Model Name : The Rule of Three and Four

Creator : Bruce Henderson, Founder of Boston Consulting Group

Year : 1976

Purpose : To become a market leader or make to the list of top-three players of the market

What Is The BCG Rule of Three and Four?

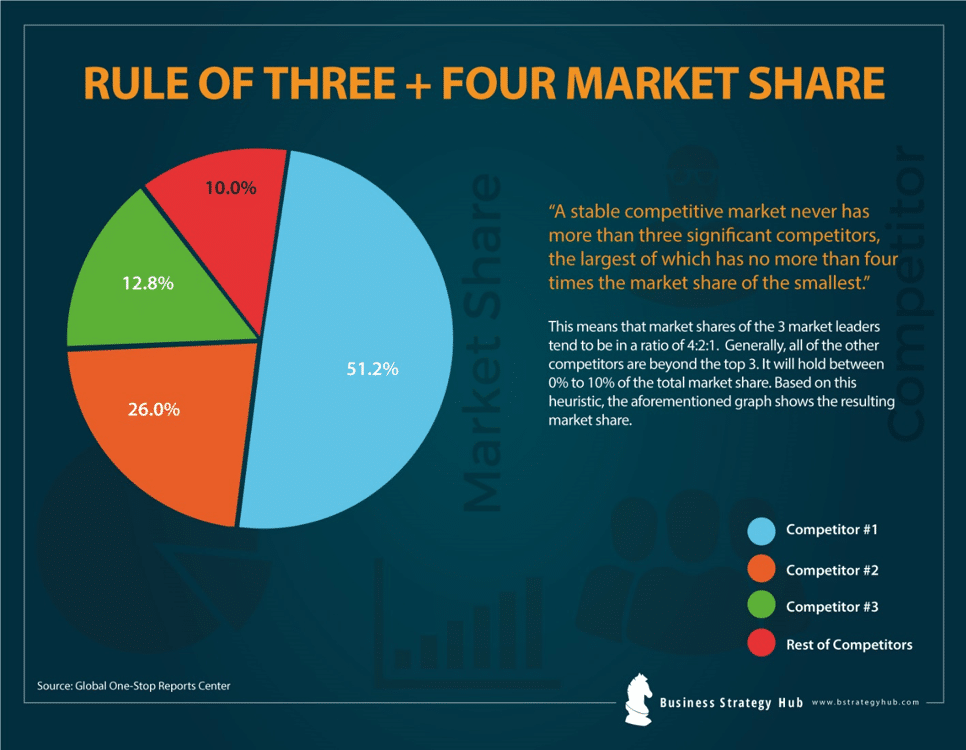

It’s a hypothesis about the evolution of industry leadership and structure. Bruce Henderson asserted that a steady competitive market’ competitors never exceed beyond being three in total, and the largest of them will, at maximum, enjoy four times the market share of the smallest competitor.

What Are The Conditions That Create This Rule?

- The industry structure will become stable once the market share between two companies reaches a ratio of 2:1. At this point, it is neither advantageous nor practical for either company to decrease or increase share. However, this is merely a reflection derived from research and observation.

- Any competitor having less than 25% of shares compared to the largest competitors’ shares, may not be a potent competitor. This is also empirical yet predictable from experience curve relationships.

Is the Hypothesis Valid in Today’s Market Structure?

The BCG Strategy Institute in collaboration with academics from various universities studied the industry data from more than 10 thousand companies dating back to 1975 to test Henderson’s hypothesis. Their analysis confirmed that “The Rule of Three and Four Hypothesis” is indeed valid.

According to them, the hypothesis perfectly describes the industry share structures, and it has remained a predictor of the industry structures’ evolution in stable, competitive industries over the decades. Moreover, the study of BCG Strategy Institute also confirmed that the “four” part of the rule – the ratio of 4:2:1 industry share is the most dominant among industries led by three generalists.

Where Does The Rule Apply?

BCG – Rule of Three and Four

Image Source: www.canadiansmallflockers.com

Examples of “three and four market share” industries

The Rule of Three and Four remains confined to industries that are stable, competitive and characterized by limited regulator intervention and low turmoil.

Examples of such industries include:

- Machinery manufacturing such as Agco, John Deere and CNH

- Car rental companies such as Avis, Hertz, and Enterprise

- Household appliances such as Electrolux, Whirlpool, and GE

- Credit-rating agencies such as Transunion, Experian, and Equifax

Where Does The Rule Not Apply?

The Rule does not seem to apply to unstable industries and industries where regulations hamper industry consolidation or genuine competition. Examples of such industries include:

Examples of such industries include:

- Investment banking

- Consumer electronics

- IT software and services

- Life insurance

- Telecommunications in the U.S where the antitrust action of the US government was seen against the merger of T-Mobile and AT&T

An Example of “The Rule of Three and Four”

Four competitors, in 2006 – Enterprise Holdings, Vanguard Car Rental, Avis and Hertz – had shares higher than 10 percent. However, the acquisition of Vanguard in March 2007, by Enterprise Holdings gave it almost half the market. Hence, it set in motion the competitive dynamics embedded in Henderson’s rule.

In 2011, the three competitors – Avis, Hertz, and Enterprise – had shares of 48 and 14 percent, close to the ratio “4:2:1”. Moreover, the acquisition of Dollar Thrifty by Hertz, in 2012, made these digits align even more closely with Henderson’s Rule of Three and Four.

How to Entangle the Rule in Decision-Making?

According to this rule, decision makers must identify if their company or business has a long-standing position in the market. The position of the largest competitor in the industry is the most wanted and desirable position of all; the number 2 and 3 positions are also maintainable. However, any other position in the industry is likely to be unsustainable.

Once the position of the company is determined, the decision makers of that company must create their strategies accordingly. If the company falls into the list of top-three competitors, the shares should be defended aggressively.

If it is not in the list of top-three, it should try to enhance its position in the industry by shifting the basis of competition or through consolidation – or it should exit the industry.

However, if the company operates in a setting where the rule of three and four does not apply, it should use adaptive strategies.

Are There Any Exceptions to this Rule?

Well, yes, there are two exceptions:

- A leadership position in a given industry sector can be achieved by a low share competitor who can dominate the position cost-wise if:

- there is an adequate shared experience between that sector of industry and the rest of the industry and;

- the company is the leader in the rest of the industry, or

- An otherwise successful company is enthusiastic to continually invest in a marginal minor product or service. This may be instigated by accounting averaging, mismanagement or full line policy.

What are the Strategy Implications of the Rule?

- In the absence of some outward limitation on the market rivalry, a stakeout is almost unavoidable if there are many competitors in the market.

- To maintain relative market shares, all competitors will have to grow faster.

- The ultimate losers will have progressively larger negative cash flows if they attempt to grow at all.

- Except for the two largest competitors, all others will be either loser or be marginal cash traps reinvesting forever.

- Anything less than at least half the share of the largest competitor or 30 percent of the relevant market is a high-risk position.

- The higher the probable return on investment and the lower the risk if any investment is cashed out quickly.

- Knowledge of the investment policies and familiarity with market share attitudes of the market leader are extremely crucial since the policies of the leader control the rate of the stakeout. The relative eagerness of each competitor to invest at rates higher than the total of both the inflation rate and physical market growth is linked to shifts in market share at corresponding prices for comparable products or services. Any company which is not willing to do so will lose share. If everyone is ready to do so, the margins and prices will be forced down until someone stops investing.

Final Thoughts

In short, the implications of this rule continue to provide direction to decision makers working in settings where classical business strategies hold as it remains relevant since its conception.

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment