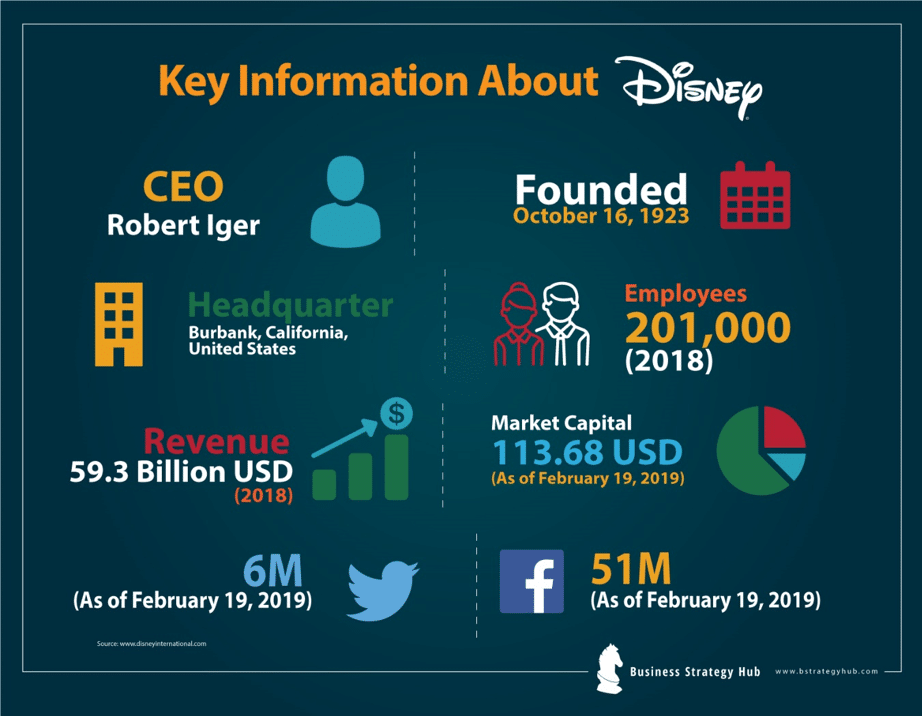

Company: Walt Disney

CEO: Bob Iger

Year founded: 1923

Headquarter: Burbank, California, USA

Number of Employees (2024): 225,000

Type: Public

Ticker Symbol: DIS

Market Cap (July 2024): $176.11 Billion

Annual Revenue (FY2023): $88.89 Billion

Profit | Net income (FY2023): $2.35 Billion

Products & Services: Television Programs | Motion pictures | Plays | Musical Recordings | Books | Magazines | Video Games | Toys | Apparel | Accessories | Footwear | Home Décor | Cosmetics | Consumer Electronics | Stationery | Radio Networks | Radio Stations | Resort Vacation Club | Cruise Lines | Theme Parks | ABC | ESPN | Disney+

Competitors: CBS | Sony | Comcast | Viacom | Time Warner Cable

Fun Facts:

- Walt Disney’s first original character was a rabbit named Oswald

- Walt Disney World Resort is the largest single-site employer in the world with 77,000 employees

- Disney’s first film to exceed $1 billion in global box office receipts was Pirates of the Caribbean

- Disney’s largest and most profitable segment is Media Networks

- Disney strives to return more than 20% of the cash generated to shareholders through dividends and stock buybacks

An Overview of Disney

Founded in 1923, The Walt Disney Company, along with its various subsidiaries and partners, is a global conglomerate that offers a wide range of family entertainment and media services. It operates in five main areas: media networks, theme parks and resorts, film production, consumer goods, and digital media.

When it comes to entertainment production for cartoons, Walt Disney Studios is one of the most successful and most recognized companies in the world. Disney Studios has an Umbrella Corporation, which has grown exponentially in the past nine decades. Disney Studios magical vision was idealized by two brothers, Walt Disney and Roy O. Disney. They have also been recognized with titles like Walk Disney Productions. Walt Disney is responsible for iconic stories like The Lion King and Alice in Wonderland.

Disney has sought to expand and strengthen its media entertainment unit by acquiring Pixar, Marvel Entertainment, Lucasfilm, and 20th Century Fox. In recent years, it has ventured into the Streaming world through Hulu and Disney+, allowing it to offer content while on the go over the internet.

This post will highlight the Walt Disney SWOT Analysis, providing insights into Disney’s significant achievements, goals, and current conditions.

The report covers Disney’s strengths, weaknesses, opportunities, and current or potential threats.

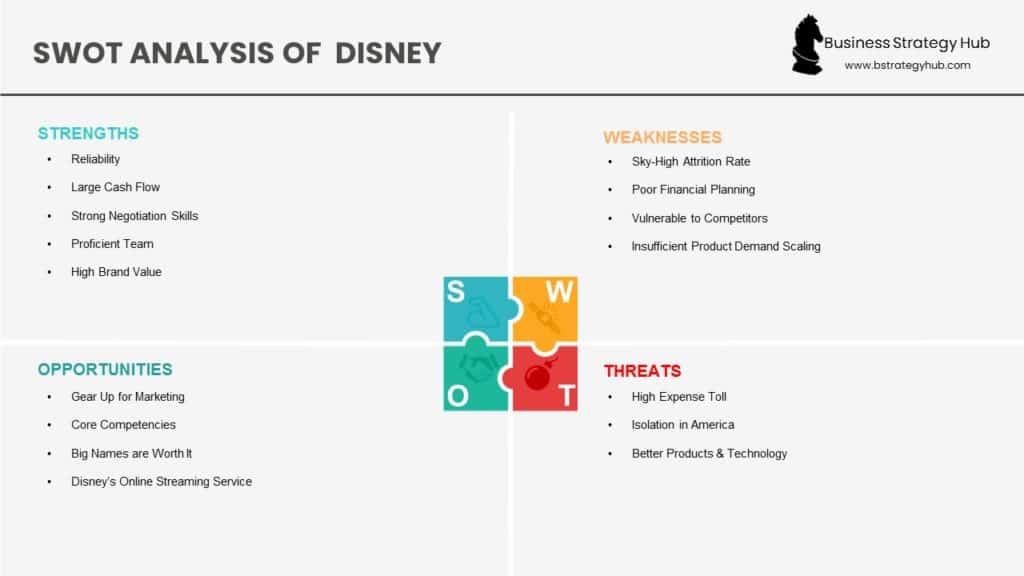

Disney’s Strengths – Internal Factor

1. Large Cash Flow

Disney‘s strong financial position distinguishes it from its rivals, allowing it to make additional investments in other regions and segments. As of fiscal 2023, it had a total operating cash flow of $9.9 billion and a free cash flow of $4.9 billion. Financial strength and stability act as evidence of the company’s strong results. The firm’s financial stability underpins its activities and investments. Furthermore, it enables Disney to navigate economic challenges more efficiently than numerous rivals.

2. Solid Acquisition Strategy

Mergers and acquisitions have been a catalyst for Disney’s expansion over the years. A prime instance is the establishment of Studio Entertainment, which laid the groundwork for the corporation. Disney is known for creating top-tier video content. Still, it has leveraged mergers and acquisitions to gain intellectual property (IP) rights ownership to its most successful film and television series. It has established a strong reputation through strategic mergers and acquisitions, enhancing its presence in the entertainment sector. Acquisitions such as 21st Century Fox for $72 Billion, Capital Cities/ABC for $19 billion, Pixar Animations for $7.4 billion, Marvel Entertainment for $4 billion, Lucasfilm, and BAMTech for $1 billion have contributed to the company’s increased revenue and market share, while also reinforcing its position in the film, streaming, television, and telecommunications sectors.

3. High Brand Value

Having been in business for over 100 years, Disney is one of the most reputable brands in the entertainment scene. All movies and products introduced to the public usually have the “D” symbol somewhere to show that they are from Walt Disney Studios, Production, or Company. According to Interbrand, the world’s most valuable brands list, Disney is ranked number 16, with a brand value of $48.26 billion in 2023.

4. Diversified Business Empire

Most players in the entertainment sector operate in specific niches only; for instance, Netflix focuses on streaming services. In comparison, Disney boasts one of the most diversified business empires spanning media networks, parks, resorts, studio entertainment, consumer products and interactive media. Additionally, it offers various products and services through its operations under several business segments like media networks, studio entertainment, direct-to-consumer, parks, experiences, and products. The diversified nature of the business has ensured the company is not affected significantly by revenue generation when there is a slowdown in one segment. In addition, the diversified business mix offers several income sources, enabling the business to keep funding fresh initiatives and innovations. This also creates a significant hurdle for rivals in replicating the extensive range and thoroughness of the company’s products and services.

5. Robust Product Portfolio

Disney boasts of a robust product portfolio, affirming its status as an entertainment juggernaut. Some of the most sought-after brands under its empire include ABC broadcast television networks, cable networks such as Disney Channel or ESPN, and some of the biggest theme parks. The broadcasting network has an audience reach of over 300 million, backed by the solid growth of cable television. It has also strengthened its streaming prospects, with Disney+ attracting over 153 million paying subscribers. Other entertainment brands under its arm include Starwave, Infoseek, Lucas Film, Pixar, Hulu, Marvel, 20th Century Studios, and Searchlight Pictures.

Disney’s Weaknesses

1. Dependence on North America

While Disney has tried to offer its wide array of offerings in various markets, it still depends on North America for Revenues. Revenue from the US and Canada account for more than 80% of the company’s revenues. In 2023, it generated $71.21 billion in revenues from the Americas, as Europe only brought in $9.53 billion. The lack of diversification in revenue streams poses significant risks should growth in North America slow down, or the region experiences a recession.

2. Dependence on key franchises

Disney does well because of the popularity of its leading brands, like Star Wars, Marvel, and Pixar. However, if these brands were to struggle, it could significantly affect the company’s earnings as they account for a significant share of revenues. Similarly, too much dependence on major brands can leave the company vulnerable to significant changes in consumer preferences. Additionally, focusing too much on certain franchises can result in a lack of new ideas and willingness to take risks. If a large part of Disney’s efforts, attention, and creative workforce is concentrated on a few franchises, other projects that could be successful might get less attention or investment.

3. Reliance on Licensing and Merchandising

The theme park company earns much money by licensing its intellectual property and merchandise. Although this is a lucrative venture, it also poses a danger that the company might lose its brand control if its brands are too widely used or licensed. Additionally, too much dependence on licensing brings unpredictability, constraints, and possible limitations. It restricts the company’s independence and adaptability in maximizing the use of its intellectual assets. Furthermore, the expenses tied to licensing deals can be substantial. Disney frequently pays large sums and royalties to obtain the rights to use well-known characters and brands from other entities. These financial commitments can reduce Disney’s earnings and its overall financial health. To sum up, depending too much on licensing hampers Disney’s power to completely direct and mould the creative path of its intellectual property.

4. Insufficient Product Demand Scaling

Disney product designers have poor judgment for the “next-big-idea,” which leads Disney to lose many opportunities compared to its competitors. Whenever there is a severe demand, companies take advantage by coiling up a relevant campaign. However, Walt Disney fails to take advantage of such opportunities.

5. Burdening Acquisition

Some acquisitions can catalyze growth, while others can lead to long-term financial turmoil. Disney’s high profitability has been devastated by the financial burden from its acquisition of 21st Century Fox. Additionally, the company has purchased numerous rival businesses, which now require consent from the Federal Trade Commission before engaging with any other rival firms. The primary worry of the authorities is that The Walt Disney Company is dominating the entertainment and mass media sector. The company is at risk of antitrust problems and potential antitrust legal actions if it continues to buy other businesses, thus reducing its chances of further acquisitions.

6. Allegation of Racism

Disney came under fire after it emerged that Barbara Farida, a top executive at Disney’s ABC News, had a long history of making racist comments and engaging in other racially insensitive and inappropriate behaviour. The backlash and anger directed at Disney prompted the company to place the accused executive on leave while investigating her conduct. With the widespread protests against racism, racist execs are a major weakness. [6]

7. High Operating Costs

The robust and diversified nature of Disney’s core business leads to a significant chunk of its revenue being used in operating costs. For instance, the company spent close to $4.9 billion to invest in its entertainment, sports, and experiences divisions. The total depreciation expense surged to $3.6 billion for fiscal 2023—the significant costs linked to its activities present obstacles that need to be tackled. Additionally, creating and distributing top-tier content contributes to Disney’s high operational expenses. Whether making hit movies, developing TV series, or crafting animated features, Disney allocates considerable funds in the planning, creating, marketing, and distribution phases. While the company spent $27 billion on content in 2023, it is expected to spend close to $24 billion in 2024. These expenses cover salaries for talent, equipment for production, special effects, promotional efforts, and the worldwide release of movies and TV shows.

Disney’s Opportunities

1. Live Streaming Market Opportunity

The global live-streaming market was valued at $38.87 billion in 2022 and is currently growing at a compound annual growth rate of 28%. Given that the market is expected to be worth $256 billion by 2032, Disney has a tremendous opportunity to unlock.

The launch of the Direct-to-consumer (DTC) service “Disney+”, which features Disney, Marvel, Star Wars, and Pixar movies, positions the company to take advantage of the enormous market opportunity. While the company has been successful with Disney+, it can grow even further by creating new content and collaborating with other media outlets to strengthen its competitive edge against Netflix.

2. Tap Animation opportunity With New franchises.

Animations that use moving visuals and visual effects for captivating and engaging audiences have given rise to a market expected to be worth $587 billion by 2030 from $372 as of 2022. Disney is one company that has flexed its muscles in the market with its successful franchises, including The Lion King, Star Wars, Moana, and Marvel Cinematic Universe. Nevertheless, the company has yet to tap into the market’s full potential, which it can do by creating new and innovative animations to engage its audience.

3. Build New Theme Parks Globally

The theme park market, where Disney is a significant player, is growing at a compound annual growth rate of 6.25% and is projected to be worth $110 billion by 2033. Despite the tremendous opportunities up for grabs, Disney only operates theme parks in four countries: the US, Japan, France and China. The company can expand this service further by opening new Disney-themed parks in emerging economies to exploit the rapidly growing middle class and improve the economic situation.

4. Expand into new Markets.

Revenues in the cinema market are growing at a compound annual growth rate of 5.68% and are projected to hit highs of $104 billion by 2029. Disney can pursue opportunities in the market by taking advantage of movie production infrastructure in India and China to expand its movie production. India boasts one of the fastest-growing cinema industries, with revenues in the country growing at 5.5% and projected to hit highs of $6 billion by 2029. Expansion into new markets could lower movie production costs, boosting profit margins. It could also help the company target a bigger audience for its streaming service.

5. Strategic Acquisitions

Disney has made several strategic acquisitions like Marvel, Pixar, and Fox, which has enabled the company to expand and exploit opportunities in different sectors and niches within the entertainment market. Disney can make other strategic acquisitions in the future and catalyze its growth.

6. Tap Emerging Technologies

Given its impact on various sectors, artificial intelligence is one of the most sought-after technologies. Likewise, Disney can leverage technology to create new, engaging content and experiences to attract more product users.

Disney’s Potential & Ongoing Threats

1. Stiff Competition

While boasting of one of the most diversified business empires, Disney has to contend with stiff competition from various quarters. For instance, it faces stiff competition on its streaming service Disney+ from Netflix, a force to reckon with. The competitive environment within the media sector undergoes significant shifts as online news and television become prevalent. Similarly, Disney’s theme parks and resorts division faces intense competition from nearby rivals who can provide more tailored products. This leads to an increase in the amount of money the company has to spend on marketing and innovation to fend off competition.

2. Technological Disruptions

While a good thing, technological advancement is increasingly shaking up old ways of doing business and what people like to buy in a constantly changing environment. New technologies like virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) could shake up the entertainment world even more. If Disney doesn’t keep up with these changes, it could lead to fewer people watching its shows and movies and less money coming in. Technology has also given power to people who make content and small studios to make good content more affordably. This could allow new creators to challenge Disney’s lead as they attract younger audiences and question the usual ways of creating and sharing content.

3. Piracy and Unauthorized Distribution Threat

Like any media company, Disney faces the ever-growing problem of piracy and unauthorized distribution of its content, which deprives it of its revenues and earnings. Additionally, piracy continues to dilute the value of its intellectual property. The widespread adoption of streaming services has bundled movies, TV shows, and other content. But, customers only want to pay for some of the content offered by a streaming service like Disney+. They only want their favorite shows, leading to increased piracy using peer-to-peer sharing solutions. The rise in piracy threatens Disney’s revenue and profitability.

4. Regulatory Risk

Being a global brand with operations in various countries, Disney is always under scrutiny from regulators. Every country has unique laws and guidelines for making content, sharing it, protecting intellectual property, managing work conditions, and handling personal information. Therefore, Disney requires a lot of money, knowledge, and familiarity with the local legal systems to follow these rules. Shifts in these laws and government decisions can affect Disney’s business plans and earnings. It also restricts Disney’s artistic liberty and affects its capacity to appeal to a wide range of viewers.

5. Increase in Hacking

Streaming services like Disney+ have soared in popularity with the increase in the number of viewers on their online platforms. Hackers have also turned their attention to streaming services to capitalize on many users. Hacking of Disney+ subscribers’ accounts has increased in the recent past. Cybercriminals can breach viewers’ accounts, resulting in unhappiness, annoyance, and diminished confidence in the cable TV services provided by Walt Disney. Additionally, these criminals can replicate popular and new content, which they duplicate onto DVDs and distribute for profit.

6. Economic Recession

Disney’s business model is highly dependent on strong consumer spending power. Consumers’ purchasing power is significantly stifled in economic downturns, recession, or high interest rates. Whenever consumer spending power is affected, Disney’s key revenue streams are affected due to reduced spending on streaming services and theme parks, among other sectors.

Conclusion

Disney was established in 1923 and is still standing strong. They started with a vision to provide excellent classical content in 2D cartoons. Over 95 years, they have become an iconic company, reaching out to the hearts of billions.

Disney will likely be around for a while. They are in high demand for their products, especially their animated movies. Disney has acquired enough companies and enough cash flow to sustain its company for the years to come.

References & more information

- Johnston, M. (2024 July 12). 7 Companies Owned by Disney. Investopedia

- Stoll, J. (2024 May 22). Number of Disney Plus subscribers worldwide from 1st quarter 2020 to 2nd quarter 2024. Statista

- Barnes, B. (2020 January 17). Disney Drops Fox From Names of Studios It Bought From Rupert Murdoch. New York Times.

- Guttman, A. (2023 December 12). Revenue of the Walt Disney Company from 2010 to 2023, by region. Statista.

- Tully, S. (2020 May 10). Disney’s biggest financial problem has nothing to do with the coronavirus. Fortune.

- Stoll, J. (2024 May 22). Content spending of Disney from fiscal years 2019 to 2024. Statista

- Carollo, L. (2024 February 16). Size of the animation market worldwide from 2020 to 2030. Statista.

- (2024 May). Amusement Park Market Size, Share, and Trends 2024 to 2033. Precedence Research.

- Mendelson S. (2020 February 28). From Pixar To Fox, Bob Iger’s Disney Legacy Is Rooted In Acquisition. Forbes.

- Feldman, B. (2019 June 26). Piracy Is Back. New York Intelligencer.

- Muncaster, P. (2020 April 22). Hackers Target Netflix and Disney+ with #COVID19 Phishing. Infosecurity.

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Hello there,

My name is Aly and I would like to know if you would have any interest to have your website here at bstrategyhub.com promoted as a resource on our blog alychidesign.com ?

If you may be interested please in being included as a resource on our blog, please let me know.

Thanks,

Aly

Hi Aly,

Sounds like a good opportunity for our readers.

let me know how I can help, contact me directly: [email protected] with more details.

Hi, I’m just wondering how to reference this article.. what date was this published? and who was the author, or all 3 of you guys?

Hi Alicia,

Article was last updated on Feb 8, 2023

Author: S. K. Gupta