Company: Zillow Group

Founders: Rich Barton & Lloyd Frink (former Microsoft executives)

CEO: Spencer Rascoff

Year founded: 2006

Headquarter: Seattle, Washington

Industry: Online real estate marketplace

Number of Employees (Dec 2018): 4336

Type: Public

Ticker Symbol: ZG / Z

Market Cap (2019): $7.55 Billion

Annual Revenue (Dec 2018): $1.33 Billion

Profit |Net income (Dec 2018): (- $119 Million)

Subsidiary: Zillow | Trulia | StreetEasy | Naked Apartments | Mortgage Lenders of America | HotPads | RealEstate.com | Out East | Zillow Premier Agent | Dotloop | Bridge Interactive | Mortech

Products & Services: Rent | Buy | Sell | Finance real estate

Competitors: Redfin | realtor.com | apartments.com | homesnap | move | zumper | Apartmentguide | Homes&Land | RealScout | Movoto

Fun Fact:

Zillow has approximately 110 Million US real estate listing database

Introduction to Zillow

Zillow is an online platform dedicated specifically for the real estate database. It is a platform that provides individuals and businesses alike with real estate listing. The system is accessible through the Zillow website or the Zillow application.

Zillow was founded originally in 2006 by two former Microsoft executive; Rich Barton and Lloyd Frink.

Zillow Group’s portfolio offers all stages of the home lifecycle, which includes renting, buying, selling, and financing. Its portfolio has 11 different types of subsidiaries. They are as follows:

- Zillow

- Trulia

- StreetEasy

- HotPads

- Naked Apartments

- RealEstate.com

- Out East

- Zillow Home Loans

- Bridge Interactive

- Dotloop

- Mortech

Zillow Group’s major portfolio brands

- Zillow: Leveraging the power of clients, data, a culture of innovation and partnership, Zillow aims to fulfill the responsibility to make it easier and pleasant for everyone. So that they find and get into their dream house.

- Trulia: With insight sourced straight from locals, Trulia helps in finding the perfect house for everyone, so that the clients experience what living in a neighborhood feels like.

- StreetEasy: StreetEasy provides accurate and comprehensive houses for sale and rent from the real estate brokerages throughout New York City and its main metropolitan area.

- HotPads: A brand for home rental and map-based apartment, to provide the best house in urban areas across the US.

- Naked Apartments: Providing innovative tools and quality listings for rental professionals, they help to connect brokers, home builders, and owners to the renters.

- RealEstate.com: Designed for the fresh and millennial buyers, it is a home shopping brand.

- Our East: Known for providing insider tips and local guides, to make it easier for buyers and renters search by the town to see the farmer markets, transportation options and other points of interest.

- Zillow Home Loans: Provides online mortgage lending service across the US.

Understanding the Revenue Model of Zillow

Zillow’s business model is based on P2P (peer-to-peer), B2C (agency-customer) and A2A (agency-to-agency) online platform. The Zillow platform also provides an extensive listing for home buying, renting, leasing, renovating and inquiring.

According to Zillow’s 2018 annual reports, Zillow Group reported that a total of 157 million average monthly unique users visit Zillow Group brands, mobile applications, and its associated websites.

Zillow Listing fees:

Sellers can list their homes for free, there are no charges for listing the homes on Zillow and homebuyers can search for homes for free! If Zillow is not charging for listings, then you might wonder, how does Zillow make money?

According to Zillow officials, Zillow works like a media company (television, magazine, newspapers, home buyers guide) that generates revenue by promoting and selling advertisement on its web site.

The following article provides an overview of Zillow revenue model, and the specifications of how does Zillow make money? in more detail.

How Does Zillow Make Money?

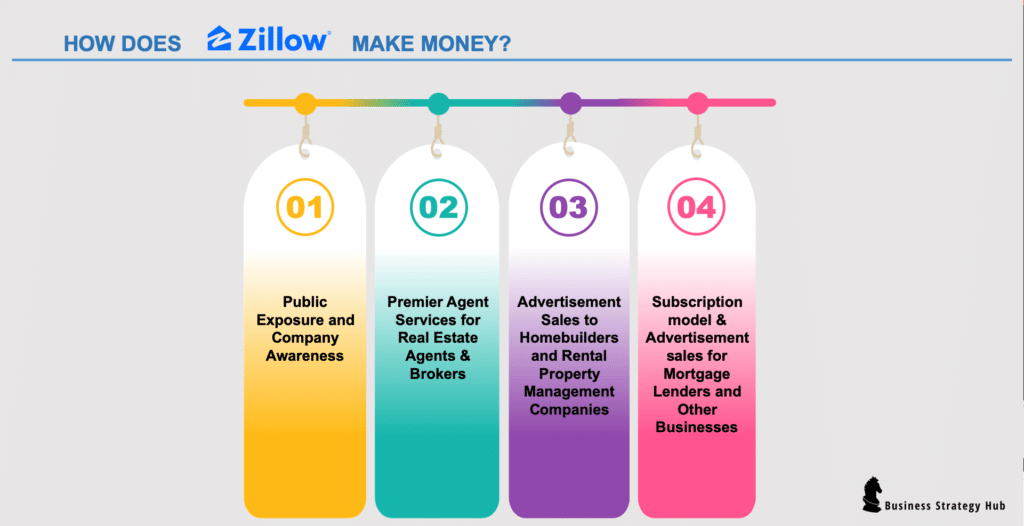

1. Public Exposure and Company Awareness

Zillow announced about a collaboration that helps direct its real estate search engine to 280+ United States based newspapers as part of the Zillow Newspaper Consortium.

Through the Zillow Newspaper Consortium feature, advertisers can choose to have their listing and open house information on Zillow. It creates a comprehensive offline and online source of open house information and contributes to various for-sale listings to help buyers search.

By establishing such a platform, its win-win-win situation for website users, selling companies and Zillow. Zillow provides more exposure to companies such as home builders, real estate agents, brokerage firms and advertisers.

They tap into Zillow’s 157 million average monthly unique users, while Zillow’s users can have access to additional real estate listings that are available on the old school newspaper.

And finally, Zillow generates an additional flow of revenue by advertisements that are posted on the Zillow online platform and other network platforms.

2. Premier Agent Services for Real Estate Agents & Brokers (67% of its revenue)

Premier Agent Revenue

It is derived from Premier Agent and broker programs. With a premier agent and broker programs, a set of marketing and technology products are offered to help the brokers and real estate agents achieve their goal of advertising.

Premier agents pay Zillow for advertisement and sales lead. Cost of advertisements and leads depends on market demand (zip code, location) and competition.

-

- Cost per ads impression – It is a cost for 1000 ads views. Agents are charged when their listing (impressions) are viewed by the mobile/web users.

- Cost per leads – Zillow sells customer leads to premier agents at a price which may vary from $20-60.

Also, all the premier agents and brokers get access to the dashboard and customer relationship management (CRM) to perform analytics and nurture their lead pipeline.

Pricing Models

Zillow has been testing two different pricing model to charge Premier agent and brokers. First, one is the Auction Based pricing model and second is Flex Pricing model.

Auction-Based Pricing Model – In April 2018, a new form of distribution and lead validation was tested. Under auction-based pricing model, the number of customer leads is distributed to agents and advertisement impressions appearing on the pages are based on agent’s share of voice (% of ads spending against competing real estate agents)

Flex Pricing Model – In Oct 2018, a new Flex pricing model for premier broker and agent advertising service was tested in limited markets. Through the Flex pricing model, premier brokers and agents are provided validated leads at no upfront cost, and the advertising fee is paid only when real estate transaction is closed with any of the leads.

3. Advertisement Sales to Homebuilders and Rental Property Management Companies

Zillow accumulates revenue through charging rental property management companies to advertise their listing on the Zillow Rental Network. Zillow charges on the basis of Cost per lead, Cost per click and Cost per lease.

Zillow reported that property management companies are spending about $3.5 Billion per year on marketing efforts. Such spending makes Zillow potential to gain such revenue streams. Those revenue streams are sought by channeling Zillow as a resourceful and exceptional platform for the real estate industry.

4. Subscription model & Advertisement sales for Mortgage Lenders and Other Businesses

Zillow generates additional income through selling “advertising space” on its website on the cost per lead basis. It is geared specifically for mortgage professionals, lenders, and other businesses that want to reach Zillow visitors.

Besides, Zillow has a subscription model for mortgage services. It includes connect and custom quote services and lead management platform.

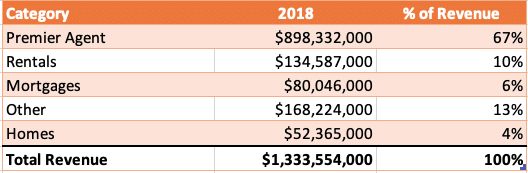

At a high level, this is how Zillow’s (2018) revenue break down looks like:

*Other – includes revenue from new construction property, ads sold to home builders

*Homes – includes resale of homes on the open market

Final Word

Zillow is an exceptional platform for buyers, investors, agents, and home builders and rental professionals. The website serves exceptionally with unique features and tools that can help professionals in improving their real estate business, assist in promoting the real estate industry and collectively help establish and grow their businesses.

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Zillow has ‘shunted’ its Premier Agent business to one side as it rolls out Zillow Offers, its home flipping operation, with aspirations of selling 5,000 homes a month with revenues of $20Bn a year within 5 years.

The bad news is Zillow Offers has LOST $178M in its first 15 months of operation with an average loss per home sold of $129K. With Accumulated Losses of $811M since inception perhaps a different title for this article would be appropriate – maybe “how Zillow Loses Money” ???