Company: Southwest Airlines Co.

CEO: Gary Kelly

Founders: Herb Kelleher & Rollin King

Year founded: 1967 ( as Air Southwest), and 1971 (as Southwest Airlines)

Headquarter: Dallas, Texas, U.S.

Number of Employees (Dec 2019): 60,800

Type: Public

Ticker Symbol: LUV

Annual Revenue (Dec 2019): $22.4 Billion

Profit | Net income (Dec 2019): $2.3 Billion

Products & Services: Business Select Flights | Express Bag Drop | Southwest Airlines Charter | Fly By Priority Lane Access | Early Bird Check-In | Business Travel and Groups | Southwest Airlines Cargo | P.A.W.S. | Southwest Gift Cards

Competitors: Delta Airlines | American Airlines | Spirit | United Airlines | JetBlue | Skywest | Alaska | Frontier | Republic

Did you know that Southwest Airlines had to sell one of their four Boeing 737s in 1972 to cover payroll?

Southwest Airlines’ Strengths

1. LUV Culture

Making every customer feel like a part of the family is an effective way to enhance customer loyalty. The airline has mastered the art of bringing the customer into the Southwest family using its enticingly warm LUV culture.

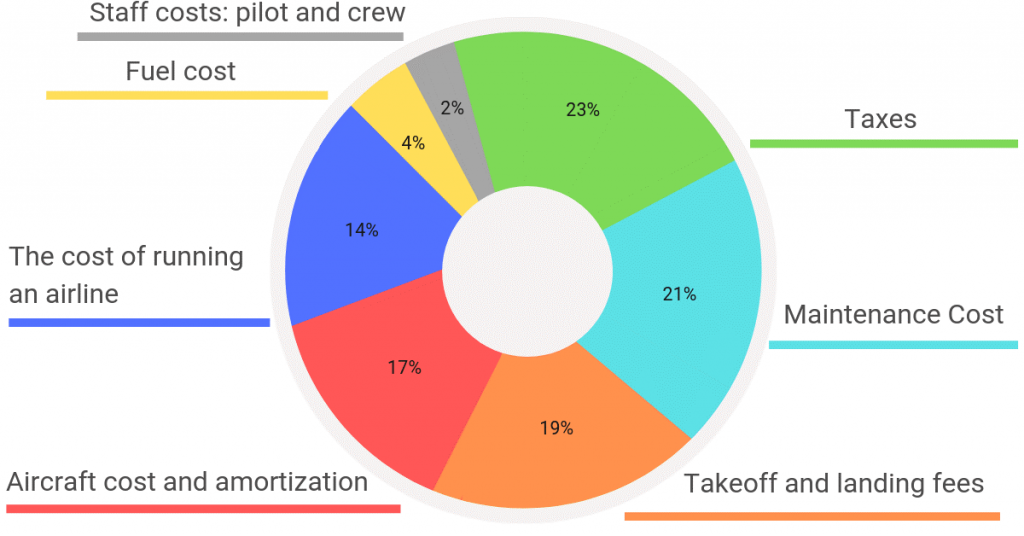

2. Lower Cost

One of the reasons behind Southwest Airlines’ large number of loyal customers is its low-cost flights. Using the airlines’ Low Fare Calendar, passengers can book flight tickets starting as low as $45 for a one-way flight. The airline has held the title of the best low-cost carrier for years.

3. Best Employer

Southwest Airlines has consistently been ranked as one of the best employers in America. According to recent Forbes ranking, Southwest Airlines is ranked #2 America’s Best Employers 2019.

4. World’s Most Admired Company

In 2019, Southwest Airlines was ranked #11 Fortune’s most admired company in the world.

5. Consistently Profitable

Attaining high profits consistently is the main purpose of going into business. It fuels growth by allowing businesses to amass capital for expansion and R&D. In 2019, Southwest Airlines showed profits for 47 years consecutively. Considering airlines is a cutthroat industry, it’s indeed a great accomplishment.

6. Brand Value

Southwest Airlines is the 4th most valuable airlines brand in the world, with a brand value of $6.6 Billion.

7. Single Aircraft Type (Boeing 737s)

Since its inception, Southwest Airlines has exclusively used Boeing 737s for all its flight operations. As of Dec 2019, it has a total of 747 Boeing 737s Aircraft. Single aircraft type has been an effective, low-cost strategy for Southwest Airlines. It allows for simplified training (pilots, staff and ground crew), maintenance, scheduling, flight operations, and effective aircraft utilization.

8. Effective Service Strategy

Southwest Airlines provide direct non-stop flights under its point-to-point service, which reduces time-wastage.

9. High Capacity

The capacity of airlines is measured in terms of Available Seat Miles (ASMs). Having a higher ASM means more seats for longer miles, which contributes to the bottom line. From 2011 to 2019, Southwest Airlines’ ASMs grew from 120.58 billion to 157.25 billion, making it one of a few national airlines with ridiculously high capacity.

10. Effective Management

From financial management to HRM, having effective management from top-level down to the mid-level enhances stability and increases the rate of growth. Southwest Airlines’ management is regarded as one of the best in the industry and the airline’s major strength.

11. Market Share Dominance

Being a dominant player in the market is particularly beneficial in industries that are influenced by intense lobbying, such as airlines. Dominant players can leverage their connections, superiority, and resources to lobby successfully for the adoption of legislation that advances their agenda.

From Feb 2019 to Jan 2020, Southwest Airlines is ranked 3rd and has U. S. domestic market share of 16.8%, followed by American (17.6%) and Delta (17.5%).

12. Thousands of Flights

The more an airline flies, the more revenue it can generate. During peak travel season, Southwest operates over 4,000 flights a day. With a large number of flights, Southwest Airlines is undeniably a force to reckon with in the airline industry.

Southwest Airlines’ Weaknesses

1. Lack of Diversification

Over dependence on a single revenue source exposes a company to catastrophic loss in case of uncertainty or economic turmoil within that sector.

In FY2019, Southwest Airlines’ reported $22.4 billion total revenues to consist of $20.7 billion as passenger revenue making up 93% of total revenues while freight revenue was $172 million, which is less than 1%.

- Passenger (air ticket) revenue: $20.77 Billion (~93 % of total revenue)

- Other (loyalty points) revenue: $1.48 Billion (~6% of total revenue)

- Freight (cargo and mail) revenue: $172 Million (~1 % of total revenue)

Southwest Airline should diversify its revenue sources. Any issues that impede tourism or travel in these uncertain times can be catastrophic for the airline.

2. Dependent on the US Market

Southwest Airlines does not offer international flights and depends on the domestic US market completely (with the exception of few tropical vacation islands in Mexico, Central America, and The Caribbean).

“Don’t put all your eggs in one basket” comes to mind. Southwest can lose profitability and sustainability in case the US market dries up suddenly.

3. Overdependence on Boeing 737s

Since its founding, Southwest Airlines has depended solely on Boeing 737s.

On Mar 13, 2019, the Federal Aviation Administration (FAA) issued an emergency order to ground all MAX aircraft following two fatal accidents. Southwest Airlines owns 31 Boeing 737 Max out of its total fleet of 747 planes.

The grounding of Boeing 737 MAX resulted in a loss of revenue due to fewer planes. This highlights the issue over depending on only one aircraft model.

Southwest Airlines’ Opportunities

1. Expand Globally

Southwest Airlines recently expanded its local flights to Hawaii and can expand further to cater to the increasing air travel in emerging economies due to globalization and improved financial situation.

For starters, South America offers an unsaturated market and can be a perfect steppingstone for Southwest’s global expansion.

2. Improve booking process

In 2019, Southwest added PayPal and Apple Pay to its website, mobile app, and in-flight WiFi purchase page. It’s a great opportunity to expand e-payment options for its customers.

3. Expand on Freight Business

Southwest airlines can expand its freight business to tap into the ever-growing global logistics market with a market size of $6 Trillion in 2019.

4. Exploit New Technologies

The ever-increasing number of use cases for the internet offers Southwest airlines an opportunity to market its services directly to a wide audience. Also, the airline can adopt emerging technology trends such as bio metric boarding kiosks to speed up the security process.

5. Offer Long-distance Flights

The market for longer flights is increasing rapidly as more millennials enter the workforce and dare to work and live further from home than previous generations. Southwest Airlines can expand from short hauls to long flights to exploit growing demand.

Southwest Airlines’ Threats

1. Global Recession

From South East Asia to Europe, Africa, America, and Australia, economies across the world are nose-diving into economic turmoil due to uncertain times. With the record rate of unemployment in the US and threat of recession looming, Southwest’s operations are under threat.

2. Boeing 737 Max Issues

Boeing’s Max aircraft are crucial for Southwest Airlines’ growth plans and modernization initiatives. With the grounding of Boeing 737 Max, Southwest’s operations have been immensely affected since its fleet consists primarily of this aircraft model.

If the situation continues, the airline can suffer from:

- lost revenue due to cancellations

- b) negative effects on customer airline choice

3. Negative Publicity

A report by the US government revealed that the airline has been flying jets without confirmed maintenance records for over two years and exposed over 17 million passengers to safety risks.

4. Intense Competition

From Jet Blue to Delta, American, Spirit, United, and Alaska, Southwest Airlines faces intense competition from other players in the US Airline industry.

In addition, Southwest Airlines considers not only the airline industry but also automobiles, buses, and trains as other forms of competition for them.

During an economic downturn, customers cut down on their discretionary expenses and choose less expensive ground transportation alternatives.

5. Increase in Fuel Price

The profitability and sustainability of airlines are heavily dependent on fuel prices. In the event of an increase in fuel prices, Southwest’s profitability and sustainability could be threatened due to increased operating costs.

6. Incidents of Terrorism

The airline industry struggled with the decline in leisure travel due to the 9/11 terror attack. Any terror attack in the future could be devastating not only to Southwest Airlines but also to the entire industry and economy.

7. Stringent Regulations

From FAA inspections to government legal compliance, the operations of Southwest Airlines can be threatened by stringent regulations in the airline industry. For one, the government recently announced that it would be taking action against the airlines’ decision to fly 49 used jets acquired from foreign carriers without proper inspection.

8. Uncertain Times (Economic Shock)

These uncertain times have highlighted the vulnerabilities of the airline sector. Planes have been grounded, and air travel demand is at an all-time low, leading to millions of dollars in losses.

In March 2019, Southwest warned its investors that its first-quarter revenue is projected to drop between $200 and $300 million. If the situation persists, Southwest’s profitability and sustainability can be affected even more.

References & more information

- 11 Little Known Facts About Southwest Airlines | Boldmethod

- 2019 One Report | Southwest Airlines

- Low Fare Calendar | Southwest

- Southwest Airlines SEC Filing

- Teneva, M. (2018). Price Wars: Airline Industry Pains and Gains. Sky Refund.

- Southwest Newsroom. Southwest Corporate Fact Sheet.

- Thomson, J. (2018, December 18). Company Culture Soars at Southwest Airlines. Forbes.

- Cowney, D. A. (2019, September 19). What is Southwest Airlines Low-Cost Strategy? Leadership Strategic Plan. Medium.

- Mazareanu, E. (2020, February 10). Southwest Airlines: Available Seat Miles 2011-2019. Statista.

- Southwest Airlines. Culture. https://careers.southwestair.com/culture

- Rothman L. A. (2019, Oct 23). Analyzing Southwest Airlines’ Market Share (LUV). Investopedia.

- Trefis Team. (2016, September 14). Factors That Have Strengthened Southwest’s Domestic Presence. Forbes.

- Booker, B. (2019, December 17). Southwest Airlines Nixes Boeing 737 Max Planes from Its Fleet until April.

- Trefis Team. (2020, February 25). Can Southwest Airlines Overcome Its Capacity Crunch To Grow Revenues In 2020?

- Pasztor A. and Alison Sider (2020, January 30). Southwest Flew Millions on Jets with Unconfirmed Maintenance Records, Government Report Says. The Wall Street Journal.

- Gilbertson, D. (2019, March 23). Southwest to cut 1,500 daily flights as passenger levels, bookings hit ‘unimaginable lows.’ USA Today.

- Ballard, J. (2019, August 31). Where Be Will Southwest Airlines in 10 Years? Motley Fool.

- Globe Newswire (2020, February 6). Global Logistics Industry 2020-2023. Globe Newswire.

- Bogaisky, J. (2019, December 26).What’s Ahead for Airlines and Aviation In 2020.

- Aditi S. (2018, Dec 13). Why millennial-themed airlines don’t attract millennials.

- Siegel, R. (2020, March 10). Airlines slash routes, outlook, and executive pay. The Washington Post.

- Tsang, A. (2019, July 25). Southwest Airlines to Leave Newark Airport as Toll of Boeing’s 737 Max Grounding Grows. The New York Times.

- Foelber, D. (2020, January 31). Why JetBlue Airways Could Be the Best Airline Stock of 2020. Motley Fool.

- Gilbertson, D. (2020, March 5). Southwest CEO says bookings down. USA Today.

- Lori Aratani, L. (2019, November 12). Southwest Airlines is operating 49 planes that may not have been properly inspected, top FAA official says. The Washington Post.

- Oliver, D. (2020, January 30). Southwest speaks out about draft government report saying it neglected to prioritize safety. USA Today.

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment