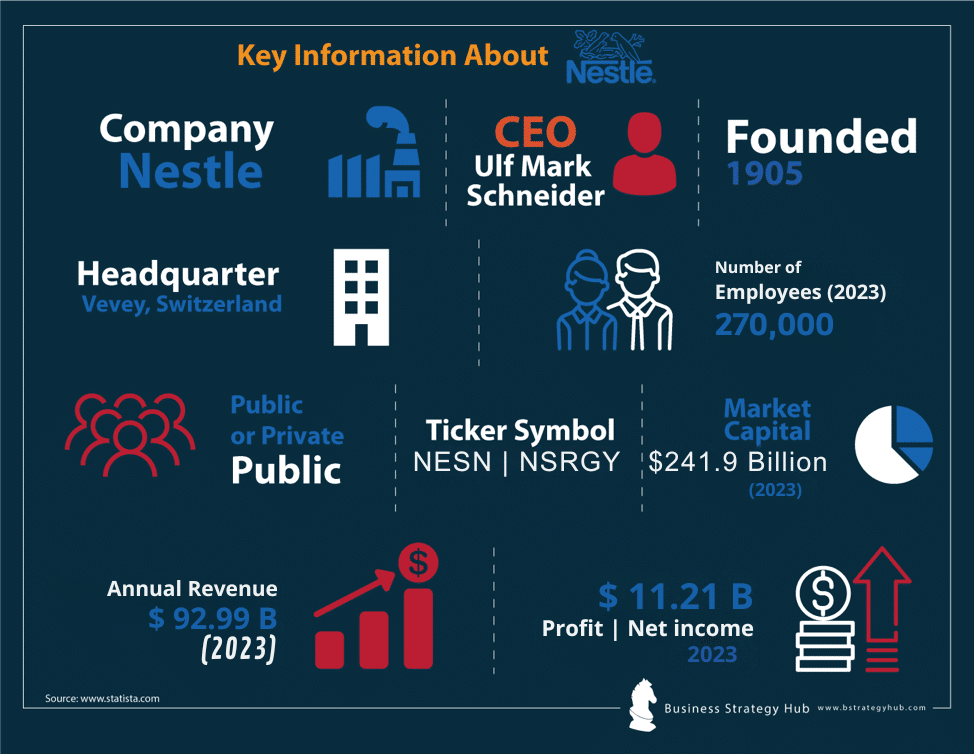

Company: Nestle S.A.

CEO: Ulf Mark Schneider

Year founded: 1905

Headquarter: Vevey, Switzerland

Number of Employees (FY2023): 270,000

Public or Private: Public

Ticker Symbol: SIX: NESN | OTC: NSRGY

Market Cap (Aug 7, 2024): CHF(Swiss Francs) 264.8 Billion

Annual Revenue (FY2023): CHF 92.99 Billion

Profit | Net income (FY2023): CHF 11.21 Billion

Products & Services: Ambient Dairy | Chilled Dairy | Coffee | Bottled Water | Juices | Culinary and Foods | Confectionary | Baby Food | Breakfast Cereals | Pet Food | Dietary & Protein Supplements

Competitors: Mars | Mondelez | Hershey | Ferrero | Godiva | Pepsi co | Lindt | Kelloggs

Fun Fact:

Did you know that Nestle is the largest publicly held food company in the world? It operates in 189 countries.

An Overview of Nestle

Nestle was founded in 1905 as a result of a merger. The Anglo-Swiss Milk Company merged with Farine Lactee Henri Nestle, which was formed by Henri Nestlé in 1867. The resulting merged company became the largest Swiss packaged food company in a short span of time. Nestle is now known as the largest publicly held food company in the world.

With more than 150 years of stability in the market and some major acquisitions, including the Libby’s and Gerber brands, Nestle has marked its strong position as top nutrition, health, and Wellness Company.

Ulf Mark Schneider currently holds the position of CEO at Nestle.

Whether it’s dairy products, chocolates or juices, Nestle is always there in our everyday purchases. It’s “Good Food, Good Life” slogan has served it right, touching millions of people worldwide.

Find out more interesting facts about Nestle in this article and get some insights about the company through its SWOT analysis.

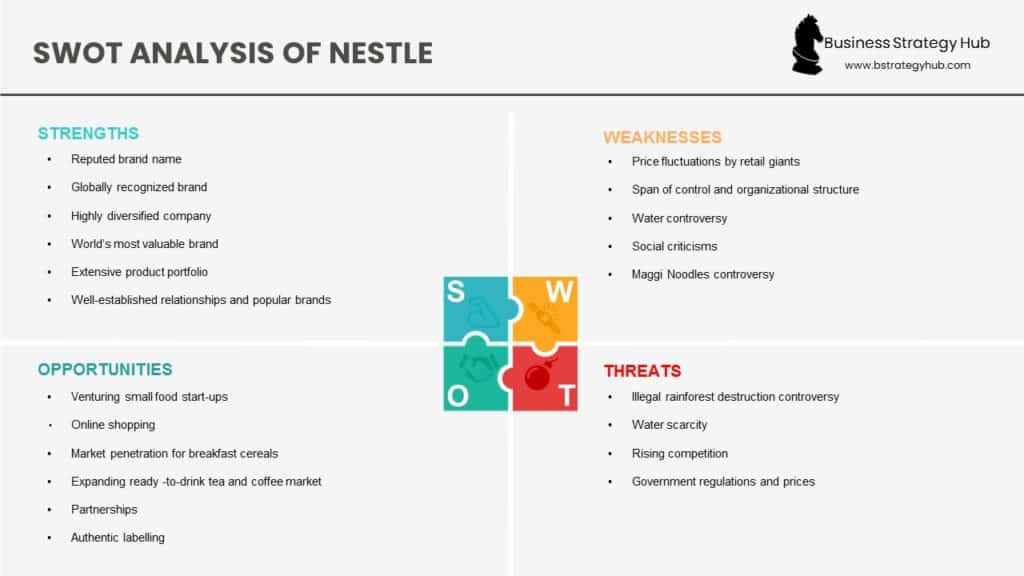

SWOT Analysis of Nestle

The following is the SWOT analysis of Nestle:

Nestle’s Strengths

Along with a huge global presence, a well-known and valuable brand, and a diverse range of products, Nestle has focused on R&D, developed partnerships with other brands, and owns an extensive distribution system. Here is a sample of some of Nestle’s many strengths.

1. Largest Food Company

With a market capitalization of 260+ billion CHF, Nestle has been one of the largest food companies in the world with the sales of its Hot Pockets, Stouffer’s, DiGiorno, Nespresso, etc.

2. Reputed brand name

Nestle has developed a respected reputation in the food and beverages sector, offering high-quality products for everyday use across the globe.

3. Brand valuation

Nestle is well positioned for growth. In 2023, Nestle ranked at #67 position by Interbrand – with a brand value of $11.4 billion. The ranking is unchanged from 2022. [1]

Nestle competitors on the list include:

- #35 – Pepsi (Brand value: $19.7 billion)

- #48 – Starbucks (Brand value: $15.4 billion)

- #78 – Danone (Brand value: $9.1 billion)

- #79 – Kellogg’s (Brand value $8.9 billion)

4. Highly diversified portfolio

Nestle owns more than 2000 brands globally and renovated over 8000 products. It is one of the world’s biggest companies with the broadest and most diverse product portfolio.

Nestle divides its products into 7 different categories:

- Powdered and Liquid Beverages—this is the largest segment of Nestle and represents about 27% of total revenue. This segment sells soluble coffee and other beverages such as tea and chocolate powder. Signature brands include Nescafe, Nespresso, Starbucks coffee (license deal), Blue Bottle Coffee, Milo, and Nestea.

Image source: Nestle

- Petcare – the second largest segment of Nestle and represents about 20% of total revenue. This segment sells pet food & toy brands Purina, Lily’s Kitchen, Tails, and Merrick.

Image source: Nestle

- Nutrition and Health Science – represents about 16% of total revenue. This segment sells products such as vitamins, minerals and supplements that help to promote health and wellness. Signature brands include Illuma, Gerber, Nestum, Cerelac, Beba, Lactogen, Garden of Life, Pure, and Vital Proteins.

Image source: Nestle

- Prepared dishes and cooking aids – represents 13% of total revenue. This segment sells frozen food, chilled prepared food, culinary and cooking aids. Signature brands include Maggi, Original Waggner, Lean Cuisine, Chef, Sweet Earth and Freshly.

Image source: Nestle

- Milk products and ice cream – represents 12% of total revenue. This segment sells milk products and ice cream products under the brand names of Nido, Nesvita, Carnation, Lattiere, Coffee Mate, Hagen Dazs, and Movenpick.

Image source: Nestle

- Confectionery – represents 9% of total revenue. This segment sells chocolate, sugar, candies, snacks, and biscuits. Signature brands include KitKat, Cailler, and Garoto.

- Water products -represents 3% of total revenue. Signature brands include S.Pellegrino, Vittel, and Perrier.

Image source: Nestle

Nestle – Revenue by product segments

| Segments | Revenue (CHF billion) | % Share |

| Powdered and Liquid Beverages | 24.8 | 27% |

| PetCare | 18.8 | 20% |

| Nutrition and Health Science | 15.3 | 16% |

| Prepared dishes and cooking aids | 11.7 | 13% |

| Milk products and Ice cream | 11.0 | 12% |

| Confectionery | 8.1 | 9% |

| Water | 3.3 | 3% |

| Total | 93 | 100% |

5. Global presence

Nestle has a strong global presence, and its products are sold almost everywhere in the world. Nestle sells its products in 189 countries. Instead of relying on a few markets, it has captured a sizeable market in a lot of developed and developing countries to earn most of its revenue. [2]

- North America is Nestle’s largest market and represents 35% of sales. This zone consists of the US and Canada. Nestle does not specify sales figures for each country.

- Europe is the second largest market, representing 24% of sales. Western Europe accounts for 71% of sales in this zone, followed by Eastern Europe at 21%, and Turkey and Israel contribute approximately 8%.

- Asia, Oceania, and Africa represent 21.4 percent of sales. The Association of Southeast Asian Nations, an economic union of 10 states, was responsible for 39% of sales in the zone, followed by the Middle East and Africa at 27%, South Asia at 18%, and Oceania and Japan at 16%.

- Latin America garners 13.7 percent of sales. This zone comprises Latin America and the Caribbean, and sales are not broken down by region.

- Greater China accounted for 5.9 percent of sales.

Nestle – Revenue by Regions

| Regions | Revenue (CHF billion) | % Share |

| North America | 32 | 35% |

| Europe | 22 | 24% |

| Asia, Oceania, and Africa (AOA) | 20 | 21% |

| Latin America | 13 | 14% |

| Greater China | 6 | 6% |

| Total | 93 | 100% |

6. List of the World’s Largest Corporations

According to the Forbes Global 2000, Nestle is among the world’s largest corporations and is ranked at 50th position in the 2023 list.[3]

7. Health-focused Breakfast

The world’s leading food conglomerate, Nestle, has reduced the amount of sugars (by 25%) used to produce its beloved Carnation Breakfast Essentials. Moreover, the company is also incorporating a completely new and environment-friendly paper packaging for the product line to enhance its sustainability.

The company is undoubtedly checking all the right boxes when it comes to things most important for shoppers. Plus, it’s also a fact that a lot of these shoppers have grown up enjoying the Carnation Breakfast Essentials line of products and want their kids to enjoy them, too. [4]

8. License deal with Starbucks & strong relationship with other brands

Nestle has entered into a perpetual license deal with Starbucks to market its products globally. The companies celebrated the 5th anniversary of the agreement in 2023.

The deal strengthens Nestle’s coffee portfolio and provides Starbucks an opportunity to use Nestle’s network for global expansion. In addition, Nestle has well-established relationships with other trusted and powerful brands like Colgate Palmolive, Coca Cola, General Mills, and L’Oréal.

9. Efficient R&D system

Nestle has the world’s largest food and nutrition research organization with 23 R&D centers Its research and development capability is one of its key competitive advantages.

More than 5000 employees are involved in R&D operations. Recently, Nestle expanded its operations in the Greater China region to 3 R&D centers and 4 product innovation centers.[5]

10. Environmental sustainability practices

Nestle puts substantial efforts in environmental sustainability practices and takes innovative initiatives in improving its quality of products. It optimizes advanced solutions to reduce waste, water usage, non-renewable energy use, and packaging material usage.

The company pledged to net zero greenhouse gas emissions by 2050. In its 2003 annual report, the company says it has reduced net GHG emissions by 13.58% since the baseline year of 2018. The company also aims to cut virgin plastics by one-third by 2025 and says it has already realized a reduction of 14.9%. [6]

11. Large distribution system

Nestle owns an extensive and diversified distribution system that is not only penetrated in urban areas but also rural regions. It has adapted local distribution methods and decentralized approach to run the business efficiently in respective countries. Nestle has strong relationships with suppliers, retailers, vendors, and distributors.

Nestle’s Weaknesses

Among Nestle’s weaknesses are negative publicity, especially involving social issues and environmental impacts. Despite its global reach and healthy earnings, there is room for improvement in a number of areas.

1. Reliance on Packaged Food Products

Consumer preferences are moving more towards organic and fresh foods. If this trend continues, it could impact Nestle since the company sells a lot of processed, packaged foods.

2. Complex organizational structure

Nestlé’s organizational structure is complex because of its global presence and wide range of products. It is organized in a matrix structure, with a large number of brands under the same umbrella group. This makes it somewhat challenging to manage the large number of individual brands, which can often result in discord and conflict of interest.

3. Environmental Impacts and Controversies

Nestle was accused of pumping millions of liters of water from a First Nations community in Canada, where residents don’t have the infrastructure to provide safe drinking water to their homes.

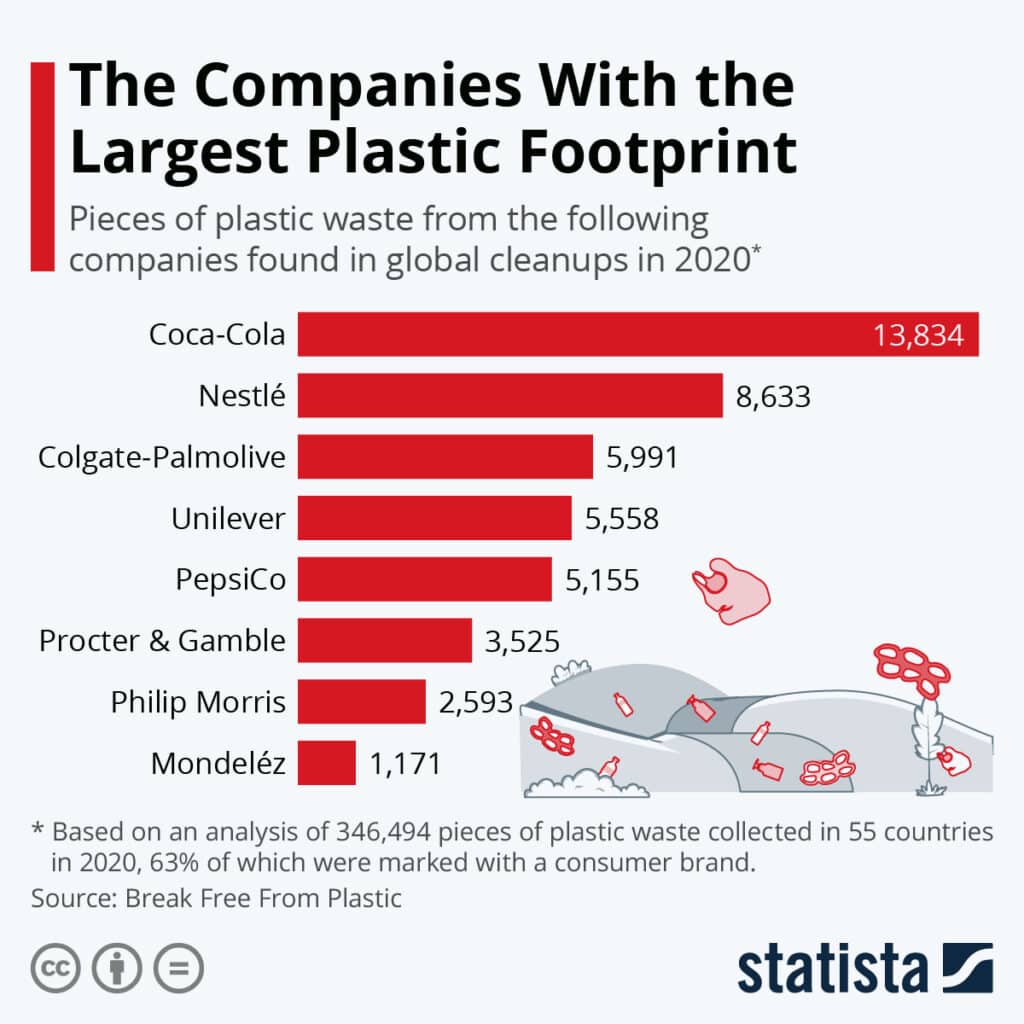

While Nestle is making efforts to reduce the amount of virgin (not previously recycled) plastics, it is a major source of plastic waste.

In 2017, Nestle was alleged to have involvement in the illegal destruction of Sumatra’s last tract of rainforest. It faced severe criticism from NGOs and environmentalists in this regard.

Source: Statista

4. Social criticisms

Nestle has become a target of media attention many times. From claims the company wants to privatize water to misleading labeling and a lawsuit for chocolate making using child and slave labor, the negative publicity has the potential to weaken Nestle’s reputation.

In a flurry of heated emotions and complaints, Netizens accused Nestle India of playing with citizens’ religious sentiments. The company came under fire after printing the photograph of different Hindu gods on wrapper. Citizens also stated that the wrappers will ultimately be disposed off in trash cans, which is blatant and utter disrespect of their gods. Nestle has since apologized for the controversy, claiming that it was never their attention to disrespect the Hindu religion.

Nestle has been criticized for perpetuating racism by using racially insensitive names on its products. In Australia, Nestle has been under pressure to stop advancing racism with its sweets named Red Skins and Chicos and recently announced that it will change the name of the two confectionery products. [7]

5. Contaminated Products

Nestle’s history consists of a long list of products that threatened consumers, such as the China Milk Scandal and tainted cookie dough. Consumers distrust companies that have sold unhealthy products in the past. [8]

In 2017, Nestle failed to clear a laboratory test in India. This created a publicity hype as people boycotted Nestle, leading to the loss of 80% of market share in the country. Nestle claimed ‘No added MSG’ in the Noodles packets. However, testing found there was MSG in the product, along with 1000 times more lead than Nestle claimed.

6. Authentic labeling

Consumers and regulators are often scrutinizing labels to make sure they are accurate.

Nestle has already been criticized for giving misleading nutritional information on its labels. So, there’s a need to improve its practices by giving trustworthy information and accurately labeling its products.

Nestle’s Opportunities

From new or expanded markets and product lineups to partnerships and acquisitions, Nestle has many potential paths to growth. E-commerce, tea and coffee, and breakfast foods are among these opportunities.

1. Online shopping

Online shopping took off during the pandemic and remains an important retail sales channel. Nestle has a remarkable opportunity to boost its e-commerce sites and online shopping platform.

Notably, the food industry’s 2024 revenues will reach approximately USD $9.12 trillion in 2024 with a CAGR of 6.47% in the 2024 – 2029 period. An essential area of growth will be in the digital space with e-commerce, a USD $25.93 trillion market (2023), projected to reach a CAGR of 18.9% in the 2024 – 2030 period. With food as a substantial element of e-commerce, Nestle’s opportunity to capitalize on e-commerce is an exciting one.

Some consumer packaged goods companies are offering expanded online services to make the shopping experience more comfortable and pleasant. Although Nestle has online stores in a few countries, expanding its online services to more areas would prove to be a rewarding decision for the company.

2. Expanding ready-to-drink tea and coffee market

The consumer demand for tea and coffee, especially in ready-to-drink forms, is continuously on the rise. This potentially booming market represents a profitable opportunity for Nestle to increase its product offerings in this space. The world coffee market is projected to reach US$10.47bn in revenue in 2024 with CAGR estimated at 10.63% in the 2024 – 2029 period.

One study indicates the value of the RTD tea and coffee market will increase from $107 billion in 2023 to $172 billion by 2030.

3. Partnerships

Strategic alliances with other food and beverage giants are also a great opportunity for the company to increase its revenues and profits. A target for partnerships is engaging the global restaurant industry which has seen substantial growth in the post-pandemic environment reaching a market size of USD $2.3 trillion (2022) and an estimated CAGR of 10.79% in the 2023 – 2030 period.

While Nestle has agreements with other brands, including Starbucks, there is plenty of room for more alliances. Focused partnerships are key to growth.

4. Market penetration for breakfast cereals

Consumers in many markets look for quick, healthy breakfast foods to save time and satisfy nutritional needs. With a projected CAGR of 6% in the 2024 – 2033 period and a projected valuation of USD $140 billion, breakfast cereals are expected to be steady in demand.

Nestlé’s cereals and oats market has shown fast growth in recent years. Thus, penetrating this market more would be highly lucrative for the company.

5. Expand through Acquisitions

Higher interest rates have slowed financial activity in the market and Nestle has an opportunity to expand through targeted acquisition to broaden its portfolio and capitalize on growth opportunities. An example would be acquiring a company that would automate operations and to find efficiencies.

The purchase of an industrial automation and control systems company would give Nestle a foothold in a growing industry valued at USD $172 billion (2022) with a projected CAGR of 10.5% (2023 to 2030).

Nestle could acquire a promising portfolio of automation businesses, streamline its own operations finding efficiencies, and sell the automation services to generate further revenue in a space outside of food.

Nestle has offloaded several low-performing brands like Herta Charcuterie and is switching to acquisitions. The company has recently acquired Seattle’s Best Coffee, gastrointestinal medication brand Zenpep, and the Better Health company. Continuing to expand its portfolio with high-performing SMB acquisitions offers immense opportunities for Nestle to grow.

6. More Plant-based and Vegan Options

After being under fire for producing unhealthy foods, Nestle seems to be gravitating towards healthier and plant-based food categories, going after a more health and environment-conscious target audience.

Continued efforts in this area are an opportunity for continued growth. Globally, the organic food and beverages market is valued at USD $231 billion (2023) with a projected CAGR of 13.9% (2023 – 2030).

After the successful launch of Vuna, a vegan substitute for tuna, Nestle said it would work on launching more vegan-based food items, especially in the protein sector. It has now launched a number of plant-based alternatives to white fish, which it says are similar in taste and texture to real fish.

The products include fish filets, fingers, and nuggets. This experience can serve as a blueprint for more alternative proteins.

7. Refocus on Profitable Ventures

Competitive pressure forces Nestle to engage on a number of fronts. Having too many brands can stretch a company’s resources to the limit and undermine overall performance. Refocusing on more profitable brands and product areas is an opportunity to improve business results. Nestle’s 2023 presentation noted a focus on “premiumization” with an estimated CAGR of 11.5% in the 2013-2023 period on premium products.

Nestle’s Threats

Prices and competition are major components on the list of threats for Nestle, along with continued economic uncertainty. Here is our list of threats the company needs to navigate.

1. Increase in prices

Costs for many companies have increased due to raw material and transportation costs, supply chain constraints, and an overall inflationary environment.

Nestle has increased prices sharply for several years, and they will continue to rise in 2024, although at a slower rate. Still, investors and analysts wonder if Nestle and other companies have pushed the price hikes too far, driving away consumers, after Nestle missed sales estimates for 2023.

2. Price fluctuations by retail giants

Nestlé’s grocery sales are achieved in large part through huge retail giants like Walmart, Tesco, Target and Kroger. Any reduction or increase in prices by these retailers can affect Nestlé’s sales and its profitability.

3. Water scarcity

Nestlé’s production is highly dependent on water usage. Accessing clean water through less costly, and less controversial, sources has become difficult for the company for many reasons. These include increasing population, climate change, growing demand for food and water, increasing pollution, water wastage, and overexploitation of resources.

4. Rising competition

Nestle faces stiff competition from other large consumer packaged goods companies.

Many CPG companies like Mondelez and Unilever offer similar food and beverage products. It is hard for Nestle to compete in a situation where the substitute products are easily accessible.

5. Government regulations

Government regulations can affect the business operations of any company, and Nestle is no exception.

With operations in 189 countries, Nestle is more susceptible than many companies to these effects. From quality standards to labor laws, regulations can have a noticeable impact on Nestle’s operations.

6. Economic Uncertainty

Even though Nestlé’s sales were not drastically impacted during the pandemic due to panic buying catalyzed by recent events, the company’s revenue is still threatened by economic uncertainty and recession in the global markets. [10]

7. Haunting Dark Past

The US Supreme Court recently reviewed whether to allow a lawsuit against Nestle for knowingly helping to perpetuate slavery in cocoa farms in the African nation of Ivory Coast. Even though the Supreme Court threw out the suit because the incidents occurred outside US jurisdiction, Nestlé’s racist past can haunt the company and affect its sales, profitability, and growth for years to come. [11]

Swot analysis of Nestle

Recommendations

Nestle is quite successful in the CPG market. However, there are still some areas where it can improve to strengthen its market standing.

Some recommendations are:

- Bringing innovation to the company’s offerings.

- Growing the number of start-ups in the food and beverage industry.

- Upgrading its online services to create a unique competitive advantage in the CPG

- Improving its production and operational procedures.

- Using authentic raw materials to avoid an outcry from environmental and social activists.

- Settling the media scandals and controversies to improve the company’s reputation.

- Participating in corporate social responsibility activities and upholding its sustainability practices.

References & more information

- Nestle. Interbrand

- Nestle. At a glance

- Forbes Ranking. Company Profiles: Nestle S.A. Forbes

- Christopher Doering. (2022, Jan 13). Nestlé cuts sugar, adopts more sustainable packaging for Carnation Breakfast Essentials. Food Dive

- Nestle S.A. (2020, April 24). Nestlé reports three-month sales for 2020, provides COVID-19 update. Globe Newswire

- Barbiroglio, E. (2020, January 16). Nestlé Wants To Take A Break From Virgin Plastics. Forbes

- Pandey, S. (2020, June). Nestle to rename Aussie candies amid race debate. Reuters

- Andrei, M. (2020, January 28). Why Nestle is one of the most hated companies in the world. ZME Science

- Gelski, J. (2020, Feb. 2). Nestle shifts focus to acquisitions in 2020. Food Business News

- Ryan, C. (2020, April 24). Nestlé Can Weather Economic Storm Even After Panic Buying Stops. The Wall Street Journal

- White, L. (2020, July 2). U.S. Supreme Court rules for Nestle, Cargill over slavery lawsuit. Reuters

- Research and Markets (2023) Ready to Drink Tea and Coffee Market, Size, Global Forecast 2024-2030

- Nestle (2023) Annual Report

- Nestle (2023, September 6) Nestlé and Starbucks celebrate five years of their Global Coffee Alliance

- Wikipedia (2024, Jun 5) List of Nestle Brands

- Statista (2024) https://www.statista.com/outlook/emo/beverages/hot-drinks/coffee/worldwide

- Statista (2024) https://www.statista.com/outlook/cmo/food/worldwide

- Fortune Business Insights (2024) https://www.fortunebusinessinsights.com/food-service-market-106277

- Market.us (2024) https://www.globenewswire.com/en/news-release/2024/02/13/2828086/0/en/Breakfast-Cereals-Market-Predicted-To-Reach-USD-140-8-Billion-In-Revenues-By-2033-With-6-0-CAGR-Market-Us.html

- Grand View Research (2023) https://www.grandviewresearch.com/industry-analysis/organic-foods-beverages-market

- Nestle (2024) https://www.nestle.com/sites/default/files/2024-02/2023-full-year-results-investor-presentation.pdf

- Grand View Research (2024) https://www.grandviewresearch.com/industry-analysis/e-commerce-market

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment