Last updated: May 18, 2020

Company: Popmoney (Division of Fiserv)

CEO: Jeffery W. Yabuki

Founders: Sanjeev Dheer

Year founded: 2010

Headquarter: New York, NY

Products & Services: Peer to Peer Payment System

Competitors: Zelle | PayPal | Venmo | CashApp

Fun Fact: The name ‘Popmoney’ is a short name for “Pay Other People Money.”

About Popmoney

Popmoney is a personal payment system that lets users send and receive money electronically without the need for cash or checks.

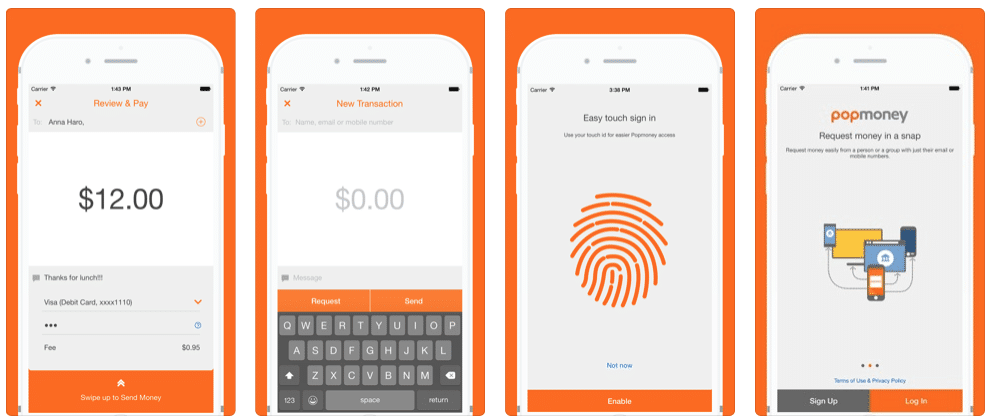

Popmoney claims that using their payment system to send or receive money is as easy as texting or emailing. Users can access Popmoney through Popmoney.com and create an account through its website or online banking account if its financial institution offers Popmoney.

Wells Fargo, Bank of America, Citibank, TD Bank, US Bank, Fifth Third Bank, etc. are examples of some banks or credit unions that offer Popmoney through online banking.

Popmoney was developed and launched by the Company CashEdge in 2010. The financial giant, Fiserv acquired CashEdge in 2011, integrating their personal payment system Zashpay with Popmoney, keeping the combined name under Popmoney.

Popmoney works by letting users send, receive, and request money. The actions are secured through a user’s bank account or the profile they set up through the website.

Unlike other person to person payment systems like Venmo or CashApp, Popmoney partners with financial institutions to allow users to send or receive money.

Some of the country’s largest financial institutions such as Citibank, PNC Bank, Regions Bank, Fifth Third Bank, and BBVA Compass were included in the combined Popmoney and Zashpay network after the company’s acquisition.

Popmoney is exclusively available for use between Eligible Transaction Accounts and registered users residing in the United States.

How is Popmoney different from other peer to peer payment services?

Popmoney can be used directly through your bank’s website if it is included in one of Popmoney’s thousands of participating institutions.

Users can simply log onto their online banking sites and start sending money to friends, family, or anyone. Popmoney (Pay other people) allows you to send money directly from your existing Eligible Account to another Eligible Transaction Account.

There is no fee to receive the money on Popmoney; however, a small fee of $0.95 is charged when sending or requesting money. The fee will not be taken from your account unless both actions are approved.

If a person’s financial institution doesn’t offer Popmoney, they can still send and receive money. All you need to do is simply create an account and verify your information to get started.

Simply log onto your online banking website to start sending money to anyone. To send money to someone who does not have a Popmoney account, the person receiving the money will first have to create an account to receive the money you sent.

Sending Money

Popmoney users can send money by using a recipient’s email address, mobile number, or Eligible Transaction Account information.

Funds usually take 1 business day to be deducted from a sender’s bank account if the payment was made after 5 p.m. Pacific Time. Funds are debited from a sender’s account immediately if they made their payment using a debit card.

Receiving Money

Users receive money depending on how the other user sent the money. If the user sent the money using an email address or a mobile number, money is received with an email or text message with instructions on how to deposit the money into a user’s Eligible Transaction Account.

If the sender used the Eligible Transaction Account information to make the payment, the money is deposited directly in that account. Users receive notifications if the money is sent with the optional message when the payment was submitted.

When users receive money, they can choose which account on their profile the deposit money into. Users have 10 days from the date the payment was received to deposit the money before it expires.

If a payment expires, the funds are returned to the sender. There are no fees to use Popmoney to receive and deposit payments. Funds will be available within one business day in a user’s account from the date of money deposited.

Requesting Money

Users can request money from someone by using either

- a name and email address, the contact will get an email with brief instructions on how to pay the request

- a name and mobile number, where a text message will be sent to the recipient on the user’s behalf with brief instructions on how to pay the request.

Popmoney has a limit on the number of requests and the value of requests that users can send within a certain time period. There is a $0.95 fee to the user to send a request.

Paying Requests

Users are notified that a request for money has been made either through email or text message included with instructions on how to pay the request. If an individual uses Popmoney through their bank, the user will log into their bank’s online website.

The request will appear in the To-Do list tab of the Popmoney section, where users can pay the request. Through the Popmoney website at Popmoney.com, users can also request through the “Pay Request/Invoice” link of the homepage.

Requests through Popmoney are paid with a US bank account or debit card issued by a financial institution. Once requests are paid, it usually takes 1-3 business days for the person who requested money to receive the payment.

The money is deposited in the requestor’s bank account. Users have 30 days to pay a request before they expire and are no longer visible in a user’s To-Do list.

Donations

Individuals can use their Popmoney account or their Eligible Transaction Account to make donations to charities and non-profit organizations. Users have the option to set up recurring donations by choosing a start date and selecting a recurring schedule option.

Privacy and Security

Popmoney uses secure technology throughout the entire transaction process. Users put in their information, including a cellphone number, and receive a verification code that they provide back to Popmoney to verify the mobile number is theirs before payments are sent or deposited.

When processing transactions, Popmoney will share small amounts of information about users, including name, email addresses, telephone numbers, and anything typed in the message field.

Popmoney uses secure technology throughout the entire transaction process. Users put in their information, including a cellphone number, and receive a verification code that they provide back to Popmoney to verify the mobile number is theirs before payments are sent or deposited.

References & more information

- Popmoney website

- FAQ | Popmoney

- Fiserv SEC Filing

- Featured Image by Mohamed Hassan from Pixabay

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment