Company: Adidas AG

Founder: Adolf (Adi) Dassler

Year founded: 1924 (as Gebruder Dassler Schuhfabrik), 1949 (as Adidas)

CEO: Bjørn Gulden

Headquarter: Herzogenaurach, Bavaria, Germany

Type: Public

Ticker Symbol: FWB: ADS, OTC: ADDYY

Market Cap (Jul 2024): € 44 Billion

Annual Revenue (FY 2023): € 21.4 Billion

Profit | Net income (loss) (FY 2023): (€ 58 Million)

Products & Services: Sports Apparel | Football Boots | Basketball Shoes | Running Shoes | Sports Bags | Glasses | Hats | Headbands and Wristbands | Hoodies | Yoga Pants | Shorts | T-Shirts | Jackets

Competitors: Nike | Puma | Under Armour | Callaway Golf | Fila | Converse | New Balance | ASICS | Lululemon Athletica | VFC | Reebok

Did you know two well-known companies – Puma and Adidas – belonged to different Dassler brothers?

In 1947, the brothers split up and opened their separate companies, which later became business rivals in the sports apparel industry.

Introduction

Adidas is the largest sportswear maker in Europe and the second largest in the world, behind rival Nike.

The company was founded as Gebruder Dassler Schuhfabrik (which translates to Dassler Brothers Shoe Factory) in 1924 by Adolf Dassler. His older brother Rudolph joined him in the business, but their relationship soured in 1947. The brothers went their separate ways and each opened their own company. Rudolf died in 1974, and Adolf in 1978.

Adolf, commonly called Adi, used his nickname and the first three letters of his last name to form the company name Adidas. His brother created a rival company, Puma.

Adidas net income hit a peak of €1.9 billion in 2019 but fell to €461 million in 2020, largely due to the pandemic. In 2023, Adidas suffered a loss of €58 million, in part due to the highly publicized split with Kanye West. Adidas broke ties with West and stopped producing his Yeezy brand of sneakers after West publicly made antisemitic remarks.

Adidas Strengths

With its long history, Adidas has many strengths, from brand value and awareness to popularity with younger buyers and its many partnerships and endorsements.

1. Brand Value

Adidas is one of the most valuable sports brands. According to Interbrand, Adidas is in the top 100 brands for all industries, ranking at #42. Its value is placed at $16.6 billion.

2. An Iconic Brand with a Prestigious Legacy

Adidas has nurtured a strong and prestigious legacy and heritage over its long, illustrious history by influencing and shaping numerous aspects of society across the world.

- For example, the company influenced sports in the 70s and shaped hip-hop culture in the 80s. Its iconic three-striped tracksuit and three-leafed motif logo transformed the brand into a cult, particularly among urban youth.

3. New Product Innovation

Since its founding, Adidas has prioritized the quality of its products over everything else. In 2023, EUR 151 million was invested in R&D. In 2022, the figure was EUR 153. High-quality, innovative products are one of the driving forces behind its ever-growing base of loyal customers.

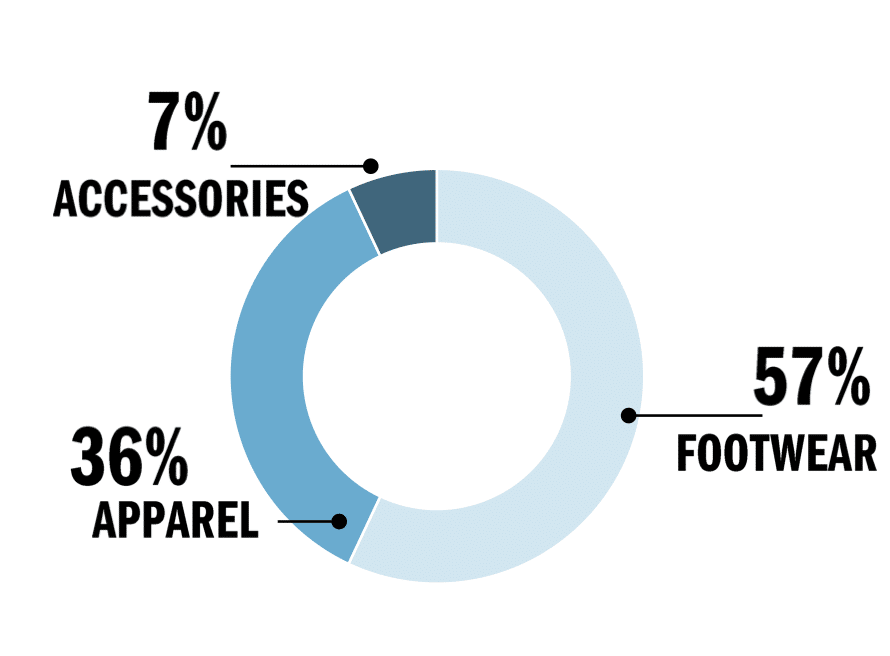

4. Diversified Portfolio

Even though the Adidas brand is restricted within the sportswear industry, the company’s products are quite diversified. It offers multiple products that are designed to cater to a wide range of sports, not just footwear. Other products include apparel and accessories. Footwear represents 57%, Apparel represents 36%, and Accessories and Gear represent 7% of Adidas’ annual sales of € 21.4 billion.

Image Source: Adidas Annual Report

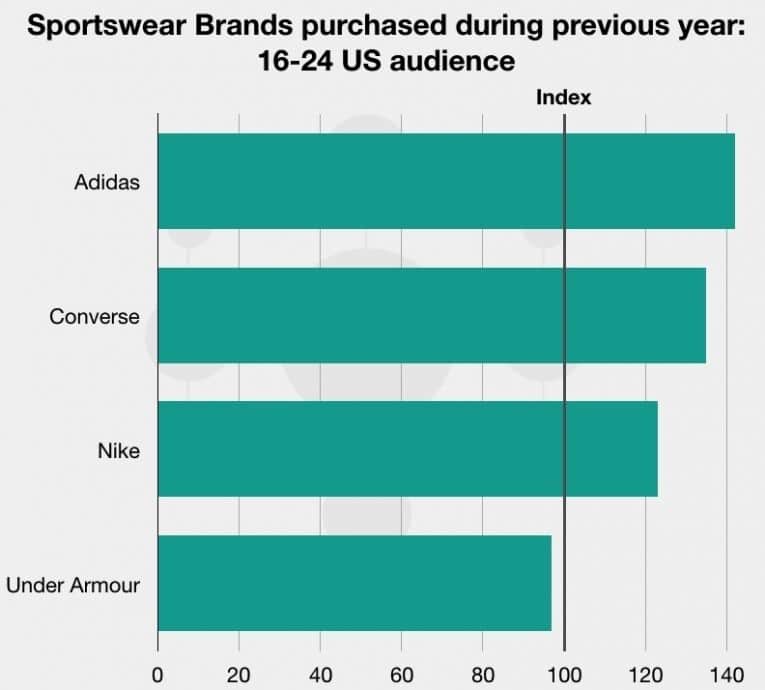

5. Young Customers prefer Adidas

The company’s consistent focus on product quality and customer experience has enabled Adidas to nurture a global and loyal customer base, particularly teens and young adults between 16 and 24 years old in urban areas.

Survey shows that US youth prefer Adidas over other sports brands

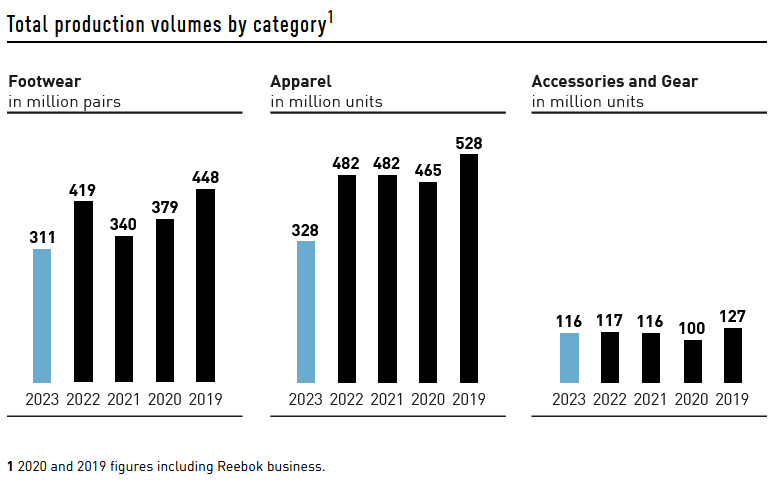

6. Effective Supply Chain Management

Supply chain management is vital to the success of global companies, particularly for Adidas, since it outsources 100% of its manufacturing to independent manufacturing partners. According to its annual report, Adidas works with 114 key strategic manufacturing partners to ensure control of the entire supply chain.

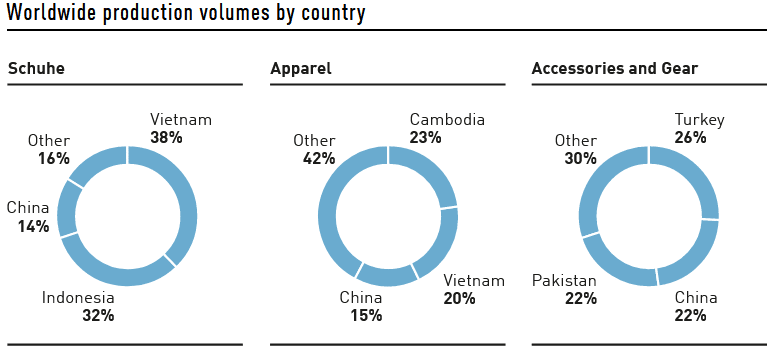

- Footwear – Adidas produced 311 million pairs of footwear in 2023. Vietnam is the largest sourcing country, representing 38% of production. It is followed closely by Indonesia at 32%. China represents 14%, and all other areas make up the remaining 16%.

- Apparel – Adidas produced 328 million units of apparel in 2021. 9 Cambodia is the largest sourcing country for this line of business, representing 23% of produced volume, followed by Vietnam at 20%

- Accessories & Gear – Adidas produced 116 million units of accessories in 2023. Turkey represents the largest sourcing country (26%), followed by China and Pakistan, at 22% each.

Image Source: Adidas Annual Report 2023

7. Strong & Diversified Distribution Network

Adidas has several distribution networks, including 1863 company-owned retail stores, over 14,000 mono-branded franchise stores, and over 150,000 co-branded retail partners and wholesale stores. In addition, e-commerce platforms help to increase sales by opening up different channels to reach target markets and sell directly to buyers within these markets.

8. Effective Marketing Strategy

The strength of the Adidas marketing strategy stems from its balanced mix of promotion, advertising, and digital technology.

9. Branding through international sponsorships

Sponsoring global organizations provides an opportunity to advertise directly to sports lovers and fanatics globally. For example, the marketing campaign for the FIFA World Cup in Russia, NBA, Olympics, Boston & Berlin Marathons, UEFA Champions League, etc.

10. Sponsorship of high-profile athletes such as David Beckham, Lionel Messi, Sachin Tendulkar, Andy Murray, Candace Parker, Patrick Mahomes, Aaron Rodgers, Alexander Zverev etc. strengthens brand desire.

11. Celebrity Endorsements

Adidas has strived to maintain and enhance its recognition as a youthful and urban brand through endorsements from celebrities. Adidas has been endorsed by a long list of movie stars and music hit-makers such as Beyoncé.

12. First Store in Singapore

The world’s second-largest athletic brand opened its first-ever store in Singapore – and it’s the largest one yet. The store is named ‘Homeground’ and is located at Knightsbridge, Orchard Rd.

It’s a massive three-story store featuring Adidas’ largest and most popular athletic apparel, shoes, and accessories. Plus, the store also features exclusive products that are only available in the brand’s Southeast Asia corridor. As soon as you enter the store, you’re greeted by a huge 3D LED TV screen displaying the brand’s promotions and latest marketing campaigns.

13. Product Development in Space

Adidas has twice partnered with the International Space Station National Lab to explore new product development.

The first partnership involved studying free-flying soccer balls in microgravity in an effort to better understand aerodynamics. The second partnership focused on the production of shoe soles.

14. Reduced Waste and Shoe Subscription

In the UK alone, it is estimated that over 300 million pairs of running shoes are thrown away every year.

Adidas engineers developed a 100% recyclable shoe that would generate no waste. The shoe uses no glue and only one type of material. Usually, shoes include more than a dozen different materials.

Once the shoe is worn out, it can be recycled into new shoes. This concept is known as FutureCraft.Loop. Who knows – this could even pave the way for a shoe subscription model in the future.

15. Augmented Reality (AR) Tech Company Teams Up with Adidas

After raising $45 million, the AR technology startup company Mojo Vision announced that it would be collaborating with Adidas to boost their new AR contact lens.

The company stated that partnering with athletic and fitness giants such as Adidas will help them streamline the technology, blending athletic wearables with fitness tracking to appeal to health-conscious consumers.

16. Expand through Strategic Partnerships

Adidas recently partnered with the Ivy Park brand. This strategic partnership provides a perfect opportunity for Adidas to attract more female customers and to try to catch up with Nike and Puma, which have a larger number of female customers. Focusing on female customers is key to gaining market share in an estimated USD $132 billion (2021) womens sports and swimwear segment estimated to reach a CAGR of 6% over 2022 to 2028.

Additional partnerships aimed at specific groups of customers would continue to drive growth for Adidas. Exploring and engaging underserved, non-traditional, and emerging markets is key to sustained growth.

Adidas Weaknesses

Despite many strengths, Adidas is not without weaknesses that have presented challenges. Negative publicity, supply chain challenges, and product price points are among them.

1. Supply Chain Shortage

Adidas outsources the production of most of its products to 3rd party or independent manufacturing suppliers, mainly in China, Cambodia, Indonesa, and Vietnam. It has exposed Adidas to the risk of overdependence on foreign suppliers.

In its 2023 Annual Report, Adidas outlined work to establish “next-level supply chain responsiveness” in an effort to get products to market more quickly.

2. Expensive Products

Adidas charges a premium or high prices for its products, which has alienated low-income consumers. Only upper- and middle-income group customers can afford over a $100 shoe.

3. Limited Product Line

Adidas Group has only the Adidas brand under its portfolio, which has restricted the company to sports footwear, sports apparel, and accessories. Therefore, a decline in demand for sports-related products can be disastrous to Adidas.

4. Links to Forced Labor

Adidas was among 83 multinational companies that were linked to forced labor a few years ago in factories across China by ASPI. Competitor Nike was also among the list of companies. Any association with forced labor not only exposes the company to legal risks but also weakens its reputation and erodes trust among consumers.

5. Allegation of Racism

Adidas has focused on building a brand that transcends racial lines. This reputation was tainted by allegations that Karen Parkin, the head of human resources, mishandled cases of racism at the company. She was forced to step down to pave the way for an investigation. The incident sparked Adidas to form a global committee with the goal of improving inclusion and equality.

6. Laxity in Home Market

Companies should defend their home market at all costs. For years, Adidas has neglected its home market and allowed Nike to increase its market share. In January 2020, Nike sales in Germany surpassed Adidas for the first time in history. Adidas is also losing key markets across Europe, with Nike’s revenue from the region expected to increase to $10 billion by the end of 2020.

Adidas Opportunities

From global expansion to product diversification, Adidas has plenty of opportunities to explore. The sportswear industry is growing, and this gives the company a chance to expand in existing and new markets.

1. E-commerce

The number of consumers who shop online or use e-commerce sites has been on the increase for years, and there is room for Adidas to capture more sales through e-commerce. E-commerce CAGR in the 2024 – 2029 period is estimated to grow at 9.49% to a market volume of USD $6,478 billion in 2029. This sales channel is key to Adidas long-term success.

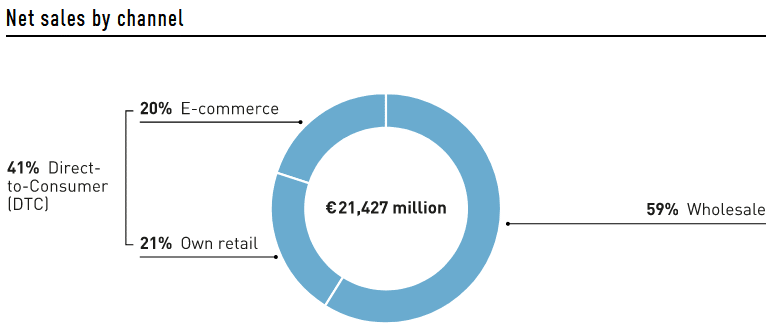

Adidas incorporated various e-commerce channels, such as Instagram’s checkout feature, into its distribution network, and in 2023, 20% of the company’s sales were through e-commerce. Adidas can replicate this success in other social media platforms such as Facebook and Snapchat.

Another 21% of sales were through retail outlets, for a total of 41% of business attributed to direct-to-consumer sales. The other 59% is wholesale.

Image source: Adidas annual report 2023

2. Growing Sportswear Industry

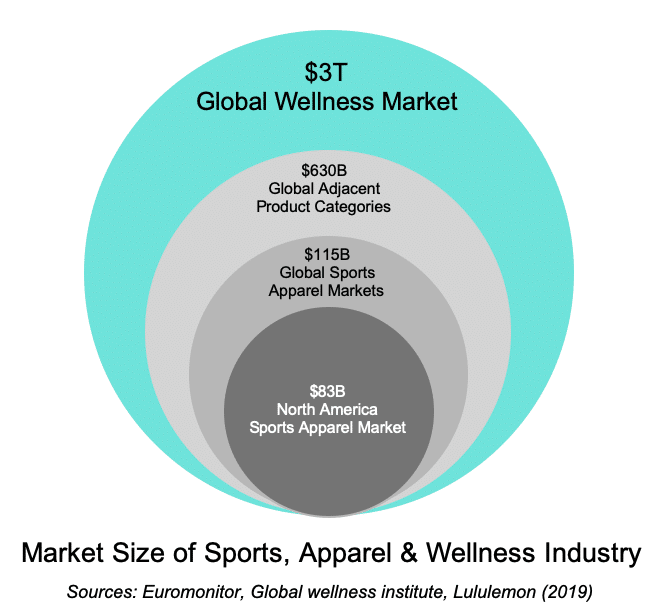

Sports and fitness have steadily grown in popularity with no sign of slowing down any time soon. They form part of the much larger global wellness industry with a projected CAGR of 6.72% from 2022 to 2030 with a market size of USD $305 billion.

The consistent increase in demand for sportswear products and assorted related products is an opportunity for Adidas to grow its market share through the introduction of new products and clothing lines.

3. Investing in Smart Materials

Technological advancements have enabled the development of new synthetic materials that are more beneficial than traditional materials. Adidas can use these materials to gain an advantage in the sportswear market sized at USD $305 billion with projected CAGR of 6.72% from 2022 to 2030

Continual, increased investment in technology and the manufacturing of new materials can provide Adidas with a competitive edge. In a great first step, Adidas announced that it would expand its product lines using newly launched fabrics made from recycled marine plastic and polyester.

4. Culture of Yoga Pants

Increased health consciousness and changes in preference and tastes among consumers have increased the demand for sports-related products, and Adidas can take advantage of this trend. Yoga’s 2023 global market value of an estimated USD $107 billion is projected to achieve a CAGR of 9.4% in the 2024 to 2030 period.

This shift to more casual clothing began a number of years ago as the “Culture of yoga pants” began redefining the sports apparel industry. Adidas is well positioned to supply eager customers with the apparel and equipment for this ongoing trend.

5. Increasing Demand for Premium Sports Products

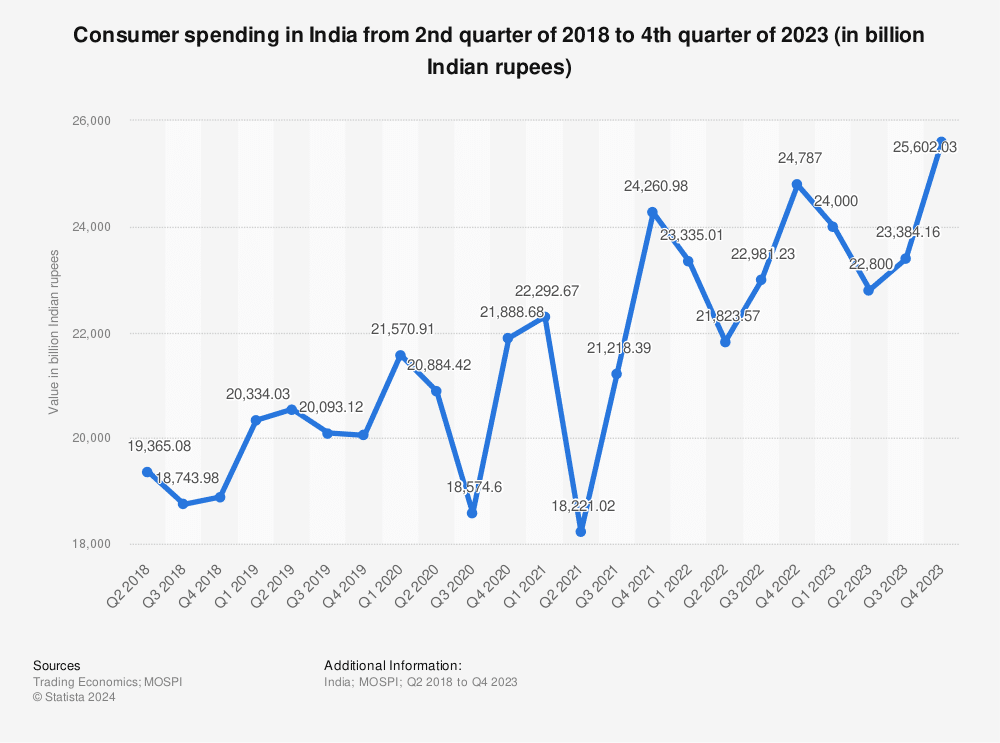

Improved economic situations in developing countries have increased purchasing power and demand for premium products. India, a key growth market, is estimated to reach a CAGR of 7.42% in the 2024 – 2028 period.

Adidas can capitalize on this by expanding its reach into countries such as India, where discretionary income and consumer spending are on the rise. Key areas of focus in India include football, cricket, and kabbadi. Adidas will be well served by understanding and engaging in emerging markets.

Source: Statista

6. Diversification into sporting equipment

Even though Adidas has a diversified portfolio, there is still room for expansion of its product line into new areas. The sports equipment market globally is worth around USD $220 billion with an estimated CAGR of 5.47% in the 2023 – 2030 period.

For example, Adidas can further differentiate itself from Puma and Nike by expanding its product line to include sporting goods such as tennis rackets, golf clubs, hockey sticks, and so on.

7. Global Expansion

There are plenty of opportunities for new sales thanks to the rapid growth of emerging markets in Africa, Asia, and South America. With a projected market size of USD $611 billion in 2031 and a CAGR of 6.7% in the 2023 – 2031 period, opportunities abound for Adidas.

Adidas has a lucrative opportunity to expand into these markets through impactful marketing, focused product development, and innovative offerings that target consumer demand.

8. Gender-Neutral Collection

The demand for gender-neutral shoes, clothes, and accessories is unmet by companies in many markets across the world. Gender neutral clothing is estimated to achieve a CAGR of 11.05% in the 2023 to 2031 period.

Adidas struck a deal with Beyonce to design, produce, and sell gender-neutral hoodies, jumpsuits, cargo pants, cycling shorts, and other items. It has an opportunity to sell more products of this type, with or without celebrity involvement.

Adidas Threats

Competition, economic uncertainty, and lawsuits are among the threats Adidas faces now and into the future. Many companies will be dealing with these issues. But Adidas also has to contend with the massive fallout from its highly-public split with Kanye West.

1. Parting of Ways with Ye (Kanye West)

In 2022, Adidas announced an end to its agreement with Kanye West to produce and sell his Yeezy brand shoes. The break came after West made antisemitic remarks at events, in interviews, and on social media.

Adidas admitted the split was hurting the company. Adidas gave anti-hate groups about $150 million USD from sales of Yeezy shoes. It also saw a decline in sales in North America and was left with an estimated 1.2 billion Euros worth of Yeezy sneakers in warehouses. In early 2023, Adidas and West came to an agreement on selling the remaining stock of Yeezy sneakers.

The split contributed to a net loss for Adidas in 2023, although the company expects a turnaround in subsequent years. The incident poses a continued threat to the company’s reputation and bottom line.

2. Competition

One of the main threats facing Adidas is increased competition. Globalization and technological advancements, which have enabled the entry of small and medium companies.

This means that Adidas has to compete against main rivals such as Nike, Under Armour, Puma, Lululemon, Patagonia while fending-off new entrants and penetrators.

3. Rapid Expansion of E-commerce

Companies are adopting and expanding e-commerce at an ever-expanding rate.

This can pose a threat to Adidas if its main competitors, such as Nike and Puma, adopt e-commerce more quickly. In its 2023 Annual Report, Adidas said process automation and system upgrades would help improve e-commerce service levels.

4. Supplier Dominancy

Outsourcing the manufacturing process for products results in a loss of control.

The fact that Adidas outsources most of the manufacturing of its products means the suppliers have more bargaining power than the company. The skewed balance of power exposes Adidas to the possibility of being held hostage by its biggest suppliers and manufacturers.

5. Technological Advancements

The threat posed by competitors increases as they become more technologically advanced.

This implies that a competitor such as Nike will pose a greater threat if they become more technologically advanced than Adidas.

6. US-China Trade Tensions

Adidas operates globally, which makes it susceptible to the reckless tit-for-tat imposition of tariffs between countries.

A trade war is particularly threatening to Adidas because the US is the company’s second-largest market, yet a vast majority of its products are made in China and other Asian countries. According to former CEO Rorsted, currency wars and tariffs pose a major threat to Adidas.

7. Exchange Rates

Fluctuations in the value of major currencies, such as the Euro and the US Dollar, can negatively affect Adidas’s profits since it operates in the global marketplace.

8. Global Economic Uncertainty

The effects of economic slowdowns, such as lower sales, negatively affect Adidas, just like any other company.

In 2020, its net income dropped by more than 90% due to the pandemic. Adidas could continue to lose if economic uncertainties persist.

9. Fake Products

Fake products introduced in the market are a threat to many major brands, and Adidas is no exception.

According to former CEO Rorsted, 10% of Adidas products in Asia could be fake. The number and quality of fake products for premium shoe brands have increased significantly in the recent past, which poses a threat to shoe manufacturing companies.

10. Loses Popularity in China

Anta Sports Products Ltd, a Chinese athletic brand, is gearing up to become a popular sports brand in China. This comes as giants such as Adidas continuously lose sales in the country.

The plummet in sales for the big athletic brands was a direct cause of a ban proposed by the Chinese public, demanding the shut-down of down Adidas and Nike on allegations of forced labor. According to reports posted by the Chinese media, western athletic brands exploit minority workers in Xinjiang, a cotton-rich city. According to Adidas, it suffered a sales drop in 2021.

11. Lawsuits Against Adidas

- In 2021, Nike filed a lawsuit against the second largest athletic brand in the world. Nike claimed that Adidas has been violating its copyright over the groundbreaking Flyknit technology that Nike introduced.The suit against Adidas was settled out of court, but other lawsuits on the topic are ongoing. The battle over knitted footwear has been fought in the courts for years.

- Loss of Trademark: In 2019, Adidas lost a three-strip logo trademark case in the General Court of the European Union, which exposed the brand to the threat of imitation. The ruling only affected one particular type of stripe placement and not most forms of the well-known 3-stripe mark.

SWOT analysis of Adidas

References & more information

- Mistreanu, S. (2020, March 2). Study Links Nike, Adidas And Apple To Forced Uighur Labor. Forbes

- Thomasson, E. (2020, June 30). Adidas human resources head steps down after race row. Reuters

- Carretero, A. (2020, Jan. 22). Nike outranks Adidas in its own home: sells more footwear than its arch-rival. MDS

- Thomasson, E. (2020, January 28). Adidas to launch new fabrics from recycled ocean plastic, polyester. Reuters

- Thomasson, E. (2019, December 19). Adidas and Beyonce to Launch Gender-Neutral Collection. Reuters

- Leen, R. (2019, December 20). Adidas And Beyonce To Launch Gender-Neutral Collection. British Herald

- Smith, E. (2020, April 27). Adidas says first-quarter profits fell more than 90% due to coronavirus store closures. CNBC

- Interbrand Rankings (2023) Best Global Brands

- Adidas Annual Report (2023) Operating Expenses

- Patent Lawyer Magazine (December 20, 2023) Nike defends its Flyknit technology by suing for patent infringement

- Wikipedia (Retrieved 2024, Jun 21) Dassler Brothers Feud

- Statista (2024) https://www.statista.com/outlook/emo/ecommerce/worldwide

- Fortune Business Insights (July 1, 2024) https://www.fortunebusinessinsights.com/sportswear-market-102571

- Grand View Research (2024) https://www.grandviewresearch.com/industry-analysis/yoga-market-report

- Statista (2024) https://www.statista.com/outlook/cmo/toys-hobby/sports-equipment/india

- Zion Market Research (2024) https://www.zionmarketresearch.com/report/sports-equipment-market

- Data Driven Market Intel (2024) https://www.linkedin.com/pulse/global-gender-neutral-clothing-market-emerging-urjve/

- Grand View Research (2023) https://www.grandviewresearch.com/industry-analysis/womens-sports-swimwear-market-report

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

It’s Amazing article

I wish to cite the same in a paper that I’m currently writing

Thank you

thank you for the info. it helps me a lot

Thank for sharing. I’ve got the ideas on my research now

An interestingly exhaustive SWOT analysis.

Much of it challenges amongst others appears to be in the field of HRD .

Glad you liked it lk!

Happy reading 🙂

Thanks for making…good for me and support to making my presentation 👌

Glad to see Neilson that analysis helped you!