Company: Meta Platforms, Inc. (formerly Facebook, Inc.)

CEO: Mark Zuckerberg

Founders: Mark Zuckerberg, Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes

Year founded: 2004

Headquarter: Menlo Park, California, US

Number of Employees (FY2023): 67,317

Type: Public

Ticker Symbol: Nasdaq: META

Market Cap (Jul 2024): $1.20 Trillion

Annual Revenue (FY2023): $134.9 billion

Profit | Net income (FY2023): $39.1billion

Products & Services: Facebook | Marketplace | Ray-Ban Stories | Messenger | Threads | Instagram | WhatsApp | Oculus – Virtual Reality Device | Workplace – Business Tool

Competitors:

• Social Media & Messaging – WeChat | X (Twitter) | Pinterest | Snapchat | Bytedance | LinkedIn

• Advertisement – Google | Amazon

• Business tools – Microsoft Teams | Slack | Zoom

• Videos – YouTube | Tik Tok

• Online Dating – Tinder | Hinge | Bumble

• Electronic Payment – PayPal | Venmo | Apple

• Peer to Peer Marketplace – Letgo | OfferUp | Craigslist | eBay

Fun Fact: Did you know that the blue color scheme for Facebook was chosen because it is the color that Mark Zuckerberg can see most clearly due to his red-green color blindness?

An Overview of Meta

Meta began life as The Facebook (and later Facebook), founded in 2004 by Mark Zuckerberg and four other Harvard students. Originally limited to universities, membership eligibility expanded in 2006 to include everyone over the age of 13 (or 14 in some countries). The company name officially became Meta Platforms Inc. (doing business as Meta) in 2021. Facebook still operates under its own name and is a large part of Meta’s business.

Meta is one of the largest technology companies in the US and is among the so-called Big Five, along with Alphabet/Google, Amazon, Apple, and Microsoft.

Despite diversifying beyond social media and into consumer electronics and virtual reality, most of Meta’s revenue (nearly 98% in 2023) comes from advertising.

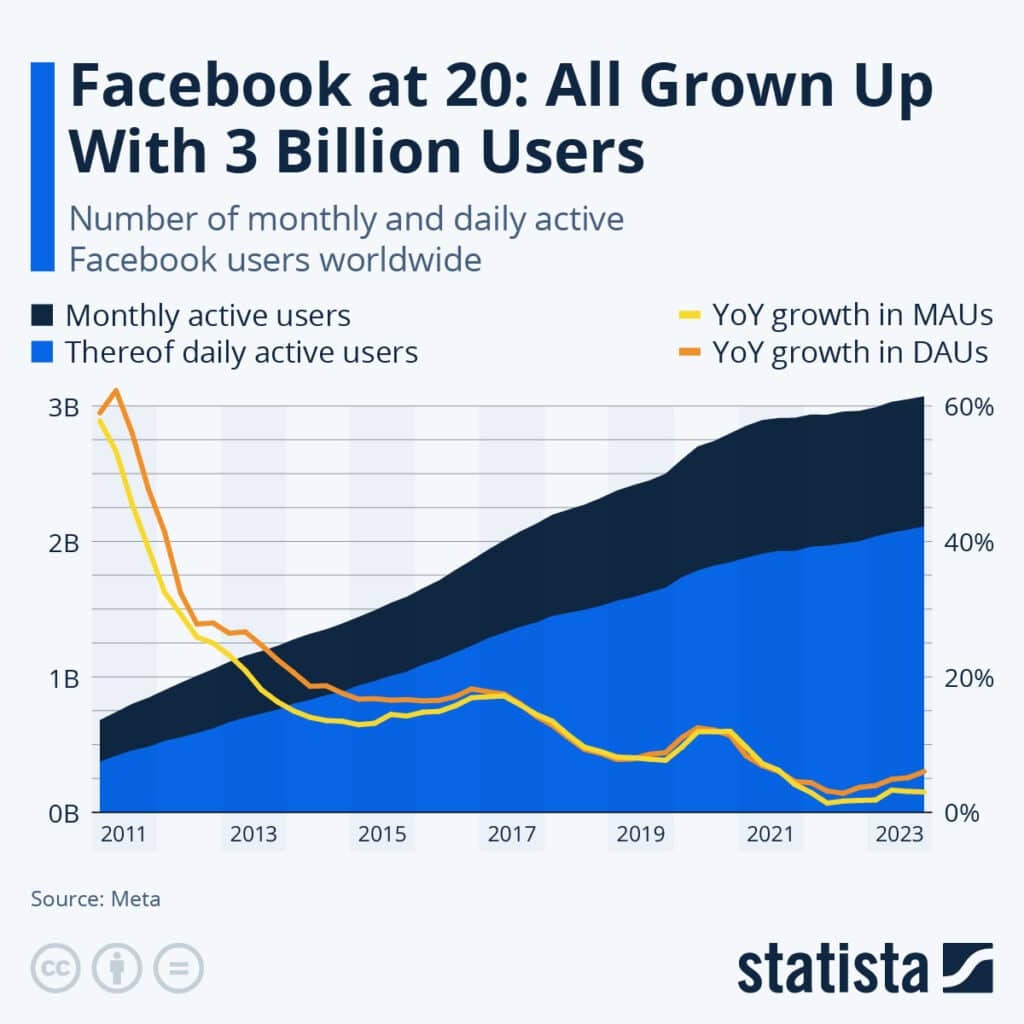

Over the years, there have been numerous controversies surrounding Facebook, including security and privacy issues, antitrust cases, and allegations of social harm. However, Facebook continues to grow and now claims to have 3 billion users.

Source: Statista

SWOT Analysis of Meta/Facebook

Facebook’s Strengths

Facebook has a number of strengths, including brand identity, a diverse range of revenue-producing apps, and dominance in the social media world. Here are more details on Facebook’s strengths.

1. Strong Brand

Having a strong brand is vital both for stability and long-term sustainability. In 2023, Interbrand ranked Facebook #21 as the most valuable brand. With $31.6 billion in brand value, Facebook is the second strongest brand in the social media space, behind Instagram (valued at 39.3 billion), which Meta also owns

2. Diversified Portfolio

Diversification enhances company stability by protecting its core financial assets if revenues decline in one sector. Meta clearly understands that you shouldn’t put all your eggs in one basket, opting instead to spread its investment across different areas.

With Facebook, WhatsApp, Instagram, Messenger, Oculus (virtual reality device), and Workplace (business tool)under its portfolio, Meta’s diversification is a major strength.

Meta divides its portfolios primarily into two segments:

- Family of Apps – represents about 98% of total revenue. This segment generates revenue by charging advertising placement fees to people who want to do marketing on Meta’s apps, namely Facebook, Instagram, Messenger, and WhatsApp.

- Reality Labs – represents about 2% of total revenue. This segment generates revenue by selling consumer hardware, software, and content products. The main focus of Reality Labs is virtual and augmented reality technologies.

| Segment | 2023 Revenue ($ billion) | % Share |

| Family of Apps | 132.2 | 98% |

| Reality Labs | 2.7 | 2% |

| Total | 134.9 | 100% |

3. Global Presence

Meta is a global technology leader with a strong presence almost everywhere. The monthly active user numbers below are as of December 31, 2023.

- The United States and Canada are their largest markets and represent about 45% of total revenue. Meta has 272 million monthly active users in this region.

- Europe is the second largest market and represents about 23% of total revenue. Meta has 408 million monthly active users in this region.

- Asia-Pacific represents about 20% of total revenue. In this region, Meta has 1.367 billion monthly active users.

- Rest of World represents about 12% of total revenue. Meta has 1.018 billion monthly active users in this region.

Meta (Facebook) – Revenue by Regions

| Regions | Revenue ($ billion) | % Share | Monthly active user (million) |

| United States and Canada | 52.8 | 39% | 272 |

| Europe | 31.2 | 23% | 408 |

| Asia-Pacific | 36.1 | 27% | 1367 |

| Rest of World | 14.6 | 11% | 1018 |

| Worldwide | 134.9 | 100% | 3065 |

4. Market Dominance

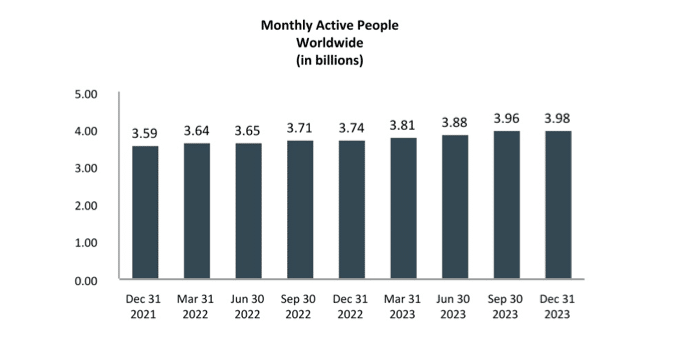

Companies that dominate the market can leverage their elevated positions to their advantage. The leading social network of the world, Facebook, and its family of products (Instagram, WhatsApp, Messenger) have a Monthly Active People (MAP) value of 3.97 billion (Jan 31, 2024).

Image source: Meta annual filing

5. Loyal Customer Base

Nothing communicates a company’s strength, stability, and success more than a large and ever-growing number of extremely loyal customers. About 40% of the world’s population uses Facebook and its family products (Instagram, WhatsApp, Messenger), putting Facebook in an enviable position.

6. World’s Best Employer Rankings

Facebook’s excellent HR policies are regarded as one of the best not only in the social media industry but also globally across all other industries. It is known to attract and retain top talent in the industry. Forbes ranked Facebook in the following categories:

- #7 Market Value (2024)

- #31 Global 2,000 (2023)

- #98 World’s Best Employers (2023), and

- #548 America’s Best Large Employers (2024)

7. Visionary Leadership

Mark Zuckerberg’s visionary leadership is a strength that most companies can only dream of. Zuckerberg’s strong leadership has produced company culture, stability, increased profitability, innovation, and sustainability with minimal internal wrangles within its ranks and management, unlike most other companies.

8. Focus on R&D

Regardless of the industry, success in the digital age requires technological innovation through research and development (R&D). Facebook is one of the global leaders in R&D spending and has increased its investment in R&D from $4.8 billion in 2015 to $38.48 billion in 2023, which is about 28% of its annual revenue.

9. Strong Advertising Business

Even though Facebook is synonymous with social media networks, its major revenue source is advertisements. In 2023, $131 billion (97% of its $134.9 billion annual revenue) came from advertising.

10. Effective Marketing Strategy

Facebook’s marketing is simple. Over 2 billion people use their applications daily, making it a very powerful and effective marketing tool

11. Facebook Geared to Invest Billions on the Metaverse

According to the CEO of Meta, Mark Zuckerberg, the company will invest $10 billion every year for the next ten years, pumping the money to grab a bigger piece of the metaverse.

The company wants to dominate the nebulous and absolutely exhilarating world of virtual avatars. According to the Financial Times, Meta has applied for various patents at the US Patent and Trademark Office, and many of those patents have already been approved.

12. Enhanced Features on WhatsApp and Facebook

In 2022, WhatsApp announced that it would launch fun message reactions and Emojis. The platform also recently announced a secret code system for Chat Lock and new features for Communities. More recently, in April of 2024, Meta announced an updated video player for Facebook, which it says will make exploring videos easier. The player will roll out gradually, starting in the US and Canada.

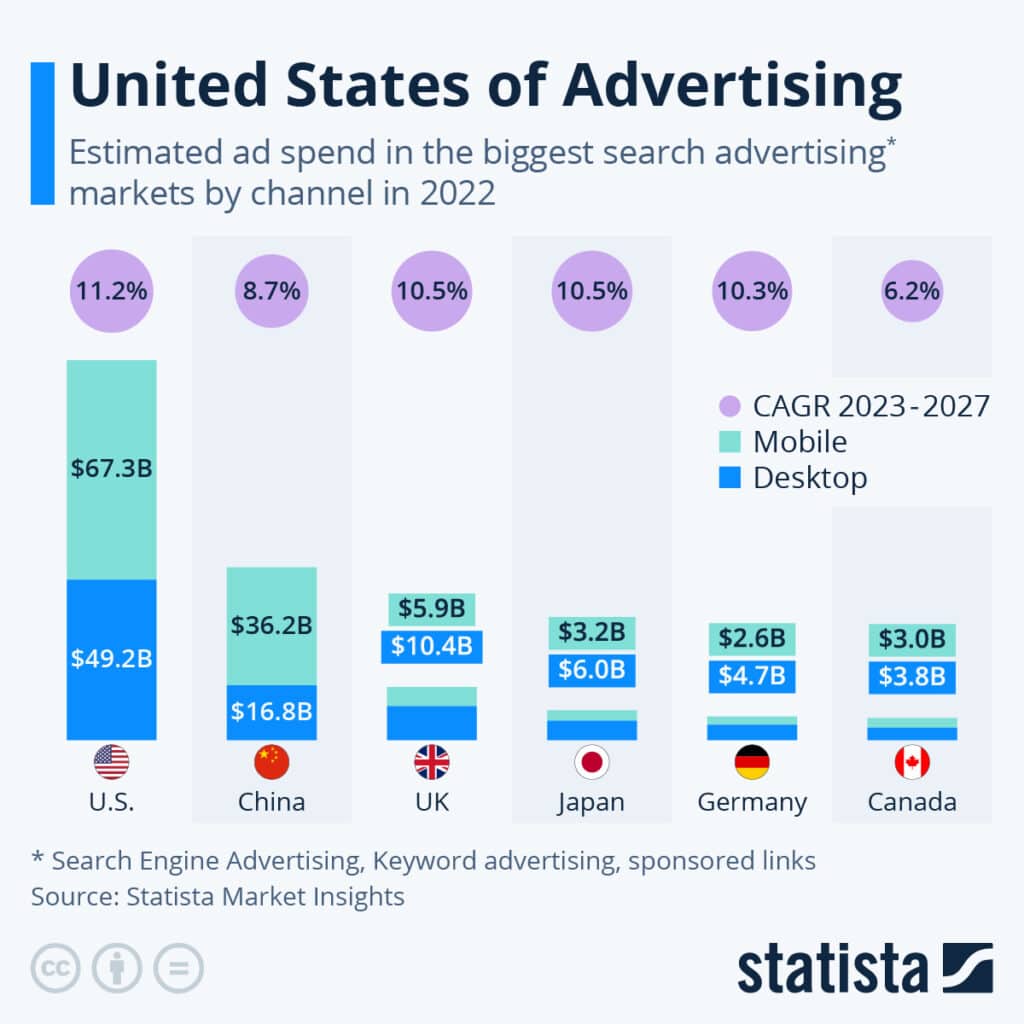

13. Exploit Changes in Advertising Trends

Facebook has an invaluable opportunity to improve its mobile-based advertising to take advantage of a 26% increase in mobile in-app ads. A majority of Facebook users access their accounts via the mobile app with overall CAGR of mobile apps expected to achieve 14.3% from 2024 to 2030

In many countries, the amount of money spent to advertise to mobile users is larger than the amount spent to advertise to desktop users. Meta’s advantages in technology, experience, and access are clear.

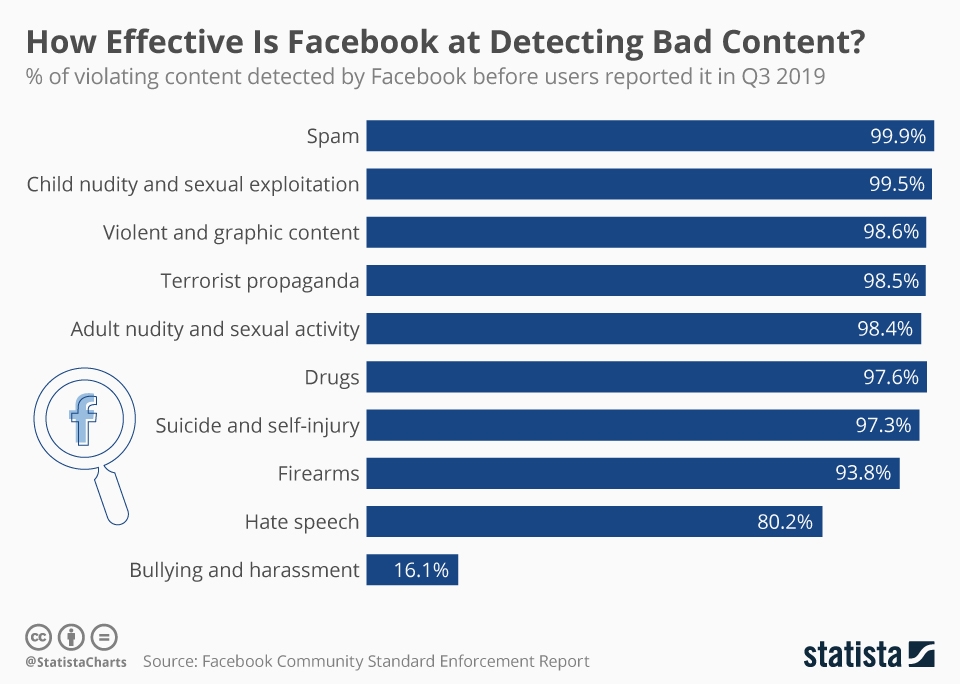

Source: Statista

Facebook’s Weaknesses

Meta’s weaknesses include negative publicity for several incidents, privacy concerns, and a dependence on single revenue streams.

1. Over-dependence on Advertising

Facebook’s business model relies heavily on advertising for its revenues. About 97% of its annual revenue comes from advertising. In 2023, out of $134.9 billion annual revenue, $131 billion was its advertising revenue.

2. Friction in Management

Consecutive scandals have been disintegrating the harmony that existed between top-level management since the company was founded. The need for accountability is turning into a weakness as top executives point fingers and seek to distance themselves from major scandals such as the Russia meddling scandal.

3. Allegations of Racial Bias

The recent inequality protests have highlighted numerous actions by Facebook that amount to racial bias. The company has been allowing advertisers to exclude minority groups from specific privileges on its platform.

Also, less than 4% of Facebook’s employees are Black. It has been impeding studies on the impact of the platform on minority groups.

The anger toward Facebook has forced over 750 companies to stop advertising on the platform, and it has been pressured to analyze whether its algorithms are racially biased.

4. Negative Publicity

In 2020, Facebook’s reputation was tainted further after the revelation that the company fired an employee who had protested Mark Zuckerberg’s inaction against Donald Trump’s inflammatory posts.

Facebook’s Opportunities

The number of Facebook users in most countries of the world, its financial resources, and technical expertise help drive opportunities for expansion and growth.

1. Generate Diversified Revenue Sources

With an estimated CAGR of 26.2% from 2023 to 2030 in North America, social media network app market growth is expected to be strong for years to come. Meta’s ownership of WhatsApp, Instagram, Messenger, and other platforms focuses the majority of its business revenue on social media and advertising. Meta has the opportunity to extend its portfolio beyond the social media industry and diversify into spaces beyond their existing revenue streams.

For example, it could diversify by developing a business model with additional paid services such as online dating, peer-to-peer marketplace, hardware devices, e-wallet, news subscription, etc. Online dating has an expected CAGR of 2.48% from 2024-2029 with revenue reaching an estimated US $3.15bn in 2024.

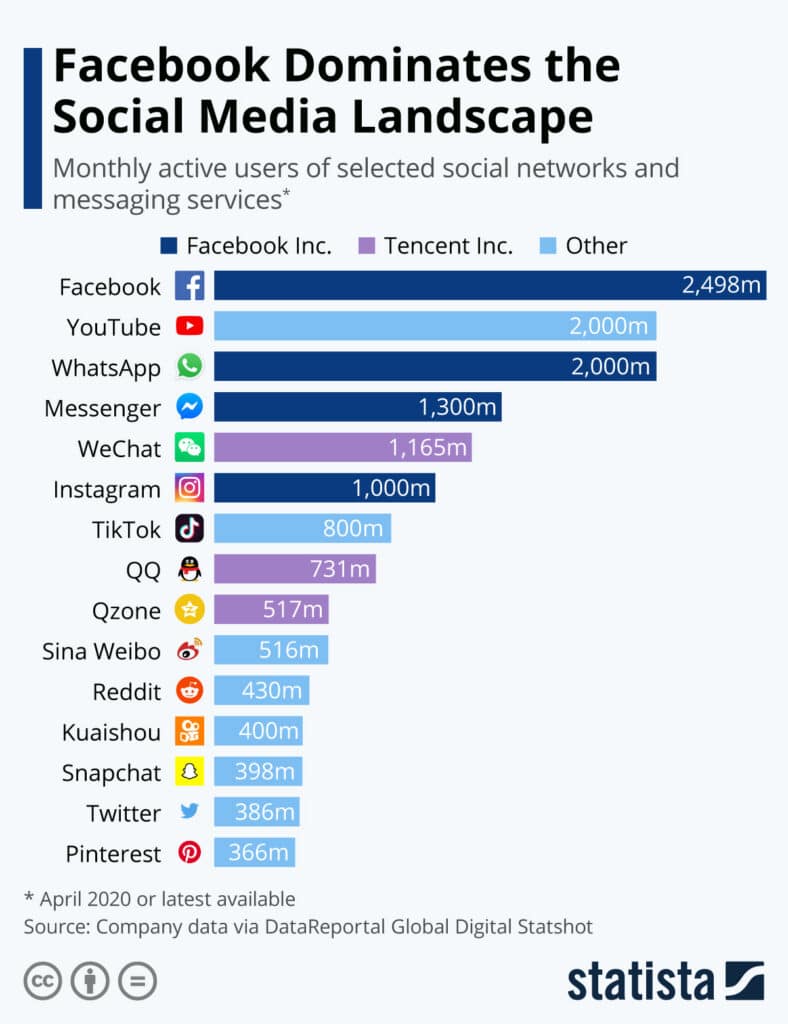

2. Expansion of Existing Platforms

Technology platforms such as social media and streaming applications continue to expand. Meta’s reach and sheer number of users make expansion easier, giving the company the opportunity for even more growth. Key countries have potential including India, with a population of 1.4 billion people, having 378 million Facebook users as of April 2024.

With billions of users, Facebook can expand its existing services, such as marketplace, online video streaming, online dating, business tools, e-wallet, etc., to compete with giants such as Amazon, eBay, YouTube, Netflix, Apple, Tinder, PayPal, etc.

Image source: Statista

3. Increasing Application Integrations

As technology advances, more and more applications and websites are integrated, allowing users to connect via other platforms. Meta’s integration into the e-commerce space taps into an area expected to grow by a CAGR of 9.49% from 2024-2029.

Facebook can open its platform to integrate with a variety of other applications such as e-commerce, surveys, blogs, podcasts, videos, contests, reviews, games, etc.

4. Acquisitions

As new technologies become available, consumer preferences change and new companies emerge to meet these preferences. With that, Meta can look to acquire more companies. Meta has the financial resources to respond to the pressures of economic headwinds by expanding its portfolio through the acquisition of established entities, including promising technology start-ups with the potential to revolutionize the world, just like Facebook itself did. Meta’s YoY net income has recovered from 2022’s notable setback to reach $39 billion in 2023, indicating the business is able to spend as needed to grow via acquisitions.

For example, In Oct 2019, Facebook acquired a brain computing start-up, “CTRL – Labs,” that specializes in sending brain signals to a computer and using these signals to perform various tasks. Over the years, there have been about 100 acquisitions by Facebook.

5. Offer Remote Work Solutions

The COVID-19 pandemic made remote work common across the world and have increased demand for remote work solutions, presenting opportunities for Facebook to become a platform of choice. Remote workspace services are expected to reach a CAGR of 23% from 2023 to 2032.

Facebook sought to exploit this opportunity and announced that it was expanding the features of its Messenger Rooms and Facebook Live to allow users to hold live video conferences with up to 50 people at a time. Continuing to focus on these features will enable Facebook to compete with service providers like Zoom and Google.

6. Autonomous Vehicles

The world seems to be moving towards autonomous driving vehicles. Facebook has extensive expertise in artificial intelligence and can develop self-driving software for manufacturers of autonomous vehicles. Rivals like Apple, Google, and Amazon are already exploiting and benefiting from the self-driving car market. The total autonomous vehicle market is estimated at $50.63 billion as of 2023, and the CAGR of autonomous vehicles is an estimated 19.5% in the 2024 – 2032 period.

A few years ago, Facebook’s COO Sheryl Sandberg attended the Frankfurt Motor Show, sparking rumors and excitement about whether the company would enter the automotive sector. Working with an existing manufacturer to explore this market using a strategic partnership model may be the route to success in this area to mitigate the risks involved with bleeding-edge technology.

7. AI Integration

Conversational Artificial Intelligence is estimated to be $9.5 billion in 2023 and projected to achieve a CAGR of 22.60% through to 2031. Meta’s integration of AI into popular products, including Facebook, Instagram, and WhatsApp offers the advantage of a large user base to seek revenue generation from cutting-edge technology.

Facebook’s Threats

Meta is large but hardly immune to threats. Aggressive competition, new taxes and regulations, and public reaction to content and policies all present challenges.

1. Increasing Competition

Competition from both old and new platforms is threatening to reduce the number of Facebook users. As new entrants to the field, such as TikTok, provide customized platforms targeting younger generations, Facebook’s future is under threat. In an attempt to compete with TikTok, Facebook Launched its own version of short, fun videos platform “Lasso”, which was later shutdown.

2. Regulations

Regulations unfavorable to Facebook are being adopted at an alarming rate, fueled by recent scandals such as Cambridge Analytica.

Jurisdictions including the European Union, UK, Canada and Australia have introduced online safety legislation. In general, the regulations are intended to force internet companies like Meta to actively regulate and remove content that could be harmful. This could include content that bullies or victimizes children, or incites violence and hatred. In addition, issues with data safety, insensitive content, and infringement of intellectual property rights have prompted several regulatory bodies to enact rules that will force Facebook to adhere to new transparency and accountability requirements.

These laws threaten to reduce the number of Facebook users and advertisers, as some of its customers can migrate to other platforms.

You will find more infographics at Statista.

3. Bans in Several Countries

In democratic countries, regulations are being adopted to curb fake news used to undermine democracy, while autocratic governments are restricting access to Facebook to curb freedom of speech.

For example, Facebook has been banned in countries such as China, Iran, and North Korea, and Russia has recently banned it.

4. Data Breach

Data breaches have been a problem for many companies, and Facebook is no exception.

Facebook has experienced many instances where its data was breached, affecting millions of its users. For example, in December 2019, during a major data breach, over 267 million Facebook users’ personal information (names, user IDs, phone numbers) was exposed to the dark web.

5. New Digital Tax

Recently, the UK and the EU introduced a new digital tax that will require Facebook to pay a higher tax, threatening its dwindling profits.

If digital taxation is adopted by more countries, a large portion of Facebook’s profits will be directed to paying digital taxes.

6. Tainted Reputation

From New Zealand’s terror livestream to the Cambridge Analytica data scandal to fake news to hacked accounts, just to name a few, the spectacular image and reputation of Facebook are going down the drain at a frightening rate. This is a major threat.

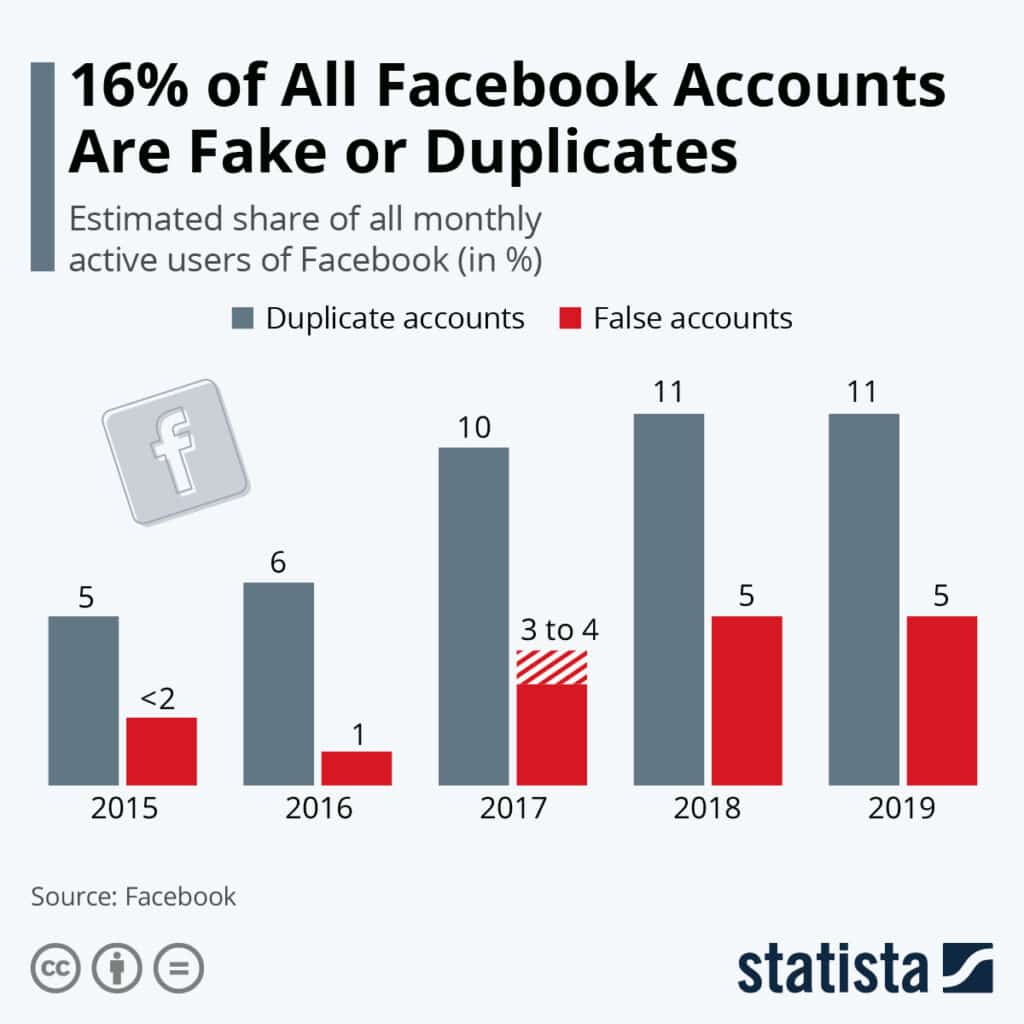

7. Duplicate & False Accounts

Facebook removed a staggering 2.6 billion fake or duplicate accounts in 2023 alone. It’s an effort that has been going on for some time.

Several years ago, Facebook estimated that out of its 2.5 billion (Dec 2019) Monthly Active Users (MAU) worldwide, 11% may represent duplicate accounts and 5% false accounts.

The number of accounts identified and removed since then would indicate this estimate was exceedingly low.

Image Source: Statista

8. Mass Boycott

In the recent past, the number of violent groups using Facebook to propagate hate and racism has increased immensely. Unfortunately, the company has failed to adequately address the issue.

In 2020, more than 1000 frustrated companies boycotted Facebook because they did not want their advertisements to appear alongside hateful and racist posts. This action, and others like it, pose a major threat since Facebook’s revenue depends heavily on adverts.

9. Facebook’s Encryption Plans and Child Abuse

There’s a concentrated effort to stop Facebook’s encryption plans because of fears it will facilitate child abuse. Government campaigns claim that adding end-to-end encryption on platforms such as Facebook Messenger and Instagram may very well help predators get away undetected.

The campaigns have stated that social media companies are deliberately turning a blind eye to this issue, integrating encrypted messaging.

10. Lawsuits

Lawsuits can weaken companies through financial and reputational damage, and Meta is facing its share of legal trouble.

Meta currently faces a $3.2 billion lawsuit in the UK. It is alleged that the social media giant willingly exploited the privacy data of more than 44 million people in a move to completely dominate the UK market.

This is far from the only lawsuit Meta will have to deal with. There is a long list of lawsuits launched by everyone, from individual Facebook users to governments.

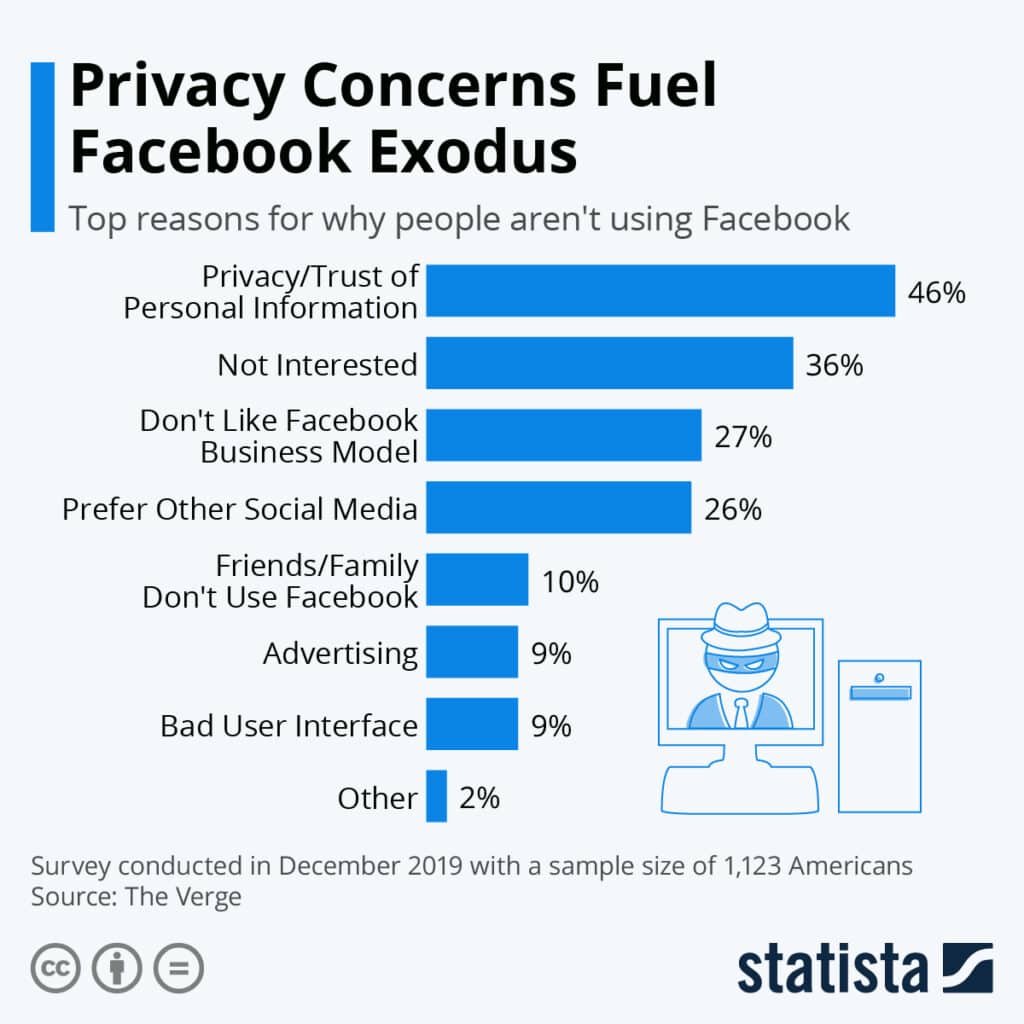

11. User’s Privacy Concerns

Meta has faced a number of concerns surrounding privacy, from data breaches to the selling of information about users to facilitate targeted advertising. Facebook is facing backlash over its negligence in the protection of users’ privacy, which has led to declines in popularity in some regions. , with the company experiencing a decline in popularity in some regions across the world. If the company does not address users’ privacy concerns promptly and effectively, it risks losing popularity.

According to Edison Research data, Facebook has lost about 15 million users since 2017.

You will find more infographics at Statista.

12. Spreading Fake News

Facebook has been under a lot of criticism for spreading fake and misleading information. Facebook’s inability to control misleading information can be very detrimental to society at large. Given this, there is a significant risk governments around the world may look to further regulate Meta’s operations.

SWOT analysis of Facebook

References & more information

- PubMatic ReportsFeatured Image by Gerd Altmann from Pixabay

- Facebook Annual Report

- Why Facebook is blue — six facts about Mark Zuckerberg

- About Facebook

- Infinite Dial by Edison Research

- What is CTRL-Labs, And Why Did Facebook Buy It?

- PubMatic Reports 26% Increase in Mobile In-App Advertising

- Statt, N. (2020, July 21). Facebook will study whether its algorithms are racially biased. The Verge

- Paul, K. (2020, June 13). Facebook fires employees who protested inaction on Trump posts. Reuters

- Alison Durkee, A. (2020, July 23). Facebook Is Launching Its Own Zoom Competitor. Forbes

- Feiner, L. (2020, April 16). Facebook’s vision for a new cryptocurrency gets watered down as it attempts to woo regulators. CNBC

- Cao, S. (2020, June 26). Amazon Buys Zoox For $1.2 Billion, Intensifying Big Tech’s Self-Driving Race. The Observer

- Jones, H. (2020 July 13). Regulators plot path for cross-border payments to counter Facebook. Reuters

- Dwoskin, E. (2020, July 3). Why Facebook’s Advertiser Boycott is gaining momentum. Washington Post

- Statista (2024, April 26). Facebook average revenue per user

- Reiff, Natian (2024, January 31) What You Need To Know Ahead Of Facebook-Parent Meta’s Earnings

- Macrotrends (2023) Meta Platforms Research and Development Expenses 2010-2023

- Statista (2024, March 20) Actioned fake accounts on Facebook worldwide

- Statista (2024, May 15) Share of Facebook users in the United States as of April 2024, by age group

- Barchart (2024) https://www.barchart.com/story/news/27442493/conversational-artificial-intelligence-ai-market-to-grow-remarkably-with-a-striking-2260-cagr-through-2031#:~:text=Conversational%20Artificial%20Intelligence%20(AI)%20Market%20size%20was%20valued%20at%20USD,period%20(2022%2D2031)

- Statista (March 2024) https://www.statista.com/outlook/emo/dating-services/online-dating/worldwide

- Statista (May 2024) https://www.statista.com/statistics/268136/top-15-countries-based-on-number-of-facebook-users/

- Statista (May 22, 2024) https://www.statista.com/statistics/376128/facebook-global-user-age-distribution/

- Statista (March 4, 2024) https://www.statista.com/statistics/277229/facebooks-annual-revenue-and-net-income/

- Custom Market Insights (October 2023)https://www.custommarketinsights.com/report/remote-workplace-services-market/

- Zion Market Research (2024) https://www.zionmarketresearch.com/report/autonomous-vehicle-market#:~:text=Autonomous%20Vehicle%20Industry%20Prospective%3A,19.5%25%20between%202024%20and%202032.

- Statista (May 22, 2024) https://www.statista.com/statistics/251328/facebooks-average-revenue-per-user-by-region/

- Grand View Research (2024) https://www.grandviewresearch.com/industry-analysis/social-networking-app-market-report

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment