Last updated: May 23, 2020

Company: PayPal Holdings, Inc.

Founders: Ken Howery | Luke Nosek | Max Levchin | Peter Thiel | Elon Musk

CEO: Daniel Schulman

Year founded: 1998

Headquarter: San Jose, California, USA

Number of Employees (Dec 2019): 23,200

Type: Public

Ticker Symbol: PYPL

Market Cap (May 2020): $177.10 Billion

Annual Revenue (Dec 2019): $ 17.77 Billion

Profit |Net income (Dec 2019):$ 2.46 Billion

Subsidiary: Braintree payments | Xoom | Venmo | iZettle | Simility | Hyperwallet

Products & Services: PayPal Smart Connect | PayPal extras Mastercard | eBay Mastercard | PayPal Cashback Mastercard | PayPal Shipping | PayPal Pools | PayPal Cash Card |PayPal Credit account | Coupons | Gift Card

Competitors: Alipay | Google Wallet | Wepay | 2Checkout | Quick2Sell | Dwolla| Braintree | Payza |ClickBank | Stripe | TransferWise | Shopify Payments | Authorize.net | Skrill | Intuit | Propay | Zelle | Square | Popmoney

Did you know – In 2019, PayPal had 305 Million active accounts and processed $712 Billion of total payment volume.

Starting off as a small company named Confinity, it established a system that allowed people to send and receive money online. The company renamed itself to PayPal two years later. Since then the company has led transformational changes in the business world that have proven to be beneficial to buyers and sellers alike.

Through its system, buyers can pay for their purchases online even if they do not possess a credit card. This has, in turn, increases their financial security. PayPal also gives the buyers the chance to purchase items in different currencies making international purchasing easier.

The same convenience is applied for the sellers who no longer have to wait for checks or clear the bank. PayPal offers them a protection policy that ensures that their losses are covered should their products be damaged or lost during shipment. PayPal’s Revenue Model is quite diverse and undergoes new changes and policies. Some of the more prominent ones are mentioned below.

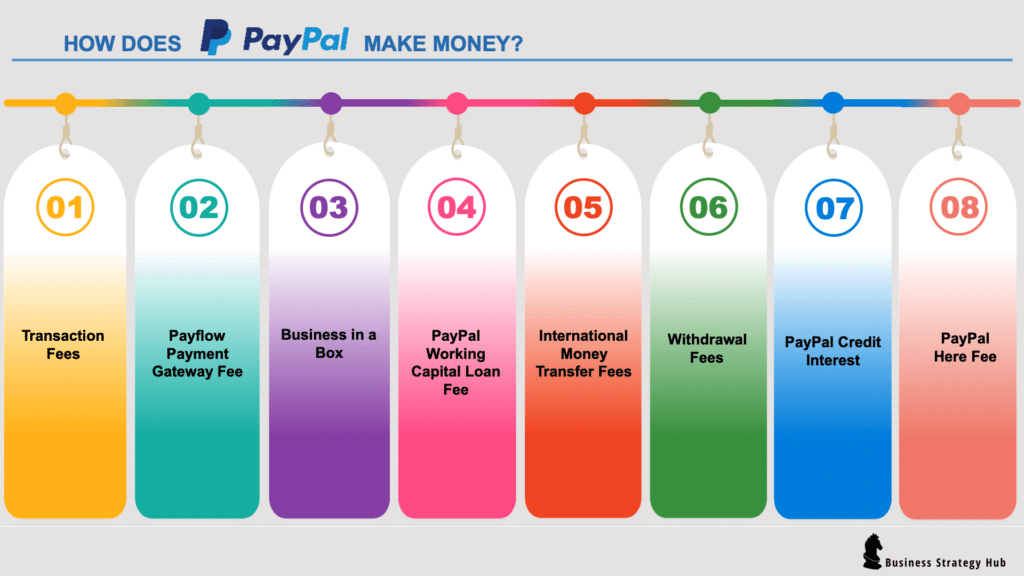

1. Transaction Fees

PayPal operates under two kinds of accounts which are either Business or Personal.

Personal Account

When you create a personal account, you can use the account for the following purpose:

- You can send and receive your money family and friends

- Donate to a cause

- Create a money pool

- Send money aboard or as a gift

- Split the bill with a friend

- Invest with Acorn

- Buy goods and services online

- You can also sell products using personal accounts, but it is advisable to use a business account in such cases.

Fees:

- Buying online & in-store is absolutely

- Sending money to friends & family – If you send money with the usage of a debit or credit card or PayPal balance, then PayPal will charge you a fee of 9% plus $0.30 within the US.

- For sales within the US, selling fees are 2.9% plus $0.30 per transaction.

- Transferring money to bank account – free to 1% of the transfer amount.

Business account

Any person can open a business account and register for free on PayPal.

Fees:

- online sales transactions and invoicing – 2.9% plus $0.30 per sale

- In-store sales – 2.7% plus $0.30 per sale

- Transferring funds to a bank account cost-free to 1% of the transfer amount.

When it comes to its customized checkout page and other special features like order management platform, these are made available for only the businesses who buy the PayPal Payments Pro payment accounts. In this case, businesses are charged an additional subscription fee of $ 30 per month.

2. Payflow Payment Gateway Fee

Acting as a payment gateway, Payflow is a service produced by PayPal. If you are using a business account, you can integrate Payflow into a website.

For online checkout pages, its different customization levels can be presented in two plans:

- Payflow Pro: Priced at $25, this premium plan provides the user with the opportunity to design and create a checkout page according to his own liking.

- Payflow link: This plan is free of charge. It is hosted by PayPal on a page where a customer can enter the payment details.

For both of these plans, the charging amount is the same for $0.10 in credit card payments for gateway fee.

The company also offers three features that are optional at an additional charge. These include.

- Buyer authentication

- Fraud protection

- Recurring billing

3. Business in a Box

The “Business in a box” is an all in one eCommerce solution for small businesses. PayPal business account gives you an option to avail partner services. You can sign up and integrate a large number of partner services such as GoDaddy, Intuit, Woo Commerce, etc.

PayPal on its part earns a commission from these partner services.

4. PayPal Working Capital Loan Fee

In simple terms, it’s a business loan for small businesses, who are looking for some extra funds to grow their businesses.

The working capital functions more distinctively than a traditional loan. There is no credit check requirement. No periodic interest and early repayment fees.

The qualification for the loan is entirely based on PayPal sales history, and there is a one-time fixed fee that usually replaces the periodic interests.

The amount of loan that a business can receive is determined by its PayPal annual sales. If you have a flourishing business, you can borrow up to 35% from your sales. Also, loan repayment is made daily as opposed to a monthly.

5. International Money Transfer Fees

If you send money to a different country, PayPal will charge you a fee between 0.3% – 3.9% plus small fixed fees accordingly. PayPal does not charge the receipt of the money. Much of these charges revolve around the currency exchange rate especially because it involves the usage of a different currency.

6. Withdrawal Fees

If you choose to withdraw your funds from PayPal account, PayPal will transfer the funds to your bank account for free, but if you would like a check, then there is a small fee.

7. PayPal Credit Interest

When you open a PayPal Credit account, you get special promotional rates in the beginning for six months. During the promotional period, if you make a purchase of anything over $99, you don’t pay any interest.

However, after the six months of promotional period is over, PayPal credit charges an interest of 26.24% on the remaining balance.

8. PayPal Here Fee

“PayPal here” are credit card readers by PayPal. It allows businesses and individuals to accept payment from any type of plastic card. There are three types of readers, and their fees range from 1.5 % to 3.5% + fixed cost per transaction.

- Mobile Card reader

- Chip and Swipe reader

- Chip and Tap reader

9. Interests from Money Deposited

If you have kept some money as part of your PayPal balance, PayPal deposits these funds in a bank account and earns interest. It becomes another revenue source for PayPal.

In Conclusion

PayPal has maintained its revenue model effectively and continues to adapt and undergone changes since its inception. Although the company has courted political controversy over its biases and throwing out individuals from its market based on their affiliations, it has remained a dominant force in the finance industry.

Additional features in its business model will guarantee it even more customers should it expand in emerging markets such as Africa and Asia.

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

I really love to get involved with PayPal investment, I share my working experience with expertise

Thanks Opeyemi !