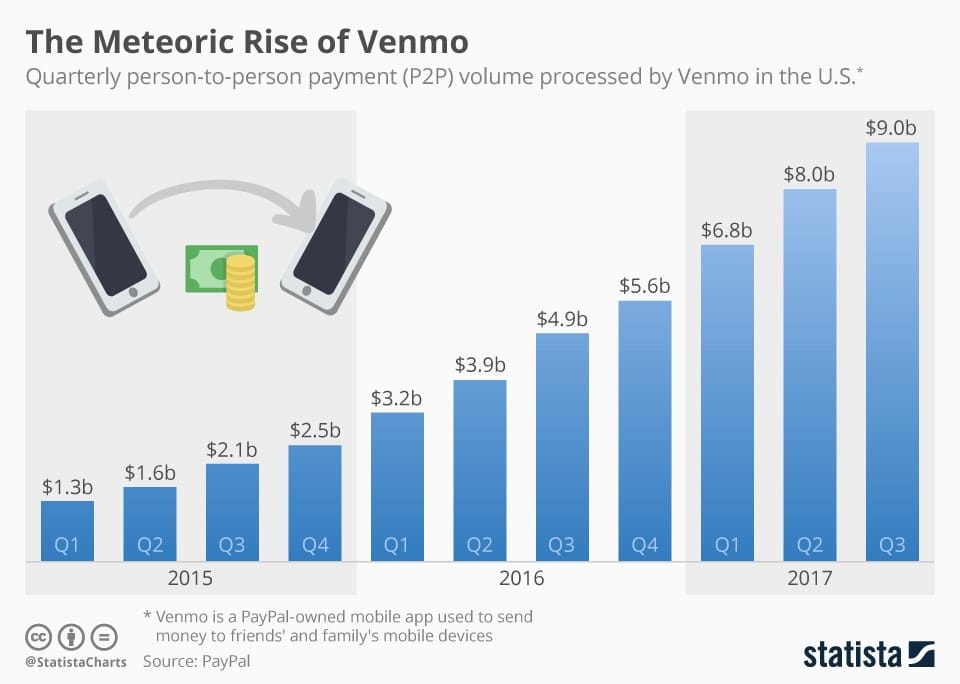

Introduction to Venmo

Venmo, a subsidiary of Paypal, is a platform that offers users to transfer funds based on a mobile-app P2P system (peer-to-peer). The platform allows users to make transactions without dealing with banks that take 1-3 days in transferring and validating clearance of such transactions. The platform was originally authored and designed by Andrew Kortina and Igram Magdon-Ismail and was later sold to BrainTree.

On September 26th, 2013, PayPal bought Braintree, adding Venmo to its portfolio. Currently, the Venmo payment is accepted by over two million locations throughout the United States.

Due to undisclosed financials, it isn’t clear how much revenue Venmo platform has brought into Paypal’s portfolio.

Despite its popularity, Venmo platform is not profitable at this point.

According to a CNBC news, PayPal CEO mentioned that “Venmo platform was able to generate about 80% terms of revenue each year since acquiring, and he further mentioned that the platform has been predicted to reach 100 Billion Dollars in total revenue by the end of 2019. Although the platform was able to produce 80% from initial investments, the CEO mentioned that;

“Venmo should be continuously developed in; new services should be implemented and introduced to the line of users, and continue with the monetization efforts that will eventually flourish Venmo capacity to generate higher revenue streams.”

The following article provides an overview of Venmo revenue model, and the specifications of how does Venmo makes money?

Venmo Business

Before acquiring Venmo, Paypal mentioned that they are to continue their focus by prompting their loyal customers to pay through the Venmo payment system. Venmo has easy functionality with low usage fees, which makes the platform an exceptional option.

The Venmo platform allows retailers to pay for merchandise through smartphones instead of using cash or credit. Regardless of what type of business or the purpose is, Venmo cashless system makes it much convenient for users to transact without the burden of involving a third party.

Venmo structure has been designed to work as an application-based peer-to-peer payment system, an alternative to processing checks, wiring transfers, and other ATM services successfully and instantly. Users can even pay utility bills easily and instantly. Venmo requires users to link a credit card, debit card, or checking account to their accounts.

- Exchange Funds

- Send Charges

- Store Funds on Venmo Platform

- Cash-out through the linked banking system

- API – allows websites and businesses to add Venmo platform to their payment service options

Venmo API Structures

Make Payments and Share

- Venmo’s API structures offer its users to transact payments across different networks/groups/ individuals using the funds that are accredited to Venmo.

- Users can also link bank accounts or debit cards simply and easily.

Connect With the Community

- Users are able to share experiences with a particular group, a specific community/individual. Such experiences may include notes, sharing of a location, notification of users paying for a specific product or service.

Making Purchases

- With the Venmo account, users can utilize the platform from the ease of their mobile app, quickly and conveniently

Transfer Money to Bank Account

- Users can easily transfer funds directly to their bank accounts

Venmo Revenue Model

Anonymous Inquiries and New Users

|

Several times a day |

4% of Users |

|

Once a day |

2% of Users |

|

A few times a week |

3% of Users |

|

About once a week |

2% of Users |

|

Once a Month |

3% of Users |

|

A few times a year |

3% of Users |

|

Non Account holders with no prior experience |

83% of Users |

- Since there are about 83% of non-account holders, they are the main ones that are signing up for the services.

Sign-ups are free, and the only fee is a standard transaction fee of 3%

Since there is no cost to sign up, and funds are backed by accredited accounts, (personal bank account), the signup conversion rate is very high.

Backed by Huge Database

One of the most strategic methods that PayPal implemented across its channels is the fact that Papal already had a wide range of users from the eBay platform alone. With this platform, they were able to promote and prompt users to utilize the platform that helps gain its potential today.

Designed for the Community and the Trusted

Venmo transaction platform allows users to send/receive funds transactions from friends, family, and people who you know and trust.

Secured Platform

The Venmo platform allows users-to-users to use the platform, meaning that Venmo users with funds cannot process a payment on behalf of someone else’s account.

Due to security measures, Venmo users should first transfer the amount directly to such a Venmo account holder, then that third person can use such funds to make the transaction legally.

The amounts of such transactions are kept classified and are displayed between the two parties involved in the transaction.

No Third-Party Association

Users and business operators can transfer funds directly into another account or transact payments through channels that accept Venmo as a legal payment option.

Users no longer need to conduct bank transfers that require a total of 3 business days for validation and clearance.

With Venmo, payments are captured and verified in approx. 20-30 minutes and revenues are generated and considered much quickly.

The Venmo Card

The Venmo card is free for all users. Users are charged a 1% fee for transacting through the card to send or receive funds. The process of transferring takes no longer than 30 minutes and is accessible within the first 24 hours.

It costs 1% for clearance and validation, unlike banking that requires 2-3 days without fees. With such options and features available, Venmo revenue streams are increased.

Venmo Payments

The number of Venmo users is increasing in both aspects of the business, private, and corporate levels. Venmo payment option is hosted and featured through the PayPal platform. However, some eCommerce website may feature Venmo as a stand-alone method

80+ million online eCommerce transaction daily

Through its accessibility, Venmo is preferred over other modes of payment methods

Venmo payments integrated on eCommerce sites helps to boost the revenue streams of Venmo, due to its simple structure.

Uber and Uber Eats Integration

- Venmo and Uber created a new payment feature that is integrated alongside with Uber and Uber Eats.

- Users can use the Venmo app and split costs or pay for the entire food order /ride in one go.

- Such integration of the system helped flourish additional streams of revenue for Venmo and increase brand awareness

- . Increase of brand awareness increases new subscribers and users

Final Thoughts

The directors and leading innovators of PayPal are continuously working around the Venmo structure to improve its functionality, services, and efforts towards monetization. Although multiple reports are mentioning that Venmo is not paying off, PayPal CEO said that their plans for Venmo are undergoing and will continue to improve and excel in terms of company growth and scaling up to profitable revenue streams.

References & more information

- https://www.usatoday.com/story/money/markets/2018/07/14/top-mobile-peer-to-peer-payment-platforms-venmo-cash-app-zelle/36726065/

- https://www.investopedia.com/articles/personal-finance/010715/venmo-its-business-model-and-competition.asp

- https://help.venmo.com/hc/en-us/articles/217532097-Can-I-use-Venmo-to-buy-or-sell-merchandise-goods-or-services-

- https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=83115828

- https://www.uber.com/newsroom/uber-venmo-team-new-way-pay/

- https://www.recode.net/2018/1/31/16957212/ebay-adyen-paypal-payments-agreement

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment