm sees up to 3.5X growth in transactions amid COVID-19 pandemic: Vijay Shekhar Sharma. Economic Times

- Saxena, A. (2020, Sept 28). Paytm launches stockbroking services, targets over 10 lakh investors. Your Story

- Paytm (2020, Sept 2). Businesses can now avail of our UPI subscription services. Paytm Blog

- Tripathi, Y. (2020, Sept 30). Paytm’s Cashback Feature Back On App For IPL 2020. Republic World

- Times Writer (2020, April 17). Paytm Payments Bank partners with Mastercard. Times of India

- Mathur, N. (2020, Mar 30). Paytm revamps app with stay-at-home essential payments. Live Mint

- Ishwar, S. (2020, September 5). Paytm reports Rs 3,629 cr revenue for FY20; eyes profitability by 2022. Business Standard

- Upadhyay. H. (2020, August 29). Paytm Mall tests a group buying feature ‘Bang.’ Entrackr

- Shrivastava, A. (2020, Feb 5). Paytm to monetize offline merchant base; plans to cut losses by half: Vijay Shekhar Sharma. Economic Times

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment