Company: Amul

CEO : Tarun Bhatia

Year founded : 1946

Headquarter : Gujarat, India

Number of Employees: 501-1000

Turnover (FY 2022/2023): Rs 72,000 Crore

Products & Services: Milk | Butter | Ghee | Cream | Beverages | Traditional Indian Sweets | Chocolates | Paneer | Ice Cream | Cheese | Pizza Cheese | Milk Powder | Yogurt

Competitors: Baskin Robbins | Kwality Walls | Vadilal | Havmor | Dinshaws | Arun Ice Cream | Mother Dairy | Britannia | Nestle | London Dairy | Heritage Foods | Akshayakalpa

Fun Fact:

- Before Amul came into the picture, India was a milk-deficit nation. After over 40 years of operation, the company has affirmed India’s status as one of the world’s largest milk producers.

- Amul reaches one million retailers daily with 10,000 dealers and 3.6 million milk producers, earning billions in total revenues.

- Did you know that in 1976, a movie called ‘Manthan’ was made based on the ‘White Revolution’ started by Amul?

An Overview of Amul

Amul was founded in 1946 by Tribhuvandas Kishibhai Patel. Its headquarters are in Anand, Gujarat. Current CEO of Amul is Tarun Bhatia.

Amul is the largest manufacturer of milk and dairy products in India, with a total milk handling capacity of 41 million liters a day and a milk drying capacity of 135 Mts a day. It is widely considered one of India’s most prominent brands and was created to embody the national identity in every sense. The company originated to protect the interests of Indian consumers and producers.

During that time, POLSON Dairy operated as the largest milk buyer from farmers in the District of Kaira. However, the POLSON establishment began to pursue exploitative practices that led to the formation of AMUL. The dairy manufacturing company became a native brand in the country.

The AMUL acronym stands for Anand Milk Union Limited and is known for starting the “White Revolution” in the country. The revolution, also known as Operation Flood, transformed India into a global leader in milk production, with milk farming becoming a key source of employment and income for millions in rural India.

Amul currently processes and gathers different varieties of milk products. It distributes approximately one million liters or more every day in the country. It is the brand that symbolizes the aspirations of the Indian farmers.

The following is the SWOT analysis of Amul:

Amul’s Strengths – Internal Strategic Factors

1. Exceptional Growth

Amul has seen exceptional growth in the past seven years as it continues its adaptive and evolutionary mechanism. After being ranked as the world’s strongest dairy brand by the Brand Finance Food and Drink Report 2023, Amul group reported a business turnover of Rs 72,000 crore in fiscal 2022 to 2023, marking an impressive 18% growth.

2. Large Production Capacity

Amul is a brand managed by the GCMMF (Gujarat Cooperatives-operative Milk Marketing Federation Ltd), a cooperative body with a total milk handling capacity of 41 million liters daily that provides about 25.9 million liters of milk daily. Its production capacity led the GCMMF to join the ranks of the top dairy organizations in the world.

As of last year, Amul was ranked as the eighth largest dairy company in the world, as it exports to more than 50 countries around the globe.

3. Market Leader

Amul has positioned itself as the market leader in India because it controls a third of the market share in the ice cream sector. The sector is projected to expand significantly, with an anticipated compound annual growth rate of 4.53% from 2024 to 2028, presenting vast opportunities for growth and development. The company’s flavored milk and cheese offerings are projected to experience a growth rate exceeding 20%.

4. Best Quality and Brand Loyalty

Owing to its standards and persistent quality production, Amul has been entrusted with a solid and loyal customer base. Its commitment to innovation and aggressive marketing strategies have propelled the brand to the forefront of the market.

The company has built a reputation of reliability and trustworthiness, thus earning the loyalty of millions of consumers. Its high-quality products have contributed to brand identity, cementing Amul’s status as a household name. The appraisals from such entities over its products have only added to its credibility and customer retention.

5. Huge Customer Base

Amul has solidified its standing among city dwellers and is now establishing itself in rural regions. This provides it with unique advantages as it broadens its customer base and ensures it is accessible nationwide. Similarly, its commercials have consistently captivated customers across various levels, contributing to a loyal following. For example, its promotional tactics are widely recognized through the famous Amul Girl, characterized by a polka-dotted dress, blue hair, and an orange complexion.

Image source: Amul

6. Unified Brand Name

Amul has effectively marketed its goods using a single brand identity. This consolidation has made its promotional and advertising efforts easier, with a small fraction of its earnings allocated to marketing. The single brand name has also boosted the brand’s recognition, making it linked to a broad selection of premium products. Amul’s wide selection covers essentials from dairy, different types of cheese, invigorating drinks, decadent ice creams, luxurious chocolates, and healthful items, serving a variety of tastes with excellence and creativity.

7. Invest in Robotics

Amul had already ventured into the automated production unit a few years back. The company has invested Rs 415 crore in four new automated plants to bolster its production capacity. A robotic high-tech warehousing facility allows the company to store 50 lakh liters of long-life milk in carton packaging in high-density storage.

This gives it a competitive edge compared to its rivals. Exploring and investing in robotics and advanced automation, the opportunities for the Indian dairy giant are endless.

Amul’s Weaknesses – Internal Strategic Factors

1. Operational Cost

The operational cost for Amul is enormous as it heavily depends on dairy unions and communities for milk supply. As the community’s needs increase and change, they demand higher prices for produce. Thanks to its massive structure. This becomes a liability for the company as Amul experiences multiple pricing changes.

A strong focus on cost-effective pricing has made it susceptible to raw material cost fluctuations as increases in milk costs have increasingly affected profit margins. Amul must develop a robust strategy to tackle these obstacles, considering the inherent risks associated with the uncertain nature of supply chains.

2. Portfolio Expansion

Amul boasts of a diversified portfolio of dairy products. However, it is yet to experience success with other products. The best example is its chocolate products, which have not reached the same level of success as its ice creams. Amul’s portfolio expansion is crucial for its brand image.

3. Cooperative Structure

While a cooperative structure governs Amul, it sometimes works against it by affecting the decision-making process compared to centralized corporate structures. The need for consensus with every decision often leads to delays affecting the company’s ability to respond to market changes and implementation of strategic initiatives

4. Brand Perception

Amul is best known as a dairy specialist, an edge that’s working to its disadvantage as it seeks to establish itself in non-dairy products. In most cases, it struggles to attract loyal customers for its non-dairy products. For instance, its chocolates have struggled to replicate the success of ice cream brands, given the presence of chocolate kings like Cadbury and Nestle in the field.

5. Use of Plastic

The dairy giant has recently gained some negative publicity from environmentalists as it asked the government to consider their request and postpone the ban on plastic straws.

The multi-billion-dollar industry could have made this decision, which would have been better. Several of its products, like juice and milk packs, use these straws. Using plastic pouches for chocolate, milk, and cheese also negatively affects the big brand.

Amul’s Opportunities – External Strategic Factors

1. Growth in Milk consumption

Milk consumption in India has increased steadily from 202 million metric tons in 2022 to record highs of 207.49 million metric tons in 2023. The demand for milk products continues to grow as the population grows, opening up new opportunities for Amul with its market-leading products. Amul can capitalize on this demand by expanding its production capacities.

2. International Markets

The worldwide market for dairy milk is growing at a compound annual growth rate (CAGR) of 5.1% and expected to be worth $1.5 trillion by 2032. Amul can explore its reach in the international markets and unlock new growth opportunities. It can access more Asian markets from neighboring countries to other regions and operate accordingly.

Amul is also set to sell its “fresh milk” in the US for the first time, partnering with Michigan Milk Producers Association to reach the East Coast and Midwest, offering the same quality as in India in various fat content options.

International exports will increase its margins and turnovers rapidly. To expand its global reach and enter new markets, the company can seek strategic partnerships and collaborations with international dairy brands. Such partnerships could help the company enhance its market penetration and increase product visibility.

3. Chocolate Product Line Expansion

In 2023, the valuation of India’s chocolate market stood at $3.8 billion and expected to be worth $9.2 billion by 2032 while growing at a CAGR of 6.1%.

Amul has the financial muscle to invest in research and development or adopt mergers and acquisitions to pursue opportunities in the chocolate market. It can invest generously in its chocolate production and thrive in the chocolate-selling business. With adequate advertising, it can become its most significant business opportunity.

4. E-commerce opportunities

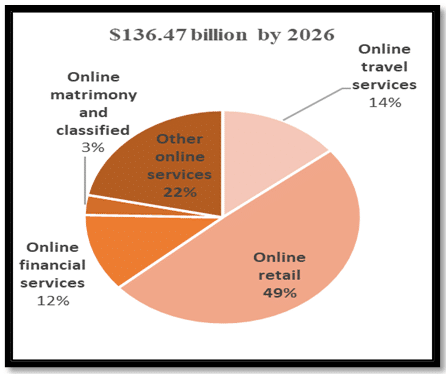

While growing at an annual growth rate of 18.29%, India’s e-commerce landscape is projected to be worth $136.47 billion by 2026. presents tremendous opportunities that Amul can tap into to reach customers with its products.

Amul can tap into e-commerce and online retail platforms to enhance its distribution network. The convenience and accessibility offered by online platforms should allow the company to fend off competition and make the mass market more accessible. With e-commerce, the company can quickly eliminate intermediaries in the sale process, expanding its profit margins.

Image source: International Trade Administration

The above image shows the major segments of the Indian e-commerce market.

Amul’s Threats– External Strategic Factors

1. Increasing Competition

Amul is increasingly facing fierce competition in the Ice Cream sector. More and more companies and brands, both local and foreign, are invading its markets and overtaking its sales. Competitors like Kwality Walls, Mother Dairy, Baskin Robbins, London Dairy, and Havmor are a few names that directly threaten its business.

2. Lawsuits

Amul had an internal crisis after it chose to advertise its products by disparaging its rival competitors. This promotion did not go unnoticed by one of its competitors, HUL (Hindustan Unilever Limited), which filed a lawsuit against the dairy company and took it to court.

HUL won its lawsuit at the Bombay High Court in 2017 and demanded that Amul stop its condescending advertising immediately. It has tarnished Amul’s image as an elitist, utilizing arrogant and unfair methods to beat its competition.

3. Negative Media Coverage

Negative media coverage has not benefited Amul’s operations. It has affected its sales and forced them to issue statements garnering unwanted media attention.

4. Negative Online Reviews

One major threat impacting all businesses, from big to small, is negative online reviews. Prompt and effective solutions can instantly change unhappy customers’ moods.

In addition, the company should engage in transparent and open communication with customers to tackle negative consumer perceptions about dairy.

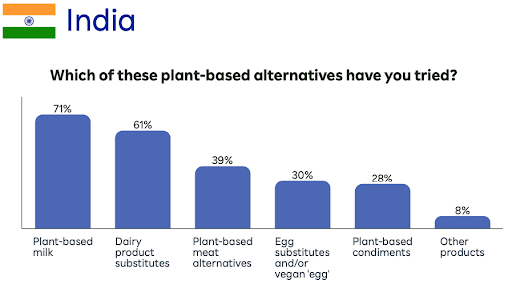

5. Growth in preference for plant-based substitutes

Many Indians opting for a vegan lifestyle, could pose a considerable threat to the dairy industry where the company generates most of its revenues. A survey conducted by Rakuten Insight showed that more than 44% of respondents in India favor plant-based products due to a vegan diet. As more people are inclined towards plant-based products, Amul’s target market could be adversely affected.

Image source: Rakuten Insights

Conclusion

The SWOT analysis clarifies that Amul stands victorious and is a winner on all fronts. A national pride for its citizens, Amul has to take the plunge and retain confidence in expanding in the global markets. With sufficient advertising and promotions, it can achieve worldwide success.

References & more information

- Service, E. (2023 April 1). Amul group’s turnover crosses Rs 72,000 crore in 2022-23. The Indian Express.

- Sousa, A. (2023 December 6). Milk processors: diving into the Top 10 milk industry powerhouses. Ceva.

- (2021 November 29). Amul invests Rs 415 Cr in four new projects, adds robotic technology. Nuffoodspectrum.

- (2022 June 10). Amul urges Modi to delay plastic straw ban, cites impact on dairy farmers. Business Standard.

- Minhas, A. (2024 February 1). Domestic consumption of milk in India from 2019 to 2023. Statista.

- (2024 March 12). Amul vision is to be the biggest dairy in the world; already exporting to almost 50 countries: MD. Economic Times.

- (2024 March ). India Chocolate Market 2024–2033. Custom Market Insights.

- Sherigar, S. (2024 Januray 12). Online Marketplace and E-Commerce. International Trade Administration.

- Gupta, S. (2017 June 17). HUL wins ice cream ad lawsuit against Amul in Bombay high court. Mint.

- Gupta, S. (2022 January 25). 12 Pricing Strategies – Maximize Your Profit with a Good Pricing Strategy!. Business Strategy Hub

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment