Company: Samsung Electronics Co., Ltd

CEO : Jong-Hee Han

Year founded : 1969

Headquarter : Samsung Town, Seoul, South Korea

Number of Employees (FY2023): 270,372

Public or Private: Public

Ticker Symbol: KRX – 005930, 005935/ LSE – SMSN/ LuxSE – SMSEL

Market Cap (Jul 2024): 558.41 KRW Trillion

Annual Revenue (FY2023) : 258.935 KRW Trillion

Profit | Net income (FY2023): 14.47 KRW Trillion

Products & Services: Camera | Smart Phones | Memory Cards | Camcorder | TV/LEDs | PC | Stove | Refrigerator | Bulb | Home Appliances

Competitors: Apple | Huawei | Xiaomi | Oppo | Vivo | Lenovo | Sony | HTC | Motorola | Microsoft | Google Pixel | Micromax | Asus | Gionee | iball | Intel | Nokia

Fun Fact:

Did you know that the Samsung Group’s annual revenue accounts for about 20% of South Korea’s GDP?

Samsung Electronics Co., Ltd stands today as the world’s second-largest technology company by revenue that produces electronic devices. It is a South Korean conglomerate business serving customers worldwide. Samsung was also titled as the number one consumer electronics brand worldwide and is recognized for its evolutionary advancements in digital technology.

The company is known for producing equipment that includes telecommunications, electronics, home appliances, and semiconductors. Key brands include the Samsung Galaxy smartphones, Tizen televisions, and Bespoke appliances. Samsung is also adding AI functionality to its products with the recent launch of Galaxy AI, AI TV, and Bespoke AI offerings for consumer electronics. Samsung is also dominant in the digital signage space, with a reported global market share of 33% in 2023.

Initially being launched as an analog-driven product line, Samsung transitioned into a universally acclaimed pioneer in technological innovation. Samsung is currently the world’s largest smartphone and mobile phone manufacturer. It sells over a hundred products of different varieties and models, with operational branches present in 74 countries as of 2023. Samsung’s innovation is recognized with industry accolades, including 46 wins at the CES Innovation Awards 2023, 75 trophies at the iF Design Awards 2024, and 50 awards at the International Design Excellence Awards 2023.

Lee Byung-Chul founded Samsung in 1938. It started as a trading company until it gradually became an electronics manufacturer in the late 1960s. It employs about 270,372 employees, with operations in 74 countries.

Samsung’s current CEO is Jong-hee Han, who also serves as Vice Chairman of the Board of Directors as of May 2024.

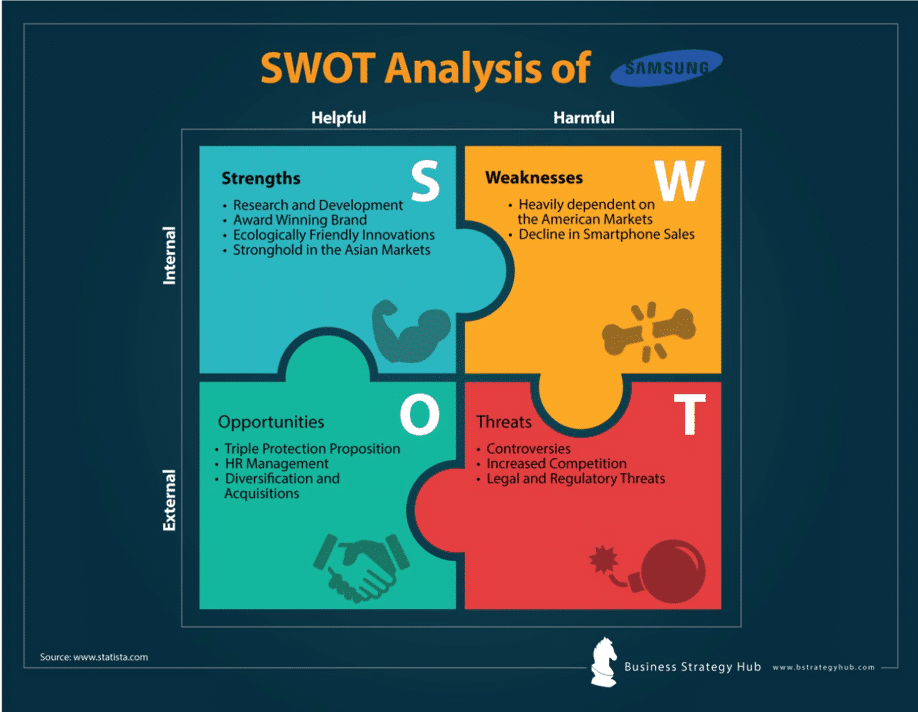

SWOT Analysis of Samsung

The following is the SWOT analysis of Samsung:

Samsung’s Strengths – Internal Strategic Factors

1. Strong Market Performance

Samsung has dominated the smartphone market for years with strong financial performance since 2010, and has led the market for the majority of that time. Its consistently strong performance demonstrates Samsung’s strength against robust competition.

A Canalys report shows Samsung’s Q1 2024 market share at 20%, followed by Apple at 16% and Xiaomi at 14%. Samsung’s product dominance is also clear in the digital signage space (33% market share in 2023) and with televisions (30.1% market share in 2023).

2. Research and Development

Samsung’s foundation has always been Innovative research and development. Efforts in this area have resulted in the company’s wide-ranging product portfolio compared to its competitors.

These include tablets, camcorders, mobile phones, cameras, TV/video/audio, Memory Cards, PCs, and other accessories. They have 41 R&D centers securing innovative technologies and enhancing global R&D capacity worldwide.

Samsung’s R&D investment in 2023 was $29.9 trillion KRW, with innovations coming to market in AI, product quality, and power efficiency.

3. Award Winning Brand

Samsung’s is considered a pioneer in innovation, and has won many awards for its products. Samsung has been awarded at the CES (Consumer Electronics Show) owing to its product designs and innovation for many years.

In fact, Samsung received 46 CES awards in 2023 and 50 awards at the 2023 International Design Excellence Awards (IDEA).

4. Ecologically Friendly Innovations

Samsung has enhanced its brand reputation through its environmentally friendly innovations. It secured the 7th position in the Top 30 Tech and Telecom companies of the Environmental Protection Agency (EPA) 2024 Green Power Partner list.

It also received a rare ENERGY STAR Corporate Commitment Award with 25 Energy Star Awards as of December 2023. Samsung’s product efficiency has saved approximately 350 million metric tons of CO2 emissions worldwide since 2009. Other companies do not share this achievement and this adds to Samsung’s appeal across all business units.

5. Stronghold in the Asian Markets

Samsung retains a stronghold in the Asian markets, particularly India and China. Both the emerging economies of India and China see markets that are growing substantially in consumer purchasing power. Samsung has taken advantage of this opportunity to expand in these countries accordingly.

6. Samsung Competes With Intel as the Biggest Chip Seller

In 2021, Samsung was hailed as the largest chip seller with a global market share of 12.3% in semiconductors by revenue, moving ahead of Intel (market share of 12.2%) thanks to Samsung’s strong growth. Samsung’s 2023 market share of 7.5% to Intel’s 9.1% indicates a very competitive market.

According to Gartner reports, the South Korean tech giant’s revenue grew 28% year-over-year to $73 billion in 2021. Due to the COVID-19 pandemic, the demand for chips used in personal computers, servers, and other electronic devices increased exponentially.

Gartner notes that the 2023 overall worldwide semiconductor revenue decreased by 11.1% YoY to $533 billion, with Samsung earning $39.9 billion.

7. Samsung Makes Powerful Processor for Next-Gen Smartphone Gaming

The South Korean tech giant recently launched its cutting-edge Exynos 2200 processor that’s integrated with the Xclipse GPU from AMD.

At the forefront of groundbreaking semiconductor tech, Samsung’s new Exynos processor is the next-level mobile processor designed with multiple CPU cores for exhilarating and breathtaking mobile phone gaming graphics and performance.

The Exynos 2200 is also integrated with an updated NPU (neural processing unit) and also features RT (ray tracing) technology.

8. Diversified Portfolio

Samsung has a very diversified portfolio and operates in four divisions – Device eXperience (DX), Device Solutions (DS), Samsung Display (SDC), and Harman International Industries, Inc. (Harman).

- Device experience (DX) represents about 66% of total revenue. Key products: TVs, monitors, refrigerators, washing machines, air conditioners, smartphones, telecommunications network systems, computers

- Device Solutions (DS) represents about 25% of total revenue. Key products: DRAM, NAND flash, mobile APs

- Samsung Display (SDC) represents about 12% of total revenue. Key products: OLED panels for smartphones

- Harman International Industries, Inc. (Harman) represents about 5% of total revenue. Key products: Digital cockpits, car audio, portable speakers

| Segments | FY23 Revenue (₩ trillion) | % Share |

| Device experience (DX) | 169 | 66% |

| Device Solutions (DS) | 66 | 25% |

| Samsung Display (SDC) | 30 | 12% |

| Harman | 14 | 5% |

| Intercompany reconciliations | -23 | -8% |

| Total | 256 | 100% |

9. Brand valuation

Samsung ranks #5 position by Interbrand in 2023 – with a brand value of $91.4 billion, following competitors such as:

- #1: Apple (Brand value $502.6 billion)

- #2: Microsoft (Brand value $316.6 billion)

- #3: Amazon (Brand value $276.9 billion)

- #4: Google (Brand value $260.2 billion)

10. Strong global presence

Although Samsung’s headquarters is based in South Korea, it has 15 regional headquarters and over 270,000 employees worldwide. It is truly a global company.

Regional Revenue Breakdown – 2023

- Samsung’s domestic market accounts for 18% of total revenue, while its largest overseas market, America, accounts for 36% of total revenue.

- Europe accounts for 19% of total revenue.

- China accounts for 11% of total revenue.

- Other Asian countries and Africa account for 17% of total revenue.

| Regions | FY23 Revenue (₩ trillion) | % Share |

| Korea | 45.6 | 18% |

| America | 92.2 | 36% |

| Europe | 48.1 | 19% |

| Asia and Africa | 44.8 | 17% |

| China | 28.2 | 11% |

| Total | 258.9 | 100% |

Samsung’s Weaknesses

1. Product Failures

Any product that threatens the life of consumers erodes confidence and trust in the company. Samsung has delivered several faulty products to the market, from the exploding Samsung Galaxy A20e to faulty foldable phones.

2. Hereditary Leadership

Since its founding, Samsung has always been under the leadership of one family for three generations. Even though keeping the leadership within the family has offered Samsung immense stability, the company can stagnate due to a lack of fresh ideas.

After being dogged by several scandals, Samsung heir Jay Lee has vowed to end dynastic succession.

3. Bribery Scandal

In 2015, Samsung’s reputation was tainted by the revelation that the president of the company bribed the government of South Korea to facilitate a merger. He was found guilty and jailed for about one year, which eroded the trust bestowed by consumers in South Korea and the world over.

In 2021, Lee Jae-Yong was released after serving 18 months in prison.

Samsung’s Opportunities

1. Robotics on the Rise

Personal robotics products present a significant, growing opportunity for tech companies. The consumer service robotics market is projected to reach US $14.98bn in 2024 with 2024-2028 CAGR projected at 13.25%. This market is maturing rapidly with emerging opportunities for innovative companies to establish themselves as leaders.

Samsung’s 2024 CES presentation introduced an update to “Ballie,” an AI-powered robot companion. Offering consumers a robot that acts as an assistant for fitness, communication, and other tasks is compelling as no other manufacturer has made a major move into the market with similar products.

2. Need for New Innovative SmartPhone Products

While Samsung is active in the smartphone sector, there is huge potential for growth. Projections indicate a growth in smartphone mobile subscriptions to nearly 8 billion by 2028. The industry is highly dynamic, with the latest trends going out of style in an instant, and new innovations always in demand.

Samsung can attain immense growth by setting the trend with innovative products like AI-enabled smartphones to differentiate itself from brands that are unable to match their technical sophistication.

3. Artificial Intelligence

Conversational AI, a key market for AI growth, is expected to achieve a CAGR of 22.60% through 2031.

Integrating AI into appliances, smartphones, and other products can provide a significant strength and key differentiator that Samsung can currently offer. Investments in R&D will help Samsung capture market share in this rapidly evolving technological space.

4. 5G Technology

As the world moves to 5G, there is a need for companies that can supply services on a large scale, with few that can currently do this. Statista forecasts 5G mobile subscriptions to grow to 8 billion worldwide by 2028. Samsung has the capacity and know-how to exploit this opportunity by providing infrastructure, although it has plenty of competition.

The company is already among the top suppliers of 5G services in many areas, including Korea, the US and Japan. Globally, it faces stiff competition from Ericsson, Huawei, Nokia, and other companies. Samsung will need to guard against losing market share to these rivals if it is to maintain a leading position in existing markets and compete for global leadership in providing 5G services.

5. Emerging Markets

As demand rises for consumer electronics in emerging markets – including parts of Africa, India and Southeast Asia – Samsung has an opportunity to expand its business in those areas. Note that Africa’s population is expected to grow to 2.5 billion by 2050 and India will reach an estimated 1.5 billion people by 2029. The growth in population means more potential customers for all Samsung products.

Low-cost, basic cell phones and other products are likely to be a key part of the demand in emerging markets, giving Samsung opportunities to increase sales and revenue. Additional opportunities may emerge as Samsung addresses localized demand.

Samsung’s Threats

1. Patent Infringement Controversies

Samsung has attracted and been involved in many controversies that have threatened its business. Its rival Apple filed a lawsuit against Samsung for patent infringement, which involved a heated court battle for seven long years until it finally reached a settlement.

However, the company did suffer financial consequences when a jury decided that Samsung had indeed copied Apple and was to pay $1.049 billion in damages. This suit damaged the company’s reputation and its sales.

2. Increased Competition

Competition, especially from those within the consumer electronics, smartphone products, and computing industries, has reached a record high.

Whether it’s Xiaomi, Apple, or Huawei, all the technological competitors are attempting to outmaneuver and outperform each other to become the top technology company. This only increases the pressure on Samsung in terms of both competition and, ultimately, financial performance.

3. Legal and Regulatory Threats

With the world becoming more globalized and digitally oriented, governmental authorities are issuing legal and regulatory guidelines that will increase the legal and regulatory threats and considerations to companies around the globe.

Samsung will need to follow these ever-changing laws and regulations, which will be different from market to market. Failure to comply could result in a complete shutdown in the respective market, which may be fatal for Samsung.

4. Economic Uncertainty

Recent global events have catalyzed uncertainty in the global market and led to a decline in new smartphone sales. Financial struggles have forced many consumers to seek recycled or refurbished phones, which has increased to 21% of the total market. Samsung has already experienced a decline in sales, and it can drop further if economic uncertainty persists.

5. Rise of Counterfeiting

According to numerous research studies, Samsung is by far the most counterfeited phone brand. Statistics from the mobile benchmarking site AnTuTu highlight that over 36% of all counterfeit smartphones are Samsung phones. In fact, the Samsung Galaxy S7 Edge holds the record as the most counterfeited smartphone model.

6. Impending Legal Considerations

Any leadership or governance disruptions can materially impact a business’s operations and financial performance. In 2020, a South Korean court was debating whether to send Samsung’s leader and heir Jay Lee back to prison. Allegations of stock-price manipulation and audit rule violations dogged the executive and threatened to cause major changes to the corporation’s leadership.

7. Dissatisfied Phone Users

There was a lot of buzz on the internet about how Samsung Galaxy S users were unable to clear their cache a few years ago. According to one complaint, as soon as a user deleted their entire cache and then re-entered the cache setting, all the data was still there.

No matter how many times you delete the cache, it doesn’t go away.

The Samsung support desk asked one user whether it is like this on other social media apps like Instagram or YouTube and the user replied that the problem only lies with the Samsung internet app.

8. LG’s Foldable Display Technology May Surpass Samsung

While it’s true that LG doesn’t seem to be making big waves in the smartphone industry, it’s also true that the company operates several different divisions. These divisions manufacture core parts or components for different smartphones and mobile devices.

LG Chem recently introduced their new foldable display technology, asserting that it’s considerably better than the current glass displays – particularly the types of materials Samsung uses. Unlike Samsung, LG claims that their new material is made with a specialized coating that has the same consistency as hard glass, yet it is malleable like plastic.

9. Patent Disputes

Samsung is in the process of disputing patents for 5G technology and data processing. Legal battles are a reality for organizations focused on pushing forward with innovative technology, especially in competitive spaces where Samsung operates.

Samsung has previously settled a legal dispute with Apple over patents related to smartphones.

10. Heavily dependent on the American Markets

It is estimated that both Apple and Samsung combined hold over 80% of the US market share of smartphones. While Samsung has diversified its resources and expanded its operations in Asia, it is still heavily dependent on the American markets.

The American economy is very unpredictable and another recession could put Samsung’s revenues in jeopardy and can damage its operational resources. That’s why Samsung needs to focus more on expanding into Asian and European markets to ensure sustainability and avoid potential failures if the US economy ever collapses.

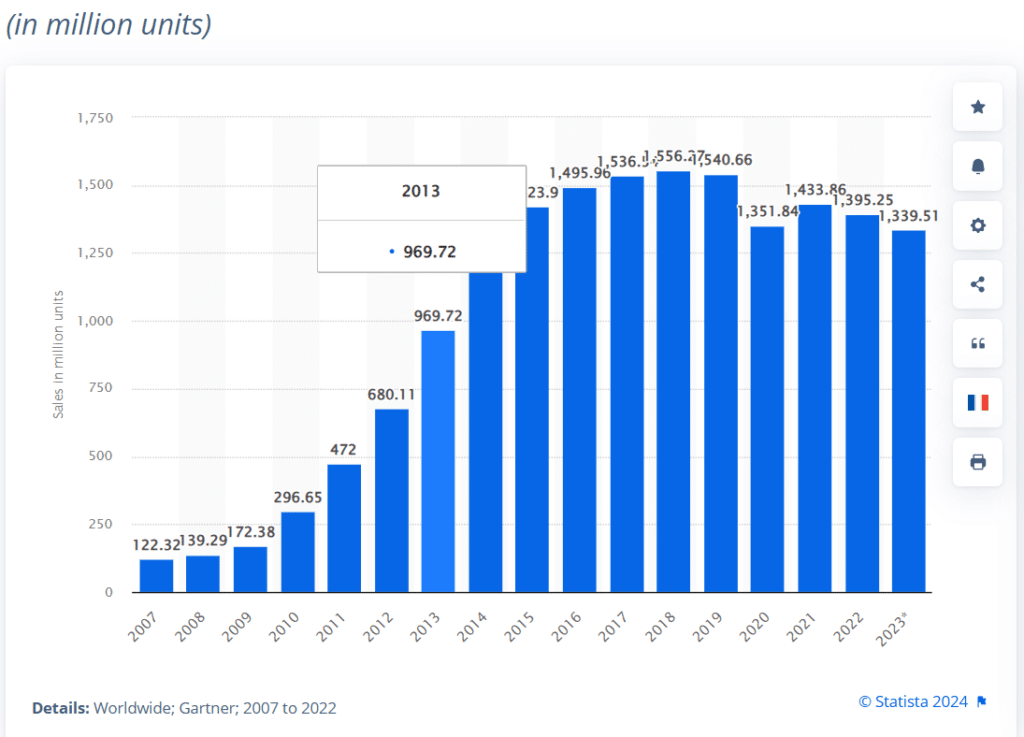

11. Decline in Smartphone Sales

Samsung has been experiencing a decline in smartphone sales since 2018. A similar trend was seen in China due to the price sensitivity of the Chinese market. They dump smartphone products into the Indian market at a lower cost which harms Samsung sales. Samsung has tried to shift more focus in India, but that strategy did not produce substantial results for the company.

Number of smartphones sold to end users worldwide from 2007 to 2023

Source: Statista

12. Dependence on Low-end Smartphones

A large portion of Samsung’s revenues have historically come from low-end smartphone sales. Supply chain constraints, i.e., component shortage and longer delivery, have impacted this segment more than the high-end smartphone segment. This has played a role in Samsung’s decline from 80 million smartphone sales and 22.1% of the market share in Q3 2020 to 69 million smartphones sold in Q3 2021 with 20.2% of the market share (as per Gartner Report).

The rise of Chinese competitors such as Xiaomi competing in the low-end market as well as an increase in used smartphone sales have threatened Samsung’s market position. Used smartphones now account for a reported 21% of global smartphone sales. Devices are also being used by consumers for longer periods. The replacement cycle, previously a two-year cycle, has shifted to a three or four-year cycle for consumers and businesses.

Conclusion

Through the SWOT analysis of Samsung, it is clear that the company is still a global leader in the chip-making and smartphone space. It has always sustained sufficient revenue and profits and strong market dominance in areas like digital signage. Its focus on artificial intelligence is a promising sign that the future remains bright for Samsung.

The primary challenge it has to face is cutting back on its overreliance on the American markets and exploring further expansion into other markets, specifically Asia and Europe.

Samsung’s limited customer base in the US is not reliable enough and may lead to limited future revenue and profits. That can become a persistent issue for the company. They need to expand internationally, win market share through innovative product offerings, and find opportunities to own underserved markets.

SWOT analysis of Samsung

References & more information

- (April 30, 2024). https://canalys.com/newsroom/global-smartphone-market-q1-2024 Canalus.

- https://www.samsung.com/global/ir/stock-information/listing-Info/ Samsung

- https://finance.yahoo.com/quote/005930.KS/financials Yahoo Finance

- https://interbrand.com/best-global-brands/samsung Interbrand

- (January 16, 2024) https://www.gartner.com/en/newsroom/press-releases/2024-01-16-gartner-says-worldwide-semiconductor-revenue-declined-11-percent-in-2023 Gartner

- Hodges, P. (February 11, 2024). https://www.icis.com/chemicals-and-the-economy/2024/02. Independent Commodity Intelligence Services (ICIS) (May 2024).

- https://www.oberlo.com/statistics/us-smartphone-market-share. Oberlo

- (2024) https://www.statista.com/outlook/tmo/robotics/service-robotics/consumer-service-robotics/worldwide Statista

- (2024) https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide/ Statista

- (July 17,2024) https://www.barchart.com/story/news/27442493/conversational-artificial-intelligence-ai-market-to-grow-remarkably-with-a-striking-2260-cagr-through-2031#:~:text=Conversational%20Artificial%20Intelligence%20(AI)%20Market%20size%20was%20valued%20at%20USD,period%20(2022%2D2031) barchart

- Taylor, P. (June 18, 2024) https://www.statista.com/statistics/760275/5g-mobile-subscriptions-worldwide/#:~:text=There%20were%20an%20estimated%201.9,download%20speeds%20and%20reduced%20latency Statista

- Stanley, A. (September 2023) https://www.imf.org/en/Publications/fandd/issues/2023/09/PT-african-century International Monetary Fund

- O’Neill, A. (July 4, 2024) https://www.statista.com/statistics/263766/total-population-of-india/ Statista

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Thanks for this! I found this very helpful for my entreprenurship assignment 🙂

Mohd Hafiz, I am glad it helped you.

Good luck with your assignment !!!

Thank you so much this was very helpful for my business environment assignment

Thank you Clara,

All the best for your assignment !

I’m so sure we are doing the same assignment

Unilus…

I enjoy reading your SWOT analysis section…..Please do make more

Glad you liked our swot analysis,

any specific company swot that you are looking for ?

Very insightful.

article. Thanks for sharing

Very Significant and Helpful article

Thank you for the valuable information. It was really helpful to complete my Business Environment assignment.

Glad you liked our analysis Lia!