Company: Netflix

Co-CEO: Ted Sarandos & Greg Peters

Year founded: 1997

Headquarter: Los Gatos, USA

Number of Employees (2023): 13,000

Public or Private: Public

Ticker Symbol: NFLX

Market Cap (Oct 2024): $390.6 Billion

Annual Revenue (FY2023): $33.72 Billion

Profit | Net income (FY2023): $5.40 Billion

Products & Services: Video on demand | Streaming to game consoles | Recommendations

Competitors: Hulu | Amazon prime video | HBO Max | Facebook | Vevo | Sony Crackle | Sling TV | Playstation Vue | YouTube | Disney+ | AppleTV+ | Microsoft | Spotify| Paramount + | Peacock

Fun Fact:

- Netflix is available in over 190 countries and boasts 270 million subscribers.

- During peak times between 9 pm and midnight, Netflix accounts for 33% of North American streaming and streams over one billion hours of content a week.

- Did you know that Netflix was originally called Kibble?

An Overview of Netflix

With 270 million subscribers worldwide, Netflix has grown tremendously over the years. It is one of the leading Internet entertainment services in the world, with paid memberships in over 190 countries.

70% of the subscribers binge-watch TV series on Netflix, while 80% rely on title suggestions recommended by the network’s algorithm. It is not just a TV series; it offers movies, documentaries, and feature films in various genres and languages.

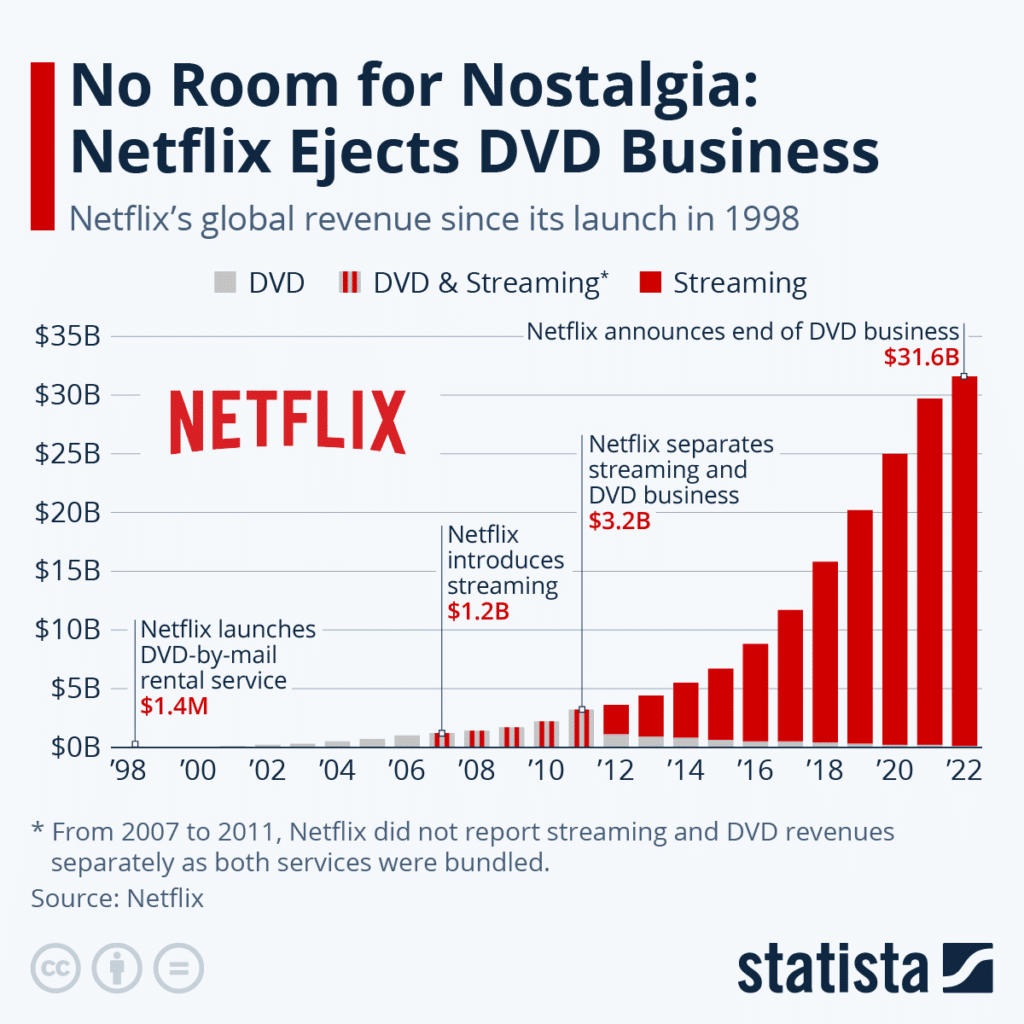

In 1997, Reed Hastings and Marc Randolph co-founded Netflix, starting as a DVD sales and rental by mail, but after a year, they focused on online DVD rental service…

In 2007, Netflix introduced streaming online, allowing people to watch movies and TV shows anywhere, anytime, on any device while retaining its DVD rental service. They started expanding online streaming internationally in 2010. With such a global reach, Netflix’s profits tripled this year. 2013, the company began producing movies and TV shows dubbed Netflix Originals. House of Cards remains one of its biggest original productions.

How is it so successful? Did it face any ups and downs? To answer these fundamental questions, let’s look at a detailed SWOT analysis of Netflix.

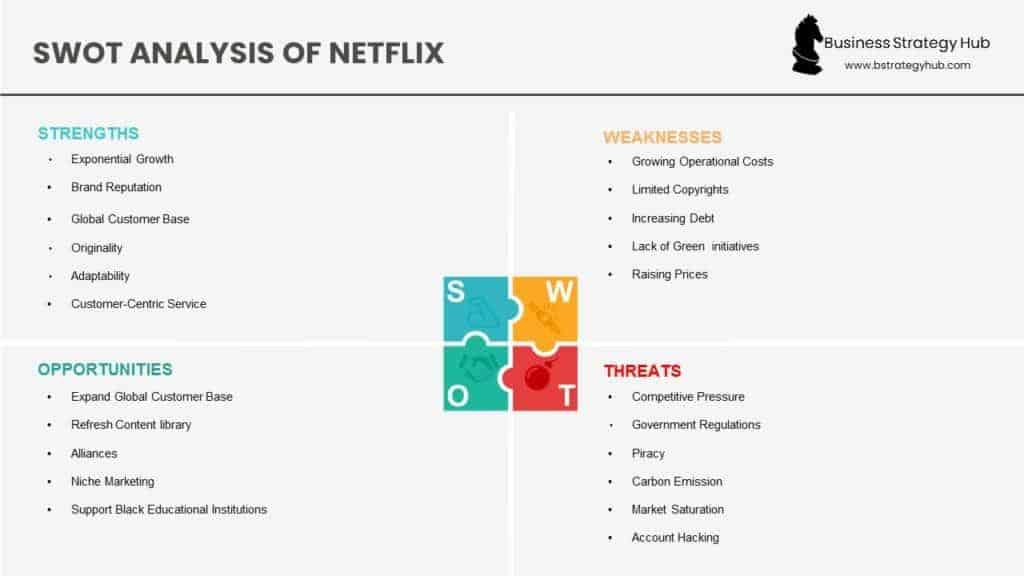

SWOT Analysis of Netflix

The SWOT analysis of Netflix is given below:

Netflix’s Strengths – Internal Strategic Factors

1. Exponential Growth

In the past ten years, Netflix has become an influential brand for online streaming content in the US and worldwide.

Image source: Statista

2. Brand Reputation

Netflix has risen to become a household name within a short period. In 2023, according to Interbrand, it ranked #39 – with a brand value of $17.92 billion.

Some close competitors on the list are as follows:

- #13 – Disney ($48.25 billion brand value)

- #21 – Facebook ($31.63 billion brand value)

- #25 – Youtube ($26.04 billion brand value)

- #69 – Spotify ($11.11 billion brand value)

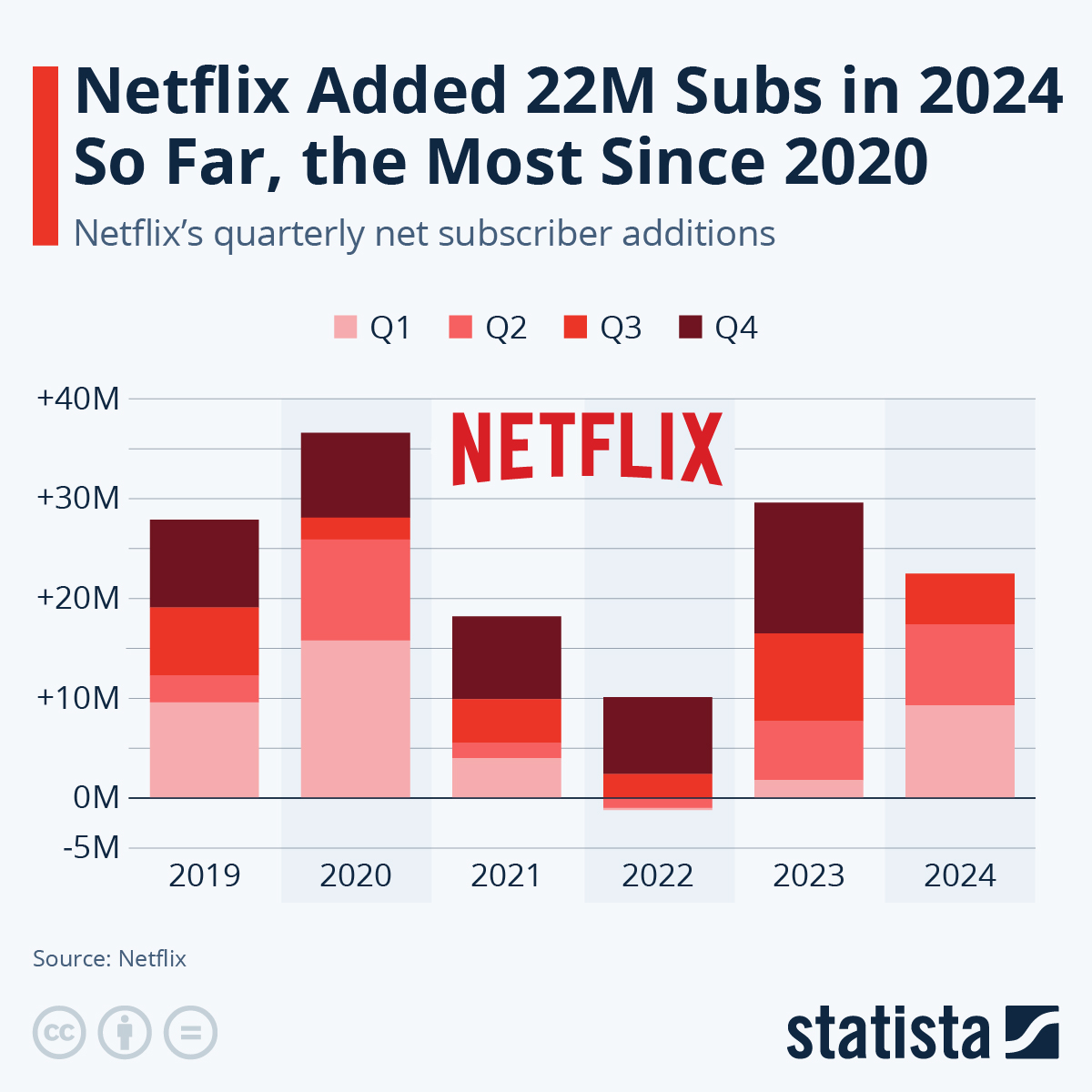

3. Global Customer Base

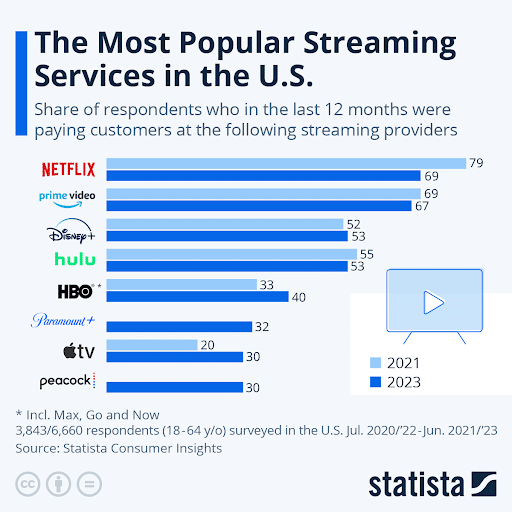

Netflix offers streaming services in over 190 countries worldwide. It has over 270 million subscribers, and 22 million new subscribers were added between January and September of 2024. The massive subscription base gives the company strong bargaining power with the studios to secure exclusive content.

Image Source: Statista

4. Originality

Another one of its strengths is that Netflix has been producing original content with the highest quality over the years. Some of its shows, like Tiger King, Stranger Things, Money Heist, Narcos, Mindhunter, and Orange Is the New Black, became so popular that its subscriber count kept increasing.

Some of the latest hits that continue to strengthen its library and attract subscribers include The Umbrella Academy, Virgin River, The Witcher, and Outer Banks.

5. Adaptability

Netflix adapted to various technologies instantly by providing streaming on all internet-connected devices like personal computers, iPads, mobile devices, and televisions.

Due to this, their business grew immensely over the years. The convenience of watching content on any device has been the catalyst behind the cord-cutting menace that has seen many people shun pay TV services in favor of streaming services.

The growing popularity of Netflix and other streaming services is why 80 million cord-cutting households will be in the US by 2026. Estimates suggest that in the U.S., cable and satellite television providers have seen a reduction of 20 million in their subscriber count.

6. Customer Centric Service

For a long time, customers were looking for an offline option to watch Netflix content in case of travel (plane, subway) or a bad internet connection. As a result, Netflix introduced a download now (offline) feature for customers to watch their favorite shows on the go.

It has upgraded the feature to ensure it downloads a personalized selection of movies for subscribers, ensuring they always have something to watch offline. In addition, it is also possible to watch something that has been downloaded partially while awaiting an internet connection.

7. Affordable Pricing

Netflix’s pricing strategy has given it leverage over its competitors. The plans that Netflix has designed are affordable and offer great value. As part of its ad-supported plan, subscribers can watch unlimited movies for a cheap price of $6.99 a month.

The inexpensive ad-tier plan has attracted many new subscribers and is projected to have close to 35.4 million subscribers by 2027, up from 13.5 million in 2024.

For unlimited ad-free movies, TV shows, and mobile games, subscribers only have to pay $15.49 monthly in addition to a premium package that supports up to four devices for $22.99. Netflix is less expensive than cable movies or going to the cinema and also offers a broader selection. For higher quality Ultra HD (4K+HDR) streaming, subscribers can get premium plans at $15.99 monthly.

8. Partnership with Telecom Companies

Alliances and partnerships benefit Netflix as it seeks to expand its services to multiple new European and Asian countries. Netflix has already initiated a strategic partnership with Deutsche Telekom Group SK Telecom and SK Broadband to enhance the customer entertainment experience in Croatia, Hungary and South Korea.

9. Niche Marketing

Netflix also has a strength in producing region-specific content in local languages, and niche marketing has proven beneficial for Netflix.

The company should continue catering to its global audience’s cultural and geographic viewership needs by not only distributing shows produced for the US audience.

Marseille, a French political drama, and Hibana, a Japanese drama, are examples of its niche marketing strategy. It has also enjoyed success with the original TV series Sacred Games in India and the massive hit Spanish series La Casa de Papel(Money Heist).

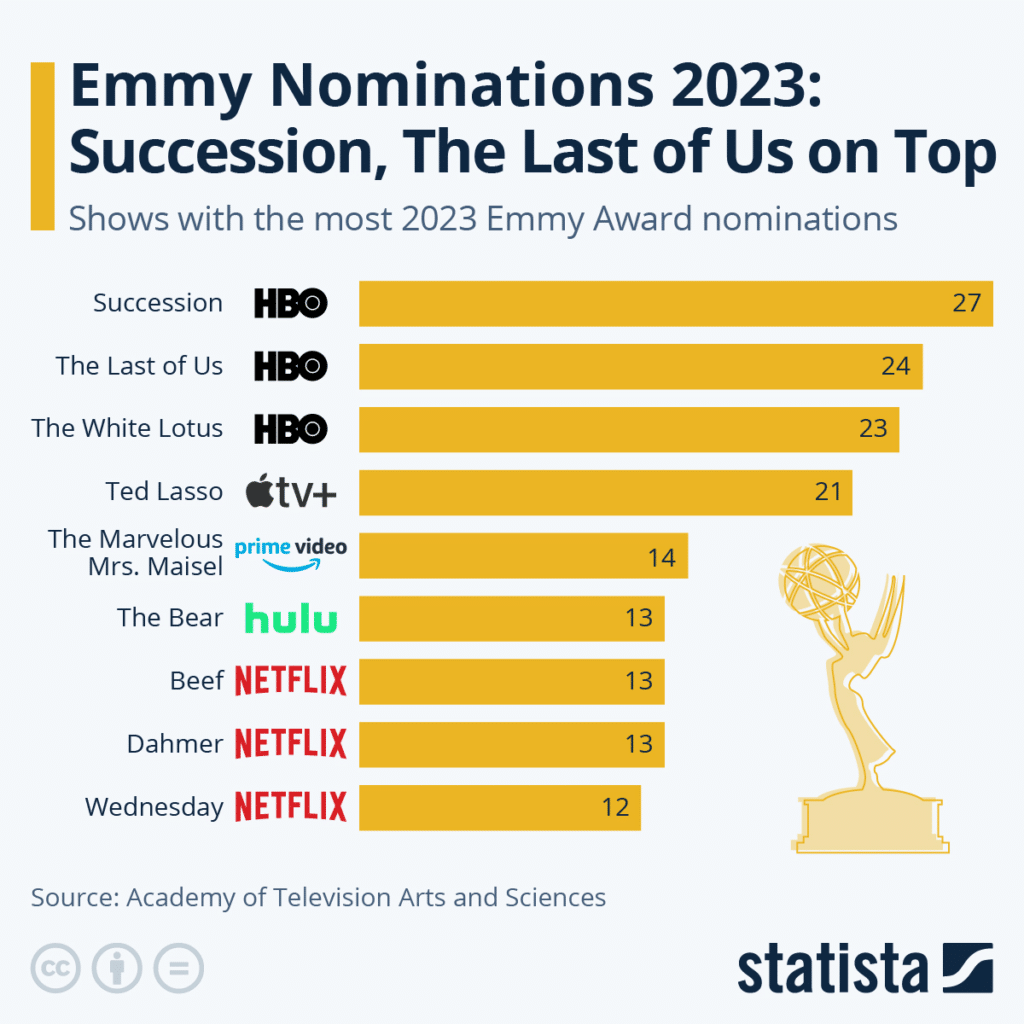

10. Award-Winning Shows

It is unsurprising that Netflix’s original shows have grown in popularity and won some of the most significant accolades. In addition, Netflix has been beating traditional television networks (HBO and NBC) in nominations. In 2023/2024, Netflix received 103 nominations at the Emmys.

- HBO – 127 nominations

- Apple TV – 54 nominations

- HULU – 42 nominations

- Amazon Prime – 41 nominations

- FX – 37 nominations

Image source: Statista

Netflix’s Weaknesses – Internal Strategic Factors

1. Limited Copyrights

Netflix does not own most of its content and licenses 47% of it, negatively affecting the company. The rights taken from other studios expire after a few years, and that content starts appearing on other streaming platforms.

The Office and Friends are popular shows that are no longer available on Netflix due to license expiration.

2. Increasing Debt

Netflix serves its diversified content in many countries worldwide, which requires vast amounts of money. By funding new content, Netflix keeps adding to its long-term debt. As of December 2023, Netflix reported $14.54 billion in interest-bearing debt.

The company’s debt increases every year as it is forced to spend more to bolster its content library and attract and retain subscribers. Netflix is poised to spend nearly $17 billion in content in 2024, a significant increase from $13 billion in 2023.

3. Highly Concentrated Portfolio

Netflix’s revenues come from two streams:

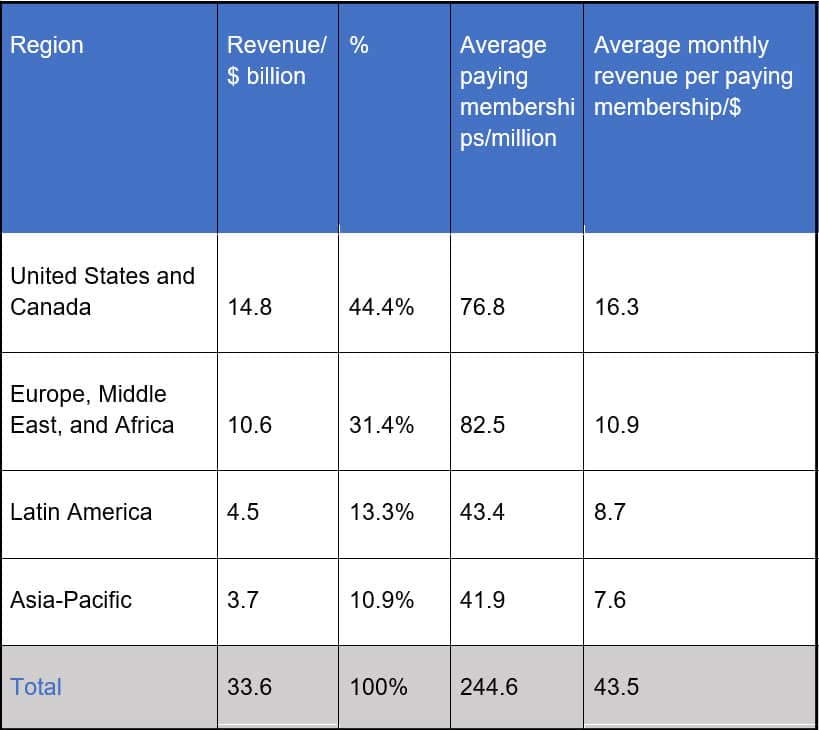

Streaming revenues are Netflix’s primary operation and represent about 99% of total revenue. This segment makes money by charging monthly streaming membership fees. Last year, the company closed down its DVD-by-mail services unit, which accounted for less than 1% of its revenues.

Image source: Statista

The fact that Netflix heavily relies on the streaming business could be a big problem, especially amid soaring competition. The company needs to embark on a diversification strategy to reduce its reliance on streaming revenues.

4. Rigid Pricing

Customers demand customized pricing with more options. Unfortunately, Netflix’s pricing model is rigid, with only three tiers: Basic, Standard, and Premium. The lack of different options has contributed to stagnation in the number of new subscriptions. The company should have more than three-tier plans to address the needs of other subscribers or market niches.

5. Over-dependence on the North American Market

Even though Netflix operates globally, it relies heavily on the North American market. In the fiscal year 2023, Netflix reported $14.87 Billion in revenue from North America, representing about 44% of its total revenue ($33.62 Billion).

This is a significant weakness because the North American Market is nearing saturation, and the company faces stiff competition from Amazon Prime and Disney Plus, among others, translating to a small room for growth.

6. Raising Prices

Netflix has raised its subscription prices to generate more money to support the production of new content and licensing more to strengthen its library.

Last October, it increased prices for its Basic and Premium subscription plans. Basic plan subscribers pay $11.99 per month, an increase of $2 per month, and Premium plan subscribers will now pay $22.99 per month, an increase of $3 per month. In contrast, its rival Peacock offers plans priced at $6 and $12, Disney at $8 and $18, and Amazon Prime at $9 and $12.

Price hikes can force Netflix subscribers to look for other inexpensive options, denying them much-needed revenues.

Image source: Statista

7. Growing Operational Costs

Adding more content gives Netflix a competitive advantage, but the cost of supporting new content keeps growing. In 2024, spending on new content is expected to rise to highs of $17 billion, an increase from $13 billion in 2023.

8. Lack of Data Center

Netflix streams content from other companies using cloud computing infrastructure, much of which is provided by Amazon Web Services.

Its reliance on other companies’ infrastructure is always subject to the requirements and limits of app stores like App Store and Google Play store. The company must consider building its own data center to control content distribution and how people access its library.

9. No Penalty for Cancellation

Whenever Netflix releases new or fresh content, users often pay for one month only and binge-watch their favorite shows quickly. Netflix loses a lot of revenue because users can cancel their subscriptions without penalty once they have reviewed all the new content.

Netflix’s Opportunities – External Strategic Factors

1. Low–Price Mobile Streaming Option

The global video streaming market was valued at $106.83 billion in 2023 and is projected to grow at a compound annual growth rate of 21.5% between 2024 and 2030.

The expected growth presents tremendous opportunities that Netflix can tap into by offering a lower-priced option to entice and retain subscribers in the international market.

2. Additional Fees for Password Sharing

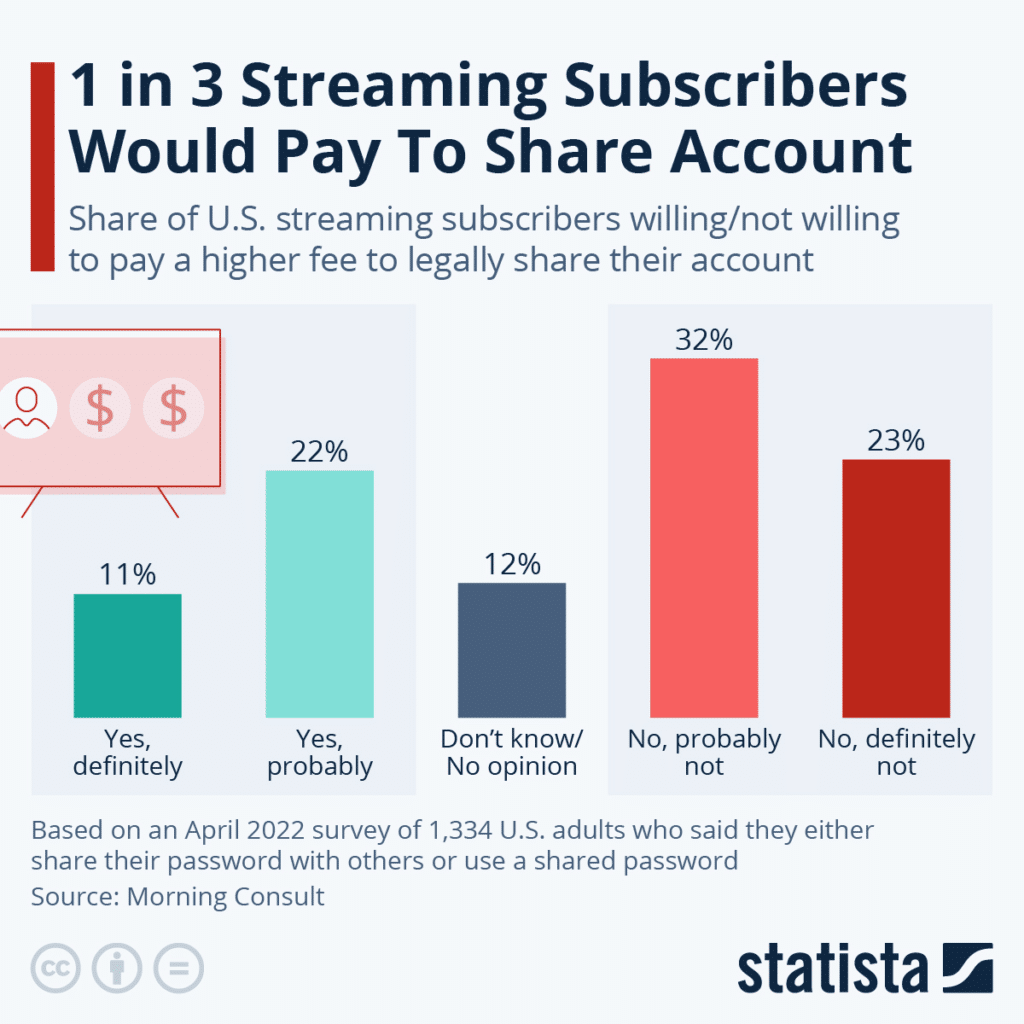

A morning consult study has shown that 11% of streaming subscribers who share passwords with others are open to paying a higher subscription fee to share accounts. Additionally, Netflix can take advantage of the fact that most subscribers are willing to pay more to share their accounts.

Image source: Statista

3. Exploit Ad-Based Model

Ad spending in the digital advertising market is projected to hit record highs of $740.3 billion in 2024 while growing at a CAGR of 8.9%.

With the ad tier plan, the company can potentially generate more revenues from the digital advertising market.

4. Expand the Global Customer Base

China’s video streaming market is growing at an 8.97% rate and is projected to generate revenues of $22 billion in 2024. Netflix can expand into China and other markets but cannot diversify its revenue streams further.

5. Refresh Licensed Content Library

Licensed content represents 47% of US viewership. Netflix can consider mass licensing movies and shows to fill its library with proven hits people want to watch. It’s the only way the company could retain and attract new subscribers amid the proliferation of streaming services worldwide.

Netflix can expand its content licensing by increasing contracts with various movie distributors. Additionally, Netflix should refresh its content library as it is now producing its original content.

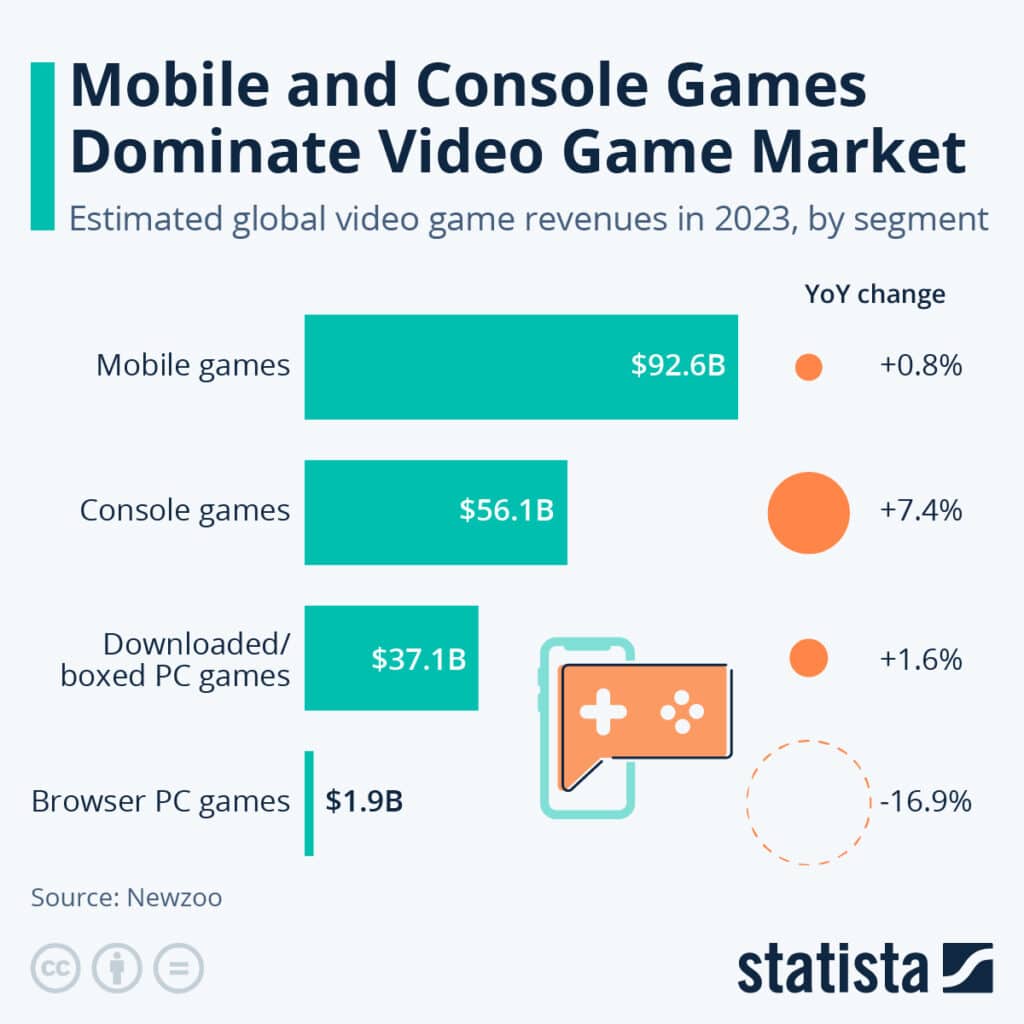

6. Gaming Opportunity

The global video game industry was worth $217.1 billion in 2022 and is projected to grow at a compound annual growth rate of 13.4% between 2023 and 2030.

Netflix can consider diversifying beyond content streaming by venturing into the multibillion-dollar gaming industry. For instance, the company can develop and offer mobile games in addition to its core movies and series.

Image source: Statista

Netflix’s Threats – External Strategic Factors

1. Competitive Pressure

Netflix is one of many companies that provide digital streaming around the world. Its competitors increase every year. Disney+, Apple TV, HBO, Amazon, Hulu, and YouTube compete continuously with Netflix by giving repeated access to new and original content to its subscribers.

Netflix’s share of streaming stood at 48% in 2019 but has since shrunk to 26% owing to soaring competitive pressure.

2. Government Regulations

Strict governmental rules and regulations regarding service providers like Netflix in many countries can significantly threaten them. For example, Netflix’s expansion to China will be unlikely because of its restriction on foreign content.

In India, the company is also facing regulatory pressures as a culture of self-censorship pervades the streaming industry. Projects that deal with India’s political, religious, or likely caste divisions are often declined.

3. Growth in Piracy

Digital piracy is still at its peak as thousands of people worldwide find ways to download media content for free. It is another significant threat that Netflix faces.

4. Password Sharing

Password sharing has been a big menace whereby one subscription is used by many households, all but depriving Netflix of much-needed revenues.

5. Market Saturation

Netflix faces stiff competition and saturation in some of its critical markets amid a spike in the cost of living and a post-pandemic reset. In the UK, the company registered a growth of 4% last year, down from a 20% growth rate in previous years.

It was the smallest growth rate since the streaming service launched in the country in 2012. Due to market saturation, Netflix will find it harder to add new subscribers.

6. Account Hacking

The number of hacked Netflix user accounts is becoming a big issue that makes people unable to access their accounts. Hackers have upped their game and increasingly leverage sophisticated measures to steal subscriptions.

There have also been instances where Netflix has been unavailable due to hacking incidents by hackers citing Netflix’s LGBTQ content as the reason. If account hacking persists into the future, frustrated Netflix users can mass migrate to rival companies.

7. Carbon Emission

According to a study by Shift Project, digital technologies have a larger carbon footprint than the aerospace industry. Online video streaming generates nearly 1% of global emissions. High carbon emission is a significant threat in this age and time where countries worldwide are threatened by climate change. They can decide to restrict Netflix’s usage.

8. Government Pressure Due to Capacity Issues

Netflix users are increasing and straining available infrastructures and resources. In March 2020, the European Union commissioner complained about how Netflix’s HD content strained infrastructure and interfered with critical functions like defense and hospitals.

Netflix was asked to reduce the data in video streams to European users for 30 days and urged users to watch using standard definition instead of HD.

Recommendations:

The SWOT analysis of Netflix highlights where the brand stands and the threats it faces in this era. Following are a few suggestions for Netflix that were recommended after this detailed analysis:

- Tap into new geographical locations by partnering with their local cable providers and streaming their local and international content in various languages. This will increase their profits and subscribers.

- Netflix should try connecting with IMDB, Rotten Tomatoes, and other internet services to provide their users with a variety of ratings and other information.

- To avoid digital piracy, Netflix should strengthen its security and expose people behind digital media. It can also provide even more generous subscription packages for different economic classes.

- Improve their application and website by providing a more user-friendly interface for their subscribers.

References & more information

- Liedtke, M. (2024, April 19). Netflix now has nearly 270 million subscribers after another strong showing to begin 2024. AP

- Zandt, F. (2023 July 20). The Most Popular Streaming Services in the U.S. Statista.

- Richter, F. (2024 April 19). Netflix Adds 9.3M Subscribers in Strongest Q1 Since 2020. Statista.

- Howarth, J. (2024 February 21). 30+ Cord Cutting Statistics (2024-2027). EXPLODING TOPICS.

- Popenya, A. (2024 July 3). Deutsche Telekom expands partnership with Netflix. Telekom.

- Fleck, A. (2023 July 13). Emmy Nominations 2023: Succession, The Last of Us on Top. Statista.

- Tran, H. (2024 February 16). Netflix Is Reaching Fair Value After the Recent Surge. Statista.

- Richter, F. (2023 September 23). No Room for Nostalgia: Netflix Ejects DVD Business. Statista.

- Buchholz, K. (2023 October 19). Intention to Cancel Netflix High Amid Price Hikes. Statista.

- Jones, R. (2024 April 25). Netflix will spend ‘vast majority’ of its $17 billion content budget on originals in 2024, despite a deluge of licensed hit shows up for grabs. Fortune.

- Richter, F. (2023 February 10). 1 in 3 Streaming Subscribers Would Pay To Share Account. Statista.

- Vendrell, D. ( 2023 April 13). Licensing content could be a gold mine for Netflix. TheFutureParty.

- Zandt, F. (2023 August 8). Mobile and Console Games Dominate Video Game Market. Statista.

- Maglio, T. (2024 February 27). The Streaming Growth Rate Halved in 2023. IndieWire.

- Bylykbashi, K. (2018 December 4). Netflix: China expansion unlikely. DigitalTV.

- Shih, G. (2023 November 20). Facing pressure in India, Netflix and Amazon back down on daring films. Washington Post.

- Sweney, M. (2023 October 10). Netflix UK subscriber growth slows to lowest since British launch. The Guardian.

- Power, S. (2023 September 20). Netflix Taken Down by Hackers Over LGBTQ+ Content. Newsweek.

- Mahdawi, A. ( 2020 February 12). The real problem with your Netflix addiction? The carbon emissions. The Guardian.

- Snider, Mike. (2020 March 19). Amid coronavirus pandemic, Netflix reduces video stream to EU users for 30 days. USA Today.

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Hi, would it be possible to provide any source of information about their Limited Copyrights weakness?

Hi Carolina,

Some of these points are from Netflix’s annual report, you can find its link in the reference section.

Thank you for this is a good detailed analysis of the for netflix

Glad you liked the analysis 🙂

May I know who is the author?

Author name : Brianna Parker

Great report!

When it was published?

Hi Micka,

The article was published on Jan 6th, 2019 and last updated in Jan 2022

Great report! When was the last update?

Thanks Joyce, the article was last updated in Oct 2024.