ASML is a Dutch multinational company based in Veldhoven, Netherlands, specializing in lithography systems for producing computer chips. The company was founded in 1984 as a joint venture between ASM International and Philips.

In 1988, the firm became independent and adopted the abbreviation ASML as its official company name. Chipmakers rely on ASML’s products and services to mass-produce microchips with integrated circuit patterns. ASML drives technological advancements across all sectors, from healthcare to energy, transportation, and agriculture. In 2021, ASML had 32,000 employees and reported a 37.9% increase in revenue to €18.6 billion($22.019 billion). The company expects 20% sales growth in 2022. [1]

ASML offers extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography machines for the semiconductor industry. The company is the sole supplier of EUV lithography systems for developing advanced chips. ASML expanded its EUV and DUV portfolios through acquisition, including SVG, Cymer, Hermes Microvision, and Berliner Glas Group in 2020.

ASML’s EUV machines sell for about $200million. It’s no wonder ASML makes over $1 billion in quarterly profits. But the company faces stiff competition from Lam Research, Applied Materials, TSMC, Nikon, and Canon. [2]

Here is an in-depth analysis of top ASML’s competitors and alternatives:

1. Lam Research

Year founded: 1980

Headquarter: Fremont, California

Lam Research is a leading supplier of wafer fabrication equipment and related semiconductor services. Chipmakers use Lam Research’s products in front-end wafer processing to create the active components of semiconductor devices and wiring.

In 2021, Lam Research had 14,100 employees and reported a 45.71% increase in revenue to $14.63 billion. [3]

Both ASML and Lam Research supply essential products for semiconductor manufacturing. Lam Research focuses on etching and deposition equipment, while ASML specializes in lithography machines. Its products are tailored for small-scale microchip manufacturing. Lam Research is the best alternative to ASML for specialized products.

2. Applied Materials

Year founded: 1967

Headquarter: Santa Clara, California

Applied Materials is a publicly-traded engineering company that offers hardware and software products for developing semiconductor chips. In 2021, the company had 24,000 employees and generated $23.06 billion in revenue, with a net income of $5.89 billion.

Both Applied Materials and ASML cater to the chipmaking industry. But ASML specializes in EUVand lithography machines, while Applied Materials develops equipment for semiconductor fabrication and display panels for PCs, TVs, and phones. Supply chain issues eroded 31% of Applied Materials’ shares between Jan and May 2022.

As of Jun 2022, Applied Materials had a market capitalization of $102billion. The company has spent over $7.67 billion to acquire 11 chipmakers, including Varian Semiconductor, Etec, and Perceptive Engineering. Applied Materials is a worthy ASML competitor. [4]

3. Taiwan Semiconductor Manufacturing Co. (TSMC)

Year founded: 1987

Headquarter: Hsinchu, Taiwan

TSMC is the world’s largest contract chipmaker, accounting for 54% of total semiconductor foundry revenue globally. The company develops chips using 3nmand 5nmtech, making it the go-to producer for advanced semiconductors. In 2021, TSMC had 65,152 employees and made $47.78 billion in revenue.

TSMC recently adopted the 5-nanometer process, the latest technology for mass-producing chips. The semiconductor giant is a competitor for ASML, but it also relies on ASML’s lithography machines for designing pattern circuits on silicon wafers.

In 2021, TSMC spent $28 billion to increase its capacity and leadership of the sector. The company increased its capital expenditure budget for 2022 to more than $40 billion. Several tech giants such as Apple Inc., NVidia, Qualcomm, and AMD rely on TSMC for production. TSMC is one of the top competitors for ASML. [5]

4. Analog Devices

Year founded: 2019

Headquarter: California

Analog Devices is an engineering company that develops semiconductors and integrated circuits. Its products cater to automotive, communications, consumer, healthcare, and industrial markets. In Aug 2021, Analog Devices acquired Maxim Integrated for $20 billion. The deal merges the No. 2 and No. 3 players in the analog chip market, with a market value of over $61 billion.

Maxim Integrated extends Analog Devices’footprint in the automobile, consumer, and medical electronics sectors. The deal creates an analog semiconductor giant with over 50,000 products, 125,000 customers,10,000 engineers, and $9 billion in annual revenue.

The increased scale could give Analog Devices more power over the prices of its components and cements its position as the second-largest analog semiconductor company after Texas Instruments. Analog Devices is one of the top ASML competitors. [6]

5. KLA Corporation

Year founded: 1997

Headquarter: Milpitas, California

KLA Corp is a leading provider of process control and yield management systems and solutions. The company was founded after KLA and Tencor merger. In 2021, KLA Corp had 11,300 employees and generated $6.92 billion in revenue, with a net income of $2.078 billion.[7]

KLA Corp offers industry-leading equipment and services for different applications across the semiconductor and nanoelectronics industries. Chipmakers rely on KLA’s advanced process control and process-enabling solutions to develop wafers, reticles, integrated circuits, circuit boards, and flat panel displays.

The company collaborates with customers globally to develop state-of-the-art inspection and metrology tech for semiconductors, LEDs, and photovoltaic solutions. KLA Corp is one of the best alternatives to ASML.

6. NikonCorporation

Year founded: 1917

Headquarter: Minato City, Tokyo, Japan

Nikon is a Japanese multinational corporation specializing in optics and imaging products. The company develops deep ultraviolet light (DUV)machines used in chipmaking. In 2021, Nikon had 20,100 employees and accumulated $3.93 billion in revenue.

Nikon’s DUV machines can be used as an alternative to ASML’s EUV lithography systems. Both Nikon and ASML compete in the DUV market. But ASML has a monopoly in EUV and dominates the DUV immersion lithography segment with higher profit margins.

In 2020, ASML sold 68 advanced DUV immersion systems worth €4 billion. The company made€5.4 billion from DUV machines versus€4.4 billion from EUV. Nikon tried to produce EUV machines but failed. In Q2 2021, Nikon sold three semiconductor lithography systems. Nikon is one of the top alternatives to ASML for DUV machines. [8]

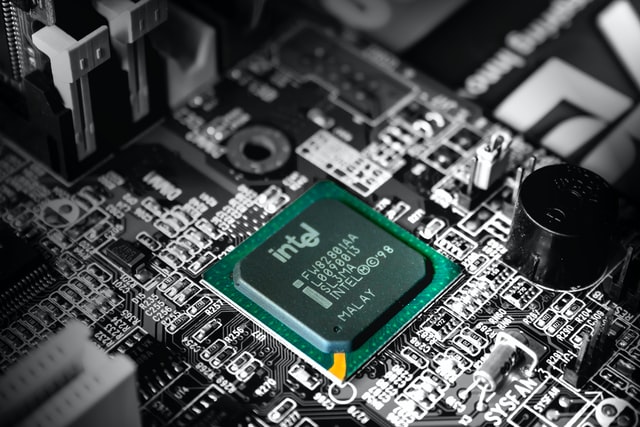

7. Intel

Year founded: 1968

Headquarter: Santa Clara, California

Intel is the world’s largest semiconductor chip manufacturer. The company operates in the EUV market but specializes in microprocessors. In 2021, Intel had around 122,900 employees and made $79 billion in revenues.

Intel and ASML collaborate in the development of EUV machines. In Apr 2022, Intel installed the first EUV lithography system in Europe. But the EUV machine was developed by ASML.

The EUV lithography system will enable Intel to produce high-performance chips at its Ireland Fab 34 facility. Both Intel and ASML are leaders and top competitors in advanced semiconductor lithography technology.

8. Canon Inc.

Year founded: 1937

Headquarter: Tokyo, Japan

Canon is a Japanese multinational company specializing in optical and imaging. It manufactures lenses, cameras, scanners, printers, and semiconductor manufacturing equipment. In 2021, Canon had around 200,000 employees and generated $30.55 billion in revenue.

Both Canon and ASML develop DUV lithography machines, but ASML dominates the EUV market. Canon made a valiant effort to catch up to ASML in 2005 and 2006. The company sold only three EUV systems in 2008 and 2009. In 2011, Canon exited the EUV market after failing to deliver a single EUV shipment in 2 years. ASMLcontrols 90% of the global EUV lithography market.

Chipmakers use Canon’s DUV machines instead of ASML’s EUV systems to develop chips for less powerful electronic devices. Canon is one of the top ASML competitors in the DUV market. [10]

9. Axcelis Technologies, Inc.

Year founded: 1978

Headquarter: Beverly, Massachusetts

Axcelis is an American capital equipment company. It manufactures and services semiconductor manufacturing equipment worldwide. In 2021, Axcelis had 1,004 employees and reported a 40% increase in revenue to $662.4 million. [11]

Axcelis offers high-productivity solutions for the semiconductor industry. The company posted a 55% surge in revenue from its semiconductor systems. This segment consists of the Purion Power Series product line, accounting for 29% of its systems revenue.

In 2021, the company opened the new Axcelis Asia Operations Center in Korea to expand its manufacturing capacity. Axcelis is a worthy alternative to ASML for ion implantation systems.

10. Veeco

Year founded: 1945

Headquarter: Plainview, New York

Veeco is an American company that develops semiconductor process equipment. The company specializes in the ion beam, laser annealing, lithography, MOCVD, and etch-and-clean technologies. In 2021, Veeco had 1,151 employees and generated $583.3 million in revenue. Its annual income increased from $454.2 million earned in 2020. [12]

Veeco develops processing systems for fabricating and packaging advanced semiconductor devices. Its semiconductor process equipment optimizes performance, yield, and cost for data storage and scientific apps, including photonics, power electronics, and display technologies. Veeco is a worthy alternative to ASML.

References & more information

- ASML (2022, Jan 19). ASML reports €18.6 billion in net sales and €5.9 billion in net income in 2021. Globe Newswire

- Gooding, M. (2021, Aug 6). ASML might be the most successful tech company you’ve never heard of. Tech Monitor

- Alsop, T. (2022, Jan 31). Lam Research’s revenue 2016-2021. Statista

- Rossolillo, N. (2022, May 3). Why Applied Materials Stock Tanked 16% in Apr. The Motley Fool

- Chien, C. (2022, Jan 10). TSMC sales hit high in 2021 after record revenue in Dec. Focus Taiwan

- Morra, J. (2021, Aug 28). Analog Devices Closes $20 Billion Deal to Buy Maxim Integrated. Electronic Design

- KLA Corporation (2021, Jul 29). KLA Corporation Reports Fiscal 2021 Fourth Quarter and Full Year Results. PRNewswire

- Raaijmakers, R. (2021, Feb 4). We underestimated the demand for DUV. Bits & Chips Magazine

- Klugt, G. (2022, Apr 8). Intel and ASML install the first EUV lithography system in Europe. Tech Zine

- Senior Editor (2022, Mar 27). ASML Competitors: Is ASML the Only EUV Company? Value of Stocks

- Axcelis Technologies, Inc. (2022, Feb 7). Axcelis Announces Financial Results for Fourth Quarter and Full-Year 2021. PRNewswire

- Veeco Instruments Inc. (2022, Feb 16). Veeco Reports Fourth Quarter and Fiscal Year 2021 Financial Results. Globe

- Featured image by Louis Reed

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment