Company: Verizon Communications Inc.

CEO: Hans Erik Vestberg

Year founded: October 7, 1983

Headquarters: Hans Erik Vestberg

Employees (Dec 2019): 135,400

Ticker Symbol: VZ

Type: Public

Annual Revenue (Dec 2019): US$131.87 Billion

Profit | Net income (Dec 2019): US$19.78 Billion

Products & Services: Verizon Smart Family | Safe Wi-Fi | VZ Navigator |Total Mobile Protection | Verizon Support & Protection | Security and Privacy | Roadside Assistance | Hum by Verizon

Competitors: AT&T | T-Mobile | Sprint Nextel | Vodafone | Cox Communications | Cricket Wireless | RCN Telecom | Comcast | Spectrum | Deutsche Telekom

Fun Fact: Verizon’s origins trace back AT&T that was a powerful monopoly in the 1970s. The power wielded by AT&T prompted the US government to break it up into pieces called ‘Baby Bells,’ which led to the founding of Verizon’s founder Bell Atlantic Corp.

In 2000, Bell Atlantic Corp. and GTE Corp. merged, marking the start of Verizon Communications, Inc.

Over time, Verizon has employed effective strategies, such as strategic acquisitions and innovative offerings. These strategies enabled the company to become the leader in the US market with the largest market share.

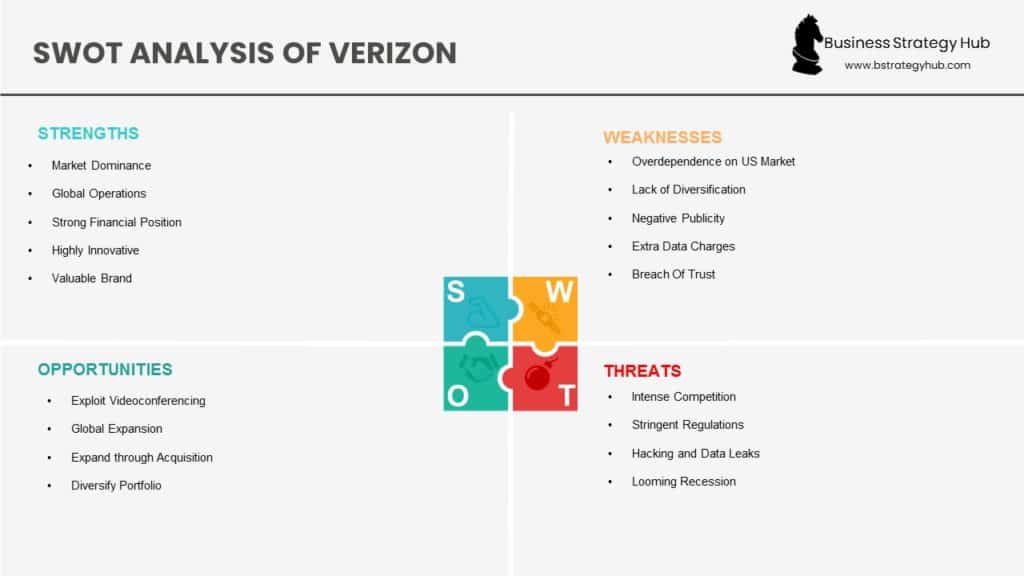

To understand how Verizon ascended to the leadership position and what the future holds, you need to assess its strengths, weaknesses, opportunities, and threats. Here is the Verizon SWOT Analysis.

Verizon’s Strengths

-

Market Dominance: Verizon is the strongest and largest wireless carrier in the US in terms of network strength and market share. As the leader, Verizon has immense influence over policies that affect the communication industry and can leverage its privileged position to advance its agenda.

-

Global Operations: From North America to Europe, Latin America, and Asia-Pacific, Verizon has offices in 150 locations that offer telecom, network management, security, and IT services. Its IP network is available in 2770 cities around the world.

-

Strong Financial Position: Having immense financial capabilities is a major strength because it allows businesses to acquire all they need to compete more effectively. In terms of profitability, Verizon’s is ranked 3rdmost profitable public company in the US.

-

Highly Innovative: Satisfying technologically-spoilt consumers of the digital age goes beyond offering bare minimum functionalities. From 4G LTE to 5G network, VoIP, and Fios, Verizon is a leader in innovation and offers some of the most innovative products and services in telecom.

-

Valuable Brand: Since its founding, Verizon has focused on building a valuable brand. In 2019, it was ranked 19th most valuable brands in the world by Forbes and 43rd strongest brand globally by Fortune 500.

-

Effective Marketing Strategy: In a competitive market with a small difference between competitors, companies can differentiate themselves through intensive and creative marketing. Verizon is renowned for creative marketing campaigns and customer-centric promotions.

-

Strategic Acquisitions: From AOL to Alltel, Yahoo, and BlueJeans for $500 million, Verizon’s strategic acquisitions have contributed immensely to its success. For instance, acquiring Alltel enabled Verizon to become the leader with the largest market share.

Verizon’s Weaknesses

-

Overdependence on US Market: Overdependence on the US market exposes the company to the issues in that market and increases the impact on the bottom line. For instance, Verizon lost 68,000 wireless subscribers and was forced to pull its 2020 revenue forecast.

-

Negative Publicity: Customers expect companies to protect their personal information and data. Any time their information is leaked or stolen by cybercriminals, the company’s reputation and trust bestowed by customers decrease. Verizon’s reputation was tainted when data of millions of customers leaked.

-

Extra Data Charges: Customers only want to pay for what they have used or will use, which is fair. But, phone companies like Verizon insist on charging more for extra data.

-

Breach of Trust: An unspoken contract exists between a company and its customers. Once trust is breached or broken, it is difficult to regain. Verizon breached this silent agreement by selling phone location data of customers to third parties and law enforcement agencies.

-

Lack of Diversification: Putting your eggs in several baskets spreads the risk and reduces losses in case one something happens to one basket. Verizon operates primarily in the telecommunication sector. In the event of a decline in the sector, the company can incur immense losses.

Verizon’s Opportunities

-

Exploit Videoconferencing: The demand technologies that support work-from-home and remote work have skyrocketed with companies like Zoom taking advantage of the opportunity. Verizon also operates in this space since its recent acquisition of BlueJeans and should focus on exploiting the opportunities in this sector.

-

Global Expansion: Regardless of the industry or type of business, the global marketplace has more opportunities for growth. Verizon only offers network management, security, and IT services to businesses and governments outside the US. It should expand its wireless services to customers globally.

-

Expand through Acquisition: Verizon increased its market share in 2008 by acquiring Alltel, which enabled the company to overtake AT&T. With T-Mobile having closed the merger with Sprint, Verizon needs to acquire another smaller wireless carrier to compete and protect its market share from the stronger merger.

-

Diversify Portfolio: There are numerous opportunities beyond telecommunications that relate to Verizon’s 5G network, such as augmented reality, smart cities, autonomous vehicles, and so on. With the arrival of 5G, Verizon should take the lead and enhance sustainability into the future.

Verizon’s Threats

-

Intense Competition: In the US telecommunication sector, Verizon, AT&T, and T-Mobile are the leaders and fiercest rivals. Verizon has always focused on fending off AT&T but now has to work extra hard to protect its market share from a more powerful T-Mobile.

-

Stringent Regulations: From business deals to secret affairs, the sensitive nature of information conveyed by telecoms requires intensive regulations to protect users. If more stringent laws and regulations are imposed on telecoms by the government, Verizon’s operations and profits can be affected.

-

Hacking and Data Leaks: Telecommunication companies are susceptible to hacking and data leaks, which can cost millions of losses in lawsuits and settlements. In 2017, a misconfigured security setting leaked personal data of 6 million users of Verizon.

-

Looming Recession: The economic destruction in the wake of the pandemic is pushing the entire world into a global recession. With the recession around the corner, Verizon’s profitability is under threat.

References & more information

- Hodel, M. (2020, April 24). Verizon’s Solid Wireless Position Should Create Near-Term Opportunities to Take Share. Morning Star.

- Parietti, M. (2020, March 5). The World’s Top 10 Telecommunications Companies. INVESTOPEDIA

- Forbes Ranking (2020). Company: Verizon Communications. Forbes

- Pressman, A. (2020, February 13). Verizon to double the number of cities with its 5G mobile service this year. Fortune

- Fortune 500, (2019). Global 500: Verizon. Fortune

- Olenski, S. (2018, May 18). Verizon CMO Believes This Is The Future Of Marketing. Forbes

- Miller, R. (2020, May 18). Verizon wraps up BlueJean’s acquisition lickety-split. Tech Crunch

- McLymore, A. (2020, April 24). Verizon pulls 2020 revenue view as it loses wireless subscribers. Reuters.

- Whittaker, Z. (2017, July 12). Security experts warn of account risks after Verizon customer data leak. ZD Net.

- Morgan, C. (2019, June 20). Here’s why phone companies like Verizon and AT&T charge more for extra data. Business Insider.

- Dang, S. (2018, June 19). Verizon to stop selling phone location data to third parties. Reuters

- Hamish, W. (2019, April 3). Telecommunications, is it a declining business model? Mobilise Global.

- Lyons, K. (2020, April 16). Verizon is buying BlueJeans, one of Zoom’s videoconferencing rivals. The Verge.

- DeGrasse, M. (2018, March 28). Verizon changes its partner program for business customers. RCR Wireless News.

- Lee, E. (2020, April 1). T-Mobile Closes Merger with Sprint. The New York Times

- Rana, A. (2019, November 21). Verizon, Snap to develop 5G augmented reality features. Reuters

- Fletcher, B. (2020, February 12). Verizon pegged as the loser in T-Mobile/Sprint deal. Fierce Telecom

- Ross, S. (2020, February 9). Government Regulated Impact on the Telecommunications Sector. INVESTOPEDIA

- Larson, S. (2017, July 12). Verizon data of 6 million users leaked online. CNN

- Trefis Team (2020, March 26). Verizon’s Stock Declined 16% In 50 Days; Will It Underperform The Market Post Coronavirus? Forbes.

- Featured Image by Niek Verlaan from Pixabay

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment