Company: Macy’s, Inc.

CEO: Jeffrey Gennette

Founders: Rowland Hussey Macy Sr.

Year founded: October 28, 1858

Headquarters: New York, NY, United States

Employees (2020): 123,000

Ticker Symbol: M

Type: Public

Annual Revenue (FY2019): US$25.3 Billion

Profit | Net income (FY2019): US$564 Million

Products & Services: Apparel | Shoes | Accessories | Cosmetics | Fragrances | Intimate Apparel | Home Furnishings | Miscellaneous Products | Consumer Goods

Competitors: JC Penny | Nordstrom | Ross Stores Inc. | Kohl’s | Neiman Marcus | TJ Maxx | Saks | Darlington | Dilliard’s | Hudson Bay | Home Retail Group

Fun Fact: Did you know that Macy’s Superintendent, Margaret Getchell, was one of the first female executives in American retail making Macy’s one of the first retailers to have a woman in an executive position?

Macy’s has stood the test of time through thick and thin to become the largest US department store by retail sales. With over 160 years of operation under its belt, we can learn a lot from Macy’s SWOT analysis.

To understand Macy’s past, present, and what the future holds, you have to assess its strengths, weaknesses, opportunities, and threats.

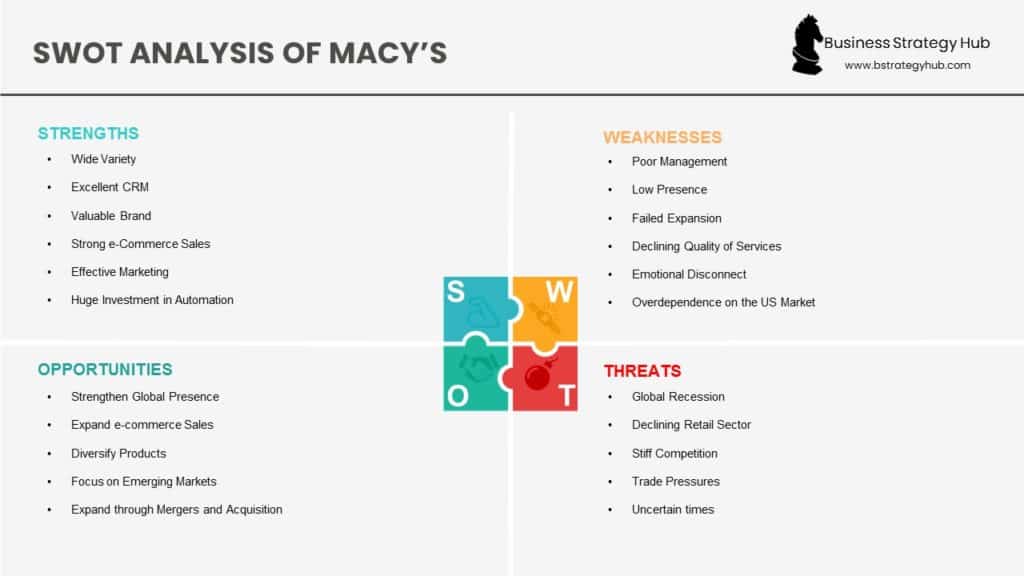

Macy’s Strengths

- Wide Variety: From apparel to accessories, cosmetics, fragrances, home furnishings, and other consumer goods, Macy’s offers a wide range of products for men, women, and children. The company’s portfolio includes Macy’s, Bloomingdale’s, and Bluemercury.

- Excellent CRM: Customer satisfaction is influenced by a wide range of factors including customer relationship management (CRM). A disappointed customer can be transformed into a satisfied customer if their frustrations are addressed fully by the company. Macy’s is renowned for having excellent customer relationship management.

- Valuable Brand: Since its founding, Macy’s operations were driven by customer-centric strategies. This has enabled the company to build a strong and valuable brand. Macy’s is ranked 120th by Fortune in Fortune 500 Companies.

- Strong e-Commerce Sales: As more consumers increasingly prefer to shop online, any company that effectively adopts e-Commerce will have an edge over the competition. Macy’s e-Commerce adoption has increased its revenues from online sales.

- Effective Marketing: While other companies pay millions for a small ad space in sporting arenas, Macy’s has its Thanksgiving Day Parade that rivals even the Super Bowl. It has grown to serve both as a cultural event and Macy’s marketing tool.

- Huge Investment in Automation: Macy’s ramped up automation to streamline its operations. The cost-effectiveness, efficiency, flexibility, and higher productivity bestowed by automation will Macy’s an advantage over the competition.

- Household Name: Macy’s is a household name and is synonymous with the clothing retail sector the world over. Being a household name offers immense benefits, particularly in marketing.

Macy’s Weaknesses

- Poor management: Regardless of the industry or type of business, having poor management is a major weakness. Macy’s management has adopted numerous bad decisions while neglecting the most effective plans. For instance, the implementation of the Polaris Plan is yet to be executed even though it promises to streamline its operations.

- Low Presence: Macy operates globally but has a very low presence in each region with some countries having one or two stores. The situation is worsened further by economic challenges due to the virus, which has forced the Macy’s to close around 125 stores across the US.

- Failed Expansion: Whenever a company makes a commitment to expand to another country or region and cancels the plans last minute, it erodes trust and disappoints potential customers. Consumers in the UAE were waiting for the arrival of Macy’s but the company pulled out of the Abu Dhabi expansion.

- Declining Quality of Service: Macy’s rapid expansion across the US spiraled out of control and stretched its resources very thin and most of its stores became messy and unappealing. Staffing the stores became a challenge leading to a decline in the quality of customer service.

- Emotional Disconnect: Rapid adoption of technology and automation of services has increased discontent among customers as machines and apps replace friendly warm faces and smiles offered by human employees. Macy’s is losing the human touch rapidly.

- Overdependence on the US Market: Macy’s depends heavily on the US market, which increases vulnerability to the negative socioeconomic issues. The murder of Floyd catalyzed large protests across the US and provided criminals with the opportunity to loot Macy’s flagship store in New York City.

Macy’s Opportunities

- Strengthen Global Presence: Selling products and services to the larger global market offers several opportunities and benefits. Macy’s should refocus its strategies away from upgrading department stores and towards strengthening its global presence.

- Expand e-Commerce Sales: Even though Macy has attained immense success in the adoption of e-Commerce, there still room to grow online sales. Expanding e-Commerce sales offers Macy’s with the highest potential for growth.

- Diversify Products: Macy’s offers apparel, sportswear, shoes, cosmetics, fragrances, designer brand clothing lines, and accessories. The company can diversify to other markets like second-hand clothes or away from clothing like the food industry.

- Focus on Emerging Markets: The demand for luxury products and high-end designer brands is increasing rapidly in emerging economies in Africa, Asia, and Latin America. By focusing on emerging markets, Macy’s can experience tremendous growth.

- Expand through Mergers and Acquisition: Acquisition and mergers offer the opportunity to expand quickly into an emerging market or sector. After stagnation in creativity, Macy’s acquired Story to cultivate new ideas. It can do the same again.

Macy’s Threats

- Global Recession: With the pandemic having destroyed economies across the world, the global recession is already upon us. Already, Macy’s is planning to scale down and become a small company based on the projection that it will incur over a billion in losses.

- Declining Retail Sector: Dubbed the retail apocalypse, many stores like Macy’s have witnessed declining revenues and profits for the past five years. If the streak of declines persists, Macy’s profitability and long-term sustainability are on the line.

- Stiff Competition: From Nordstrom to JC Penney, TJ Maxx, Kohls, and many more, Macy’s market share and profitability are always threatened by stiff competition.

- Trade Pressures: Trade is influenced by a wide range of complex and overlapping issues like politics, trade wars, economic factors, and so on. In the past three years, most of these factors were affecting trade negatively. In 2019, Macy’s stocks dropped by 50% thanks to global trade pressures.

- Uncertain times: Scientists believe that a second wave of the virus is inevitable. Macy’s has already lost $1.1 Billion due to the lockdown and may be too weak to survive continuous lockdowns and decline in sales.

References

- Forbes (2020). Companies: Macy’s, Inc. Forbes

- Keenan, J. (2018, March 19). Choice the Driver of Macy’s Transformation Strategy. My Total Retail

- Fortune 500 (2020). Company: Macy’s. Fortune

- PYMNTS (2018, April 16). Macy’s Leads The Pack As Top Online Apparel Retailer. PYMNTS

- Klara, R. (2019, November 18). How Macy’s Thanksgiving Day Parade Ballooned Into a Cherished Holiday Tradition. AdWeek

- Sweeney, E. (2018, September 27). Macy’s ramps up automated digital creative in an expanded partnership with Madras. Marketing Dive

- DiNapoli, J. (2020, April 12). Macy’s taps Lazard to bolster finances as coronavirus saps sales. Reuters

- Loeb, W. (2020, February 10). To Get Back On Top, Macy’s Will Have To Make Big Changes. Can Its New Strategy Deliver? Forbes

- Jones, C. (2020, February 5). Macy’s is closing roughly 125 stores. Here’s a list of the first round of closings. USA TODAY

- Duncan, G. (2018, November 1). Exclusive: Macy’s pulls out of Abu Dhabi’s upcoming Al Maryah Central mall. The National

- Wahba, P. (2019, November 21). Macy’s Stumbles Badly Despite Slew of Attempted Remedies. Fortune

- Percy, S. (2019, February 8). How can businesses leverage technology without losing their personal touch? Telegraph

- Corkery, M. (2020, June 2). Macy’s Damage Is Limited, but Looting Deals a Symbolic Blow. The New York Times

- Walton, C. (2019, November 22). Macy’s CEO Jeff Gennette’s Recent Strategies Are As Outdated As Department Stores Themselves. Forbes

- Gagliordi, N. (2020, February 5). Macy’s doubles down on digital growth strategy amid latest restructuring. ZD Net

- Howland D. (2019, August 29). Macy’s debuts secondhand apparel sales with ThredUp. Retail Dive

- Collins, T. (2020, January 29). Big spenders: Africa’s luxury goods market. African Business Magazine

- Kestenbaum, R. (2018, May 2). Macy’s Acquires Story: A Small But Bold Move That Could Save The Department Store. Forbes

- Fares, M. (2020, May 21). Macy’s to be ‘smaller company’ as loss to hit $1 billion in quarter amid lockdowns. Reuters

- Maheshwari, S., and Ben Casselman. (2020, June 1). Pretty Catastrophic month for Retailers, Now the Race to Survive. The New York Times

- Brownfield, A. (2020, February 24). S&P cuts Macy’s credit rating to junk. BIZ Journal.

- Klebnikov, S. (2019, September 26). Macy’s Stock Is Down 50% So Far This Year. Here’s Why The Famous Retailer Is Struggling. Forbes

- Selyukh, A. (2020, May 21). Macy’s Sees A $1.1 Billion Loss, While Pandemic Lifts ‘Essential’ Stores Like Walmart. NPR

- Featured Image by Nick Sarvari on Unsplash

Tell us what you think? Did you find this article interesting?

Share your thoughts and experiences in the comments section below.

Add comment