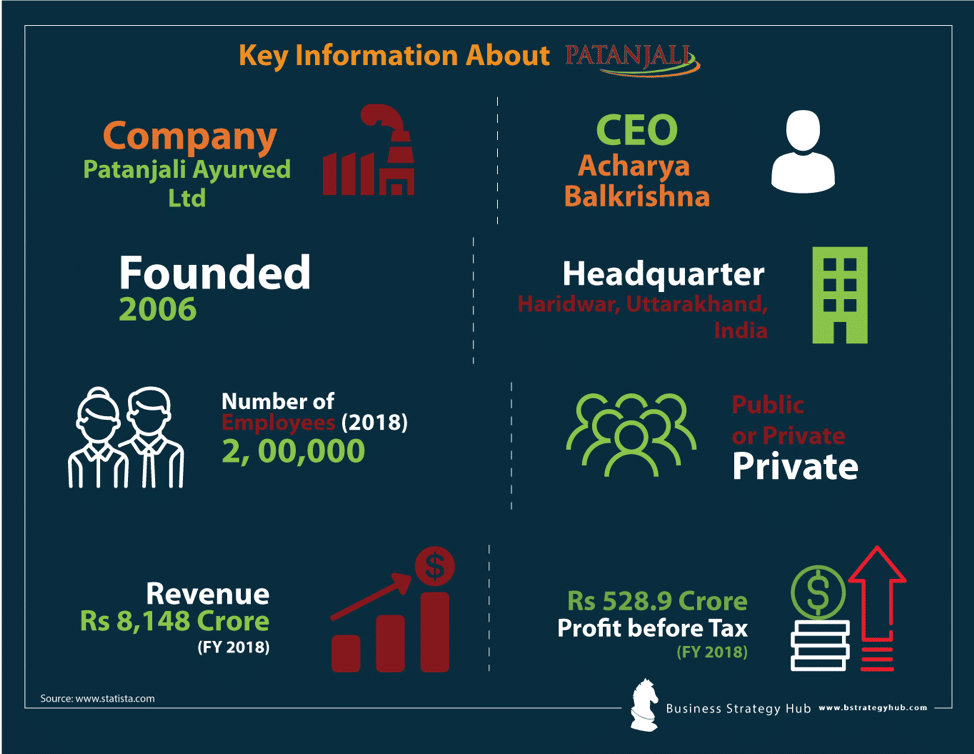

Company: Patanjali Ayurved Ltd

CEO: Acharya Balkrishna

Year founded: 2006

Headquarter: Haridwar, Uttarakhand, India

Employees (2024): 200,000

Public or Private: Private

Annual Revenue (FY 2023): Rs 31,800 Crores

Net Profit (FY 2023): Rs 886.44 Crore

Products & Services: Skin Care | Hair Care | Toiletries | Herbal Home Products | Health Care | Dental Care | Food Products

Competitors: Dabur | Himalaya Herbal| Procter and Gamble | Nestle | Marico | HUL| Sweetal | Pisaganj | Prabhuti Enterprises

Fun Fact:

- Patanjali has developed a unique word-of-mouth marketing strategy that generates all revenue without advertising.

- Patanjali Ayurveda has its own Patanjali Food and Herbal Park, which runs under the government’s food park plan.

- Did you know Patanjali is India’s fastest-growing FMCG (CPG) company?

An Overview of Patanjali

Patanjali has been widely considered a game changer in the Indian market, serving the personal care and food sectors. What started as Patanjali Ayurveda Ltd. (PAL), a small pharmacy, underwent an evolutionary transformation and accelerated its growth, resulting in a net income of upwards of Rs. 800 crores. The company became dominant in the Indian FMCG (Fast Moving Consumer Goods) sector, also known as CPG (Consumer Packaged Goods).

Founded in 2006 by Yoga master Baba Ramdev and Ayurveda professor Acharya Balkrishna, the company has revolutionized the Indian market by creating a society focusing on Yoga and Ayurveda as a form of natural living.

The company boasts a range of over 300 Ayurvedic medications for treating various conditions, including biscuits, noodles, ghee, footwear, apparel, and more. Its operational capacity comprises 15,000 stores, 100 mega-marts, and 5000 distributors.

Acharya Balkrishna serves as the company’s CEO. According to Forbes, Balkrishna was ranked 68th in India’s 100 wealthiest people list in 2023, with a net worth of about $3.23 billion, mainly derived from the consumer goods giant Patanjali Ayurved.

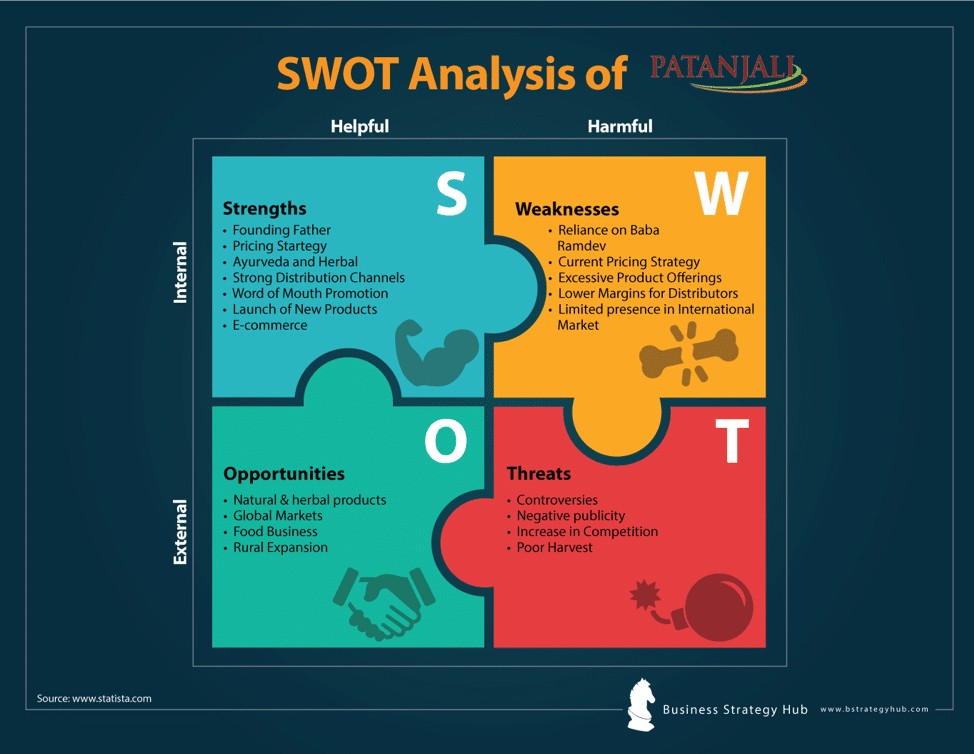

Patanjali’s Strengths

1. Founding Father

Baba Ramdev, a Hindu spiritual guru, is the founding father of Patanjali. Baba Ramdev is the reason behind Patanjali’s exponential growth. The spiritual guru is the brand ambassador, using his popularity and fame to persuade consumers to buy his products. Baba Ramdev has managed to boost the company’s growth through his influence and power.

The guru has strengthened the customer base by using the society’s religious, moral, ethical, and spiritual aspects. Patanjali wouldn’t be such a big brand if Baba Ramdev weren’t its ambassador. However, Baba Ramdev owns no stake in the business, with Balkrishna owning close to 94% of the company’s shares.

Image source: Patanjali’s Annual Report.

2. Pricing Strategy

The pricing structure of Patanjali’s products gives it leverage over its competitors. The brand has successfully captured the interest and loyalty of the Indian lower- and middle-class demographic. The products are priced at least 20-30% lower than its competing rivals. The budget-friendly products are easily accessible and are preferred by the less affording consumers.

Competitors and rivals can’t compete with Patanjali on such an advantageous pricing strategy that involves offering products at highly discounted prices. Additionally, the products are offered through 1200 Patanjali Chikitsalayas (doctors’ clinics), 2500 Arogya Kendra (health and wellness centers), and 8000 Swadeshi Kendra (non-medicine outlets).

3. Launch of New Products

In 2023, Patanjali introduced 14 fresh offerings across its nutraceuticals, health biscuits, Nutrela millet-based cereals, and dried fruit categories. Among these, Nutrela Sports was unveiled with six offerings including powders, capsules for vitamins, and supplements. Additionally, Nutrela MaxxMillets, a collection of millet-based products, was introduced. The company also expanded its product line with ragi biscuits and various digestive biscuits. This expansion was a strategic move by Patanjali to achieve a turnover of Rs. 1 trillion within the next five years.

4. Diversified Portfolio – Ayurveda and Herbal

Patanjali has intelligently utilized Ayurveda and herbal products. Its rich Ayurvedic heritage is deeply ingrained in Indian culture and is trusted for its holistic approach to health and wellness. Its marketing strategy specifically promotes its herbal products, highlighting the benefits of natural and organic materials.

The Swadeshi products that Patanjali markets are loved and widely consumed by the Indian masses. Authentic Ayurvedic formulations and treatments are in high demand as consumers seek natural and traditional remedies. The natural element the brand has incorporated into its product line has given it a competitive advantage over its rivals.

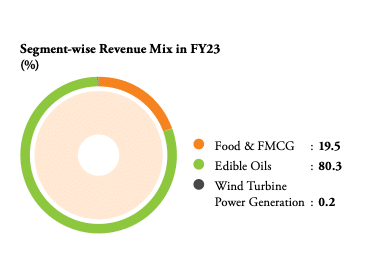

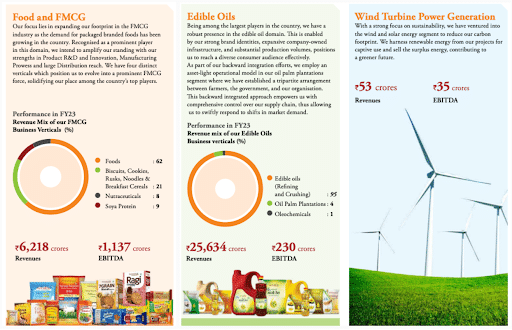

The images below show Patanjali’s revenue breakdown by segment.

Image source: Patanjali’s Annual Report

Image source: Patanjali’s Annual Report

5. Strong Distribution Channels

Patanjali has developed a robust distribution network across India that includes over 15,000 retail outlets, better known as Patanjali Chikitsalayas. It also boasts tie-ups with traditional retail stores. The brand sells its products through medical centers in Patanjali Arogya Kendras, Patanjali Chikitsalayas, and Swadeshi Kendras (non-medical centers).

Its ability to reach consumers across diverse geographies using wholesalers, retailers, and ecosystems has always affirmed its competitive edge. This has helped the brand build trust and customer loyalty.

6. Word of Mouth Marketing

Patanjali has been utilizing word-of-mouth publicity. Patanjali was one of the very first brands to use this strategy. Initially, the company didn’t rely on any other form of marketing. Word-of-mouth publicity benefitted Patanjali, with Baba Ramdev’s yoga camp followers promoting and endorsing the brand. The company has been pushing its products through all promotional campaigns in recent years. Furthermore, Patanjali has solidified its market position by launching medical and non-medical centers.

7. E-commerce

Patanjali has an E-commerce advantage over its competitors as most of its products are sold online. The company also sells its products through platforms such as Amazon, Big Basket, among other major retail platforms, therefore able to reach the mass market. Due to this, consumers can easily find Patanjali’s products online.

8. Baba Ramdev Influence

In addition to being the company’s founder, Baba Ramdev also acts as its spokesperson and brand ambassador. Because of his reputation as an Ayurvedic specialist and yoga guru, Baba Ramdev has developed a cult following for Patanjali products in India. Millions of Indians follow Baba Ramdev, providing a sizable market for Patanjali Ayurved Limited’s goods. Association with Baba Ramdev has allowed Pantajil to become a household name in India.

9. Millennials and Gen Z-Oriented Products

Contrary to the general misconception that Ayurveda is for the old, Patanjali’s products are good enough for millennials and Gen Z to accept. They created natural and organic goods with a novel twist to engage millennials and Gen Z consumers leaning towards local, socially, and environmentally sustainable choices as they remain mindful of what brands stand for. The company has partnered with Facebook and Google to invest in online advertising to reach millennials.

Patanjali’s Weaknesses

1. Reliance on Baba Ramdev

The company relies heavily on Baba Ramdev himself. Nevertheless, he has been in and out of a lot of controversies. Baba Ramdev had to apologize to the people of Assam for a Patanjali official’s harsh and insensitive comments. Satinath Barale, a yoga instructor and Patanjali employee made outrageous comments about Vaishnava saint Srimanta Shankardev at a yoga camp.

The aftermath of the event saw massive public outcry. The backlash became so severe that Baba Ramdev had to apologize, all but tarnishing the brand image. The Patanjali brand may suffer if any government agency takes up a political vendetta because of Baba Ramdev’s political ties.

2. Current Pricing Strategy

The company’s low pricing strategy, designed to undercut competitors, is unsustainable. Patanjali needs to revise its current pricing strategy, or the company will fail to sustain itself.

Offering steep discounts affects the company’s ability to generate significant revenues, needed to bolster its profit margin. The current pricing strategy gives low-profit margins necessary for Patanjali’s survival. The company will have to deal with high labor and raw materials costs if it doesn’t change its pricing strategy.

3. Excessive Product Offerings

Patanjali has too many products in its portfolio, which makes it challenging to maintain consistent quality control across its vast product range. Some of these are profitable, while others fail to generate any profit. Despite having such a diverse product portfolio, only 5 or 6 products, like shampoo and toothpaste, generate high revenues. The company must discontinue low-profit products or solidify them to generate substantial profits.

4. Lower Margins for Distributors

Patanjali’s core focus is on volume rather than margins, owing to its strategy of undercutting competitors through pricing. It offers lower margins to distributors than other companies that deal in consumer goods. For this reason, the company is a demand-run company. The inability to provide distributors with attractive margins has seen most of them opt to sell and distribute their competitor’s products that offer better margins.

5. Limited presence in the International Market

Patanjali is a brand with a limited international presence that concentrates on the Indian market. The company has yet to establish a more robust global presence to diversify its revenue stream and reduce reliance on a single market.

Baba Ramdev has followers across the globe and can offer promotions in areas where his largest following resides, like Nepal. Moreover, the company should focus on the youth demographic in India, who are technologically skilled and proficient with the internet.

6. Limited Marketing and Advertising

Patanjali has not fully tapped into the capabilities of its extensive range of products because it lacks detailed marketing and advertising plans. The business has mainly depended on recommendations from customers for its promotional efforts, leading to limited recognition of its brand in a fiercely competitive environment where there are many choices and substitutes available.

Patanjali’s Opportunities

1. Natural & herbal products

India’s herbal extracts market is growing at a compound annual growth rate of 11.7%. Consequently, this is the perfect time for Patanjali to invest more in its organic farming sector as the market will be worth $2.6 billion by 2027 as more people switch to organic and natural products.

2. Global Markets

The global Yoga market was valued at about $107.1 billion in 2023, growing at a CAGR of 9.4%; Asia Pacific dominated the industry, accounting for 37.2% of total revenues.

The global markets provide a fertile ground for a company like Patanjali. Spirituality, or anything related to mysticism, is popular among African, Asia, and Middle East inhabitants. While

Pantajil must learn from its competitors, such as Haldiram, Amul, Dabur, etc., and proceed with a similar action plan. Thanks to Baba Ramdev, the company is directly associated with yoga and can tap into opportunities in Far East Asia.

3. Food Services Market

In 2023, the market for food services in India was estimated to be worth $70 billion, and it is expected to increase to $125 billion by 2029. Patanjali can capitalize on the expected growth by opening quick restaurants like Haldiram and offering edibles that use natural and organic ingredients. This will allow it to exploit the growing demand for products free of artificial additives, preservatives, and harmful chemicals.

A shift towards sustainability and ethical consumerism should allow the company to differentiate itself. Consumers are seeking products that prioritize sustainability and social responsibility. By offering food items, the company can establish a stronger image in the Indian market.

4. Expand in Rural Markets

Currently, the company runs less extensive operations in rural India, which is critical for every company. Patanjali should expand into rural areas and cater to the rural region where consumers prefer affordable natural products. Additionally, its unique pricing strategy of making products 20% to 30% cheaper would strengthen its competitive edge in rural areas and attract more sales.

5. Expand E-commerce

Due to an expanding number of people using the internet, the worth of India’s online shopping sector is anticipated to peak at $350 billion by the year 2030, increasing from $22 billion in 2018. Therefore, Patanjali should embrace the e-commerce opportunity wholly as an effective way of selling its products.

By improving its digital shopping features on its platforms, Patanjali can grow its presence in new areas both within India and internationally, aiming to increase its market share in a fiercely competitive environment. The firm can streamline different operations and improve the management of its stock to better understand market movements by embracing digital solutions.

6. Tap into the Luxury Market

In an era where consumers are conscious about the products they consume, how and where they are produced, and what they stand for as part of sustainability efforts, Patanjali has an opportunity to tap into the high-end luxury markets. It can benefit from its heritage-oriented brand image and name and grow its customer base.

Patanjali’s Threats

1. Regulatory Hurdles

Patanjali operates in a highly regulated industry, regularly facing challenges and obstacles. Being a producer of ayurvedic and organic goods, the firm is required to adhere to strict rules regarding components, packaging, and safety.

Not meeting these standards could lead to the firm facing fines and legal responsibilities. Its activities in global markets are also influenced by distinct regulatory systems that impact its functioning. These strict rules frequently hinder its capacity to introduce and market new items

2. Counterfeits Threat

As one of the leading brands in the industry, Patanjali constantly faces the threat of fake products and copycats aiming to exploit its well-known brand image. Counterfeits and imitations are increasingly imitating the company’s products, denying the company the much-needed revenues and affecting its reputation and credibility, as most are usually substandard.

3. Negative publicity

The company faced a major crisis when the Nepal Department of Drug Administration indicated they had found some of its medical products to be “substandard quality.” The products used to detect mold, bacteria, and other toxins had failed their microbial tests. This crisis resulted in negative word of mouth, damaging the company’s reputation.

4. Increase in Competition

Big companies like Marico, HUL, and Dabur have given Patanjali tough competition. Newer entrants in the market, like Sri Ayurveda, are also increasing Patanjali’s competition. As new players enter the market, Patanjali risks losing customers to alternative brands. Additionally, it might be forced to offer more discounts to fuel sales, a move that would curtail its margins further.

5. Poor Harvest

The Indian farming community depends on the weather and the monsoon season to grow their crops and ingredients. Climate change can severely affect the production of major crops. This can endanger Patanjali, who needs to create a backup plan if the country ever faces a natural disaster or bad climate.

6. Highly Politicized Brand Rumor

Patanjali has been allegedly rumored to be a highly politicized brand. Though there may be no truth behind this claim, such rumors can threaten the brand’s image, and investors are reluctant to put their stake in such companies.

7. Negative Online Reviews

One major threat impacting all businesses, from big to small, is negative online reviews that affect brand perception. Increased negative reviews on e-commerce platforms could make it difficult for Patanjali to attract and retain loyal customers.

Conclusion

The SWOT analysis of Patanjali shows that the company is well on its way to tremendous success. The company has to manage its communications and abstain from anything that directly impacts Baba Ramdev. It needs to place more confidence in itself to pursue worldwide markets and connect with more consumers interested in its brand and offerings.

References & more information

- Dsouza, S. (2023 June 16). Patanjali Foods launches 14 products to push its premiumisation strategy. Business Standard.

- India Herbal Extracts Market – Forecast(2024 – 2030). Industry ARC.

- Yoga Market Size & Trends. Grandview Research.

- Statista, Research. (2023 December 6). Estimated market value of the food service industry in India in 2022 to 2029. Statista.

- Minhas, A. (2023 September 15). Market size of e-commerce industry across India from 2014 to 2018, with forecasts until 2030. Statista.

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

very nice information for business …Thanks

Good analysis. Very useful for research scholars, faculty, students and others.

Thank you for your feedback Dr. Ravindranath.

Glad you liked our analysis.

Happy Reading 🙂