Company: Infosys Limited

Founder: Narayana Murthy

Year founded:1981

CEO: Salil Parekh

Headquarter: Bangalore, Karnataka, India

Employees (FY23): 317,240

Type: Public

Ticker Symbol: INFY

Annual Revenue (FY24): Rs 1,53,670 Crore

Profit | Net income (FY24): Rs 26,233 crore

Products & Services: Next Generation Integrated AI Platform | Infosys Consulting | Infosys Information Platform (IIP) | Infosys Equinox | Infosys Finacle | Infosys Meridian

Competitors: HCL Enterprise | IQVIA | Virtusa | IBM | Accenture | NTT Data | Fujitsu | Oracle | Wipro | Tech Mahindra | Deloitte | Dell

Infosys Fun Facts

- Narayana Murthy borrowed Rs 10,000 from his wife to start Infosys with six of his friends in 1981

- Infosys was the first Indian company to be listed on the New York Stock Exchange in 1993

- Founded in 1981, the IT Company operated without a computer for two years until 1983.

Infosys Strengths

1. Second-largest Indian IT Company

Infosys is India’s largest information technology company, offering business consulting, information technology, and outsourcing services to over 50 countries. It is ranked the seventh largest company in India, with a market cap of about $70 billion as of May 2024. The large scale gives Infosys a competitive advantage in cost minimization and business negotiations.

2. Strong financial growth

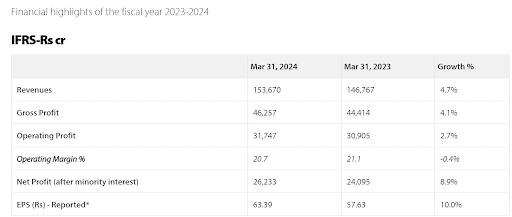

Infosys has grown tremendously in the past few years, achieving a 5-year CAGR of 28% in revenue. The company reported revenue of Rs 153,670 in FY 2023/2024, a 4.7% increase compared to the previous fiscal year. Net profit increased 8.9% to Rs. 26,233 crore, translating to a 10% increase in earnings per share of 63.39.

Source: Infosys

3. Strong clientele base

Infosys provides services to various clients in various industries, from finance to healthcare, retail to manufacturing, and beyond. One of the main reasons for Infosys’ solid client base is the company’s dedication to understanding and meeting the needs of its clients amid the digital revolution. By diversifying its client portfolio, Infosys not only reduces the risk of industry-specific volatility but also helps Infosys take advantage of its expertise in different areas.

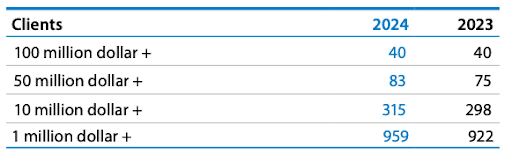

In fiscal year 2024, Infosys had 1,882 clients, with 40 clients that represents $100 million+ clients.

Image source: Infosys annual filing

4. Vast market reach and diversified portfolio

Infosys and its global subsidiaries can be found across 265 locations in more than 56 countries. It boasts a significant presence in North America, Asia, Australia, Japan, and the Middle East.

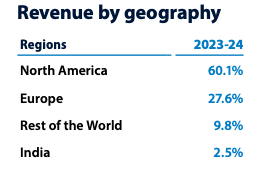

The company operates a global network of 82 sales and marketing offices and 123 development centers worldwide. The diversified nature of its operations sees North America account for 60.1% of revenue, Europe 27.6%, rest of the world 9.8% and India 2.5%.

Image source: Infosys annual filing

5. Phenomenal brand growth

Infosys has been recognized as the fastest-growing IT services company in the world, according to Brand Finance 2024 report.

The tech giant’s brand value has grown by over 52% since 2021, doubling to $14 billion over the last five years. Consequently, it is ranked as the #145 most valuable brands globally.

6. Strong brand recognition

Infosys has a strong brand image for the quality of products and services it provides. It is the third most valuable brand in India and is recognized as the fastest-growing IT services brand.

The company has also won several awards, including being the leader in the Gartner Magic Quadrant, Green Apple Award, and Global System Integrator of the Year. In 2023, Ethisphere recognized it as one of the world’s most ethical companies.

The company can use its strong brand reputation to attract customers and influence consumer decisions.

7. Product innovation

The tech giant drives innovation by partnering with select startups to provide novel services to its clients. It has opened a network of 20 high-tech co-creation incubators for digital innovation globally, the latest being in Sydney, Australia.

The company allocates approximately 0.5% of its yearly income to research and development efforts aimed at fostering product innovation. It also has a strong history of executing major IT initiatives in different sectors and builds a skilled group of experts with knowledge in diverse fields, such as software creation, cloud technology, and data analysis.

8. Strategic partnerships

Infosys has partnered with major players in the business and technology space, enabling it to position its IT business solutions and consultancy services better and cement it as a market leader in the IT services segment. Currently, the conglomerate is associated with blue-chip companies like Amazon, Google, IBM, Microsoft, HP, and Oracle, to name a few.

Strategic partnerships also open the door for the company to access new opportunities in new segments and markets in addition to cutting-edge technologies.

9. Broad products & diversified end markets

Infosys operates across multiple business segments, including energies & utilities, telecom, manufacturing, hi-tech, and life sciences, with around 42.1% of revenue generated from financial services and retail segments.

It makes the company less vulnerable to shifts in market forces within the IT space.

10. Quality employee training programs

Infosys has one of the best employee training and competency development programs in the IT industry. It uses an exciting blend of classroom, virtual, macro, and microlearning setups to retool its workforce. The company offers around 1,500 courses in continuous education and has been actively transforming the training process using digital platforms.

Infosys Weaknesses

1. Overreliance on a few clients

Infosys depends on North America for more than 60% of its revenues, which poses significant challenges and limits its growth. Consequently, the company is exposed to heightened vulnerability due to geopolitical economic and regulatory risks.

2. Unsuccessful company acquisitions

Infosys has not enjoyed the smoothest of rides with the integration of its acquisitions. Difficulties in cultural alignment, given that the company has its cultural values and ways of doing business have made it difficult to unlock significant value from its acquisitions.

On former CEO Vishal Sikka’s watch, Infosys bought Panaya, a US-based automation technology company, in 2015 for $200 million and Skava, a US-based retail digital solutions company, in 2015 for $120 million. Both the acquisitions were unsuccessful, resulting in the tech giant writing off $90 million on the deals.

3. Controversies

Infosys has been involved in several controversies. Its involvement in the Russian energy industry was most notable after the country invaded Ukraine. It was also hit with an $800k fine for tax fraud in the US in 2019 due to its failure to adhere to California’s laws on immigrant workers’ payrolls.

4. Management/ownership changes

Infosys has been plagued by battles in its top leadership, where the board and founders needed to see eye to eye over governance issues. This led to the departure of CEO Vishal Sikka in 2018.

5. Regulatory challenges

One of the biggest challenges Infosys faces regarding regulatory compliance is the many different laws and regulations in the other countries it operates. As a global company operating in various countries, you must deal with many different legal frameworks, sector-specific laws, data protection laws, labor laws, etc.

Ensuring compliance with all these laws and regulations while ensuring compliance across different regions is challenging. If you don’t comply with the relevant laws and regulations, you can face legal repercussions, penalties, and even damage to your reputation.

6. High employee attrition rates

Infosys is one of India’s companies with a high employee attrition rate of 12.6%. Its employees often leave to seek better career opportunities and higher education in today’s highly competitive IT services and consulting market; attracting and retaining the best talent is essential for long-term growth, innovation and customer satisfaction. Losing skilled employees can result in knowledge gaps, project disruption and higher recruitment and training costs.

Infosys Opportunities

1. Opportunity in the unexploited IT value chain

India is emerging as one of the fastest-growing digital ecosystems in the world with its IT industry growing at a rate of 15.5% annually since 2022, twice as fast as the country’s economic growth.

Experts estimate that by 2025, the software product sector will have a $1 trillion opportunity globally. From providing software solutions that enhance business operations to providing outsourcing services, Infosys is staring at massive business opportunities amid the digital revolution in India.

2. Increasing demand for cloud-based solutions

India’s public cloud services segment presents unique opportunities for growth while growing at an extraordinary rate of 22.9% annually. The market is projected to be worth $17.8 billion by 2027. As enterprises invest in modernizing their applications and developing cloud-native solutions, Infosys will have tremendous opportunities to unlock these.

Expanding the cloud service market should create new opportunities for Infosys to provide digital marketing, a digital workplace, digital commerce, and digital experience and interaction solutions.

3. Emerging markets

India is the top outsourcing destination in the world, making up 55% of the IT and Business Processing Management services market. With the average spend per employee in the IT services market expected to reach highs of $49 by the end of the year, Infosys should benefit as one of the biggest IT companies. Spending in India’s Information Technology sector is expected to experience a significant increase of over 11.1%, reaching a total of $138.6 billion in 2024, which is a rise from $124.7 billion in the previous year. Increased spending should result in significant opportunities that Infosys can tap into.

4. Expansions and acquisitions

The size of Infosys gives it an advantage in acquiring smaller competitors and expanding its business landscape.

Most of the previous acquisitions have greatly benefited the company, and Infosys can continue doing so to advance its business to the next level.

Infosys Threats

1. Cybersecurity threat

As technology advances, so does the risk of data breaches and cyberattacks. The development of advanced hacking tools and the increasing value of data makes it easier for criminals to take advantage of weak spots in Infosys’ defenses, which can seriously impact Infosys’ reputation and bottom line.

Infosys must invest in advanced cybersecurity solutions to protect its clients’ confidential data and intellectual property. This includes the implementation of solid firewall, intrusion detection, and encryption solutions, as well as regular vulnerability assessment and penetration testing.

2. Geopolitical and economic risks

Geopolitical uncertainty affects international trade and cross-border operations. Trade wars, protectionist policies, political uncertainty, and diplomatic tensions can make it difficult for Infosys to conduct business effectively across borders. Economic uncertainties such as recession, currency volatility, and policy shifts can also significantly impact business environments, making it difficult for the company to achieve its profit targets.

3. Workforce attrition

Indian IT companies cannot stem the tide of employees leaving, with Infosys experiencing the worst overall attrition rate among the tech giants.

The company experienced an attrition rate of 12.6% in the most recent year. Employee attrition has cost implications as recruits taking up the vacancies must undergo training.

4. Intensified competition

Infosys operates in the highly competitive IT industry, with major competitors such as Accenture, IBM, and Oracle. This could lead to pricing pressure and cost concerns in the future.

Infosys’s operations are susceptible to notable technological advancements, as well as ongoing product innovation and development. To satisfy the needs of its clients, the business must constantly work to create new products, update old ones, and create new technologies. A large amount of research and development resources are required to introduce new goods and technologies.

5. Regulatory hurdles

A variety of foreign legislations and regulations govern Infosys’ business activities. Consequently, it is constantly under the scanner of regulatory authorities worldwide regarding its business operations, data protection and security measures, consumer protection measures, and market power.

A regulatory action or an antitrust proceeding could restrict Infosys’ operations or force the company to modify its operations. Infosys’ compliance with the above regulations could help the company’s business, brand image, and financial situation.

References & more information

- Haigh, R. (2024). BRAND FINANCE GLOBAL 500 2024. Brand Directory.

- Parker, B. (2020 September 21). First Mover Advantage: An Opportunity for a Free Ride or a Chance to Establish Brand Loyalty?. Business Strategy Hub.

- Sood, V. (2018 April 14). Infosys wipes out Vishal Sikka legacy, to sell Panaya, Skava. Live Mint.

- (2022 April 1). Infosys is shutting its Russia office: Report. Business Today.

- (2022 August 14). Infosys is in stable position due to its founders, says CEO Salil Parekh. Economic Times.

- Sinha, N. (2022 September 11). Indian IT industry: Miracle of brilliance. The Times of India.

- Bureau. (2019 November 27). Indian IT moving up value chain with young entrepreneurs focussing on software products. The Hindu Business Online.

- (2023 December 14). India’s Public Cloud Services Market Grew to US$3.8 Billion in 1H2023, Expected to Reach US$17.8 Billion by 2027. IDC.

- (2024 March ). IT & BPM Industry in India. India Brand Equity Foundation.

- Vidaya, S. (2022 July 25). Infosys’ attrition highest among top 3 IT majors, Wipro improves in Q1. Business Today.

- (2022 October 13). Infosys attrition rate moderates sharply at 27.1% in Q2 compared to Q1FY23. Live Mint.

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment