Last updated: April 20, 2020

Company: Uber Eats

Founders: Travis Kalanick and Garrett Camp

Year founded: 2014

CEO: Dara Khosrowshahi

Headquarter: San Francisco, CA

Number of Employees (Dec 2018): Est. 5,000

Type: Public (Subsidiary of Uber Technologies, Inc.)

Ticker Symbol: NYSE: UBER

Annual Revenue (Dec 2018): $1.46B

Products & Services: Online Food Ordering and Delivery Platform

Competitors: Grubhub| DoorDash | Postmates | Swiggy | Zomato

Fun Fact:

Did you know despite being founded in 2009 with the intention of expanding into food delivery, Uber didn’t introduce their food delivery service, Uber Eats, until 2014?

About Uber Eats

Uber Eats is a mobile and online platform for ordering food from local restaurants and having it delivered right to your door. The app is a subsidiary of Uber Technologies, Inc., the company behind the world’s largest ride-sharing app.

As of 2017, Uber Eats partnered with well over 46,000 restaurants to allow customers to order off their full menus through the app.

How Uber Eats works

Uber Eats benefits three different parties: customers, restaurants, and drivers. Here’s how the app works for each.

For customers

- Browse hundreds of local restaurants

- Order from the restaurant’s menu

- Follow your order in the app

If you’re wanting food from a local restaurant but aren’t in the mood to actually dine out, Uber Eats provides a solution. Users can scroll through the app or website to view all of their options in their area or search for a specific restaurant or cuisine.

Next, simply place an order and make sure your address is correct, then wait for your order to arrive. Orders are tracked in real-time in the app, so customers aren’t left in the dark about when their food will arrive.

For restaurants

- Make the orders

When someone orders from a restaurant through Uber Eats, restaurants simply need to prepare the food for delivery, and an Uber Eats driver will deliver the food to the customer. Like customers, restaurants also have the ability to track the order from the restaurant to its destination.

Restaurants keep 70% of the profits from each sale, as Uber Eats takes a 30% commission on every order.

For drivers

- Choose your hours

- Use your own vehicle

Uber Eats drivers are independent contractors, are paid hourly, and have a lot of flexibility. Drivers can choose their own work schedules – both which days to work and how many hours per day – and are able to deliver food in their own vehicle, whether it’s a bike, scooter, or car.

However, as independent contractors and not employees of Uber, drivers do not receive benefits or paid time off.

How Uber Eats makes money

Uber Eats generates revenue (but not profits – we’ll get to that) in a number of ways, including:

- One-time payment and commission fee from restaurant partners

- Delivery, service and small order fees from customers

- Optional monthly subscription fee

- Investor funding

Customer fees and subscriptions

First, the platform charges the customer a number of fees each time you make an order on the app.

Customers pay :

- a delivery fee,

- a service fee,

- a ‘small order’ fee for orders less than $10, and

- a tip for the driver.

Service fees are 15% of the order’s total, and small order fees are $2, while delivery fees vary depending on the restaurant and location. Customers can expect fees ranging from 49 cents to $3.99.

Uber Eats also uses the subscription model to earn revenue. Customers have the option to pay a subscription fee of $9.99 each month for the app’s ‘Eats Pass.’ Eats Pass allows subscribers to get 5% off orders over $15 at all restaurants in their city, with no delivery fee.

Restaurant partnerships

Another revenue stream comes from the restaurants who sell through Uber Eats. To become an Uber Eats restaurant partner and feature their menus on the app, restaurants not only pay a one-time fee between $350 to $500, but also 30% of their sales made through the app.

While this may seem steep, Uber Eats argues that restaurants are still receiving a high ROI, as their restaurant and menus are promoted to a greater number of potential customers, resulting in higher sales.

The company also claims that delivering through Uber Eats is more efficient and cuts down average delivery times to just 15 minutes. Still, despite these claims, some have pointed out that this model can really only benefit larger, highly profitable restaurants.

Investor funds

Due to the high cost of operations, including driver’s wages, processing payments, and more, Uber Eats – and Uber as a whole – is not yet a profitable company.

Therefore, the company’s growth has been possible due to major contributions from investors who are attracted to the promising growth of the mobile food delivery and ride sharing markets.

Where Uber Eats stands in the food delivery market

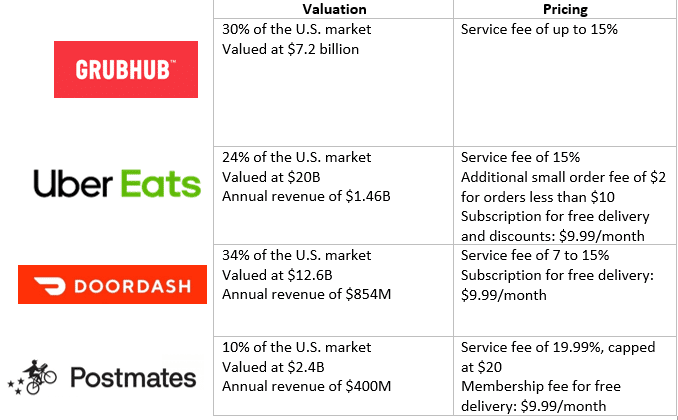

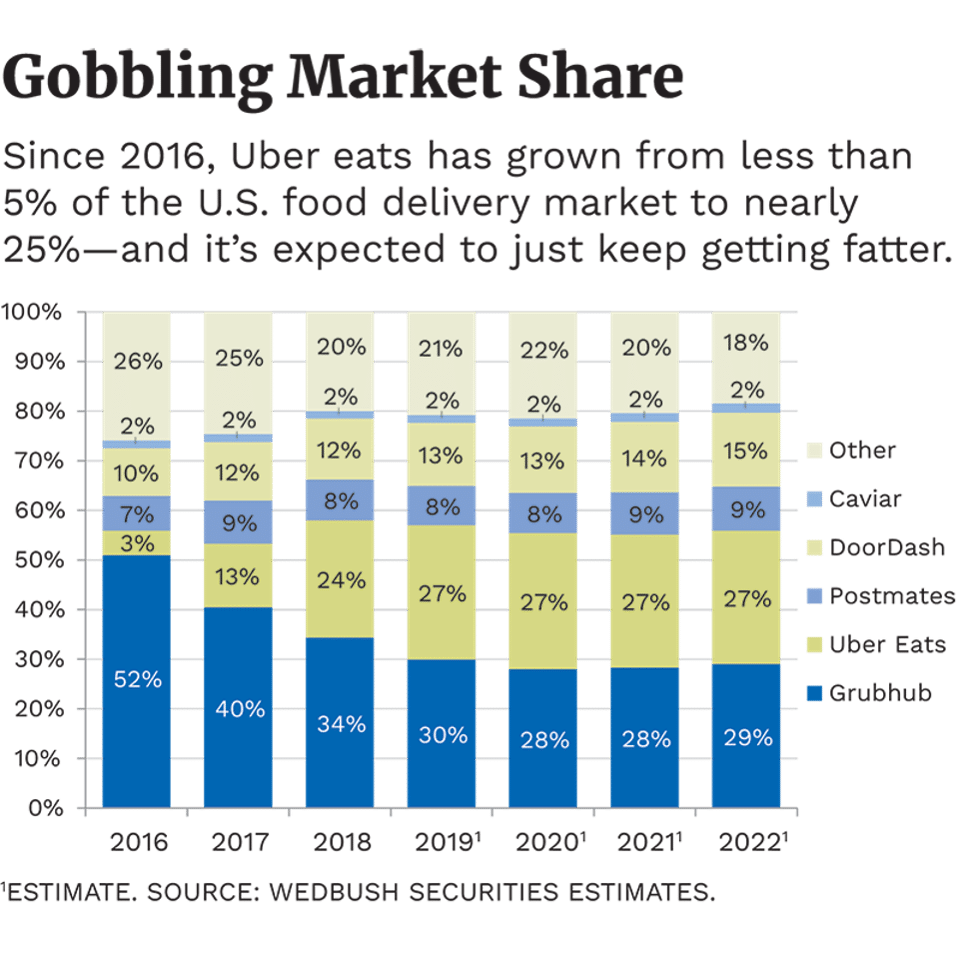

Uber Eats has grown from nearly 5% of the U.S. food delivery market in 2016 to a nearly 25% share in 2019. Uber Eats’ revenue has also grown by about 149% from 2018 to 2019, and the subsidiary makes up 13% of Uber’s total annual revenue.

According to CEO Dara Khosrowshahi, bookings on the platform are growing over 200%.

However, despite its staggering growth, Uber, and Uber Eats, is still experiencing losses as a company. In just three months of operations, Uber as a whole spent roughly $700 million on its operations and posted losses of $1 billion.

In order to aggressively expand and dominate more of the market, Uber has even been cutting its profit margins even more. Grubhub, on the other hand, one of Uber Eats’ top competitors, is profitable.

Conclusion

While Uber Eats demonstrates an effective strategy for expansive growth and market domination, its model doesn’t offer such a good example of how to grow profits. It remains to be seen if banking on market potential will eventually prove to turn Uber’s losses into positive cash flow.

References & more information

- Photo by Charles on Unsplash

- Carson, B. (2019, February 6). Uber’s Secret Gold Mine: How Uber Eats Is Turning Into A Billion-Dollar Business To Rival Grubhub. Retrieved from Forbes: https://www.forbes.com/sites/bizcarson/2019/02/06/ubers-secret-gold-mine-how-uber-eats-is-turning-into-a-billion-dollar-business-to-rival-grubhub/#4c75c6481fa9

- Dowling, S., Wilhelm, A., Mascarenhas, N., & Rowley, J. D. (2019, April 11). Inside The Uber S-1: Revenue, Growth, And Losses. Retrieved from Crunchbase: https://news.crunchbase.com/news/inside-the-uber-s-1-revenue-growth-and-losses/

- Hawkins, A. J. (2018, October 23). Uber Eats announces its plan to conquer the US suburbs. Retrieved from The Verge: https://www.theverge.com/2018/10/23/18010490/uber-eats-growth-70-percent-us-suburbs

- Kim, T. (2019, November 21). Investors Bail on Uber… Right Behind the Founders. Retrieved from The Motley Fool: https://www.fool.com/investing/2019/11/21/investors-bail-on-uber-right-behind-the-founders.aspx

- Newcomer, E. (2019, April 12). Uber Has a New Growth Story, Just Not a Profitable One. Retrieved from Bloomberg: https://www.bloomberg.com/news/articles/2019-04-12/uber-ipo-filing-tells-a-growth-story-in-food-delivery

- Owler. (n.d.). Uber Eats. Retrieved from Owler: https://www.owler.com/company/ubereats

- Sharma, A. (2019, June 7). Is It Too Early to Invest in Food Delivery Companies? Retrieved from The Motley Fool: https://www.fool.com/investing/2019/06/07/is-it-too-early-to-invest-in-food-delivery-compani.aspx

- Solomon, B. (2017, April 18). UberEats Passes 46,000 Restaurants As It Tries To Catch Up Globally. Retrieved from Forbes: https://www.forbes.com/sites/briansolomon/2017/04/18/ubereats-passes-46000-restaurants-as-it-tries-to-catch-up-globally/#59c5bc764a8f

- Uber Eats. (n.d.). Retrieved from Uber Eats: https://www.ubereats.com/en-US/

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment