Company: Ford Motor Company

CEO : James Duncan Farley Jr.

Year founded : 1903

Headquarter : Dearborn, Michigan, USA

Number of Employees (FY 2022): 173,000

Public or Private: Public

Ticker Symbol: NYSE: F

Market Cap (Mar 2023): 49.78 Billion

Annual Revenue (FY 2022) : $158.05 Billion

Profit | Net income (FY 2022): -$1.98 Billion

Products & Services: Cars| SUVs and Crossovers | Trucks and Vans | Hybrids and EVs | Commercial Vehicles | Future Vehicles | Fleet Vehicles

Competitors: General Motors Company | Toyota Motors | Tata Motors | Daimler | Hyundai Motors | Honda Motor Company |Tesla Motors | Volkswagen | Renault Group | Fiat Chrysler Automobiles | Nissan | Group PSA | Geely Group | Maruti | BMW | Mercedez

Fun Fact:

Did you know that Ford is the second largest family-owned company in the world?

An Overview of Ford

Henry Ford founded Ford in 1903. Its headquartered in Dearborn, Michigan, USA. It is one of the top car brands in the world and sells commercial vehicles under the Ford brand while the luxury vehicles under the Lincoln brand.

It is also one of the best American-based Automobile manufacturers with the most profits earned through the North American Segment. Every year it produces over four million vehicles. It is the fifth largest automobile manufacturer in the world.

With such massive sales every year and being one of the leading car brands in the world, where does it stand today?

Let’s get to know more about this luxury car brand and discuss Ford’s SWOT analysis in detail.

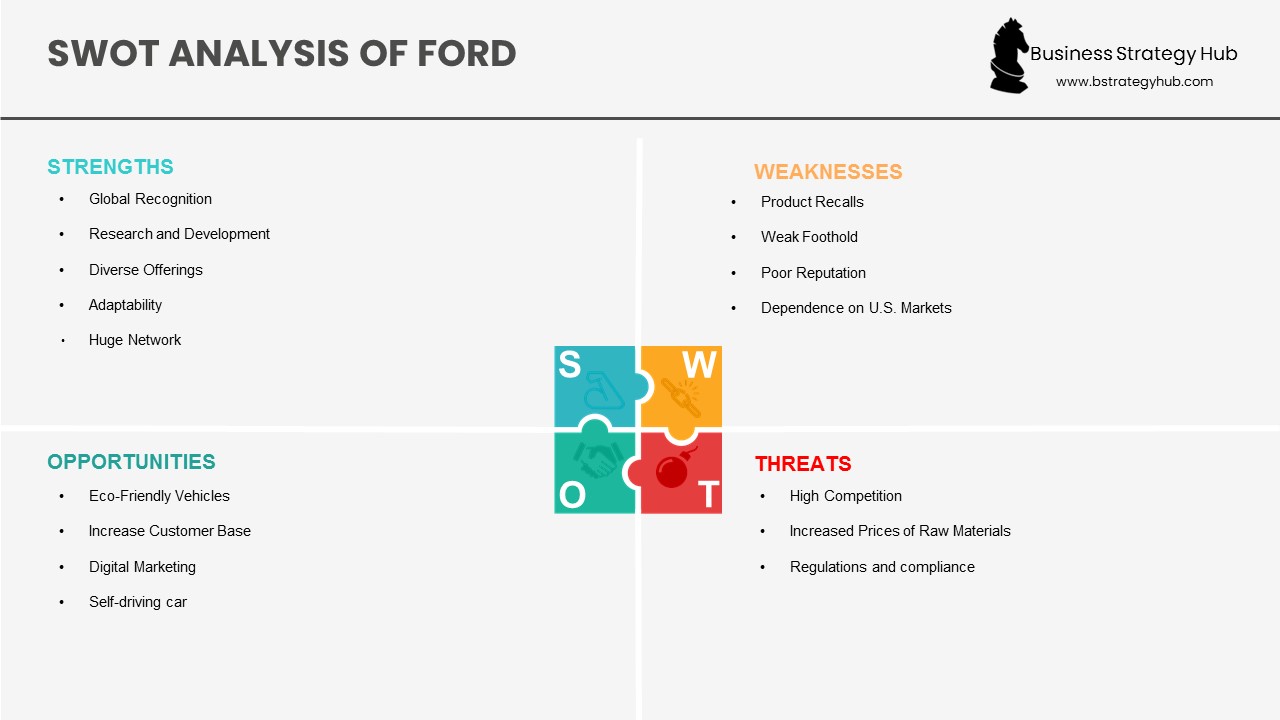

SWOT Analysis of Ford

The SWOT analysis of Ford is given below:

Ford’s Strengths – Internal Strategic Factors

1. Global Recognition

Ford is a well-known brand in the automobile industry and is also recognized in the global markets because of its success in marketing and advertising. It operates two brands under Ford Motor Company i.e. Ford and Lincoln. Its brand value is $10.44 billion according to the 2021 report of Statista.

2. Automotive Segment

Ford is currently the second-largest automaker in the U.S. (behind GM) and fifth largest (behind Toyota, Volkswagen, Hyundai, GM) in the world. Ford Motors sold a total of 4,231,000 vehicles in 2021 worldwide in 2022. [1]

3. Research and Development

Ford’s research and development is one of its key strengths because the company is committed to making and developing new products. They are continuously trying to improve the performance of their vehicles. The evaluated factors include fuel, efficiency, safety, and customer satisfaction.

4. Diverse Offerings

Ford caters to all kinds of demographic groups with their diversified brands and car models. They take care of the needs and wants of their consumers by providing them with more variety of cars and commercial vehicles. The business also has a diversified portfolio, including the automotive, mobility, and Ford Credit segments.

|

Segment |

Revenue/$ billion |

% |

|

Automotive |

148.9 |

94.26% |

|

Mobility |

0.09 |

0.06% |

|

Ford Credit |

8.97 |

5.68% |

|

Total |

158.05 |

100% |

5. Adaptability

Ford has a wide product and services portfolio that gives them substantial leverage and less dependency on just one product range. Their commitment to adopting new technologies also gives them a boost in the competitive automobile market. They are also working on light weight, cabin technology, and powertrain to enhance their product quality.

Ford recently redesigned its best-selling pick-up truck, the F-150, to adapt to changing consumer preferences and demographics. The new generation F-150 pickup truck has been redesigned to entice the younger target market and will be released in the market in May 2021. Ford also released an electric version of the F-150 in 2022. This enables the company to ensure that its best-selling model keeps up with consumers’ migration away from petrol to electric. [2]

6. Huge Network of Dealers

The company is also diverse in its operations and distribution, as they have a huge network of about 9,611 dealers across the world. Ford develops its cars on standardized procedures. They also invest heavily in various fuel sources.

7. Strong Financial Position

The demand for pickups and SUVs drives Ford’s strong financial position. In 2022, the company generated an overall net loss but better-than-expected annual revenue of $158 Billion. The fact that Ford is going strong despite the turmoil in 2020 highlights the company’s growth in the future will be even bigger. [3]

8. Ford’s Rivian Investment Results in $8.2 Billion Gain

The Ford Motor Company announced that the company has resulted in an $8.2 billion gain from the Rivian investment earlier this month. Ford invested in the electric car manufacturing company shortly following Rivian’s massive EV debut in November 2021.

Rivian also announced an initial public offering (IPO) late last year, which is what helped the company increase its market capitalization to $100 billion in 2021. However, it’s also true that the EV company has recently experienced a sharp decline in share prices, up to 27%.

Ford’s Weaknesses – Internal Strategic Factors

1. Product Recalls

Ford faced a huge loss and poor brand image suffered due to product recalls back in May 2016. They recalled approximately 830,000 Ford and Lincoln vehicles to replace faulty side door latches. It also recalled vehicles in May 2015 because of the safety failures of Takata airbags. Ford recalled 20,500 Kuga PHEV vehicles in Europe after its high voltage battery causes the cars to ignite. The company also recalled more than 558,000 midsize SUVs in North America due to brake issues. [4] The company also issued 65 recalls in 2022, including more than 8.6 million vehicles.

2. Weak Foothold in Emerging Markets

As Ford’s operations are diversified in many geographical areas, they lack focus on performance and productivity. They do not have a stronghold in emerging markets like India.

3. Poor Reputation

Ford has a poor reputation compared to its European and Japanese rivals. Lincoln, in particular, is considered an inferior brand as compared to English and German luxury car brands.

4. Dependence on U.S Markets

Ford is highly dependent on the European and US markets, which limits its profits and revenues. Experts predict that the majority of future car sales will come from emerging markets such as China and India. Ford’s sales in the US market have been declining year after year due to the saturation of the market. In 2020, it sold just over 2.04 million vehicles in the US, representing a decline of 15% compared to 2.4 million vehicles in 2019. Dependence on the US market is becoming a major disadvantage for Ford. [5]

|

Region |

Revenue ($ billion) |

% |

|

United States |

105.481 |

66.7% |

|

Canada |

12.590 |

8% |

|

United Kingdom |

8.22 |

5.2% |

|

Germany |

6.471 |

4.09% |

|

Mexico |

1.813 |

1.15% |

|

All Other |

23.482 |

14.86% |

|

Total |

158.057 |

100% |

5. Overdependence on Trucks and SUVs

Ford’s diversified variety is disappearing quickly as the company focuses more on trucks and SUVs. Currently, trucks make up for more than half (54%) of Ford’s total number of vehicles sold in the U.S. market, with plans to increase SUVs in the future. In 2020, its car segment declined by 45% (vehicles sold). Depending too much on trucks and SUVs is risky since most consumers know about climate change and moving away from big gas guzzlers. [6]

6. Ford Records 7% Decline in Vehicle Sales in 2021

At the end of fiscal year 2021, the Ford Motor Company announced that it had experienced a 7% decline in vehicle sales. The company stated that due to uncertain economic conditions and complications in the supply chain, Ford struggled to roll out its trucks and other vehicles. Moreover, the company also needs help with worldwide chip storage.

Ford’s Opportunities – External Strategic Factors

1. Eco-Friendly Vehicles

As Ford is already trying to be technologically adaptive, they have a fantastic opportunity to produce fuel-efficient cars and commercial vehicles. For example, they can build vehicles that run on different forms of energy. In this way, they have more options for designing eco-friendly vehicles. The 2018’s C-Max and Fusion Hybrid car model can be their most significant opportunity, as they have already captured the market with this new model.

2. Increase Customer Base

Ford is already working on penetrating the automobile market in India and China, they have an excellent opportunity to tap into other small countries and grow their customer base. From July to September 2020, Ford’s sales in China rose by 25% to 164,352 units, which indicates the company’s growing customer base in Asia. [7]

3. Digital Marketing

Digital marketing is prevailing worldwide these days, so Ford has an opportunity to work on their digital marketing skills to grow its customer and supplier engagements.

4. Self-driving car

In 2017, Ford invested $1 Billion in Artificial intelligence company, Argo AI, to develop its self-driving technology. In addition, Ford has partnered with Walmart and Postmates to test the future of grocery delivery. Ford announced that it would introduce the “Active 2.0 Prep Package” in its Mach-E model that allows for hands-free driving in certain situations. Cars with this semi-self-driving technology will be available in the market by the second half of 2021. [8]

5. Expand into Related Fields

Ford has extensive experience in different sectors related to the auto industry. The company’s new CEO, Jim Farley, recently announced that it would be expanding operations into software, fleet management, electric vehicle charging, and other related technology fields. [9]

6. Ford Partners with Stripe Signing a 5-Year Contract

Ford has entered into a 5-year agreement with online payment company Stripe. The automotive giant plans to enhance its online commerce features, optimize e-commerce transactions and vehicle reservation capabilities, and streamline its vehicle ordering processes.

Stripe will help Ford scale its finance capabilities, adding features such as enabling commercial customers to make online purchases and re-route payments using Ford’s official website. With the new features, customers will be able to make payments to the right Ford and Lincoln franchises. The automotive company plans on launching Stripe’s payment technology after June 2022.

Ford’s Threats – External Strategic Factors

1. High Competition

Ford is already facing cut-throat competition from its rival companies like Toyota, Tesla, and Tata. Ford keeps struggling to maintain its innovative position in the industry.

2. Increased Prices of Raw Materials

The rising raw material prices of steel and steel coil can directly affect the company’s cost and profit margin.

3. Regulations and compliance

The compliance and regulatory threats for automobile brands have increased in the past years because of environmental improvements going around the world. Vehicles are now inspected for public safety and quality issues. Ford can face severe challenges if it fails to comply with the new regulations. Ford is facing a civil lawsuit in the US Supreme Court after it was sued by two people who were injured in crashes involving second-hand Ford vehicles. [10]

4. Market uncertainties

In the first quarter of 2020, market uncertainties globally hammered Ford very hard, leading to a decline in sales to 516,330 total vehicles, which was lower by 12.5% compared to the same period in 2019. It has been affected more adversely than its rivals General Motors and Fiat Chrysler. Market uncertainties also forced Ford’s German branch to apply for a $582 million loan from the German government to cushion the impact of the decline in sales. [11]

5. Strong Labor Unions

Canadian autoworkers union is growing stronger and using its influence against automakers operating in the country like Ford. In 2020, the union threatened to strike if Ford did not invest in safeguarding its employment in the long term. To avoid the strike, Ford was forced to invest $1.4 billion in its Oakville and Windsor plants in Canada as part of the deal with the union. [12]

6. Ford shuts down manufacturing plants in India & Brazil

Ford has stopped its automotive manufacturing operations in India. It means that Ford will stop selling Figo, Aspire, Freestyle, Ecosport, and Endeavor in India. However, Ford will continue to run its business solution, engineering, and customer support operations in India. Similarly, Ford closed three manufacturing plants in Brazil in 2021.

Ford is going through a restructuring program to raise its profitability, and the global pandemic accelerated this decision.

7. Superior Court Certified Class-Action Lawsuit Against the Ford Motor Company

The Superior Court certified the lawsuit earlier this month, which means it will go to trial. The automotive company was accused of advertising misleading campaigns, misrepresenting their 2013 and 2014 vehicle as having better fuel consumption.

The lawsuit is against all Ford subsidiaries as well as Ford Canada. It has been found that the company has violated regulations such as the Competitions Act and the OCP (Ontario Consumer Protection Act).

Recommendations

1. As Ford is manufacturing in various countries, it should improve its operations department by increasing efficiency and hiring the right employees and labor.

2. Ford should start producing more eco-friendly vehicles because the demand for these kinds of vehicles is growing worldwide.

3. Ford can partner with Uber and other app-based vehicle services to grow its revenue and customer base.

Final Thoughts

The above Ford SWOT analysis highlights the strengths, weaknesses, opportunities, and threats of this massive automobile manufacturer. The company needs to take quick and practical initiatives to remain competitive and profitable.

References & more information

- Ford Annual Report 2022

- White, J. (2020, Sept 17). Ford says new generation F-150 pickup trucks to go on sale in November. Reuters

- Wayland, M. (2023, Feb 2). Ford posts full-year net loss, ugly fourth quarter as ‘execution issues’ plague operations. CNBC

- AP (2020, Aug 13). Ford recalls midsize SUVs to fix possible brake fluid leaks. Economic Times

- ZX (2020, Jan 7). Ford reports US sales to decline in 2019 despite upbeat truck data. Xinhua Net

- Thibodeau, I. (2020, Jan 6). Ford sales were off 3% last year, but industry-wide totals still hit 17.1 million. The Detroit News

- Sun, Y. (2020, Oct 16). Ford’s Q3 China car sales rise 25% y/y to 164,352 units. Reuters

- O’Kane, S. (2020, June 18). Ford’s hands-free driving feature won’t be available until late 2021. The Verge

- Lienert, P. (2020, Aug 4). New Ford CEO Farley eyes expansion into tech fields. Reuters

- Frankel, A. (2020, Oct 8). Supreme Court struggles over broad jurisdictional rules in Ford crash cases. Reuters

- Miller, B. (2020, April 4). Coronavirus hammers Ford, as sales drop more than 12 percent. Biz Journals

- AFP (2020, Sept 22). Ford reaches a deal with the Canadian union, averting a strike. Economic Times

Great work. Really helped with my assignment.

Hi Nijad,

Thanks for the word of appreciation, I am glad you liked it.

Happy reading !

“Great work. Really helped with my assignment.”

HAHA!! ctrl+c ,ctrl+v ..

just like that.

thanks its really helpful.

Ishan,

Ha Ha Ha, glad it helped with your assignment.

Happy reading!

Thank you so much! It really helped with my presentation!!! 😀 Thank you!