Company: Walmart Inc. (NYSE: WMT)

Founders: Sam Walton

Year founded: 1962

CEO: Doug McMillan

Headquarter: Bentonville, Arkansas

Number of Employees (2023): 2.1 million

Type: Public

Market Capitalization (July 2023): $432.17 billion

Annual Revenue (FY 2022): $572.75 billion

Net Income (FY 2022): $13.67 billion

Products & Services: Grocery, electronics, apparel, toys, and home furnishings (some stores also sell fuel)

Means of Sales: Physical Stores and E-commerce.

Competitors: Target Corp, Costco, Dollar General, Dollar Tree, Family Dollar, Kroger, Amazon, Best Buy, and BJ’s Wholesale Holdings.

Introduction to Walmart

Walmart is the largest enterprise in the world in terms of revenue. The retail giant operates 10,500 stores in 24 countries, offering thousands of products to over 230 million customers annually. Besides selling products from its stores, it also sells them via several E-commerce sites like Walmart, Sam’s Club, and Flipkart.

Walmart attracts customers by offering some of the industry’s lowest prices for groceries and merchandise. It does this by buying directly from the manufacturers and is precise with its expenses.

Sam Walton founded Walmart in 1962. He entered the variety retail industry when he opened a Ben Franklin chain variety store, threw away the traditional rules of running a retail shop, and developed his own. Even though he had to shut shop in a little while, the experience was a strategic success and helped him start Walmart.

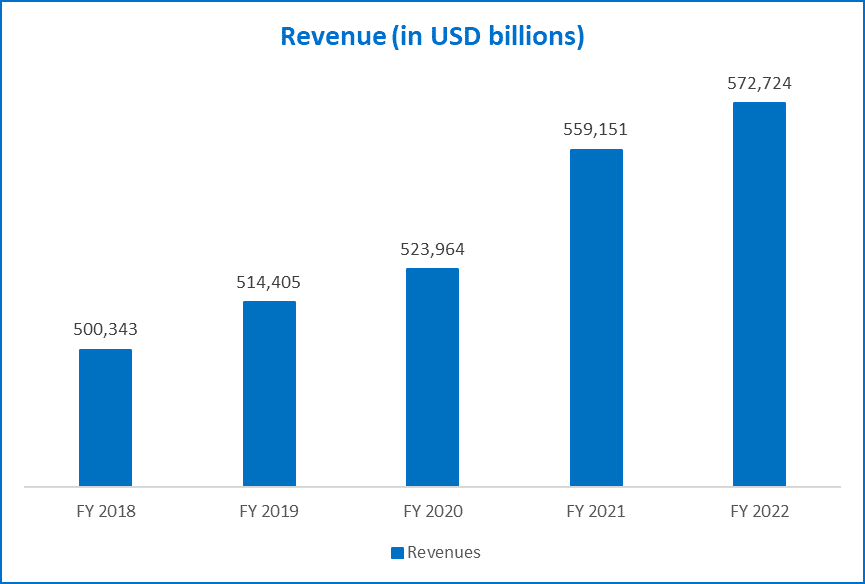

Today Walmart is a retail behemoth. The company’s revenue grew from $44 million in 1970 to $572 billion in 2022, with share prices rocketing from $0.77 in 1982 to $146.67 in 2022.

Walmart’s Business Model

1. Customer Segments

Walmart’s customer base comprises two segments:

- Individual customers

- Business customers

The firm markets to consumers through its two distinct brands. Walmart’s target demographic consists of middle-income and lower-income families who prefer to shop in one location. On the other hand, Sam’s Club caters primarily to the middle and upper-income groups.

Together, the two businesses have a massive customer base that spans the entire country and encompasses virtually every demographic.

2. Value Propositions

Walmart offers customers a range of products at the best possible price and in the most convenient way, living up to its motto of

“Save Money. Live Better,“

It achieves this by focusing on a strategy that revolves around four key ideas:

- Buy Cheap, Sell Cheap

- Earn profits on volumes

- Focus on customers

- Avoid pointless expenses

The company has also renewed its focus on technology, investing more than $14 billion in automation technology, supply chain, and customer-facing initiatives in FY 2022.

3. Key Partners

Being the largest retailer in the world necessitates establishing a global network of distributors, suppliers, and manufacturers for the company to manage its massive supply chain effectively.

Over 100,000 vendors and 210 warehouses are on-board with the organization. Walmart’s distribution network is among the largest in the world, providing service to shops, warehouse clubs, and home delivery.

In addition, more than 11,000 individuals contribute to Walmart’s transportation system, which includes a fleet of 9,000 tractors, 80,000 trailers, and several other vehicles.

Some of the primary suppliers to Walmart include-

- Plug Power Inc.

- Proctor & Gamble

- Hewlett-Packard

- Green Dot Corp

- Primo Water Corp

4. Key Activities

- Buying Goods: Since Walmart is in the retail sector, it must frequently purchase various products from numerous categories. This method involves extensive negotiations and bulk purchases from suppliers and manufacturers. The company also distributes products under the Great Value

- Transporting and Delivering Goods: The corporation sells around 120,000 distinct types of products. Most of these commodities are purchased in bulk, so the corporation must devote substantial resources to transportation. Additionally, the business must organize conveyance for home deliveries and in-store pickups.

- Inventory Control: To ensure that its shelves are always stocked, it has to confirm an appropriate amount of inventory.

5. Key Resources

- Human Resources: With approximately 2.1 million employees, the corporation is the largest private employer in the world. These individuals are vital to managing its over 10,500 stores, distribution hubs, and virtual infrastructure.

- Mobile app and website: The corporation already reigns supreme among retail outlets. After experiencing intense competition from online retailers like Amazon, the company’s website and shopping app now account for a significant amount of its overall sales.

- Stores: The company operates 10,500 Walmart and Sam’s Club locations. These retail locations generate the majority of Walmart’s revenue.

6. Key Acquisitions

After a certain point, every company augments the traditional organic growth route with strategic acquisitions. Walmart has also followed the same path, with some of its notable acquisitions such as:

- Asda: Walmart Inc. owned this British supermarket until last year when it was sold to the EG group for more than GBP 6.8 billion.

- Seiyu Group: Walmart owns a 15% stake in the Japanese retail company. Seiyu has more than 400 stores in Japan and is worth an estimated $13 billion.

- Flipkart: Walmart acquired a 77% stake in the Indian E-commerce giant in 2018. Currently, Flipkart is India’s second-largest E-commerce company. It also owns other notable online companies like Myntra and PhonePe.

- Massmart: It is the second largest distributor of goods in Africa. The company owns local brands like Makro, Game, and Jumbo, each occupying a different space in the consumer necessity and discretionary market. Walmart bought the company for $2.54 billion in 2011.

7. Key Competitors

The retail industry is ancient, mature, and overcrowded. Even though Walmart is the largest retail chain in the world, it still faces stiff competition from-

- Amazon: Amazon has changed the game in the retail industry. It can offer customers products are extremely low prices since its overhead costs are next to nothing. The online retailer received a significant boost during the pandemic when retail stores were forced to shut down.

- Costco: Costco offers the best hotdog and soda combo in the US and is also one of the favorite places to shop for consumers. Its strategy of a no-frills warehouse-like store that offers everything in bulk is a real challenge to the savings promised by Walmart.

- Target: Just like Walmart, Target also focuses on savings, but it also focuses on online sales, with more than 18% of its revenue coming from online channels. It also has smaller stores with more premium-looking interiors and a youthful feel.

- Dollar General: Dollar General is the largest discount retail chain in the US, with more than 18,000 stores. The company generally targets low-income demography and offers products at significantly low costs. In the current inflationary environment, with forecasts of a recession, Dollar General is expected to increase its footfall.

8. Channels

- Wal-Mart Discount Stores

These are mid-sized stores offering a variety of value-priced items. The discount stores are spread across 107,000 square feet, employ about 225 associates and offer 120,000 items each.

- Wal-Mart Supercenters

These 24/7 large stores focus on offering customers the convenience of a one-stop shop. These stores have third-party restaurants, hair salons, banks, fuel stations etc.

Supercenters average 187,000 square feet, employ 350 or more associates on average and offer 142,000 different items.

- Wal-Mart Neighbourhood Market

These stores are the smallest of the lot and focus on delivering everyday items like groceries, pharmaceuticals and general merchandise. Neighborhood Markets have an average size of 42,000 square feet, employ 95 associates on average, and offer about 29,000 items.

- Sam’s Club

This members-only warehouse club offers general merchandise and large-volume items at value prices to small business owners and families.

The average size of Sam’s Clubs stores is 132,000 square feet, employ around 160-175 associates, and roughly have 5,500 products.

- Online:

The company generates a majority of its online revenue in the US from the following two sites:

- walmart.us

- samsclub.us

It also has a majority stake in the Indian E-commerce giant Flipkart.

9. Customer Service

Walmart has a long and distinguished history of putting customers first. The company’s founder, Sam Walton, invented the concept of door greeters. The organization also employs a workforce to provide customer service via chat, internet, and telephone, besides in-store customer support representatives.

Today, Walmart’s CRM strategy, customer service strategy, and customer experience initiatives work in tandem to develop customer loyalty that rivals most other retailers. According to InMarket, Walmart has the most loyal customer base of all retailers in the United States.

10. Walmart’s Cost Structure

Walmart is a wholesaler and retailer, acquiring goods from producers and suppliers.

- The cost of buying and transporting these goods (cost of sales) was $429 billion in FY 2022, $9.3 billion more than FY 2021’s cost of sales of $420.3 billion.

- Operating and SG&A costs (short for selling, general, and administrative) amounted to $117.8 billion in FY 2022, up $1.5 billion from $116.29 billion in FY 2021.

11. Walmart’s Revenue Streams

- The company posted revenue of $567.76 billion for FY 2022, an increase of 2% over FY 2021.

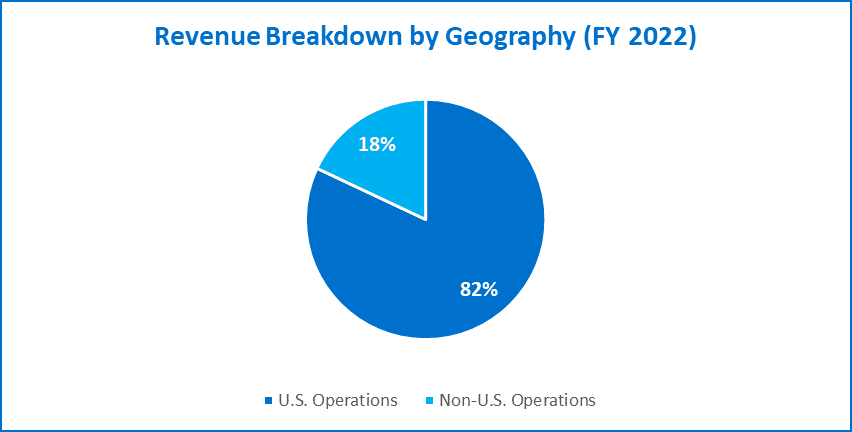

- Most of Walmart’s revenue (82%) was from the US, followed by its International business (18%).

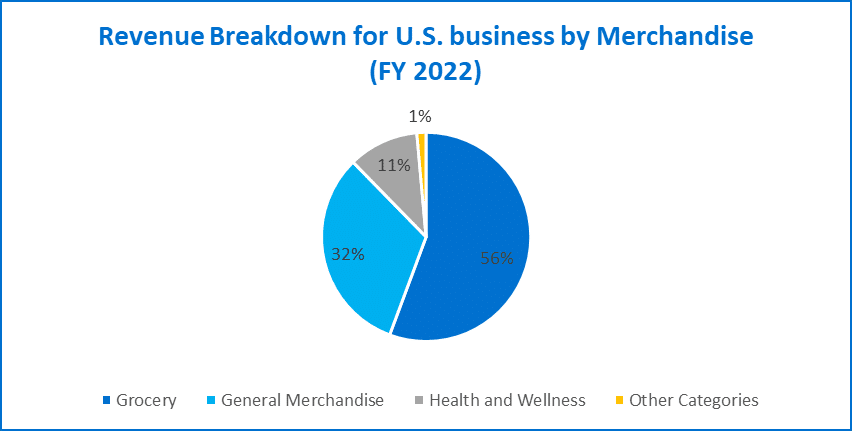

- In FY 2022, groceries accounted for 56% of Walmart’s total income in the US, followed by general merchandise (32%), health and wellness (11%), and other categories (1%).

- The company posted a net profit of $13.67 billion in FY 2022, slightly higher than the $13.5 billion profit in FY 2021.

- Walmart also witnessed a surge in inventory from $44.95 billion in FY 2021 to $56.5 billion in FY 2022, indicating a slow movement of products.

Final Thoughts

Walmart is #1 on the list of Fortune 500 companies in the United States for 2022. The annual list of Fortune 500 companies, compiled and published by Fortune magazine, ranks the most significant corporations in the United States in terms of revenue for the fiscal year.

The changes implemented by the company on how consumers shop have influenced the overall culture, leading to its robust growth.

Walmart’s business ethics have also provided investors with astronomical returns on equity. For instance, an investor who bought $1,000 worth of shares in 1972 when the company first listed on the NYSE would have seen its value rise to nearly $3 million at the end of 2022.

References & more information

- Walmart SEC filings: https://stock.walmart.com/financials/sec-filings/default.aspx

- SimilarWeb: https://www.similarweb.com/top-websites/category/e-commerce-and-shopping/

- Linda Shepherd for NCESC: https://www.ncesc.com/companies-owned-by-walmart/

- Liz Flynn (2019, April 19): https://moneyinc.com/companies-you-didnt-know-walmart-owned/

- Marianne Wilson (2021, November 06): https://chainstoreage.com/walmart-has-most-loyal-customers-us-followed-fred-meyer-meijer-and-target

- Sandra Gudat (2022, May 2): https://www.customer.com/blog/retail-marketing/how-walmart-customer-loyalty-rose-to-the-top-and-stayed/

- Elvin Mirzayev (2019, September 03): https://www.investopedia.com/articles/active-trading/070715/target-vs-walmart-whos-winning-big-box-war.asp

- Walmart corporate website: https://corporate.walmart.com/

- Yahoo Finance: https://finance.yahoo.com/quote/WMT?p=WMT&.tsrc=fin-srch

- Richard Best (2022, May 02): https://www.investopedia.com/articles/insights/050116/walmart-stock-analyzing-5-key-suppliers-wmt.asp

- James Moore (2014, January 10): https://www.talkativeman.com/sam-walton-frugality-wal-mart/

- Featured image by Marques Thomas

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment