Coinbase is one of the largest and most prominent crypto exchange platforms, with a 24-hour trading volume of $3.48 billion. Crypto exchange platforms offer a secure environment to buy, sell, and trade their digital currencies. Think of these online platforms as a stock exchange that facilitates the exchange of cryptocurrencies instead of company stocks.

What is Coinbase?

Founded in 2012 by the due, Brian Armstrong and Fred Ehrsam, Coinbase is a crypto exchange platform that aims to modernize the traditional financial system and boost economic freedom for crypto enthusiasts.

Like other crypto exchange services, it supports trading, staking, storing, and international transfers. However Coinbase’s ability to offer a secure infrastructure for customers to engage in on-chain activities, including decentralized apps and self-custody wallets makes it stand out against the competition.

Coinbase Customer Segmentation

Coinbase primarily caters to three customer segments:

- Retail customers: Coinbase allows retail crypto enthusiasts to trade cryptocurrencies. It also makes it easier for them to participate in onchain activities.

- Institutions: Hedge funds, banks, asset managers, market managers, investment advisors (ones registered on the platform), private and public organizations, and payment platforms also use Coinbase to avail of its range of crypto services.

- Developers: Developers, merchants, financial companies, and creators use Coinbase to create onchain applications, products, and protocols.

Coinbase is a prominent crypto exchange platform with over 7 million monthly trading users (MTU) in over 100 countries. But why do individual investors and diverse organizations trust this platform? Let’s find out.

Coinbase’s Value Propositions

Coinbase’s unique value propositions for its customers include the following:

1. Crypto trading

Coinbase’s USP is that it offers traders, first-time and advanced, a secure environment to buy and sell cryptocurrencies. Additionally, it provides advanced trading tools, including real-time market data through digital charts, order books, and live trade history to experienced traders. Bonus features like recurring trades and fixed price quotes enhance customer experience.

2. Dedicated platform for institutional customers

Coinbase’s full-service brokerage solution, CoinBase Prime, allows institutional users to take advantage of interconnected trading routes through liquidity access and best rate execution strategy.

3. Supports spot and derivatives trading

Customers can trade derivatives and spots on the Coinbase Exchange, the Coinbase Derivatives Exchange, and the Coinbase International Exchange. Coinbase is working tirelessly to get regulatory approval from various authorities to allow non-US residents to trade internationally.

4. Crypto ecosystem products

Coinbase is also pushing the envelope and offers other products and services to its customers, like stablecoins. Moreover, it facilitates proof-of-stake service to make staking easier, earn rewards, and enable its customers to maintain 100% ownership over their digital assets. That’s not all.

The crypto platform provides financing to eligible customers so they have enough liquidity while trading and hedging. Partnered organizations might also be able to finance their working capital requirements.

5. Self-custody wallet

Coinbase Wallet empowers customers to participate and take advantage of Dapps (decentralized applications) and other crypto usage, eliminating the need for a centralized intermediary. Although users have the option to link the wallet with their Coinbase account, they’ve complete control over their private keys and seed phrases.

Users interested in onchain activities might benefit from Coinbase’s web3 wallet feature.

6. Product suite for developers

Coinbase offers a suite of products for developers, including Coinbase Cloud, Base, and Coinbase Pay. CoinBase Cloud offers access to crypto trading and payment APIs (application programming interface), staking IT infrastructure, and data. This helps developers model digital products quickly and improves their interaction with blockchain networks.

Similarly, Base is an Ethereum Layer 2 chain that allows developers to use the Coinbase ecosystem and boosts speed and productivity. On the other hand, Coinbase Pay and Coinbase Commerce lets merchants and developers incorporate cryptocurrency transactions into their business model.

Who are the Key Partners of Coinbase?

Coinbase’s partners have helped propel the company to success. Its key partners include:

- Investors: Coinbase’s investors help keep the company afloat.

- Banking partners and payment processors: Coinbase enjoys mutually beneficial partnerships with multiple financial institutions.

- Joint ventures: Coinbase has entered into various joint ventures with organizations, including Circle, the USDC issuing authority.

- Buyers and sellers: Several individual and institutional buyers and sellers use Coinbase to purchase and offload their cryptocurrencies.

- Developers: Coinbase’s developer product and service suite allows varied developers and merchants to adopt, integrate, trade, and transact in digital currencies.

What are Coinbase’s Key Resources?

Coinbase’s key resources include:

- Coinbase’s crypto exchange platform is its biggest resource.

- Profitable partnerships, joint ventures, acquisitions, and strategic investments across the globe.

- Coinbase’s ecosystem of over 3,400 employees globally.

- Intellectual property rights, like trademarks, patents, copyrights, contractual provisions, confidentiality procedures, and trade secrets.

- Enviable network of payment service providers (PSPs).

- Excellent brand image in the cryptocurrency sector.

What are Coinbase Channels?

Crypto enthusiasts can sign up on Coinbase through its website. Additionally, the crypto exchange company is active on multiple social channels—X (formerly Twitter) and Facebook—and leverages them to promote its operating systems. The company also has an active blog page where users can explore more about the world of cryptocurrency and onchain services.

How does Coinbase Maintain Customer Relationships?

Coinbase customers can sign in and visit the Contact Us page to choose the product they’ve questions about, such as Coinbase, Coinbase Prime, Coinbase NFT, Coinbase Wallet, Coinbase Commerce, Cloud, and Coinbase Card, and contact the Support team.

Or visit the Help Center to access self-service tools for the most common problems, such as getting started, adding a payment method, managing accounts, reporting fraud and suspicious activity, trading and funding, paying taxes, and privacy and security.

They can also get help based on the product they’ve questions about, like Coinbase Wallet, Coinbase Advanced, USDC (USD Coin), Futures, Coinbase NFT, Coinbase Card, Coinbase Earn, Learning Rewards, Dapps, Cloud, and Coinbase Commerce.

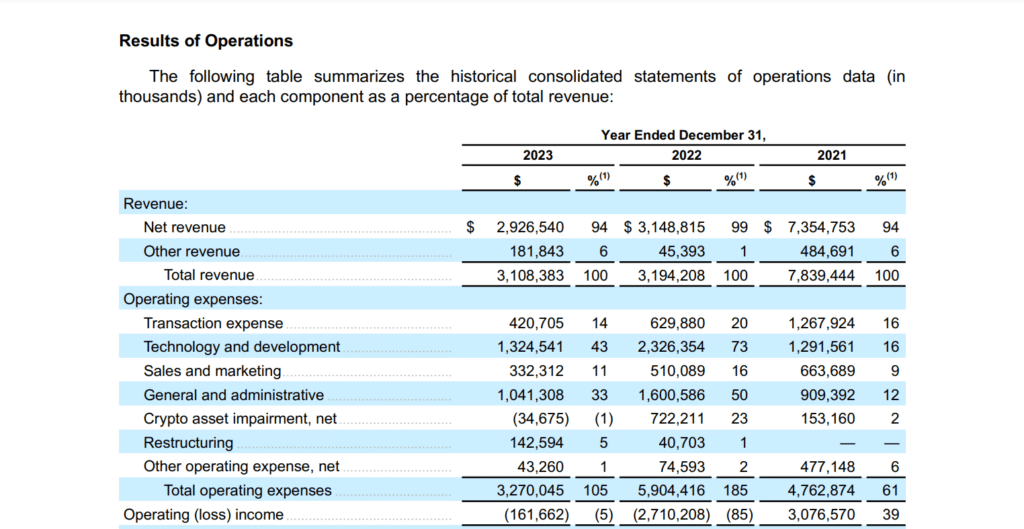

What is Coinbase’s Cost Structure?

For the fiscal year ending December 31, 2022, Coinbase’s total operating expense was approximately $3.27 billion.

It incurred $420 billion in transaction expenses, $1.32 billion in technology and development, $332 million in sales and marketing, ($34.6) million in crypto asset repair, $142 billion in restructuring, $1.04 billion in general and administrative expenses, and $43 billion in other expenses.

How Does Coinbase Generate Revenue?

Coinbase’s total revenue was around $3.12 billion for the fiscal year ended December 31, 2022. Its net revenue was nearly $2.93 billion while it earned $181 million as other revenue.

But how does Coinbase make money? Let’s find out.

Coinbase’s revenue streams can be categorized into three sections:

1. Income from transactions

Coinbase’s primary source of income is transaction fees applied to spot trades. The fee depends on the price and quantity of the digital currency (or asset) purchased, sold, or converted.

2. Income from subscriptions and services

Coinbase’s partnership with USDC makes it eligible for stablecoin revenue. The company earns a proportionate amount of USD Coin’s reserves on multiple platforms, as well as the circulation and usage of the stablecoin. It also earns a cut from the staking rewards earned by its customers.

Additionally, the platform generates interest income from customer custodial funds deposited with partnered banks and loans issued to qualifying customers. Further, Coinbase charges customers a custodial fee in exchange for its cold storage wallet. Subscription revenue from Coinbase Cloud, Coinbase One, and Prime Financing also pad the company’s bank accounts.

3. Other sources

Income from other sources includes interest earned from corporate cash and cash equivalents and the sale of crypto assets.

The Bottom Line: Coinbase is empowering customers across economies

Coinbase has carved a niche for itself in the crypto asset industry by empowering customers across the globe to explore, buy, sell, trade, and convert cryptocurrencies on their terms.

References & more information

- Raynor de Best (January 9, 2024). Biggest crypto exchanges 2024. Statista

- Coinbase

- Coinbase – Investor Relations

- Coinbase Global, Inc 2023 – 10K

- Coinbase Global, Inc 2023 – 10K

- Contact Us – Coinbase

- Coinbase Help

- Featured Image by PiggyBank

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment