Company: Walmart

CEO: Doug McMillon

Year founded: 1962

Headquarter: Bentonville, USA

Number of Employees (2024): 2.1 Million

Public or Private: Public

Ticker Symbol: WMT

Market Cap (Feb 2025): $812.6B Billion

Annual Revenue (FY 2024): $648.13 Billion

Profit |Net income ( FY 2024 ): $27 Billion

Products & Services: Retail | Money Services | Health Services | Pet Services | Product Services | Registry Services | Auto Services | Business Services

Competitors: Target | Amazon | JC Penney | Best Buy | Kroger | KMart | Giant Eagle | Ikea | Ali Baba | Home Depot | Lowe | 7 Eleven | Walgreens | CVS

Fun Fact:

- Did you know that Walmart makes a profit of $1.8M every hour?

- Walmart is the largest retailer in the world, with over 10,000 locations and sales of upwards of $600 billion.

- Doug McMillon, the CEO, has worked in the company for over 30 years, starting as a teenager unloading trucks.

- Walmart is one of the biggest employers in the world, employing over 2.1 million people.

- Walmart has its museum in Walton’s 5 & 10 in Bentonville, Arkansas.

An Overview of Walmart

Everyone’s favorite big box store, Walmart, is the world’s largest retail corporation that sells everything from groceries to musical instruments. More than 270 million customers visit Walmart for their purchases every week, and many make online purchases through its website.

Walmart started as a single small discounted store in 1962 in Arkansas. For 50 years, it has grown into the largest retailer, with over 10,000 stores in 19 countries and websites (e-commerce) in 10 countries. It operates through three primary business segments: Walmart U.S., Walmart International, and Sam’s Club.

Its core business revolves around offering low prices for its customers every day, which it achieves through economies of scale and an efficient supply management system. The retailer also focuses on cost leadership, which leverages its purchasing power to negotiate lower prices from suppliers.

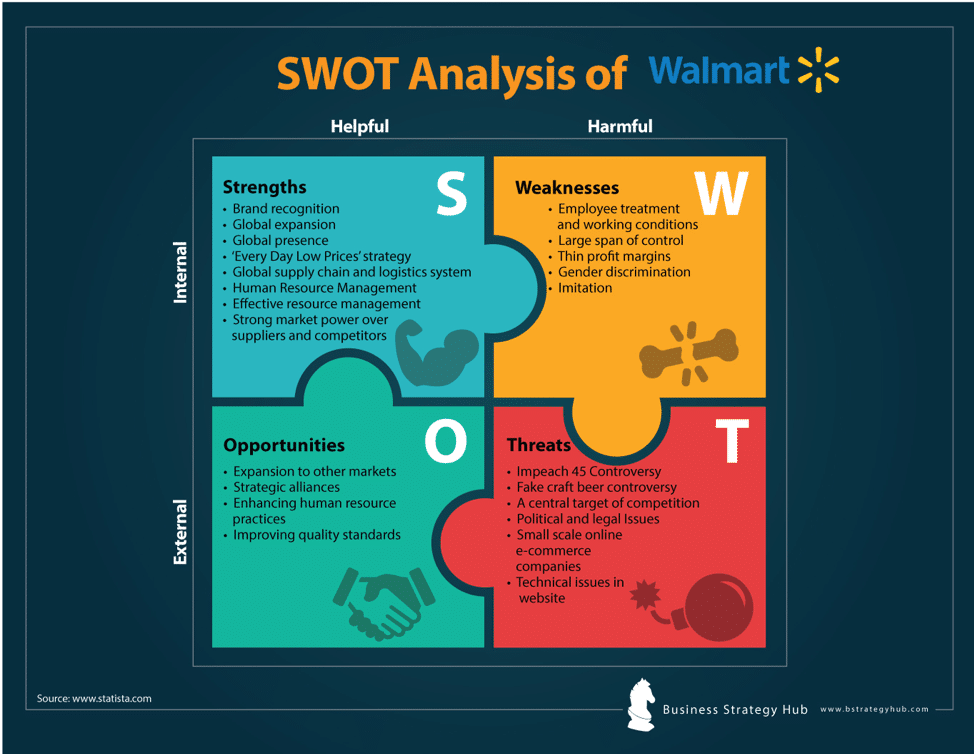

Read the article and get a detailed sketch of this retail giant through the SWOT analysis of Walmart.

Following is the Walmart SWOT analysis:

Walmart’s Strengths – Internal Strategic Factors

1. Brand Recognition

While serving 37 million customers daily and 255 million customers every week, Walmart is the most recognized retail brand in the world. There are over 70 million items available at the Walmart online store. Walmart comes in third as the world’s most valuable retail brand, with a brand value of about $69 billion.

2. Global expansion

Walmart has strengthened its footprint on the international scene with the acquisition of ASDA, the UK-based retailer, and Indian e-commerce giant Flipkart. Besides, it has created a joint venture with India’s most prominent retail store, Bharti.These global expansions have proven to be a great success for the company. It currently maintains operations in 19 foreign countries, which allows it to diversify its revenue streams. The company plans to reach $200 billion in gross merchandise sales in international markets in five years.

3. Robust and Diverse Revenue Streams

Walmart is known for its diversified sources of revenue, which give the company both stability and adaptability, even in the fast-changing business landscape. This variety is achieved through the company’s expansion into new markets, industries, and business areas. Beyond its current income sources, Walmart has also invested in e-commerce and digital technologies. Walmart’s strategy of spreading its income sources gives it an edge because it’s too dangerous to depend too much on just one product or market segment.

4. ‘Everyday Low Prices’ strategy

Walmart is based on an economies-of-scale agenda that allows low prices. In this case, it leverages its size to purchase goods in bulk from suppliers, therefore being able to negotiate lower prices than its competitors can. In return, it can offer customers significant discounts, which explains its high gross merchandise sales. It has fixed costs for thousands of products. Thus, it’s one of the cheapest shopping places in the world.

5. Global supply chain and logistics system

The distribution and logistics systems are Walmart’s core competencies . It uses information technology (I.T.) to monitor the performance of every product in each store in each country efficiently. Walmart’s approach to managing its supply chain focuses on establishing direct, enduring connections with producers, suppliers, and online retailers. The aim is to minimize the number of interactions in the supply chain to cut down on delivery times and accelerate the process of getting products to customers.

6. Strong Customer Base

With a large and loyal customer base, Walmart has built a strong base in the retail industry, focusing on keeping customers and achieving steady business expansion. With over 250 million customers shopping at Walmart stores weekly, the company generates billions of dollars in revenues. By regularly analyzing customer data, Walmart can collect and examine information on how customers act, what they buy, and what they like. This information allows the company to customize its offerings to better suit its customers’ requirements, leading to higher customer happiness and loyalty.

7. Human Resource Management

Employees are Walmart’s critical assets. It invests hugely in developing and managing its employees. 0.5% of America’s working population is employed at Walmart. It also operates its resources, including information systems, supply chain networks, distribution facilities, knowledge, and other skills. It has excellent operations in all the locations.

8. Effective adoption of e-commerce

While Walmart is known as a brick-and-mortar store, it’s also becoming a big player in online sales, which aligns with the digital revolution. Its online sales in the U.S. grew by 22% in its fiscal Q1 2025 as global e-commerce sales grew 21%, reaching $100 billion. Online sales have been growing 31.8% per year.

Walmart’s Weaknesses – Internal Strategic Factors

1. Overdependence on the U.S. Market

While Walmart operates close to 10,607 retail units, more than 45% of the stores are in the U.S. In fiscal 2024, the company generated 69% of its revenues in the U.S. at $441.8 billion, affirming its reliance on North America’s operations for profits. Reliance on the U.S. market exposes the company to risks from economic shifts and variations in the U.S. economy. Given that the U.S. market represents the bulk of Walmart’s income, any downturn or recession in the U.S. can significantly affect the company’s financial health. A clear illustration of this is the 2008 global financial crisis. Walmart’s sales and income were deeply affected by the severe economic downturn in the U.S. Overdependence on the U.S. market also leaves the company vulnerable to political and regulatory changes.

2. Employee treatment and working conditions

Despite holding the title of the world’s biggest private employer, boasting more than 2.1 million workers, Walmart’s employment policies have faced widespread criticism and debate for a long time. The corporation has been charged with mistreating its workers, sparking numerous issues related to employee safety and leading to adverse media attention for Walmart. It has received criticisms and lawsuits several times regarding its workforce. Low wages, inadequate healthcare, and poor working conditions are a few issues that have been publicly criticized. Walmart has also faced backlash due to its low pay and substandard work environments. It’s reported that many of the firm’s workers receive minimum wage or just a bit more, which frequently falls short of covering basic needs or supporting a household. Consequently, there’s a considerable staff turnover rate, as workers often depart in pursuit of higher-paying positions.

3. Thin profit margins

Walmart has made a name for itself by offering its customers products at affordable prices. This approach helps the company attract new shoppers and keep current ones, which poses a challenge. Walmart’s low-cost leader strategy has led to thin profit margins. For instance, it generated an operating income of $27 billion on selling goods worth $642 billion in fiscal 2024.

Offering low-quality products might result in a reduced focus on research and development. The company may be reluctant to spend on new technologies or creative solutions due to the potential increase in expenses, which could lead to higher prices for consumers. Moreover, Walmart’s focus on low prices can also affect its interactions with suppliers. The low prices Walmart sets for its products compel suppliers to reduce their prices, potentially affecting their profit margins. This demand for lower prices can strain the relationships between Walmart and its suppliers.

4. Limited e-commerce operations

In an era where almost everything occurs online, Walmart is paying a price for focusing on the traditional brick-and-mortar retail business instead of enhancing its operations on commerce. The company faces the risk of falling off and lagging as its fierce competitors, led by Amazon and Alibaba, continue growing their online sales and targeting more customers.

Walmart’s restricted online sales strategy leaves the company at a severe disadvantage in a significant and swiftly expanding market. Online shopping has grown in popularity over the past few years, with shoppers preferring the internet for its ease and affordability. Walmart’s restricted online sales strategy hampers its ability to take advantage of this shift.

5. Competitive disadvantage

Walmart’s focus on affordability and low prices has left it at a significant disadvantage compared to the product quality of specialty retailers. Specialty retailers provide unique products and services, including superior customer support and upscale food options. Walmart is required to maintain a wide range of stock levels, which could lead to a decrease in the company’s focus. This might impact the product’s quality and the level of customer contentment. Additionally, shoppers often need more choices in sizes, prompting them to seek alternatives from different stores.

Imitation: Walmart’s business model can be easily copied. The company owns no specific competitive edge over its rivals except for its vast business size.

Walmart’s Opportunities – External Strategic Factors

1. Expansion to other markets

While Walmart operates in 19 countries, it has yet to unlock the full potential of the global retail market, which is growing at an 8.5% compound annual growth rate and is projected to be worth $31310.6 billion in 2024. Walmart can take advantage of this opportunity by expanding its business to markets it has yet to venture into, especially in Europe, Africa, Latin America, and the Middle East, where it has a limited presence. As online shopping becomes an integral part of modern society, Walmart can tap this opportunity by enhancing its online offerings and deliveries to grow its sales.

2. Strengthen online sales

The number of online consumers has increased dramatically recently as the e-commerce market grows at a CAGR of 8.5%, expected to be worth $7.9 trillion by 2032. Walmart can strengthen its online sales channels to exploit this opportunity. Focusing on e-commerce sales can help bolster the company’s market share.

3. International Shipping Opportunity

Walmart boasts of one of the biggest and most robust shipping networks it uses to ship products across the globe. Likewise, the company can venture into the global cargo shipping network using its already developed network to take advantage of opportunities in the shipping market expected to reach $4.2 trillion by 2031. Establishing an international shipping operation would also help enhance its e-commerce business, allowing it to compete better against Alibaba and Amazon.

4. Advanced Technologies Opportunities

The markets for Augmented Reality (A.R.) and Virtual Reality (V.R.) are growing at a compound annual growth rate (CAGR) of 11.8%. They are expected to reach a combined value of $106.2 billion by 2033. Amid the growth, the technologies are increasingly used in retail. Walmart can tap into the two technologies to enhance the customer’s experiences in its online and offline marketplaces. Customers have already shown that they are more than ready to shop in stores that offer A.R. experiences. The advantages of incorporating augmented reality/virtual reality into the customer’s purchasing journey are significant, encompassing greater involvement and conversion rates, increased expenditure per transaction, and enhanced satisfaction throughout the entire buying experience.

Walmart’s Threats – External Strategic Factors

1. Competition Threat

The world’s largest grocery retailer, Walmart, is always a primary target for competitors. Stiff competition from traditional retailers like Target and Costco and e-commerce heavyweights like Amazon pose the biggest threat to Walmart’s prospects. The company has been forced to resort to steep discounts as one of the ways of holding on to customers and shrugging off competition, which has significantly affected its margins. A significant obstacle for Walmart in dealing with the fierce competition is the strain on its pricing strategy. As various stores vie for a piece of the market pie, there’s an ongoing downward trend in pricing. Consequently, Walmart must constantly tweak its pricing approach to stay ahead. This can lead to diminished profit margins and decreased income.

2. Regulatory Risks

Walmart has operations around the globe and is subject to various regulations that keep changing. Because of its large scale, growth across different regions, and intricate operations, Walmart faces a variety of legal and regulatory requirements in both domestic and international areas. Such changes can affect how the company operates and its costs, affecting its profitability. In addition to national regulations, Walmart has often been scrutinized for its employment policies and how it treats its workers. The retail giant has recently encountered a series of legal actions and inquiries due to problems like unpaid wages, unfair treatment, and substandard work environments. Such inquiries could lead to significant penalties, harm to Walmart’s image, and expensive court cases. These actions could lead the government to enact legislation against Walmart’s interests to safeguard the public.

3. Economic uncertainty

Walmart’s core business depends heavily on the health of the economy. In times of economic uncertainty and recession, consumer spending power takes a hit, affecting their ability to buy goods and services that Walmart sells. During such periods, Walmart is always susceptible to significant reductions in revenues and earnings. Moreover, when the economy is struggling, people tend to buy cheaper items or visit stores that offer lower prices, leading to more competition for Walmart.

4. Changing Shopping Patterns

A further risk to Walmart’s business strategy comes from consumers’ constantly changing tastes and purchasing behaviors. Tastes can shift due to various factors, including economic fluctuations, technological progress, and changes in cultural norms. For instance, in recent times, consumers have grown awareness about the importance of environmental sustainability and ethical business conduct.

Consequently, they might prefer to purchase from retailers that emphasize these principles, even if it means they have to pay more. Thus, Walmart could significantly decline its customer base if it fails to recognize these shifting tastes. Shifting tastes among shoppers can also affect the variety of items Walmart stocks. Should Walmart neglect this, it might experience a significant drop in sales, and its position in the market.

5. Hacking and Data Breach Risks

Walmart is one of the biggest retailers, catering to millions of shoppers daily across 19 nations. The firm gathers details from customers’ credit or debit cards in nearly every purchase, whether for in-store purchases or online transactions. It secures this card information and safeguards it against unauthorized access. However, there’s always a risk of data breaches, and customer information has been compromised and leaked occasionally. Its e-commerce activities rely on the safe transfer of private data through public networks, which includes details allowing for payments without cash. As hackers up their game by deploying sophisticated technologies and tactics, Walmart is always susceptible to attacks that could significantly lose confidential data and money, leading to regulatory scrutiny and fines.

Recommendations

The following recommendations are given through which Walmart can improve its weak points and strengthen its market position for the future:

- Improving its HR management standards and resolving the employees’ issues. An effective HR system will prevent Walmart from any potential criticism regarding its workforce.

- Expansion of business to global markets – Walmart needs to explore opportunities in developing markets to strengthen its position and increase market share.

- Bringing advanced improvements in the global supply chain and distribution network – It will fortify its vast retail empire.

- Addressing the controversial issues as quickly as possible. Walmart needs to enhance its online selling website and include only authentic products to prevent further public criticism.

- Upgrading its online e-commerce sites. Walmart needs to resolve technical issues that hinder the website’s progress and offer a satisfying shopping experience for the customers.

- Boosting marketing and promotional activities – it will help the company to enhance its brand image and attract new customers.

- Walmart should also play an active role in environmentally sustainable practices to create a positive image in the industry.

References & more information

- Stambor, Z. (2023 June 5).Walmart eyes growth in international markets and retail media. Emarketer.

- Görlitz, L. (2024 April 7). U.S. Retail Giant Reached US$100 Billion. ECDB

- (2024 February).Retail Global Market Report 2024. Research an Markets.

- Wankhade, U. (2024 February 23). Global Retail E-Commerce Market Size, Forecast, Analysis & Share.

- (2024 April 11).Augmented Reality and Virtual Reality Market at a CAGR of 11.8% by 2033. Linkedin

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

I started working at Walmart and it sucks

We watched tone of videos and then we’re sent onto the floor with out any real training. They are way to expensive for the quality of the products they have. They sometimes keep us at work late but don’t like to pay overtime and night shift people only get a half hour lunch even though they move and transport heavy items with not training other that a couple videos on the WIMIS stuff and how to use a scan gun that’s pretty much all the training I got then they put me out to work and said “just figure it out in the next few days”