Stash’s annual State of Money in America report found that 90% of surveyed Americans desired to build wealth, but nearly 50% had no clue how to achieve their financial goals. Worse, only 31% had a non-retirement investment account, while most didn’t even have a brokerage account. The reason? A lack of investing knowledge.

The good news is brokerage companies like Robinhood aim to facilitate financial literacy in the Americas and make it possible for the general public to invest and grow their wealth.

What is Robinhood?

Founded in 2013 by Vladimir (or Vlad) Tenev and Baiju Bhatt, Robinhood is a financial services platform to make financial markets accessible to the residents of America — not just the 1% crowd.

To make investing a viable option for the public, the founders launched a commission-free stock trading app. The intuitive interface and simple underlying technology soon became a hit, and millennials are looking for an approachable venue to begin their investing and saving journey.

Robinhood Customer Segmentation

Robinhood primarily caters to four customer segments:

- Retail investors: Accounting for the lion’s share of Robinhood’s customer segmentation, retail investors — both novice and seasoned — are the primary focus of this financial platform. Americans looking to participate in IPOs (initial public offerings) and freelance gig workers looking to save money for their retirement fall under this category, too.

- Traders: The app is regularly used by traders with a Level 2 or 3 understanding of options trading, interest in fractional trading, or eligibility for investment on margin.

- Crypto enthusiasts: Crypto enthusiasts looking to buy and transfer crypto commission-free use Robinhood to get their feet wet. The Robinhood wallet and the platform’s role as a custodian on behalf of its consumers sweeten the deal.

- Developers: In 2023, the platform launched Robinhood Connect, a channel allowing users to finance their Web3 wallets without leaving the dApp they’re using. While beneficial for crypto customers, developers can effortlessly embed this feature into their dApps to facilitate crypto transfers.

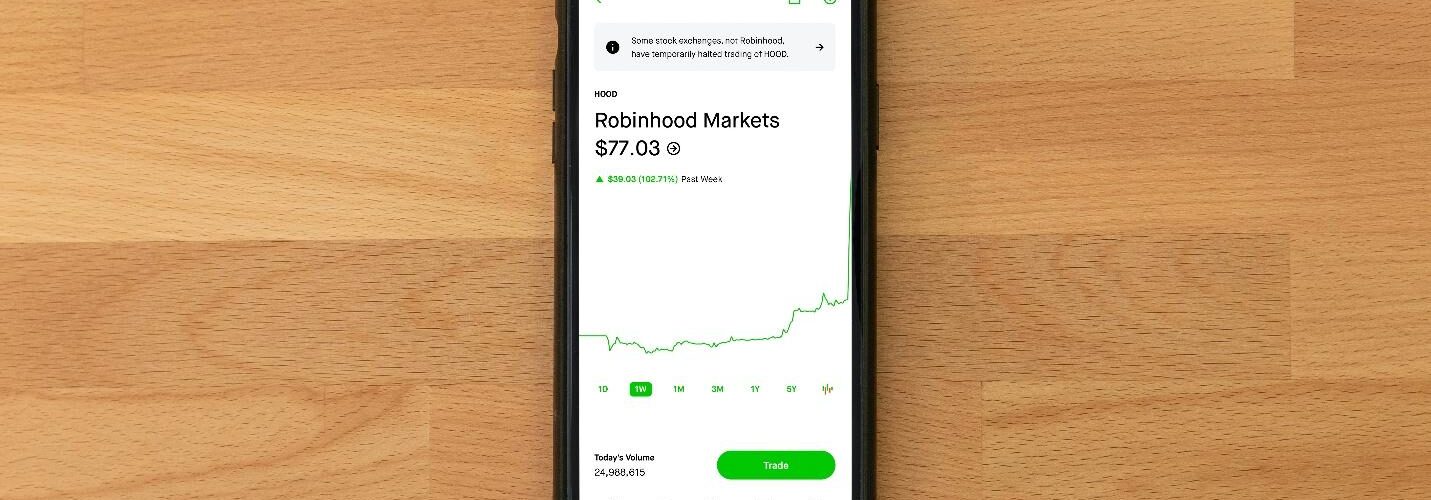

As of November 30, 2024, Robinhood has a whopping $195 billion worth of assets under custody, an LTM (last twelve months) net deposit growth rate of 38%, and boasts of 24.2 million funded customers. But why do individuals, traders, and crypto enthusiasts use this brokerage platform? Let’s find out.

Robinhood’s Value Propositions

Robinhood’s unique value propositions for its customers include the following:

1. Brokerage

While Robinhood’s primary offering is brokerage services, it’s anything but basic. Its customers can invest in multiple avenues, including US-listed stocks, American Depository Receipts (ADRs), and exchange-traded options (ETFs).

The highlight? All of these investment options are commission-free. The cherry on top is 24-hour trading (5 days of the week) of stocks and ETFs. Plus, users get insights about their financial decisions through charts and in-depth analysis.

Knowledgeable traders can participate in options and fractional trading. Some might even be eligible to enjoy the ‘investing on margin’ feature. Other options include Robinhood Retirement, fully paid securities lending, access to IPOs and the Directed Share Program, the ease of recurring investments, monthly Cash Sweeps, and instant withdrawals.

2. Robinhood Crypto

Robinhood serves as a trusted agent and offers commission-free crypto trading to residents of all US states, barring Hawaii, certain pockets of the European Union (EU) and the District of Columbia. The ability to finance their Web3 wallets without abandoning their dApp via Robinhood Connect is another benefit for the platform’s customers.

3. Custodian services

Robinhood stores and transfers all settled cryptocurrencies for its customers in hot or cold wallets. It stands out due to its heightened security, attention to detail, and detailed records of account balances.

4. Robinhood Wallet

Robinhood Wallet is a self-custody Web3 wallet available in 150 countries via Robinhood Non-Custodial Ltd., a Cayman Islands subsidiary. Here, customers have complete control over their cryptocurrencies and can add, move, and store the digital currency at their discretion. Simply put, customers are the sole keepers of their private keys. Additionally, the Wallet doesn’t impose gas fees on the users.

5. Robinhood Gold

Robinhood Gold works on subscription based model that offers subscribers premium services, including higher interest on Cash Sweep, a higher match on IRA contributions, Morningstar stock research reports, Nasdaq Level II market data, a higher amount of instant deposits, and a better rate for investing on margin.

6. Robinhood Credit Card

The financial services company offers its customers credit via Robinhood Credit Cards, which are financed by an agreement between Coastal Community Bank and Robinhood Credit, Inc. The lack of yearly charges and late and foreign transaction fees make them a lucrative venue. Rewards on each purchase don’t hurt, either.

7. Robinhood Cash Card and Spending Account

The Robinhood Cash Card is a prepaid spending card issued by Sutton Bank. Money in the account is qualified for FDIC insurance and offers varied benefits, such as early paycheck access, recurring investments, and generous cashback.

Who are the Key Partners of Robinhood?

Robinhood’s partners have helped propel the company to success. Its key partners include:

- Investors: Robinhood’s investors help keep the company afloat.

- Financial institutions: Robinhood seemlessly partners with multiple financial institutions to further its credit offerings.

- Customers and traders: Individual customers and traders use Robinhood to seamlessly invest money, trade stocks, and buy or transfer crypto.

- Strategic partnerships: Robinhood partners with J.P. Morgan Chase Bank, N.A., to offer its customers a Spending Account. The Robinhood Cash Card is issued in partnership with Sutton Bank. Its credit cards are issued by Coastal Bank. It has partnered with several third-party service providers to expand its operations and geographical reach.

- Technology partners: These partners help the platform run without glitches and seamlessly roll out new features or products.

What are Robinhood’s Key Resources?

Robinhood’s key resources include:

- Robinhood’s website and mobile app are its most significant resources.

- The company headquarters is in Menlo Park, California.

- Profitable partnerships and strategic investments across the globe.

- Robinhood’s ecosystem of over 2,200 full-time employees.

- Intellectual property rights, like trademarks, non-disclosure agreements, registered domain names, patents, copyrights, know-how and expertise, confidentiality procedures, license agreements, trade secrets, proprietary technology, and intellectual property assignment agreements.

- Excellent brand image in the financial services sector.

What are Robinhood Channels?

Customers can access Robinhood through its website. It also has dedicated apps to serve iOS and Android users, which can be downloaded through the App Store and Google Play.

Additionally, the brokerage company is active on multiple social channels — X (formerly Twitter), LinkedIn, Instagram, TikTok, and YouTube — and leverages them to engage with its customers.

How does Robinhood Maintain Customer Relationships?

Robinhood customers can sign in and visit the Support page to get their queries answered. They can also contact customer support for speedy redressal of their grievances.

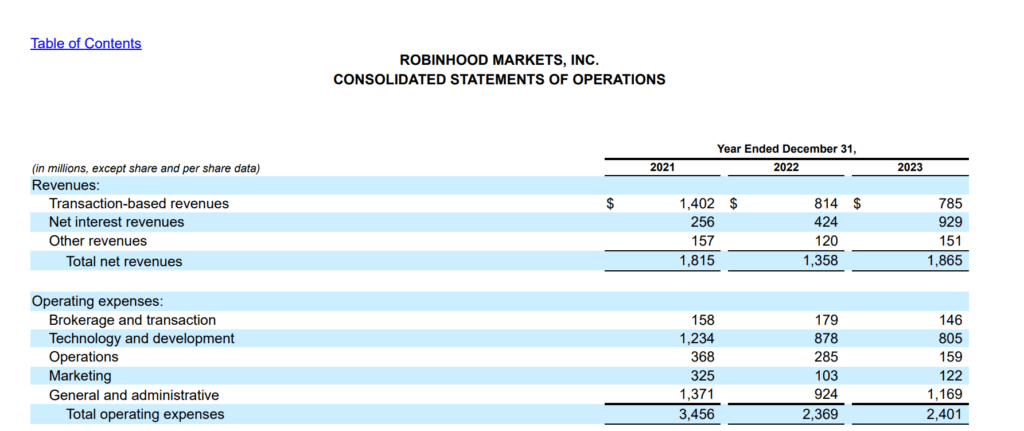

What is Robinhood’s Cost Structure?

For the fiscal year ending December 31, 2023, Robinhood’s total operating expense was approximately $2.4 billion. It incurred $146 million in brokerage and transaction, $805 million in technology and development, $159 million in operations, $122 million in marketing, and $1.17 billion in general and administrative expenses.

How Does Robinhood Generate Revenue?

As of fiscal year ending 31st December, 2023; Robinhood’s total net revenues were around $1.86 billion.

But how does Robinhood make money? Let’s find out. Robinhood’s revenue streams can be broadly categorized into three main categories:

1. Transaction-based revenues

Robinhood’s main source of income is transaction-based. With a monthly-user base of 10.9 million and average revenue per customer (ARPU) of $80, it earns a handsome payment for order flow (PFOF) for options and equities and transaction rebates for cryptocurrencies.

2. Interest revenues

The brokerage platform earns interest on cash and investments, segregated cash and cash equivalents, margin loans to users, deposits with clearing organizations, Cash Sweep, securities lending transactions, and carried customer credit card balances.

3. Other revenues

Revenue from Robinhood Gold subscription, ACATS fees charged to users, and proxy revenues fall in the other revenues category.

The Bottom Line: Robinhood is Boosting Access to Financial Markets in America

Robinhood is making financial instruments accessible to the general public, helping them save and invest on their terms. Further, it’s educating Americans through Robinhood Learn, newsfeeds, Robinhood Snacks, and in-app information so they can make informed decisions.

References & more information

- 90% of Americans Want to Invest but Almost Half Don’t Know Where to Start | Stash Learn

- About Us | Robinhood

- Governance – Board of Directors

- Robinhood

- 10 years and counting

- Robinhood Markets, Inc.

- Robinhood – Investor Relations

- Robinhood Support

- Featured Image by Andrew Neel

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment