Company: Nordstrom, Inc.

Co-Presidents: Erik Nordstrom and Pete Nordstrom

Founders: John W. Nordstrom & Carl F. Wallin

Year founded: 1901 (as Wallin & Nordstrom), 1971 (Nordstrom Inc.)

Headquarter: Seattle, Washington

Employees (FY2019): 74,000

Type: Public

Ticker Symbol: JWN

Annual Revenue (FY2019): 15.9 billion

Profit | Net income (FY2019): $ 564 million

Products & Services: Shoes | Clothing | Accessories | Home Goods | Gifts | Jewelry | Beauty | Restaurant | Espresso Bar | Home Furnishings | Design | Spa | Stylist | Alternation & Tailoring | Nordy Club

Competitors: JC Penny | Macy’s | Ross Stores Inc. | Kohl’s | Neiman Marcus | TJ Maxx | Saks | Bloomingdale | Darlington | Dillard’s | Hudson Bay | Home Retail Group | Mercuries & Associates | Amazon

Fun Fact:

Even though the department bears the name of John Nordstrom, he wasn’t enthusiastic about the business of selling shoes and only co-founded the shoe store because of Carl Wallin had plenty of expertise and experience in the business.

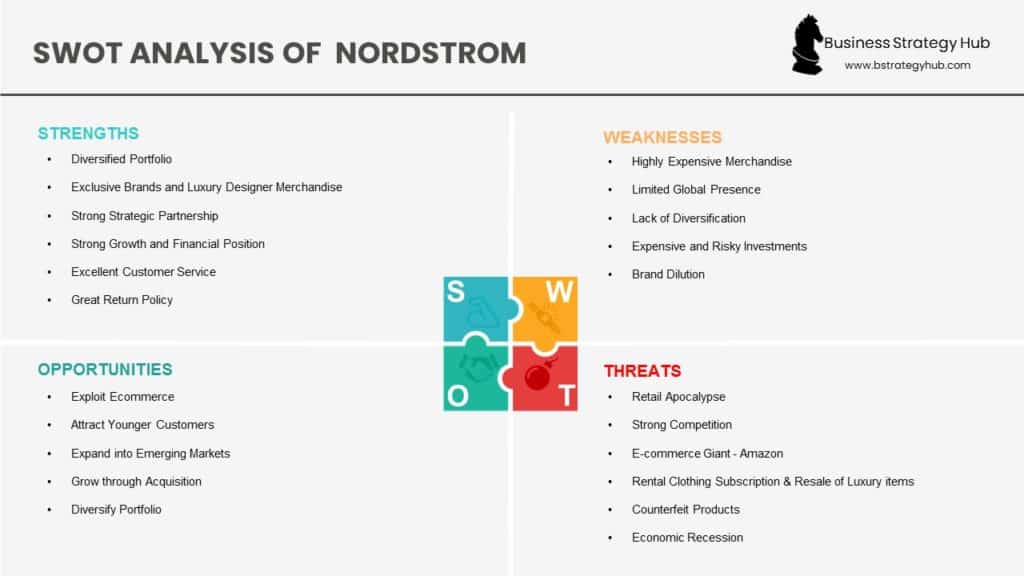

Nordstrom’s Strengths

- Diversified Portfolio: Nordstrom’s portfolio includes Nordstrom Rack (discount stores), Haute Look, Trunk Club (subscription box service), and Bevy Up, allowing the company to cater to the most vital shopping-needs of their customers in the digital era.

- Exclusive Brands and Luxury Designer Merchandise: From clothes to shoes, to handbags, to jewelry, Nordstrom has positioned to be a high-end department store that sells luxury items and designer brands.

- Strong Strategic Partnership: Nordstrom has differentiated itself from competitors by partnering with small but strategic brands such as Top Shop, Allbirds, Greats, Reformation, Stella, Dot, and Glossier that are digitally native and direct-to-consumer. More consumers are visiting Nordstrom to access these strategic brands, which drives sales growth 30% faster than non-strategic brands.

- Strong Growth and Financial Position: While other department stores struggle with ongoing store sales declines, Nordstrom’s financial position is strong with $ 15.9 Billion in annual revenue (2019) and growing steadily boosted by the effectiveness of its rack-store, e-commerce stores, anniversary sales, pop-up stores, and promotions.

- Excellent Customer Service: Personalized VIP customer service is one of Nordstrom’s core strengths. Sales associate greets the Customers once they enter the store and assists them in finding and picking out different items that they seek.

- Great Return Policy: Nordstrom has excellent (no questions asked) return policy, which makes customers feel more confident in making their purchase.

- A leader in Innovative Customer Experience: Nordstrom was among the first department stores in the US to adopt and exploit digital technologies to deliver the customer experience. For better Omni-experience, it opened a new NYC flagship store that allows customers to try on clothes virtually and access a Trunk Club to customize the clothes before they order in-store or online.

- Competitive Fulfilment Options: Nordstrom offers free shipping on every order without a minimum order limit. On the other hand, Nordstrom competitors, for example, Macy’s has $75, and C. Penney has a $99 minimum order limit to qualify for free shipping. With the ever-increasing number of online shoppers, free shipping gives Nordstrom a competitive edge.

- High Ecommerce Penetration: In department store sales, Nordstrom is second in e-commerce sales only beaten by Neiman Marcus. Currently, $4.7 Billion (30% of its total $15.9 B revenue) comes from digital sales.

- Effective BOPIS Strategy: Nordstrom offers the option to buy online, pick in-store (BOPIS). It is not only the most profitable transaction for the company but also caters to customers’ increasing demand for convenience.

- Nordy Club Membership Program: Nordstrom’s customer loyalty/ reward program has been growing. With the program, customers can earn points, access exclusive deals, and personalized services. The program has over 13 Million members (2019). These members generated about 2/3 of the annual revenue. Nordstrom can create a lock-in situation with its members.

- Strong Corporate Responsibility: Nordstrom supports the communities where it does business by donating millions of dollars to hundreds of NGOs in the U.S., Canada, and Puerto Rico. Apart from supporting Good+Foundation, Nordstrom pledged $5 million as investments and community grants within New York City by the end of 2020.

Nordstrom’s Weaknesses

- Highly Expensive Merchandise: Nordstrom has nurtured the image of its brand as high-end and offers expensive top-line designer brands. The high price tags of most of its products push away the middle and lower-income earners to competitors such as TJ Maxx.

- Limited Global Presence: Nordstrom has locations only in the US, and Canada, which effectively confine its operation to North and Central America. Any changes to the economic situation in these regions can catastrophic to the profitability and sustainability of the company.

- Lack of Diversification: Nordstrom operates primarily in high-end clothing, footwear, and accessories, which exposes the company to the risk of catastrophic losses because it has ‘put all its eggs in one basket.’

- Expensive and Risky Investments: Nordstrom invested over $500 million into its new 7-story high flagship Manhattan store. In the age of e-commerce, the foot traffic to retail stores is declining. Opening an expensive brick and mortar store can be a risky move. If the Manhattan store fails, more than half a billion goes down the drain.

- Brand Dilution: Nordstrom continues to expand its off-price discount stores i.e. Nordstrom rack, last chance clearance, Nordstromrack.com. In 2019, it had 249 Off-price stores 132 full-line stores (Nordstrom, Nordstrom.com, Trunk Club). This strategy exposes Nordstrom to brand dilution.

Nordstrom’s Opportunities

- Exploit Ecommerce: More and more customers are shopping online. Nordstrom can focus on expanding its e-commerce platforms and increase online sales even further.

- Attract Younger Customers: Nordstrom has the opportunity to expand its customer base by adopting strategies to effectively targeting younger customers with iconic youthful brands. According to Nordstrom, its average purchaser age is 42 years, and young customers (18 – 34 years) constitute only about 36 % of its customer base.

- Expand into Emerging Markets: Tapping into emerging economies in Asia and Latin America will provide Nordstrom an invaluable opportunity to capitalize on the growing demand for luxury products globally. It will also help in diversifying its dependence in the US market.

- Grow through Acquisition: A majority of smaller department stores are struggling to compete in the retail sector. Nordstrom can exploit its vast financial reserves to acquire smaller stores with the potential to attain growth within a short period.

- Diversify Portfolio: Nordstrom’s products and services are restricted within clothing, footwear, and accessories. The company can diversify to expand products from other sectors such as sports apparel (Nike, Adidas) and home décor.

Nordstrom’s Threats

- Retail Apocalypse: Euromonitor data shows that department store sales have experienced a streak of declines for the past five years. Sales of department stores dropped by 4.8% in the first nine months of 2019, reports the commerce department. If the retail apocalypse persists in the coming years, Nordstrom can lose not only its profitability and sustainability but also its existence.

- Strong Competition: Neiman Marcus, Bloomingdales, Saks fifth avenue, Macy’s, JC Penney, TJ Maxx, Kohl, and many other competitors are giving Nordstrom a run for its money. As the competition grows, Nordstrom can lose a substantial amount of its customers.

- E-commerce Giant – Amazon: Many of the luxury brands, which were exclusively available at high-end retailers, are now available on Amazon. It poses a threat to high-end luxury stores like Nordstrom.

- Rental Clothing Subscription & Resale of Luxury Items:There are few new categories of competition in the marketplace.

- Rental subscription service such as Rent the runway

- Online social marketplace for luxury items such as Threadup, Poshmark, etc.

- Counterfeit Products: As the accessibility and quality of counterfeit products are increasing, this could prove to be a big threat for Nordstrom’s high-end merchandise. According to the United States Government Accountability Office report, about $1.38 Billion counterfeit product shipment was seized by Custom and Border Protection in 2016.

- Economic Recession: Experts argue that the prevailing economic stability is the ‘calm before the storm’ based on the decline of the Consumer Confidence Index over the past three years. This is a bearish signal for Nordstrom because its expensive luxury products will be among the first non-essential expenses to be cut down, abandoned, or replaced with cheaper substitutes during tighter periods.

- Corona Virus Outbreak: The outbreak is already undermining global economic growth and stability with the disruption in the supply chain, travel, and retail shopping.

References & more information

- Nordstrom annual report

- moneyinc.com

- nasdaq.com

- forbes.com

- fool.com

- bloomberg.com

- seattletimes.com

- gao.gov

- bargainbabe.com

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment