Company: TESLA, Inc.

Subsidiary: SolarCity, Maxwell Technologies, Tesla Grohmann Automation, Hibar Systems

CEO: Elon Reeve Musk, since Oct 2008 – Present

Founders: Elon Musk, Marc Tarpenning, Martin Eberhard, Ian Wright, JB Straubel

Year founded: 2003

Headquarters: Austin, Texas

Type: Public

Ticker Symbol: TSLA, NASDAQ

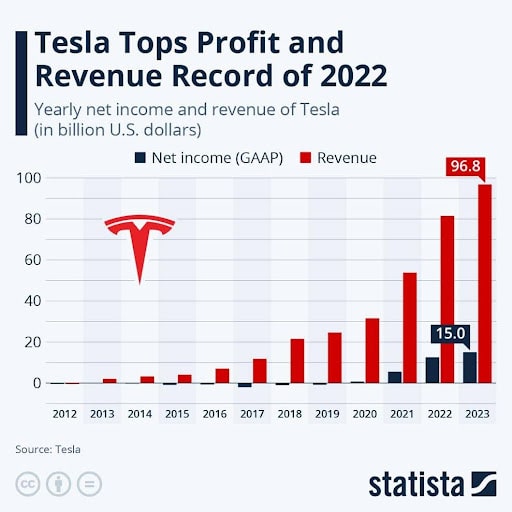

Annual Revenue(FY 2023): $96.8 Billion

Profit | Net income (FY 2023): $14.99 Billion

Products & Services: Tesla Motor Vehicles | Auto service | Financial Services | Energy Storage (Power battery packs) | Solar panels | Lifestyle products | Retail merchandise

Competitors: Mercedes-Benz | BYD| Volkswagen | AION | SGMW| BMW | Hyundai | Kia | Ford

Did you know ?

Tesla models together spell as S-E-X-Y (S3XY)

S = Model S

E = Model 3

X = Model X

Y = Model Y

Image Source: Reddit

Introduction

Tesla Inc. is an American automotive and energy company that moved its corporate headquarters to Austin, Texas, from Palo Alto, California, in 2021. Tesla Inc. was first incorporated in July of 2003 as Tesla Motors and was named after Nikola Tesla, a successful inventor and electrical engineer. In February 2017, its name changed from Tesla Motors Inc. to Tesla Inc. to better reflect its scope of business, which also includes energy.

Tesla, Inc. has reached vertigo-inducing success as a dynamic automotive and energy solutions business. It is famous for its innovative approach, dominant position worldwide, and its brilliant and erratic CEO Elon Musk, who enjoys saying what he wants, when he wants, and who has no qualms smoking weed on the world’s most popular podcast.

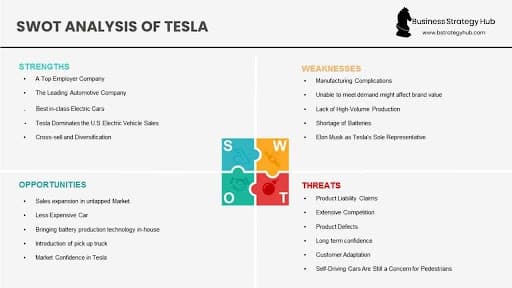

Tesla has emerged as one of the most discussed and analyzed companies among business enthusiasts. This SWOT analysis of Tesla will reveal all the significant insights regarding every factor of Tesla’s business model. Moreover, the overall results of this analysis also provides opportunities for strategic reforms in light of all the SWOT factors, i.e., strength, weakness, opportunities, and threats.

So, let’s dig in and find out what factors affect this incredible organization’s competitiveness in the global automotive and energy markets.

Tesla’s Strengths

Let’s start with the strengths of Tesla Inc., which will include the positive internal aspects of the company, which have reinforced Tesla’s position as one of the most dominant companies in the world for the past decade.

The following strengths are factors that are Tesla’s top attributes that have ensured the company’s profitability, expansion, and popularity, especially in the long term.

1. Most Valuable Automotive Company

Despite its issues, Tesla’s sales revenue was $96.8 Billion, with 1.81 million vehicles to customers in the 2023 fiscal year. The increase in the number of deliveries and its profitability of $14.99 Billion pushed the company’s market capitalization to just over $500 Billion. It surpassed the market cap of these top four automakers: Toyota, Volkswagen, Ford, and General Motors.

Tesla became the world’s most valuable automaker by market value and continues to hold its dominant position.

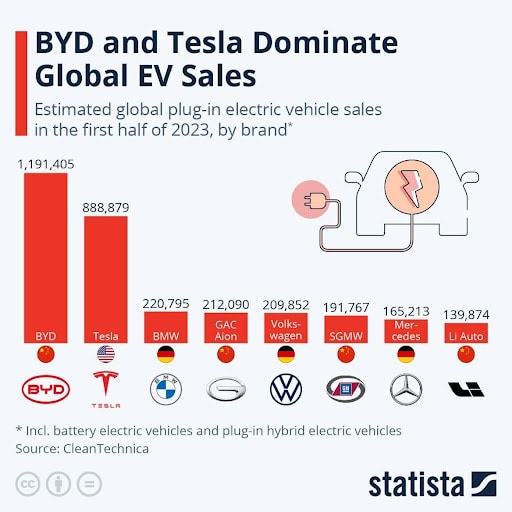

Image source: Statista

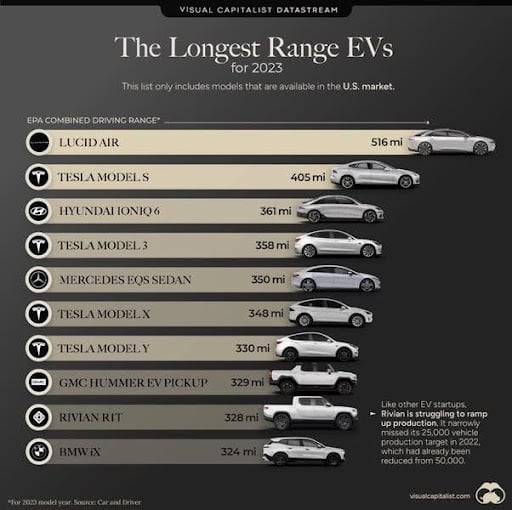

2. Best in-class Electric Vehicles

Tesla has jumped well ahead of every other electric vehicle manufacturer in producing the finest electric cars. When comparing the range of electric vehicles, Tesla vehicles have proven to be the best. A recent comparison shows that four Tesla models, S, 3, X, and Y, are in the top 10 when comparing electric vehicle driving ranges. The Tesla Model S will get you the furthest of all Tesla models – traveling up to 405 Miles on a single battery charge.

Image Source: The Visual Capitalist

3. Strong Electric Vehicle Delivery and Over 50% Electric Vehicle Market Share

In 2023, Tesla delivered 1,808,581 vehicles, a 38% increase compared with 2022. Even with recent electric vehicle headwinds, Tesla has grown its electric vehicle market share to 51.3% as of Q1 2024.

Image Source: Statista

4. Cross-sell and Diversification

Tesla has launched a comprehensive insurance program for its vehicles, which CEO Elon Musk said could represent 30% to 40% of Tesla Inc.’s future value.

5. Innovative Company

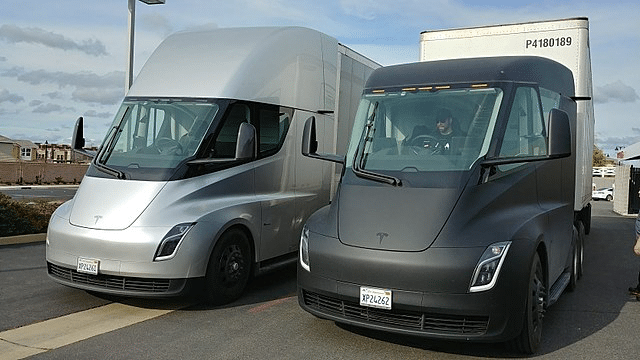

Tesla has been and continues to be a leader in innovation. Two noteworthy Tesla innovation examples include the world’s first fully electric semi-truck and its Cybertruck, which has been available in North America since December 2023. With an impressive track record, the market trusts and expects the company to develop competitive and profitable products, leading to substantial financial gains.

Image credit: Sven Piper

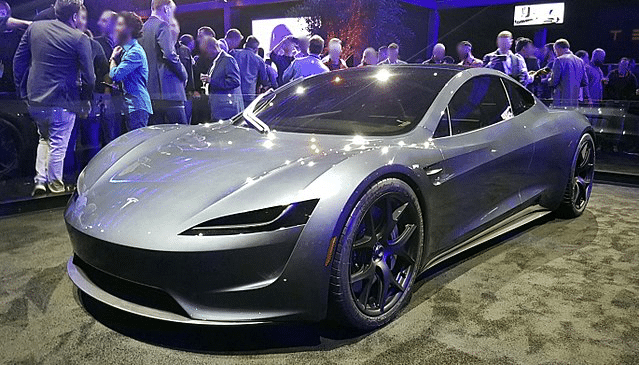

Image Credit: Smnt [CC BY-SA] | Wikimedia Commons | Tesla New Roadster 2020 Model

Image Credit: Korbitr [Public domain] | Wikimedia Commons | Tesla Semi

6. Better Positioned

According to Business Insider, it could take US automakers another ten years to catch up to Tesla regarding electric vehicle market share. As more US and global consumers move to electric vehicles, Tesla won’t face the same problems traditional automakers will need to contend with, such as how best to transition from combustion engine vehicles to electric ones.

7. Unconventional but Effective Strategies

Tesla’s unique but highly effective management strategy was exposed after its employee handbook was leaked to the public. It revealed the unconventional secrets behind its success. Just like its founder, Tesla’s handbook is no-nonsense, direct, and to the point. The company hires the smartest and most innovative employees and holds them accountable by setting clear and concise targets.

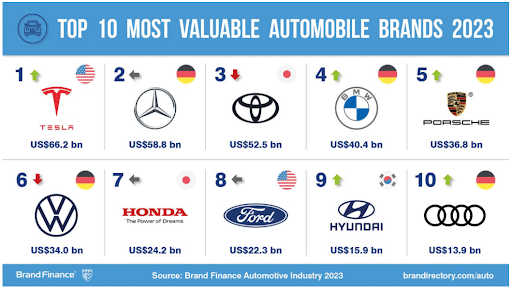

8. Strong Brand Value

Tesla continues to have an attractive brand known for producing stylish and environmentally friendly electric vehicles. In fact, as of 2023, Tesla has become the world’s most valuable automobile brand with a brand value of $66.2 Billion, moving past Mercedes-Benz (brand value: $58.8B) and Toyota (brand value: $52.5B) to claim the top spot.

Image credit: Brand Finance

9. A Top Employer Company

Any organization is only as good as its employees. In the case of Tesla Inc., it is one of the key factors for the company’s remarkable success. Wall Street Journal reports that Tesla has emerged as an ideal company for employees due to its diversity and innovation-encouraging culture.

Image source: Elon Musk Tweet

10. Charismatic CEO

While this can be a double-edged sword, there is no denying that Tesla’s CEO, Elon Musk, has driven the Company to its heights of success. He has proven his critics wrong time and again, and the market continues to have confidence that Tesla will end up on top after any global storm thrown its way.

Tesla’s Weaknesses

The SWOT analysis identifies all the internal factors in a company that are underperforming or causing damage. These are some of Tesla’s internal shortcomings, which will reduce its competitiveness and business growth.

1. Manufacturing Complications

The higher the standard of innovation, the greater the likelihood of mechanical complications resulting in production issues. Tesla faces manufacturing and production delays while launching their new vehicles and other products.

For example, Tesla faced endless manufacturing challenges when they were about to launch Model X, which led to constant delays in distribution. Similarly, the company went through extreme troubles while manufacturing Model X’s battery module assembly line at Gigafactory 1. Most recently, Tesla missed its Q3 vehicle deliveries as it faced production halts as it upgraded its factories.

2. Elon Musk as Tesla’s Sole Representative and Brand

Tesla accepts that the company is a ‘one-man show.’ Sadly, that man, Elon Musk, has much on his shoulders to give his hundred percent to the company. Musk is also deeply involved in other projects like space launch vehicles with Space Exploration Technologies Corporation (Space X), The Boring Company, Neuralink, and his relatively recent purchase of Twitter (X).

3. Financial Uncertainty and Headwinds

Tesla has an outstanding debt of $10.67 Billion. Tesla is currently generating enough cash to service their debt and has a solid Current Ratio of 1.72 for 2023, indicating they are adequately liquid. However, with interest rates at 40-year highs, Tesla’s liquidity will erode as they spend more cash on servicing their debt.

4. Employee Safety Concerns

Tesla continues to face employee complaints and reports of safety violations. Workers who feel their safety is at risk or isn’t being managed appropriately will be less motivated and this can negatively impact productivity.

5. High-Risk Factor Due to Use of Lithium-ion

Tesla uses lithium-ion cells in their battery packs. Lithium is a highly reactive and explosive element, which increases the risk factor of our products. Tesla has faced a few cases where its cars have caught fire and vented smoke, which has hurt its global brand.

6. Excessive Wait Times Will Impact Sales

The wait time from when you ordered a new Tesla to when you received it has been notoriously excessive. While they have made significant improvements in delivery times, it can still take one to three months, depending on the model and the add-ons.

Customers may look for comparable electric vehicles from their competitors if they can get their coveted electric vehicle months faster than Tesla.

7. Tesla Faces Lawsuit over Sexual Misconduct

Earlier, six Tesla workers filed a lawsuit alleging sexual misconduct and harassment at the workplace. The women have complained that the company fosters a dark culture of sexual misconduct. They also alleged that they were cat-called and were frequently subjected to shameful remarks, groping, and misogynistic behavior.

8. Product Defects

Due to the highly complex engineering for their innovative vehicles, Tesla’s vehicles and the highly complex engineering involved in their innovative vehicles, Tesla’s vehicles and other energy products have experienced material flaws and recalls. A recent example is Tesla having to recall its recently released Cyber Truck due to the acceleration pedal being prone to getting stuck.

9. Elon Musk’s Erratic Behavior Affecting Tesla’s Reputation

Tesla’s entire reputation is built upon the personality of Elon Musk. But recently, his strange behavior and impulsive reactions are affecting Tesla’s worth as an iconic, innovative brand.

Recently, his marijuana smoking incident on Joe Rogan’s podcast created controversy for being inappropriate. Subsequently, Tesla’s stock value dropped close to 9 percent due to this unexplainable behavior from a man who was a visionary genius.

Image source: CBS News

Tesla’s Opportunities

The opportunity section of this SWOT Analysis emphasizes the external opportunities that can improve its business performance, management structure, and strategic growth.

1. Sales Expansion in Untapped Market

The most significant opportunity for the company right now is the Asian market, which is still unsaturated.

The electric vehicle market in Asia is estimated to reach $324.1 Billion by 2024 and $428.2 Billion by 2028 – a compound annual growth rate (CAGR) of 5.77%. Moreover, electric vehicle sales are anticipated to grow from 7.2 million in 2024 to 9.3 million by 2028.

2. Increasing Market Share in China

China is the world’s largest electric vehicle market. Tesla currently has its largest vehicle production plant outside the US, located in China, and is positioned well to gain further market share. China’s EV market has an estimated total addressable market of $305.57 billion, with an estimated compound annual growth rate (CAGR) of 17.15% from 2024-2029.

3. Continued and Enhanced Government Incentives

Governments worldwide are offering incentives to make electric vehicles more attractive and increase their sales compared to the carbon-producing competition. It’s clear most Western and other countries are not going to meet ambitious carbon reduction goals.

With this in mind, governments may look to sweeten the pot and provide more incentives, such as purchasing rebates that will lower the price of electric vehicles even more, thus increasing the pool of potential buyers. With Tesla vehicles priced on the higher end of the scale, certainly, to their Chinese competitors, this will make their vehicles less attractive.

4. Energy Storage

The total addressable market of energy storage globally is estimated to reach $275.9 billion in 2024 and to nearly double to $506.5 billion by 2031 – a 9.2% CAGR.

Tesla’s expertise in battery technology positions it well to capitalize on the growing demand for energy storage solutions beyond electric vehicle batteries, such as grid-scale battery storage systems and home energy storage products like the Powerwall. These solutions can help stabilize renewable energy grids and provide backup power during outages.

5. Offer Less Expensive Vehicles

Low-cost electric vehicles are an excellent opportunity for Tesla to expand the size of their audience market.

Tesla can introduce a new low-cost electric vehicle that is more affordable but has less range, power, and features.

6. Bringing More Battery Production Technology In-house

According to Grand View Research, the global battery market was valued at $118.20 billion in 2022 and is projected to reach $329.84 billion in 2030.

Tesla has the potential to expand its capacity for producing battery cells used in its electric vehicles. This strategic move could significantly impact the company by increasing its manufacturing rate and lowering production costs. Additionally, it would decrease Tesla’s reliance on other battery suppliers, with Panasonic currently serving as its primary supplier.

Furthermore, battery production could serve as an additional revenue stream for Tesla.

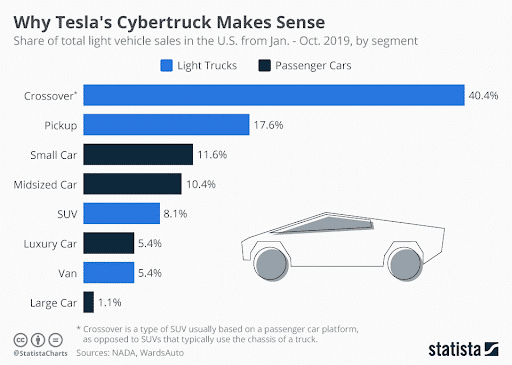

7. Introduction of Pick-up Truck

According to National Automobile Dealer Association market share data, pickup trucks account for 17.6% of the US automotive market, which has huge opportunity of growth in Electric Vehicle.

The Cyber Truck can bring a lot of growth opportunities for Tesla in this segment.

Image Source: Statista

8. Air-Taxi Market

Demand for innovative urban air-taxi services to supplant conventional taxis and reduce traffic congestion and pollution is projected to increase drastically by 2025.

Tesla has the expertise and technology to deliver electric vertical takeoff and landing (eVTOL) vehicles, and a second-largest shareholder has already invested millions in air taxi startup Lilium.

9. Artificial Intelligence

Tesla’s self-driving vehicles and technology are likely the first things that come to mind when thinking how they will leverage artificial intelligence (AI). However, Tesla is leveraging AI in other areas, such as analyzing vast amounts of data that will help it glean valuable insights, resulting in more efficient operations.

Tesla has embarked on an aggressive strategy to capture more global market share by cutting its vehicle prices. This has fueled a price war that Tesla can win if it can find efficiencies and eliminate redundancies by effectively utilizing AI to bring down its production costs.

10. Robotaxis

The Robtaxi Market, self-driving taxis, was valued at $0.4 billion USD in 2023 and is projected to reach 45.7 billion by the end of 2030. This predicted growth will result in an incredible industry CAGR of 91.8%.

Leveraging its in-house technology and exceptional brand value, Telsa is positioned well to become the leading Robotaxi company in the US and internationally. In fact, Tesla has announced it will reveal its Robotaxis on August 8th, 2024.

Tesla’s Threats

Threats are external factors beyond Tesla’s control that they need a line of sight on to prepare to mitigate and manage any associated risks.

1. Product Liability and Defect Claims

Despite Tesla’s premium quality assurance and high manufacturing standards, the automobile industry, in particular, is accustomed to facing significant product liability and defect claims, which can result in material financial consequences. Tesla has also recently recalled 3,878 of its Cybertrucks for a faulty accelerator pedal. Not only do recalls impact Tesla’s bottom line, but they also negatively impact its brand image.

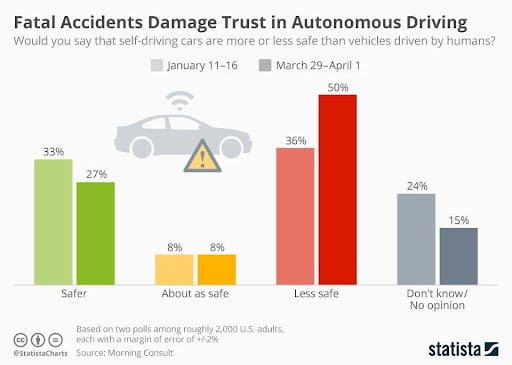

Tesla has also launched many autopilot vehicles, and there have been accidents that have resulted in fatalities and lawsuits. If these liability claims continue, then Tesla may face greater liability and financial exposure.

Image Source: Statista

2. Extensive Competition

Tesla, Inc. faces aggressive competition from alternative fuel vehicles (Hybrid, Plug-in hybrid, fully electric car) with and without self-driving technology. Many automotive brands in the luxury segment, like Mercedes, BMW, Audi, Lexus, and in the economy segment, like Toyota, Ford, General Motors, Volvo, and BYD, are all looking to aggressively compete for market share.

Many brands are not only launching or planning to launch their environment-friendly but also, they are offering at a comparably lower price to self-driving technology but also offering them at lower prices than Tesla’s electric vehicles. It is a definite threat for a company like Tesla, which thrives in business environments where innovation is rewarded. However, this has made their vehicles priced comparably high and are unaffordable for many consumers looking to purchase an electric vehicle.

Image credit: Statista

3. Long term confidence

For any company, the assurance of long-term sustainability is essential to maintain the public image, long-term sustainability is essential to maintaining its public image and morale. Tesla, due to its history of unstable manufacturing conditions, along with an eccentric CEO, has made individuals and the media call into question its long-term existence.

While Tesla has been able to put this lack of confidence to bed many times in the past ten years, it is a storyline that the media often picks up on and goes with.

4. Customer Adaptation

Tesla’s ability to sell its electric vehicles and other products is dependent on whether consumers are ready to accept and adapt to new and innovative products. The speed at which this acceptance and transition takes place will govern how fast Tesla can grow its sales.

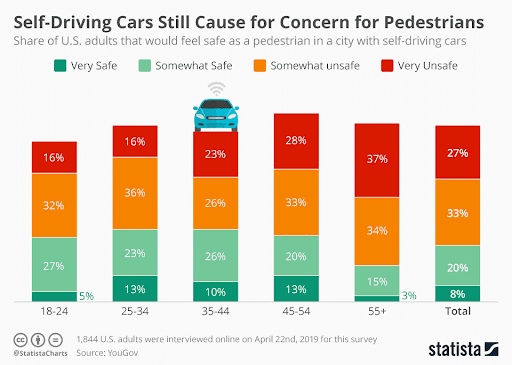

5. Self-Driving Cars Are Still a Concern for Pedestrians

In a survey from YouGov, US adults still feel unsafe to walk around self-driving cars. People above the age of 55 are especially afraid to be around self-driving vehicles.

Image Source: Statista

6. Disruption of Supply Due to Material Shortages

Like other manufacturers, Tesla is susceptible to supply chain challenges that may restrict supply, increase costs, and limit their ability to meet production targets. The company uses aluminum, steel, lithium, nickel, copper, and cobalt, as well as lithium-ion cells from suppliers. All these materials have volatile prices, which can affect the company’s ability to manufacture electric vehicles at costs that provide healthy returns.

7. Lack of Regulations for Self Driving

Self-driving vehicles and companies face inconsistent self-driving regulations in many countries, including the US. This limits Tesla’s Ability to sell its self-driving cars in certain countries and regions until more legal and regulatory certainty is provided.

8. Economic Uncertainty

Even though Tesla is better positioned to survive economic uncertainty than many of its competitors, Tesla’s vehicles are still selling at premium price points, which may result in a smaller pool of buyers as higher interest rates continue to bite into consumer spending.

9. China’s BYD Dethrones Tesla as World’s Largest EV Manufacturer

BYD produced 526,400 electric vehicles in Q4 of 2023 compared to Tesla’s 484,000. Tesla faces intense pressure from Asian competitors who are well situated to sell their electric vehicles in markets they understand and at more competitive price point.

10. Capital Markets

Tesla is seeing its first revenue decline in the past four years, and a drop in production, are giving the capital markets concern and its stock continues is precipitous fall. The Tesla stock price from a 52 week fell to a 52-week low in April 2024 at $148.7, down from $253.33 seen in December 2023, a 42% drop.

11. Battery and Supply Chain Shortages

Tesla and other electric vehicle makers face significant supply chain headwinds, with battery shortages front and center. Any interruptions in battery development and delivery can bring production to a halt. McKinsey has said demand for EV batteries is projected to grow by 30% by 2030.

12. Shareholder and Management Wrangles

Friction and conflict between management, the board, and shareholders can undermine productivity and ultimately degrade financial performance. A shareholder (who only owns 9 Tesla shares!) sued Tesla to invalidate Elon Musk’s $56 Billion pay package, which a judge granted.

While Tesla is appealing the decision, it will likely take years to resolve the issues which will require Elon Musk and Tesla’s board to spend valuable time on this issue rather than driving shareholder value through value enhancing activities such as new vehicle models or sourcing mission critical supply such as batteries.

13. The Unexpected Slowdown in Electric Vehicle Demand

Recently, U.S. electric vehicle sales experienced a significant slowdown in growth, mainly due to high prices.

According to a Cox Automotive study, the average price for an electric vehicle in the U.S. is about $50,000, and very few options are available for just under $40,000. The lack of lower-price car options has led consumers to view electric vehicles as luxury vehicles.

It is a significant threat to Tesla and raises questions about changes in customer behavior and EV adoption trajectory.

SWOT Analysis of Tesla

Conclusion

In this Tesla SWOT analysis, industry-leading position, Tesla must continually work to enhance its strengths, minimize its weaknesses, and capitalize on external opportunities. We highlighted each notable strength, weakness, opportunity, and threat that Tesla faces in the global market.

To maintain its industry-leading position, Tesla must continually work to enhance its strengths, minimize its weaknesses, capitalize on external opportunities, and mitigate the dynamic threat environment.

References & more information

- Korosec, K. (2020, July 1). Tesla Blows Past Toyota to Become Most Valuable Automaker in the World. Tech Crunch

- Wagner, I. (2020, July 15). Tesla’s vehicle deliveries by quarter – YTD Q2 2020. Statista

- Pettitt, J. (2020, May 9). These experts think Tesla is in a better position than other US automakers to survive the recession. CNBC

- Kelly, J. (2020, February 14). Tesla’s Leaked Employee Handbook Is As Unconventional As Founder Elon Musk. Forbes

- Kolodny, L. (2020, July 2). Tesla shares soar after reporting a big beat on second-quarter deliveries. CNBC

- Chokshi, N. (2020, May 13). Tesla Posts $105 Profit for Quarter, Extending Rebound. The New York Times

- Atkins, B. (2019, February 25). Tesla’s Leadership Challenge. Forbes

- Shelton, R. (2019, September 13). Elon Musk is not the problem at Tesla — blame the people around him. CNBC

- Korosec, K. (2020, July 2). Tesla delivered 90,650 vehicles in the second quarter, a smaller-than-expected decline. Tech Crunch

- Hawkins, A. J. (2020, June 8). Tesla’s second-largest shareholder invests $35 million in air taxi startup Lilium. The Verge

- Zandt, F. (2024, Jan 25) How Successful Is Tesla? Statista

- Yahoo Finance, Tesla Inc. (2024, May 8) (TSLA) Income Statement. Yahoo Finance

- Yahoo Finance, Tesla, Inc. (2024, May 8) (TSLA) Valuation Measures & Financial Statistics. Yahoo Finance

- Mordor Intelligence (2024, May 8). China Electric Vehicle Market Analysis.

- Business Wire (2024, Jan 2) Tesla Vehicle Production & Deliveries and Date for Financial Results & Webcast for Fourth Quarter 2023. Tesla Investor Relations

- Nga, Lawrence (2023, August 3)Tesla Is Set to Win Big in the AI Race. Here’s Why. | The Motley Fool

- Jin, Hyunjoo; Wange, Ethan; Steitz, Christoph. (2024, April 21) Tesla cuts prices in China, Germany, and around globe after US cuts | Reuters

- Chiu, Kent (2023, October 27) Tesla is most popular EV brand for US fleet companies | S&P Global (spglobal.com)

- Reuters (May 13, 2024) Tesla cuts price of Full Self-Driving software by a third to $8,000 | Reuters

- https://ir.tesla.com/press-release/tesla-vehicle-production-deliveries-and-date-financial-results-webcast-fourth-quarter-2023

I was laughing about Elon Musks and Grimes’ baby name. It was X Æ A-12, that’s pretty weird. I guess they updated it to X Æ A Xii though? It’s just the same but with Roman numerals.

TESLA seems in a strong position poised for another quantum jump. Europe recovering. The US recession seems more talk than reality. Tesla is a debt-free company. Its new upcoming lines are very promising – power storage systems, commercial and home robotics, complete battery production integration, ramping up EV production, Semi started coming out of the production line, cyber truck to soon start coming out of the production line, and a few more. There is no tech or competition or threat at least for the next 4-5 years. Doubling car production is not so difficult. yes. The negative psyche will be there for the next 3-4 months. Tesla shares are bound to jump back to 450-500 within the next 6 months.