Company: Target Corporation

CEO: Brian Cornell

Founders: George Dayton

Year founded: 1902

Headquarter: Minneapolis, Minnesota, United States

Number of Employees (Oct 2020): 368,000

Type: Public

Ticker Symbol: TGT

Annual Revenue (Feb 2019): $78.1 Billion

Profit |Net income (Feb 2019): $2.937 billion

Products & Services: Beauty and health products, bedding, clothing, and others

Competitors: Walmart | Amazon | Best Buy | CVS | Walgreens | TJX companies | Macy’s | Costco | Home Depot | Lowe’s | Kroger |

Fun Fact:

Target Corporation is amongst the 10 largest employers in the United States of America.

Introduction

Target Corporation was formed in 1902 in Minnesota, United States. The company is reputed for providing differentiated merchandise to its customers at discount prices, ranging from luxury products to everyday essentials. Their suite of fulfillment options, loyalty offerings, devotion towards innovation, advanced technology, and efficient supply chain has enabled Target to provide their customers with the preferred shopping experience.

The disciplined approach adopted by the organization towards business management has opened new routes for future growth. For facilitation of customers, the presence of digital channels has made it easier for purchasing the products.

Let’s reveal the competitive advantages of Target Corporation by exploring its latest dynamic through a SWOT analysis as it has allowed it to attain dominance in the retail industry of the US.

Target’s Strengths (Internal Strategic Factors)

-

Wide Range of Merchandise – One stop shop for all items including Pharmacy, Grocery, designer clothes, accessories, electronics, sporting goods, home décor, etc. For the benefit of customers, their digital channels also offer a wide range of merchandise along with complimentary assortment. In March 2020, Target joined the list of a few retail stores that benefited from the panic buying of essential goods. Even though the company’s revenue from apparel, accessories, home décor, and sporting goods declined, it saw a more than 50% rise in same-store sales thanks to a rise in demand for groceries, foodstuffs, toiletries, and other essential goods. [1]

-

Brand positioning – They provide trendy, fashionable merchandise of high quality at discounted prices for their customers. The customer base that Target attracts is medium to high-income group families with a median household annual income of $64K.

-

Customer shopping experience – Target offers a better experience to customers as compared to Walmart through an improved floor plan, better shopping carts, clean store environment, and well-lit and marked aisles. The retailer has attained immense success in trying time thanks to its store-centric fulfillment model. The effectiveness of Target’s store-centric fulfillment model contributed to the growth of same-day services by 278% in the first quarter of 2020. The fact that nearly 90% of its online orders were fulfilled swiftly through stores highlights that Target’s investment in customer experience, satisfaction, and fulfillment is paying off. [2]

-

Designer apparels – For maximum satisfaction of customers and provision of variety, Target offers designer clothes in their stores by partnering with elite fashion designers. Roughly 20% ($15 Billion) of their total revenue ($75 Billion) comes from “apparel and accessories” segment.

- Partnership with Starbucks – The partnership of Target Corporation with Starbucks is highly effective for increased sales as Starbucks drives traffic to target stores.

-

Charity work in the community – Philanthropy is a core value of Target Corporation, which is evident from its program sponsorships and donations. Since 1946, the Target Foundation has been distributing 5 % of its profit (4 million each week) to the local communities towards kids’ education, food drives, disaster preparedness, and relief efforts.

-

Efficient System of Distribution – To allocate the vast majority of merchandise, Target Corporation utilizes its 40 distribution centers and collaborates with common carriers for shipment of general merchandise.

-

Market Presence: Target has a strong presence in the US market. They have a total of 1844 stores in 49 US states, with the most number of stores in California (287), Texas (150) and Florida (123).

-

Effective Inventory Management – Various forms of replenishment and inventory management techniques (demand forecasting, planning, vendor management, seasonality) are adopted to minimize spoilage, lost sales, and inventory markdowns. Target added inventory planning software in Q3 of 2019 to maintain optimum inventory levels without leading to stockouts or interrupting the flow of backroom operations. The retailer is also planning to adopt a robotic sorting system to manage its inventory at the warehouses. [3]

-

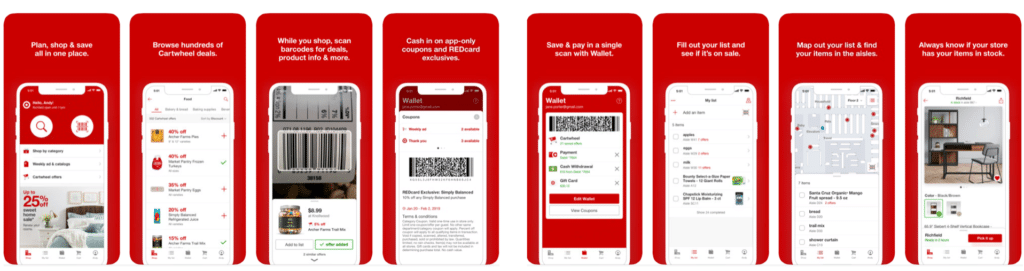

Digital Services (App) – Target has created an excellent app, “Cartwheel,” for its digitally savvy customers. Through cartwheel app, Target shoppers can order online, check store inventory, check prices, find items by aisle location, access coupons/ offers, scan items, checkout, manage a credit card, etc.

-

Effective Adoption of E-Commerce – In 2020, Target leveraged e-commerce very effectively to fulfill the needs of its customers. The effective adoption of e-commerce resulted in a 195% increase in digital sales in Q2 of 2020. Target’s same-day services grew by 273%, driven by the success of its in-store pick-up, Drive up and Shipt, which increased its total quarterly revenue by 25% to $22.98 billion. Target is now one of the top three e-commerce giants, along with Amazon and Walmart. [4]

- Strong Financial Growth – Target is on its 11 consecutive quarters of positive sales growth and healthy performance in-store and online sales channels. In FY 2019, net earnings increased from $2.94 billion in FY 2018 to $3.28 billion. Target increased its online sales and in-store growth rate further in 2020. Its profit for the fiscal second quarter of 2020 increased by 80.3% to $1.7 billion. Target has built a sustainable business model that will continue to catalyze strong topline growth, bottom-line performance, and high profitability in the long-term. [5]

-

Robust Omnichannel Model – Target’s years of investment in its supply chains and inventory visibility across both online and in-store channels have delivered one of the best omnichannel models in the retail sector. It enabled the company to pivot very quickly from the in-store model to curbside pickup, ship from store, and other online/in-store sales methods. In April 2020, Target’s digital sales increased by 282% year-over-year, with 80% of digital orders being fulfilled in its stores. [6]

Target’s Weaknesses (Internal Strategic Factors)

-

Expensive – According to a study conducted by business insider, Target charges about 15% more for groceries compared to Walmart, their biggest competitor.

- Customer Data Security – In 2014, Target had faced one of the worst data breach incidents. Nearly 70 million customers’ credit/ debit card information was stolen. AS a result, it has negatively impacted Target’s reputation, and they had faced many class-action lawsuits.

-

Little presence in the International Market – Target has failed to expand into the international market. From 2011-2015, Target had opened 133 stores in Canada. However, their expansion to the international market was a big failure, and soon, Target had to close down all of its stores in Canada.

- Store-Centric Approach – In the digital age, retailers have to adopt an e-commerce-first approach. Even though Target is one of a few retailers that has benefited from the rise in online shopping, a decline in brick-and-mortar sales is undercutting gains online. Target’s sales of apparel and accessories have also declined, which is worrying because these are low-margin items. A decline in sales of low-margin products has a bigger impact on the profits. [7]

Target’s Opportunities (External Strategic Factors)

-

Target’s partnership with CVS – In December of 2015, CVS Health had acquired Target’s clinic and pharmacy business for nearly $1.9 Billion. What it means is that the Target pharmacy section is managed and operated by CVS health now. It gives Target customers a great opportunity to access industry-leading health care services in their stores.

-

Small – Format Stores – Target Corporation has been opening small-format stores that are located in dense urban areas and college campuses, etc. These stores are roughly one-third of the size of their normal average size stores. The company opened its 100th small-format store in the summer of 2019, with total sales through these stores exceeding $1 billion by the end of 2019. In 2021, the company will introduce its first compact small-format stores of about 6,000 square feet in densely congested neighborhoods and college campuses. Also, it plans to open almost three dozen new small stores ranging from 12,000 to 40,000 square feet. Small-format stores have immense potential and can drive Target’s growth for many years to come. [8]

-

REDcard Rewards Loyalty Program – Target has a great opportunity to expand its REDcard loyalty program, allowing it to gain insights about changing customer habits and their preference. This will also provide them access to customer information for marketing and promotions.

-

Same Day Delivery – Target has acquired a grocery delivery service Shipt for $550 million to provide same-day delivery like Amazon and Walmart to accelerate its effort of digital fulfillment. In 2020, Target has focused on adding Drive Up for grocery pickup in dozens of its small-format locations to expand same-day delivery service further. [9]

-

Expand Private-Label Brands – Another key opportunity for Target is to develop its own portfolio of private label brands. Private label brands help differentiate retailers, and they carry higher margins.

-

Increase Market Presence – Target has increased the number of stores from 1,844 to over 1,868 stores in 2020, which increases its market presence. Most of its new stores are mega shopping centers that stock everything from apparel to electronics and groceries. About 80% of Target’s stores are 50,000 to 169,999 square feet, and 15% are bigger than 170,000 square feet. The remaining 5% are small-format stores that are smaller 49,999 square feet. [10]

- Store Remodeling – While renovation might seem like a small investment, it has a high return on investment (ROI). By the end of 2020, Target expects to complete remodeling its 300 stores to bring the total of remodeled stores to 1000. Each remodeled store will see an increase in sales of between 2% and 4% in the first year alone and can maintain at over 2% in the next few years. If sales in all its 1000 remodeled stores increase by an average of 3%, the total revenue generated will rise by a wide margin. Store remodeling is a major growth opportunity for Target. [11]

Target’s Threat (External Strategic Factors)

-

Local Competition – Target operates in a highly competitive and low margin industry. Its major competitors like Walmart, Costco, Kroger, Home Depot, etc. have numerous stores located close to the local population, thus impacting their market share. To counter stiff competition in the e-commerce sector from Amazon, Target commenced its holiday season deals in October. It also expanded its Black Friday pricing for the whole of November with nearly 1 million more deals. The company has to spend more and more to keep up with the frontrunners, which will continue into its profits as the competition increases. [12]

-

Changing Customer Preferences – The performance of Target Corporation may have intense negative implications due to the growing trends of online shopping. The growth streak of competitors like Amazon is moving further, pushing its supply chain management with online shopping. Although it may create opportunities for growth, yet the logistics expansion and on-time delivery by Amazon towards changing customer demands may pressurize and create difficulties for Target to compete in populated hubs.

-

Failure to differentiate – The failure to differentiate may serve as a threat to Target Corporation. Their brand loyalty may be affected due to the shift of numerous shoppers towards emotionless and price-sensitive online shopping.

-

Vulnerable to Economic Downfall – Target sales are highly dependent upon the macroeconomic factors. Since most of their stores are in the US market, when there is a turbulence in the health of the US economy, Target’s business is also negatively impacted.

-

Low Barrier to Entry – The retail business, although capital intensive, is easily replicable. Any new company can undercut Target’s prices and take a big share of the market.

-

Market Uncertainties – Uncertainties in both local and global markets has impacted the bottom line of many retailers. Even though Target has not been affected significantly, the uncertainties have forced the company to revise its projections and expansion plans. The company announced that it is downsizing its store remodeling plans from 3000 to only 300 due to market uncertainties. [13]

-

Rising Costs – Target’s Q1 profit plunged by 64% due to rising costs of doing business. Although online sales increased by 141% and quarterly revenue rose 11.3% to $19.37 billion, the company spent about $500 million to maintain safety measures. The high cost of doing business eroded its gains leading to a decline in net earnings from $795 million in Q4 2019 to $284 million in Q1 2020. [14]

Conclusion

Deriving immense level of customer loyalty and benefiting from globalization, Target Corporation as one of the reputed retailers in the United States.

In spite of this, it is necessary for the entity to consider all material aspects that may negative implications on the organization. Thus, this SWOT analysis of Target evaluates the strength, weakness, opportunity, and threat, which Target Corporation encounters in its respective market.

References & more information

- Venugopal, A. (2020, Mar 25). Sales of essential goods at Target soar in March as shoppers stock up. Reuters

- Kapadia, S. (2020, Aug 17). Target’s investments in store-centric fulfillment pay off. Supply Chain Dive

- Leonard, M. (2020, Jun 5). Target’s plan for a store-fulfillment manager. Supply Chain Dive

- Perez, S. (2020, Aug 19). Target sets sales record in Q2 as same-day services grow 273%. Tech Crunch

- Repko, M. (2020, Aug 19). Target reports a monster quarter — profits jump 80%, same-store sales set a record. CNBC

- Alpha Staff (2020, May 14). Target: Riding The Wave Of Omni Channel Retail In 2020. Seeking Alpha

- Repko, M. (2020, April 23). Target’s shares tumble as retailer says first-quarter profits will be hurt by higher costs. CNBC

- Genovese, D. (2020, Mar 24). Target’s small stores getting even smaller. FOX Business

- Springer, J. (2020, Aug. 19). Target Refires Drive-Up Grocery. Win Sight Grocery

- Redman, R. (2020, Mar 03). Target accelerates the omnichannel game plan. Supermarket News

- Unglesbee, B. (2020, Mar 24). Target plans a 6K-square-foot store as it ramps up small format expansion. Retail Dive

- Balu, N. (2020, Sept. 29). Target to start holiday discounts in October, take on Amazon’s Prime Day. Reuters

- Kline, D. (2020, Mar 25). Target Downsizes Its 2020 Store Remodels Due to Coronavirus. The Motley Fool

- Kalluvila, S. (2020, May 20). Target profit sinks 64% as COVID-19 costs offset gains from sales surge. Reuters

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

Add comment