Company: Johnson & Johnson

CEO: Joaquin Duato

Founders: James Wood Johnson, Edward Mead Johnson, and Robert Wood Johnson I

Year founded: January 1886

Headquarters: New Brunswick, New Jersey, United States

Employees (June 2024): Over 130,000

Ticker Symbol: JNJ

Type: Public

Annual Revenue (Dec 2023): $85.2 Billion

Profit | Net income (Dec 2023): $13.33 Billion

Products & Services: Medical Devices | Pharmaceutical | Consumer Packaged Goods

Competitors: Reckitt Benckiser | Unilever | Procter and Gamble | Abbott | Bristol-Myers Squibb | Colgate Palmolive | Merck | Novartis | Pfizer

Fun Fact:

- Johnson & Johnson’s Credo or mission statement has been translated into dozens of languages and dialects, from Arabic to Vietnamese, with 342 words in English, 415 words in Romanian, and 607 words in the Chinese language.

- Johnson & Johnson has revolutionized baby care with baby powder and shampoo products.

- Johnson & Johnson collaborated with NASA to develop advanced wound-care products.

Overview

Founded as a family business over a century ago, Johnson & Johnson grew steadily and survived the worst economic period to become the global powerhouse in medical services. While it started with only 14 employees, mainly consisting of friends and family, it endured all the rough periods and now employs over 130,000 people worldwide.

2023 was a year of significant change and expansion as the company set out to be a leader in the global healthcare sector for many years to come. Following the successful division of the consumer health division, Johnson & Johnson is now dedicated to addressing the most pressing health issues worldwide through cutting-edge scientific research and technological advancements.

The company is now at the forefront of innovating for patients across various healthcare solutions. By concentrating on developing innovative medicines and medical technologies, it hopes to solidify its role as a leader in innovation. The company is also at the forefront of innovating for patients across various healthcare solutions.

As entrepreneurially spirited people, Johnson & Johnson SWOT Analysis offers an invaluable opportunity to learn and build our empires.

Here is an in-depth Johnson & Johnson SWOT Analysis.

Johnson & Johnson’s Strengths

1. Global Dominance

Johnson and Johnson is a leading healthcare company globally, with over 275 operating companies in over 60 countries. It is a leader in medical devices and diagnostics, pharmaceutical products, and consumer healthcare, offering all its products in almost 200 countries.

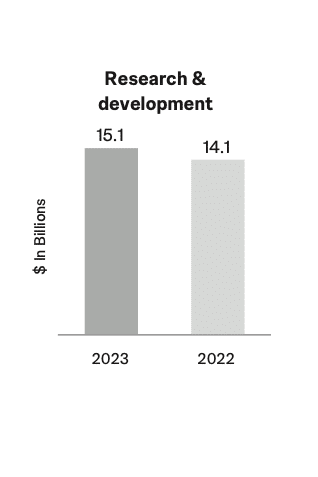

2. Highly Influential on R&D

Johnson & Johnson is one of the most influential companies in the world. It influences the economic well-being of many countries, including the US stock market. The influence stems from the company spending billions of dollars on yearly research and development to develop new medicines and medical devices. For instance, it spent more than $15 billion in 2023, becoming one of the heavy spenders in the sector.

Image Source: Johnson & Johnson

3. Highly Experienced

With over 130 years of experience, Johnson & Johnson understands what it takes to fulfill the target market’s needs fully. Years of experience see the company spearhead the development of innovative medicines. For the 12th consecutive year, it has reported above-market growth in its innovative medicine business. It has already made advances in its pipeline with FDA approval for AKEEGA and TALVEY.

4. Extensive Product Portfolio

From Purell to Tylenol, Listerine, baby products, Destin, Visine, Clean & Clear, Neutrogena, Band-Aid, Stayfree, and Acuvue Lenses, all these products enhance the company’s stability and superiority in the market. The company’s growth is also being fuelled by key brands, including DARZALEX, ERLEADA, STELARA, and TREMFYA, and recently launched CARVYKTI, SPRAVATO, TALVEY, and TECVAYLI.

5. Strong Community Engagement

Johnson & Johnson engages fully in international affairs as a concerned global citizen in matters that affect global health. The company is always at the forefront of global health matters, from the Healthy Child Initiative with the UN to the malaria campaign with the AU and combating the virus with the US government.

6. Robust Supply Chain

Johnson & Johnson has an extensive supply chain that ensures all raw materials are readily available to develop medicines and devices. It also relies on a robust supply chain network to provide pharmaceutical consumer products and medical devices to reach consumers when needed. The strong supply chain has been the catalyst for the company’s year-over-year growth in sales.

7. Brilliant Partnerships

Most companies insist on manufacturing each profitable product, which can be catastrophic. Johnson & Johnson understands the ineffectiveness of this strategy and opts to partner with leaders in specific regions and fields of expertise to deliver highly effective products. For instance, it has a strategic partnership with Microsoft (MSFT) to enable and enhance its digital surgery solutions. It has also inked a strategic partnership with Nvidia (NVDA) to test how industrial edge AI capabilities can be used to enhance surgeries in a medical environment.

8. Effective Marketing

Johnson & Johnson’s marketing strategy focuses on exploiting the emotional connection to nurture trust and long-lasting relationships between mothers and their products. The strategy has effectively marketed the products and attracted customers globally.

9. Strategic Acquisitions and Mergers

The quicker a company enters new and lucrative markets, the faster it grows. Johnson & Johnson strategically acquires and merges with big and small companies for quick and profitable expansion. For instance, it has acquired Ambrx, affirming its commitment to innovation in prostate cancer and adding to the acquisition of Shockwave Medical and Laminar in recent months. The company has spent over $100 billion in investments and mergers, expanding and strengthening its prospects in oncology cardiology, among others.

Johnson & Johnson’s Weaknesses

1. Product Recalls

Some of Johnson and Johnson’s products’ quality has been questioned due to their composition of certain compounds that may cause health issues. For instance, the company’s cough syrup has been recalled in six African countries due to claims of high toxicity levels. In 2021, the company was forced to recall five NEUTROGENA® and AVEENO® aerosol sunscreen product lines due to high levels of benzene in some samples. It also had to recall 33,000 bottles of its Baby powder after the US Food and Drug Administration found small amounts of asbestos samples.

2. Lack of Diversification

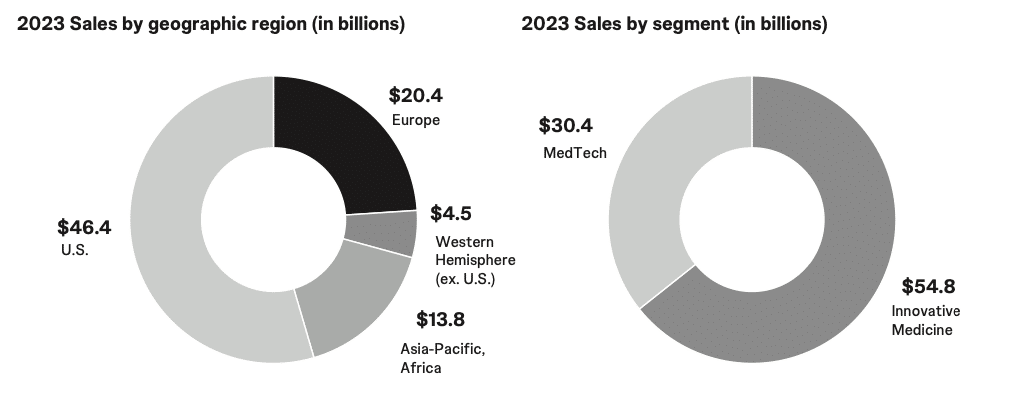

Johnson & Johnson relies on the US market for 54% of its total revenue, with Europe accounting for just 24%. Reliance on the US exposes the company to significant risks of the economy experiencing recession or the high interest rate environment hurting consumer purchasing power.

Image Source: Johnson & Johnson

The lack of diversification is also evident because the Innovative Medicine business segment accounts for about 64% of the total revenue at $54.8 billion in 2023. With all its eggs in a single basket, Johnson & Johnson can incur catastrophic losses.

3. Overdependence on Successful Products

Once a product is launched and raised to become a leader in the market, there is nowhere else to go but down. For instance, Stelara generated $10.85 billion, and Darzalex, $9.744 billion in 2023, accounted for 22% of total revenues. Reliance on the two drugs for revenue exposes the company to significant risks should it lose patent protection and is subject to generic competition.

Johnson & Johnson’s Opportunities

1. Bioimplants Opportunity

The bioimplant market is on the rise, driven by the increasing need for medical devices that can be implanted to replace or repair damaged biological structures. With a robust compound annual growth rate (CAGR) of 8.2%, the market is expected to reach a valuation of $132 billion by 2023.

The growing demand for implants is attributed to the prevalence of chronic illnesses like cardiovascular issues. Johnson and Johnson can tap into this emerging market opportunity by offering implants for various procedures like joint replacement and dental implants.

2. Focus on Emerging Markets

The pharmaceutical sector in Africa is expanding with a 5.98% CAGR, anticipating a rise to $16.02 billion in revenue by 2028. Meanwhile, Asia’s market is advancing at a slightly higher 6.69% CAGR, with projections to achieve a substantial $305 billion in revenue by the same year.

Johnson and Johnson needs to diversify and expand its operations into the two markets and reduce its reliance on the US market, which accounts for 54% of its revenues. Emerging markets of Africa and Asia present significant opportunities owing to their growing populations and increasing purchasing power.

3. Digital Health Opportunity

The global digital health market is forecasted to grow at a CAGR of 18.7% over the period from 2023 to 2032. Starting from a base of $211.9 billion in 2022, it’s expected to climb to over $1.17 trillion by the conclusion of the forecast period.

The predicted growth presents unique investment opportunities for Johnson and Johnson to tap into with the provision of technology to help improve people’s lives, such as ingestible sensors, mobile health apps, and robotic caretakers. Having made a name for itself in the provision of medicines, the company can also spearhead the digital revolution in the healthcare sector.

4. Telehealth Adoption

Telehealth, vital for specialties such as radiology and cardiology, is advancing with a 22.0% CAGR and is expected to hit $791.04 billion by 2030.

Johnson and Johnson can tap into this market by developing and offering systems and technology that enable the distribution of health services via electronic media. The company has already invested in Telehealth startup Thirty Madison, signaling its push for opportunities.

5. Expand through Acquisition

Johnson & Johnson’s revenue increased immensely from 2016 to 2020 with acquisitions like Tylenol. It can broaden its portfolio and strengthen its prospects in oncology and cardiology through acquisitions. With the oncology sector expanding at a CAGR of 8.8% and anticipated to be valued at $470 billion by 2032, there are significant opportunities to explore through mergers and acquisitions. Similarly, the cardiology field is experiencing a growth rate of 7.10% CAGR and is forecasted to attain $108 billion by 2031.

For instance, its acquisition of Shockwave Medical for $13.1 billion is poised to enhance its prospects in the cardiovascular sector. The company also spent $850 million to acquire Proteologix to spearhead its dermatitis treatment.

Johnson & Johnson’s Threats

1. Stiff Competition

From Reckitt Benckiser to Unilever, Procter and Gamble, Abbott, and many more, many strong global players competing against Johnson & Johnson threaten profitability. On the pharmaceutical front, it faces stiff competition from Pfizer on various drugs. Its drug Remicade for autoimmune conditions is already rivaled by Pfizer’s biosimilar Inflectra. Novartis Cosentyx is also rivaling its Stelara drug used for Psoriasis. If stiff competition stiffens further, Johnson & Johnson will lose a substantial portion of its market share.

2. Increase in Generics Drugs

Johnson & Johnson’s revenue dropped after the sales of generic versions of Zytiga were allowed into the market. Its flagship drug, Stelara, which brought in $10.85 billion in 2023, has already lost its patent protection and is, therefore, subject to generics competition. If generic drugs increase drastically in the future, the company’s profitability and sustainability will be threatened further.

3. Stringent Regulation

Since Johnson & Johnson offers its brands in different markets worldwide, it has to comply with numerous regulations enacted by governments. Its record does not help the company. Constantly changing rules in various jurisdictions could significantly affect its operations and profitability. In addition, the company is always susceptible to government investigations and litigation.

4. New Technologically Advanced Entrants

Innovative drug manufacturers are emerging rapidly from countries like India. If any company acquires the technological capacity to develop cheaper and more effective substitutes, retaining even most customers will be challenging for Johnson & Johnson. As the industry undergoes rapid technological advances, the company has to spend billions of dollars to stay up to date, which could affect its margins.

5. Intensified Fight against Drug Abuse

The role of drug manufacturers in the opioid epidemic in the US can lead to the enactment of harsher laws in the future. If governments ban drugs manufactured by Johnson & Johnson, this will threaten the profitability or even the existence of the company.

6. Lawsuits

Johnson & Johnson has faced several lawsuits over claims its products are defective. The company has also been accused of triggering the Opioid crisis and has since been sued for millions of dollars. The company reached a $149.5 million settlement with Washington State over claims it helped drive the pharmaceutical industry’s expansion of prescription lawsuits. The company is also being sued in a $6.48 billion lawsuit over claims its baby powder product and talc products contain asbestos that causes cancer.

References

- Valdes, M, Golden H. (2024 January 24). Washington state reaches $149.5 million settlement with Johnson & Johnson over opioid crisis. PBS NEWS.

- (2024, April 8). Acquisitions by Johnson & Johnson. Tracxn.

- Spector, M, Knauth, D. (2024 May 2). J&J advances $6.48 billion settlement of talc cancer lawsuits. Reuters.

- (2024 April). Bioimplants Market. Global Market Insights

- (2024 March). Pharmaceuticals – Africa. Statista

- Dige, L. (2024 January 10). Digital Health Market Size to Surpass USD 1,176.63 Bn by 2032. LinkedIn

- (2024 June 3). Telehealth Market Size Share Growth & Covid 19. Fortune Business.

- Niewolny, D. (2024 March 18). Johnson & Johnson MedTech Works With NVIDIA to Broaden AI’s Reach in Surgery. Nvidia.

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment