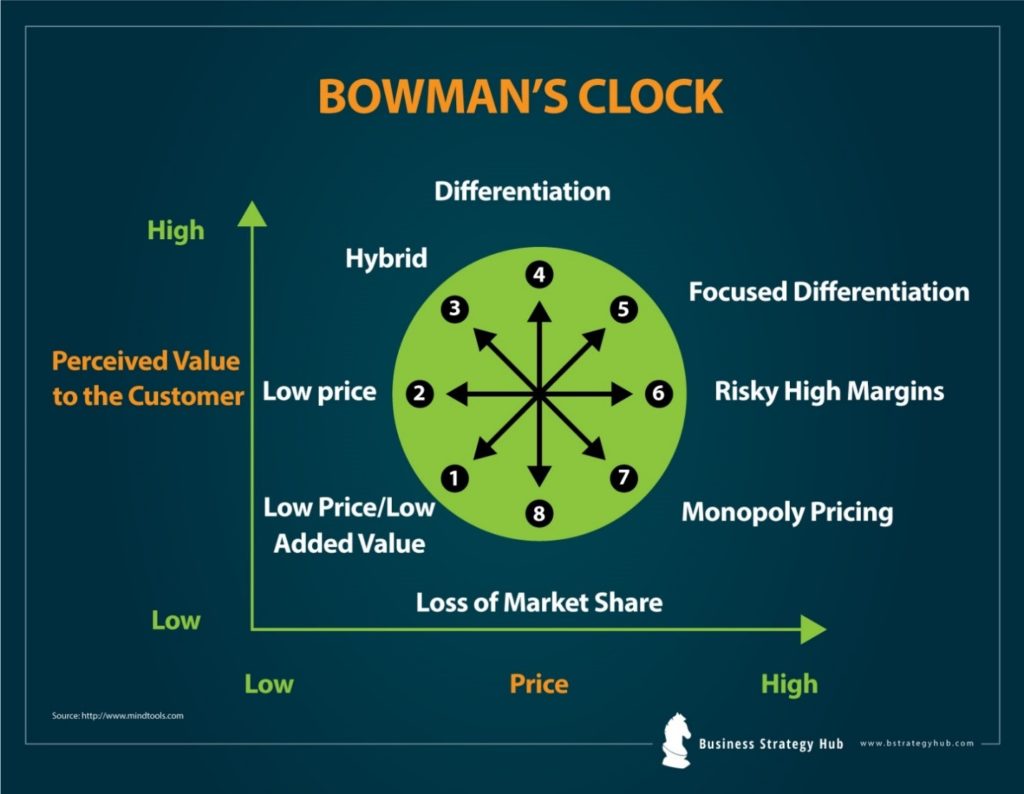

Model Name: Bowman’s Strategic Clock

Author: Cliff Bowman and David Faulkner

Year: 1996

Purpose: Competitive strategy | competitive advantage | play to win strategies | better performance

If you are looking for your business to earn a competitive market position, Bowman’s Strategic Clock has got you covered.

This marketing model explores strategic positioning options. Its purpose is to demonstrate that a business, company or brand will have a range of options through which they can position a product based on its perceived value and price.

Looking at the diverse blends of these two dimensions – price and perceived value – within the Bowman Strategy Clock leads to 8 conceivable strategies, divided into four quadrants. Based on the model’s name, these eight strategies are demonstrated in a clock.

A business can pick a position from the Bowman Strategy Clock that offers the greatest competitive advantage.

In order to evaluate and analyze the company’s present strategy, understanding these 8 basic strategic positions is a must. With the understanding of this model, changes can be made that will improve the competitive position of the company in the market.

Commencing at the top and spinning clockwise, this marketing model has the following positions:

Position 1: Low Price and Low Value Added

This position is not very competitive within the Bowman Strategy Clock. Despite a low price, the product or service lacks differentiation, and the consumer perceives little value.

This strategy is bargain basement – keeping the price low to remain competitive in the market and wish that no competitor will undercut you.

Products are of inferior quality, however, prices are attractive enough to motivate customers to try them, occasionally. Companies rely on selling in large volume to sustain their business model.

Example

Dollar Tree sells the majority of items for $ 1.00 or less. It’s a great place to buy party supplies such as decorative goods, gift bags, wraps, paper plates, cups, etc. After the party, you would prefer to throw them anyways.

Position 2: Low Price

Low pricing businesses are often the ones that also tend to produce large quantities. Low-profit margins are expected on each product as businesses value their merchandise at a noticeably lower rate, in comparison to similar competing products in the market.

The high volume of output, however, can still produce high profits. This position favors cheaper market leaders that have an emphasis on minimizing the cost; fast and low-priced production and employing economies of scale.

Example

At this position, conceivable price wars are fought quite often. American airline JetBlue has successfully expanded its business thanks to this strategy.

By the year 2004, SouthWest airlines offered the lowest airline fares which were 6.2 cents per available seat-mile. JetBlue offered lower airline fares which were 4.7 cents per available seat-mile, giving it the leverage it needed over other airlines.

Another example is Walmart that dominates the low price and high volume category.

Position 3: Hybrid (Moderate Price/Moderate Differentiation)

A hybrid strategy combines certain aspects of low price and certain aspects of product differentiation. This strategy utilizes the strengths of both the strategies to added value for the consumers. A hybrid model attracts consumers by offering products/services at a lower/reasonable price with some product differentiation that is not being offered by other brands.

It could be a very efficient positioning strategy, especially if the added value implicated is consistently offered.

Example

Ikea is a good example of higher perceived value at reasonable prices. It has built great brand loyalty with this strategy.

Another example :

Lush cosmetics has successfully implemented this strategy. They differentiated their products and brand by offering products that were ethically made.

They don’t buy material from companies that are engaged in animal testing. Their commitment to social and corporate responsibilities give them a competitive edge over their rivals.

Position 4: Differentiation

The goal here is to provide consumers with the maximum level of perceived value. Moreover, product quality plays an essential role in this strategy, so does the branding.

A top quality product or service with loyalty and robust brand awareness is probably best-placed to attain high prices and added-value that this strategy necessitates.

Example

Think about brands like Apple, Starbucks, and Nike.

Apple is the leading brand that has implanted the differentiation strategy. It has innovated technologies and introduced products in the market that weren’t already available.

Owning an iPhone has become a symbol of class today. They outperformed their competition, Microsoft, and became the pioneer of offering cutting- edge technology devices.

Starbucks charges a premium price for their products. Due to their differentiation and brand loyalty, customers are willing to pay $ 5 for a coffee. And similarly, Nike charges a premium price for their shoes.

Position 5: Focused Differentiation

Focused Differentiation targets to position a product or service at the utmost price levels, where buyers purchase the product or service because of the high perceived value.

This positioning strategy is embraced by luxury brands in all industries such as Gucci, Rolex, Tiffany, Rolls Royce, and Louis Vuitton; which target to attain best prices by highly targeted segmentation, and distribution.

Their products are high priced and their target customers are willing to pay anywhere from 10 to 25 times more than their economy competitors.

If this strategy is done successfully, it can result in the utmost profit margins. However, only the finest brands and products can withstand the strategy in the long-term.

Position 6: Risky High Margins

As the name suggests, this is a high-risk positioning strategy. Many argue that, sooner or later, it is doomed to fail. With this strategy – without offering anything extra in regards to perceived value – the company sets high prices. If consumers continue to purchase the services or products at such high prices, the returns can be high.

But, ultimately consumers will discover a better-positioned service or product that offers more perceived value for the lower or same price.

Being able to retail at a premium price without explanation is hard in any ordinary competitive market.

Position 7: Monopoly Pricing

When there is a monopoly, there is just one business or company in the market offering the service or product. Monopoly pricing has little to do with what value the consumer is getting. In this strategy, consumers have limited options. They can either buy the product/service or not. There are no substitutes.

In theory, the monopolist is able to set the price at whatever level he wishes. But, luckily, in many countries, monopolies in the market are strictly regulated to avert the monopolists from setting price points as they wish.

Example:

Think about Microsoft in the 90s when Windows operating system was the only viable option for personal computers. Microsoft demanded software developers unreasonable prices for the patent license and information fee. Subsequently, Microsoft was fined $1.3 Billion by European union due to antitrust laws.

Another example:

Pfizer, the pharmaceutical company, had enjoyed monopoly pricing on its famous little blue pill – Viagra. Thanks to the patent protection laws.

The story goes back to 1998, when Viagra, a patent protected pill, was launched to treat male erectile dysfunction. Viagra soon became a household name and was sold at a whopping retail price of $65 per pill.

In 2017, when the patent protection monopoly ended, many generic drugs were available in the marketplace at reasonable prices as low as $1 per pill.

Position 8: Loss of Market Share

Looking for a disaster recipe? Cease your hunt! This position meets all the criteria to result in a recipe for disaster in any competitive market.

Setting a standard or middle-range price for a service or product with low perceived value is implausible to win over many customers.

Why would a consumer buy a product at a higher price when other, better options are available at the lower or same price from other competitors?

Example:

Remember Blackberry phones?

Imagine the time when the iPhone was first launched in June 2007, it changed the customer perception of the so-called Smartphones.

At that time, Blackberry was already a dominant player in the smartphone market and had mainly focused on business customers. It was known to put emails in the hands of millions of corporate customers.

The entire consumer market was drawn towards the iPhone and later towards Android, which was launched in October 2008. Very soon, Blackberry phones lost their perceived value and subsequently lost their market share.

To Conclude

Bowman’s Strategy Clock is a very beneficial model that enables you to comprehend how companies or businesses compete in the marketplace.

By studying the above combinations of perceived value and price, you can choose a position that makes sense for you and your company’s competencies.

This marketing model is an excellent way of understanding how to establish as well as maintain a competitive position in a market-driven economy.

However, three strategic positions – 6, 7 and 8 – in the Bowman Strategic Clock out of the overall eight are not competitive, where the price point of products or services is higher than the consumer’s perceived value.

Companies or businesses in this position should either change the product or service in such a way that it increases the perceived value or lower the price for such products or services.

If both the options are next to impossible, they better withdraw from the market!

Nonetheless, there will always be entrants that offer a lower price for a higher perceived value.

References & more information

- https://www.pinterest.com/pin/470696598534975870/?lp=true

- https://s3-eu-west-1.amazonaws.com/tutor2u-media/resource-samples/AQA-Business-Year-2-Teacher-PowerPoint-Presentations-Sample.pdf?mtime=20160916112238

- Tassabehji, R. and Isherwood, A., 2014. Management use of strategic tools for innovating during turbulent times. Strategic Change, 23(1‐2), pp.63-80. https://doi.org/10.1002/jsc.1960

- Shakhshir, G., 2014. Positioning strategies development. The Annals of the University of Oradea, 977, pp.416-437. https://ssrn.com/abstract=2479318

Hi,

I am a student and found your article very useful to answer one of my assignment questions, so thank you very much indeed!

Best Regards

Chaminda de Silva

Hi Chaminda,

Wonderful, glad to hear that the article helped you in your assignment.

Happy reading!